TREASURY CLEARING: REASSEMBLY REQUIRED

Central clearing will reshape the U.S. Treasury market.

This article was updated on January 16th, 2024 to reflect changes as of the formal adoption in late December 2023 of the SEC’s rules requiring clearing of U.S. Treasury transactions.

When Alexander Hamilton, the first Secretary of the United States Treasury and founder of the Bank of New York, created a plan for the nation’s debt, it was rooted in two core attributes: safety and liquidity. Government bonds would be safe because they would be backed in full by the U.S. government on their original terms, and liquid because they could be easily converted to cash at a fair market price.1

FULL REPORT

The Securities and Exchange Commission has finalized its central clearing proposal. Market participants need to begin preparing now because central clearing will reassemble the functioning of the U.S. Treasury market.

Read the full article in Reassembly Required: Central Clearing Could Reshape the U.S. Treasury Market - Updated January 2024

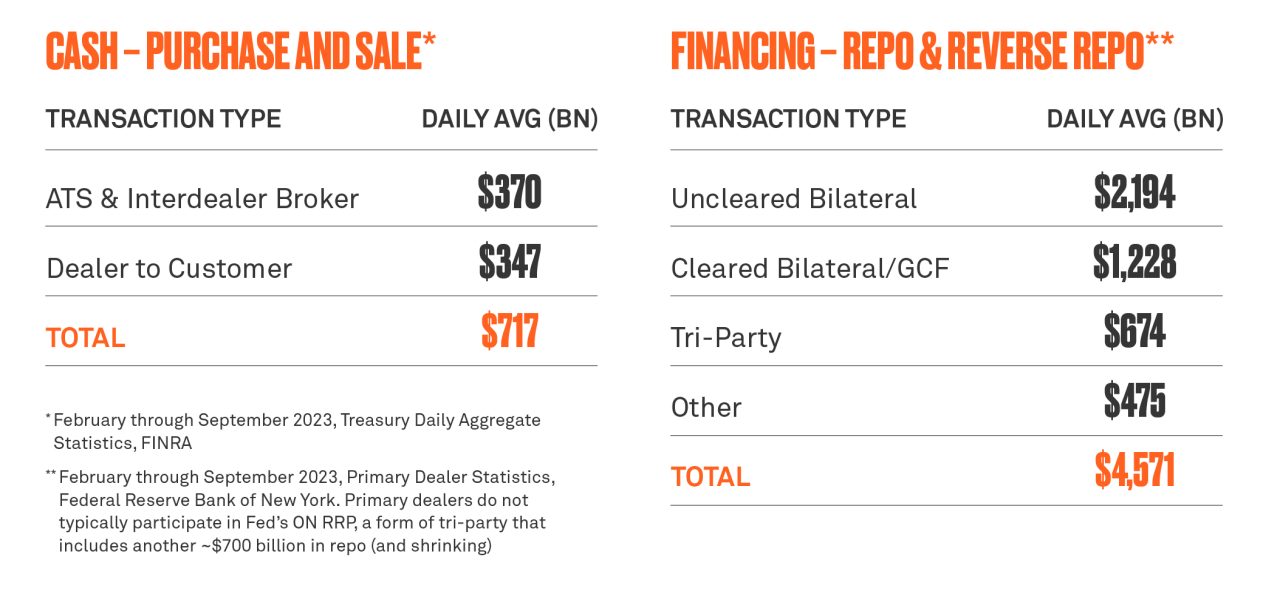

Those characteristics have endured. Today, the U.S. Treasury market has $27 trillion of Treasury securities outstanding and there is no other market in the world where so much liquidity can safely change hands so quickly. An average of over $700 billion and $4.5 trillion in cash and financing transactions, respectively, involving Treasury securities occur every day.

Preserving the safety and liquidity of the Treasury market is paramount, given the market’s global importance. Apart from financing the U.S. government, Treasury securities are also an instrument of monetary policy, the world’s largest safe haven for global investors during uncertain times and risk-free benchmarks for pricing corporate credit, mortgages and other financial products. They are the bedrock of the U.S. economy and global financial markets.

Even so, several liquidity events over the past nine years have raised public and private sector concerns about the market’s resilience. As part of an interagency response, the U.S. Securities and Exchange Commission (SEC) has adopted a final rule to improve facilitation of additional central clearing for the U.S. Treasury market. In the rule, the SEC highlighted that, with only about 13% of the Treasury cash market fully centrally cleared currently, the market is more susceptible to counterparty credit and systemic risks in the event of a default.

SPOTLIGHT ON: CENTRAL CLEARING EXPANSION

BNY Mellon experts cover the specifics of the SEC's final rule on Treasury market central clearing expansion, its market impact as well as how participants should begin preparing.

