DISRUPTIVE FORCES ON CREDIT CARDS AND THE DIGITAL PAYMENT LANDSCAPE

Credit cards are generally considered a critical part of the payments infrastructure. However, a myriad of factors may shape new pathways in the payments landscape, undermining the current dominance of credit cards. This may create new opportunities for revenue growth for banks, fintechs and other financial institutions.

Dominance of credit cards

The prevalence of credit cards as a payments infrastructure has been a driving force in the modern economy. The invention of credit cards in the 1950s, starting with Diner’s Club card,1 paved the way for a multitude of benefits such as enhanced fraud protections, monetary rewards for routine spending, spend tracking and a faster way to build credit than traditional methods.2 As a result, credit cards have become a ubiquitous mode of payment with 48% of businesses using credit cards for payments3 and U.S. consumers are using cards for 37% of payment transactions.4 Beyond this, the Federal Reserve Board of San Francisco found that credit card payments are at their highest level since 2016, indicating that credit cards are gaining ground compared to cash or other forms of payment.5

How they work

The technology infrastructure behind credit cards, also known as payment rails, is the core of their supremacy. These rails allow for digital money transfers to be made between payers and payees, regardless of country, currency, digital payment method, or whether the parties are businesses or consumers.

Credit card rails work by using a physical or digital card that can be presented to a merchant. Once a transaction takes place, the details are sent to the bank that acquires payment, which then sends it to the bank that issued the card. When the issuing bank receives the transaction, it ensures it has enough available credit and authorizes the transaction. The issuing bank routes the transaction back through the card network to the acquiring bank, completing the transaction.6

This is referred to as the dual message system; the merchant sends an authorization request with the first message and requests settlement with the second message. Dual message networks are generally considered to be more secure, as they have additional authentication measures. Further, the dual message networks are still often the only available choice for remote debit sales, according to the Federal Reserve.7