*As of January 11, 2024

Central counterparties (CCPs) clear market transactions by effectively becoming the buyer to every seller and the seller to every buyer, reducing counterparty credit risks. They net down transaction flows across the market and then require counterparties to put up margin, such as cash or securities, and commit other resources to guarantee that the trade's obligations are met, even if either counterparty defaults.

The SEC believes that the expansion of central clearing will reduce risk by increasing the share of activity that is subject to the centralized netting and risk management systems of a central counterparty, of which there is currently only one in the Treasury market, the Fixed Income Clearing Corporation (FICC). The SEC’s aim is to bolster the market’s resilience through improved default management processes, smaller settlement flows and reduced settlement fails.

Central clearing will strengthen the market’s core attributes of safety and liquidity in times of stress by reducing counterparty credit risk. But the rule represents the most significant change to the Treasury market’s structure in decades and will reassemble the way the Treasury market functions at a time of heightened volatility. The rule calls for additional clearing to be completed in the cash market by the end of 2025, and in the repo market by mid-2026. Implementing the changes will be costly and difficult, and market participants would do well to begin preparing now.

Treasury market turbulence

The SEC rule comes amidst an extended period of turbulence.

The market has grown dramatically since the pandemic and the Congressional Budget Office forecasts it will almost double in size over the next 10 years, with government deficits and the rising cost of interest payments pushing the market from today’s $27 trillion to around $46 trillion. This will pressure dealer intermediation capacity and boost the amount of collateral to be financed.

Projected values based on 10-year CBO budget projection

Source: https://www.cbo.gov/publication/59159

At the same time, the Federal Reserve continues to battle inflation and reduce its balance sheet, which will increase the demand for liquidity by banks as their reserves fall. Technological and regulatory changes are also making liquidity management more urgent, by speeding up payments and increasing liquidity requirements at banks. These factors will further increase the demand for cash and other forms of short-term liquidity.

Geopolitical tensions have added to the uncertainty, amplifying high levels of volatility.

A well-functioning Treasury market is particularly important given the environment.

The SEC sets its sights

The SEC’s rule to expand central clearing was adopted on December 13, 2023, and is arguably the most significant of five workstreams being explored by the official sector to strengthen the Treasury market’s resilience.

The workstreams are in response to recent liquidity events, including the repo market pressures in September 2019 and the pandemic “dash for cash” in 2020.

The SEC adopted the rule to protect the FICC, or any other Treasury market CCP, from contagion risk that could arise from a counterparty default in the non-centrally cleared portion of the market, which has grown rapidly in the last two decades. Three of the main sources of contagion risk noted in the SEC’s rule include:

- Interdealer brokers and principal trading firms (PTFs): Interdealer trading represents roughly half of the cash Treasury market, in which buyers and sellers trade Treasury securities. Traditionally, dealers would trade with each other in the interdealer market to hedge their risks and all of these trades were centrally cleared. But today over half of the interdealer market involves trading by PTFs, many of which rely on the interdealer broker – a FICC member – to clear their trades. The SEC notes that the FICC is exposed indirectly to a default of a non-FICC member in the event the interdealer broker lacked sufficient resources to contain the losses.

- Hedge funds and leverage: Hedge funds play a large role in the dealer-to-client market, the other half of the Treasury cash market, and typically finance their positions by borrowing cash in the repurchase, or repo, financing market, collateralized by the Treasury securities and other holdings. The rule highlights the risk that hedge fund exposures could pose to a CCP in the event of a default, particularly because leverage can amplify losses.

- Repo markets: In the Treasury repo market, a modestly higher share of activity is centrally cleared compared to the cash market, perhaps around a quarter. The SEC rule highlights the bilateral portion of the market for repo and reverse repo that is cleared outside of the FICC, a market segment of more than $2 trillion. These bilateral trades involve dealers sourcing collateral from clients (such as hedge funds) and matching that with funding from cash providers (such as money funds). The SEC notes the lack of consistent and transparent margining practices in this market segment, where competition for that business and other factors have helped drive collateral margins down to zero.2As a result, the collateral held by FICC members could be insufficient to guard against the default of the collateral provider.

Preparing for central clearing

In simple terms, under the SEC’s rule, members of any Treasury market covered clearing agency, like the FICC, would be required to centrally clear:

- all repo and reverse repo transactions.

- all purchase and sale transactions with registered broker-dealers, government securities dealers.

- all purchase and sale transactions when acting as an interdealer broker.

The rule includes exemptions for transactions with certain types of entities, including central banks.

The rule includes exemptions for transactions with certain types of entities, including central banks.