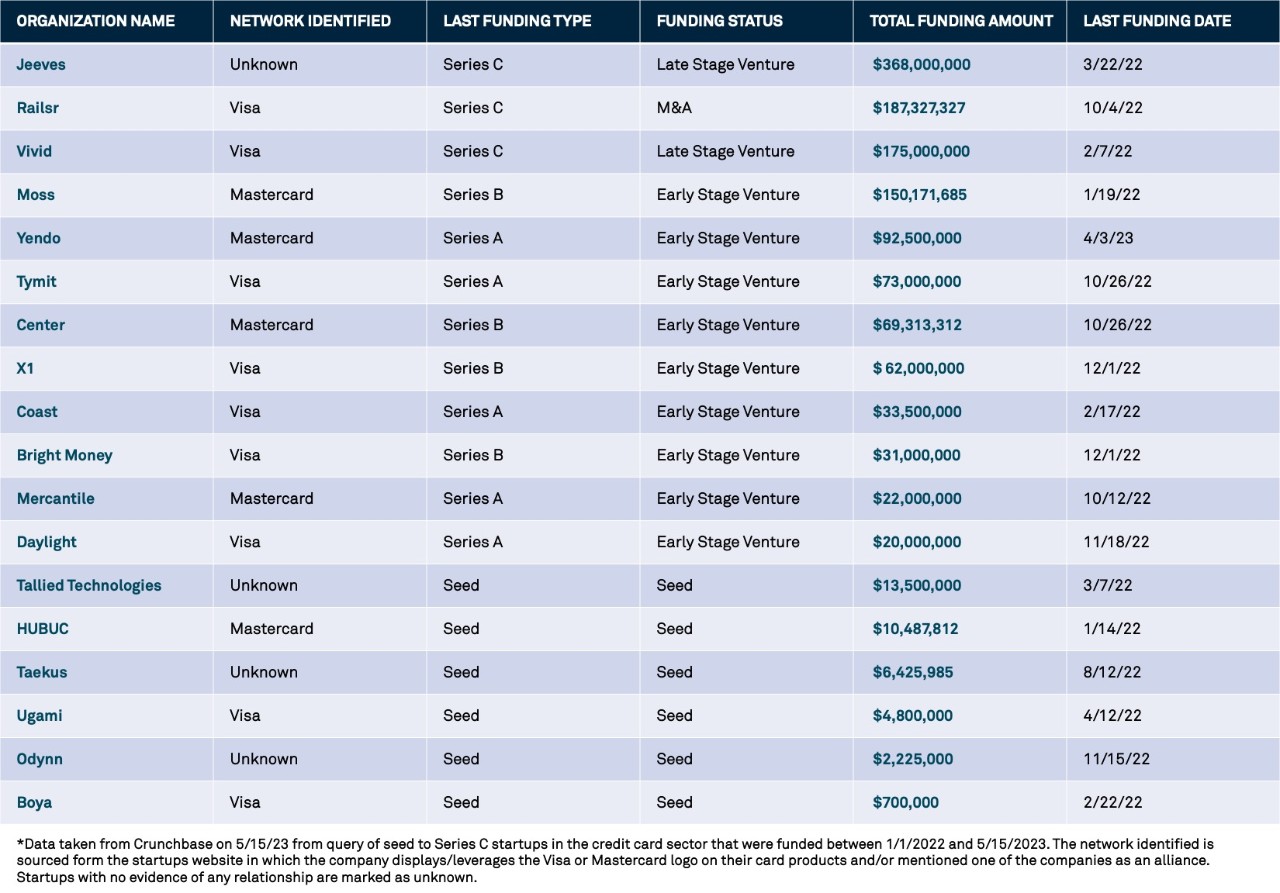

One of the factors that seemingly contributes to the dominance of credit card companies, such as Visa and Mastercard, is the type of payment networks they operate. Visa and Mastercard control most dual-message transaction networks, which has become a barrier to entry in the space.8 Start-ups in the credit card space are often connected to and/or backed by major card providers due to the speed, and resources required to replicate such a network. Hence, as new credit card models emerge, one asks if they can be sustained as they’re not on a scalable network. How do they make the unit economics work?

In a look at Seed through Series C startups that were funded since January 1, 2022 in the United States, over 78% identified with being associated with Visa and Mastercard networks.

Pressures and challenges with credit cards

There are, however, certain obstacles facing the credit card model such as:

- Process inefficiencies: Often, suppliers who accept credit card payments typically have teams that enter remittance data manually. Once a buyer has paid an invoice with a credit card, the accounts receivable (AR) team on the supplier side receives an email notifying them that a virtual card has been used to make a payment and that they must now process that payment. In most cases, the card details are sitting in the body of the email. The issue is that the vendor then must manually enter those details into their point of sale (POS) system. Once they input the card details, they must wait for the success or failed message, address that message appropriately, and confirm the remittance data is entered into the Enterprise Resource Planning platform (ERP). This process requires a high level of effort, and if the dollar value of each transaction is low, profit margins of the supplier are diminished.9

- Operational expenses and security: The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store or transmit credit card information maintain a secure environment.10 PCI DSS isn’t a one-size-fits-all framework. The level of compliance required is based on factors like: size of business; number of transactions; and banking requirements. However, across companies both large and small, the costs for building, maintaining and complying with PCI DSS can be onerous. Further, processing credit card payments can create a potential risk for data breaches.11

- Interchange fees: Interchange fees are often named as among the biggest pain point for credit cards. When a transaction uses a credit card, the cost for processing the requesting and receiving authorization, checking for fraud and payment is covered by an interchange fee.12 In most cases, an interchange fee will include a fixed fee plus a percentage of the total sale. These fees and percentages can vary based on the type of card anywhere from 0.5% -3.5%.13 As credit card payments increase, so does the potential impact to profits. The Retail Industry Leader’s Association (RILA) recently made a public statement in 2022 to this effect:

In 2021, U.S. retailers paid an astounding $138 billion to accept electronic payments, a significant increase from 2015 when merchants paid $83 billion, and this past year’s number is more than double what the retail community paid in 2011, $64 billion. This current trajectory is simply unsustainable and reflects a broken market.

RILA believes competition is the hallmark of America’s retail industry. It drives innovation and brings consumers lower prices and new products and services. However, the absence of competition in the payments ecosystem has resulted in the U.S. being one of the most expensive countries in the world to accept credit cards.14

Implications and options

As a result, new pathways are emerging in the payments landscape that could undermine credit card dominance. While the dual-message-network-barrier-to-entry creates a lack of legitimate alternatives to credit cards, a promising new movement towards open banking may be imminent. Open banking refers to the secure interoperability of the banking industry, enabling third-party payment service providers and other financial service providers to access personal and financial information from their customers’ banks. The customer must grant access to the sharing of information, and the relevant data is then shared with third-party providers through exposed application programming interfaces (APIs), facilitating faster and more secure transactions. While open banking is already well established in the European Union and certain parts of the Asia-Pacific region, the United States has been slower to adopt this innovation. Nonetheless, with the help of open banking and new technologies, potential alternatives to credit cards are gaining ground

- Pay by Bank: Pay by Bank is an open banking payment solution that enables customers to make purchases directly from their bank accounts. Through secure and direct integrations between banks, Pay by Bank facilitates immediate fund transfers using the Automated Clearing House (ACH) system to draw funds from the customer’s checking or savings account and settlement is the next day (unless Same Day ACH is used). This payment option provides a more secure and convenient means of completing transactions without the need for customers to enter their credit or debit card details. Customers are redirected to their online banking platform where they can easily link their bank account using their login credentials to finalize the transaction. This payment method also offers merchants similar protections as those provided by card networks, while potentially reducing interchange fees.15 Further, in some cases the provider will “guarantee” the payment for the business in real-time, allowing them to collect funds instantly and eliminate the risk of ACH returns later in the process.

- Faster payments – Same day ACH & RTP: Same day ACH and Real-Time Payment (RTP) are two electronic payment methods utilized within the U.S. for transactions currently valued up to one million dollars. ACH offers the ability to push funds into a recipients account (credit push) and pull funds from a recipients account (debit pull). RTP transactions support credit push and are processed in real time with every transaction cleared and settled individually, accompanied by confirmation messages sent to both parties. Although real time transaction volumes around the world increased by 40% in 2020, the U.S. payment infrastructure lags and numerous transactions are not eligible for RTP Request for Payment messaging. To utilize this payment rail, both the sending and receiving parties’ banks must have opted in as participating institutions in the RTP system and as of now the RTP® network reaches more than 60% of U.S. demand deposit accounts.16 Moreover, many larger businesses may be constrained by the transaction limit, rendering RTP and Same Day ACH payments impractical for certain high value B2B use cases.17

- Venmo and electronic payment solutions

Currently Venmo offers electronic payments that operate outside the dual messaging system. While the company does offer a credit card, it presently operates on the Visa rails. Given its increasing market share, it remains to be seen whether Venmo or another electronic payment provider could develop a competitive payment rail to challenge those currently available.18

- Blockchain-enabled solutions

Blockchain technology opens up a wide spectrum of options that may rival the status quo. It already has in place a system to both submit, receive and authenticate payment. Is it possible to create a blockchain-enabled solution that would minimize costs to retailers and small businesses, but provide a similar service to consumers? Vitalik Buterin, CEO of Ethereum, thinks this may be a potential option.19

Although credit cards are unlikely to become obsolete anytime soon due to their significant technological advantage and market penetration that has grown over decades, the advent of open banking presents new opportunities for banks and their partners to collaborate in the development of innovative products and experiences. With the growth of open banking and other technologies, the barriers to entry in the payment landscape are gradually eroding.

As the payment ecosystem evolves, cards and new instant digital payment methods will very likely strike a new balance. We expect increased competition as well as collaboration both amongst players as well as payment networks being utilized, including card and non-card rails. What is clear, especially for use cases where card is predominantly utilized, is that fraud-prevention and consumer experience will be the key drivers to success for anyone who looks to compete or collaborate in this space.

— Carl Slabicki, co-head of Global Payments at BNY Mellon Treasury Services

If you are a credit card alternative startup, please reach out to our Accelerator.

RTP is a registered service mark of The Clearing House Payments Company L.L.C.

- https://www.nerdwallet.com/article/credit-cards/history-credit-card

- https://americanhistory.si.edu/collections/search/object/nmah_1444151

- https://www.pymnts.com/news/b2b-payments/2021/less-than-half-of-businesses-make-payments-via-credit-card/

- https://www.mckinsey.com/industries/financial-services/our-insights/reinventing-credit-cards-responses-to-new-lending-models-in-the-us

- https://www.forbes.com/advisor/credit-cards/credit-card-statistics/

- https://tipalti.com/payment-rails/

- https://midigator.com/glossary/dual-message-system/, https://news.bloomberglaw.com/banking-law/visa-mastercard-face-emerging-competition-in-online-payments

- https://capstonedc.com/insights/the-gathering-regulatory-storm-for-visa-and-mastercard/

- https://www.versapay.com/resources/solving-the-virtual-card-dilemma

- https://www.pcicomplianceguide.org/faq/#1

- https://www.alliedwallet.com/blog/blog-posts/the-pros-and-cons-of-accepting-credit-cards/

- https://www.bankrate.com/finance/credit-cards/what-is-an-interchange-fee/#fee

- https://www.forbes.com/advisor/business/interchange-fees/

- https://www.rila.org/focus-areas/public-policy/leading-retailers-welcome-credit-card-competition

- https://thefinancialbrand.com/news/payments-trends/in-merchants-vs-banks-war-pay-by-bank-trend-is-next-battleground-155174/, https://www.chargebackgurus.com/blog/pay-by-bank

- https://www.theclearinghouse.org/payment-systems/rtp/rtn

- https://orum.io/real-time-payments-vs-ach-guide-to-features-and-fees/

- https://financebuzz.com/venmo-credit-card

- https://futurism.com/ceo-ethereum-could-challenge-credit-card-companies-in-a-couple-of-years

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

©2023 The Bank of New York Mellon Corporation. All rights reserved.