Estimating the additional volume of activity that will be centrally cleared is difficult and will depend on the implementation of the rule. However, with few exceptions the rule will expand central clearing to encompass the interdealer cash market segment and the non-centrally cleared bilateral and tri-party financing market segments, currently comprising over $3 trillion dollars in daily activity. FICC member trades with exempt accounts could reduce that figure somewhat.

Treasury cash and financing market trading volumes

The SEC is requiring implementation of the clearing rule and associated risk management changes over the next two-and-a-half years. CCPs will be required to make risk management and access related changes by March 31, 2025. Eligible cash and repo market transactions must be centrally cleared by December 31, 2025 and June 30, 2026, respectively.

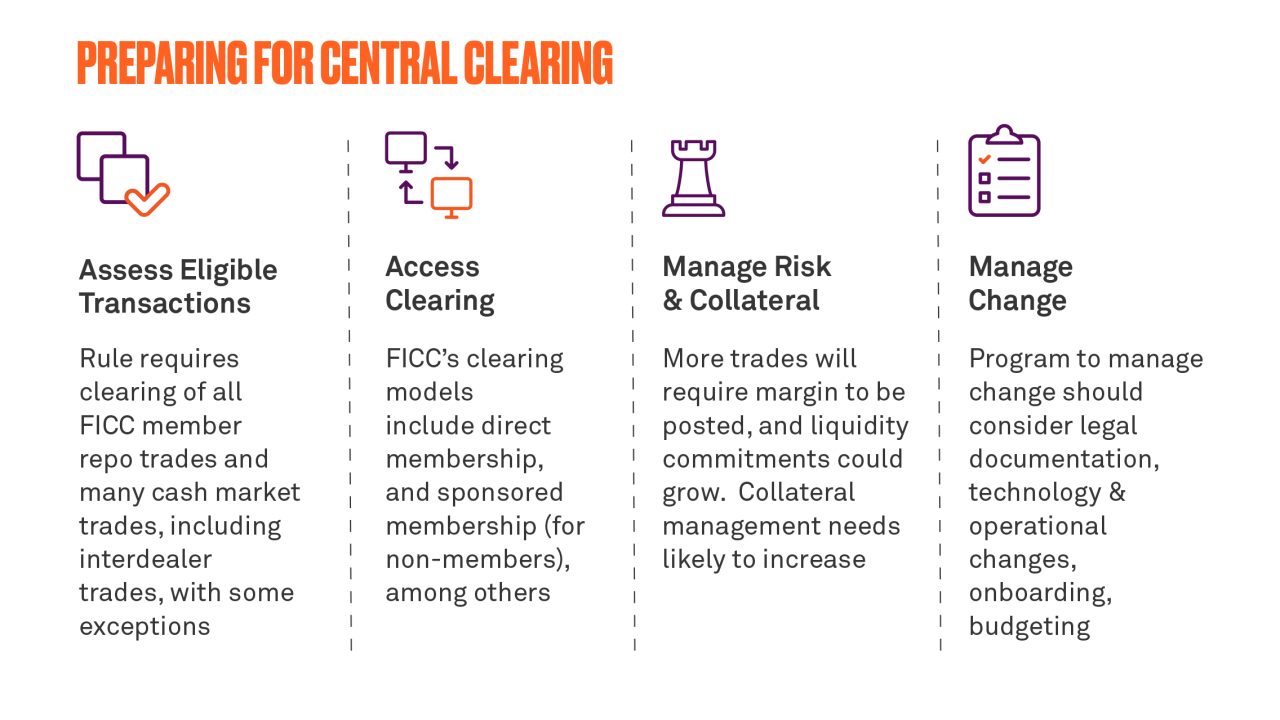

Given the broad impact of the rule, market participants need to start preparing now for the changes ahead. There are four key areas:

1.Assess the eligibility of transactions

Market participants will need to carefully review the types of transactions they conduct to determine whether they require central clearing. Although the rule includes a substantial portion of Treasury market trading, most trades between dealers and clients are not within the scope of the rule, nor are certain financing transactions that are economically similar to repos, such as securities financing trades. Trades done by exempt participants are not in scope either.

2. Determine an access model and provider

The rule will create significant demand by market participants for access to clearing using one of the FICC’s clearing models. Direct members of the FICC can clear their own transactions, while nonmembers can work with direct members to access central clearing indirectly through one of FICC’s client clearing models. Of these, the Sponsored Delivery-Versus-Payment (DVP) and Sponsored General Collateral (GC) models are already in growing use. In these models, a direct member sponsors a client transaction into central clearing for a fee or spread.

FICC’s models also permit a direct member to clear trades that are conducted between a client and a different bank or dealer, a so-called done away trade. This model may see increased use as dealers and banks seek to optimize their sponsorship capacity. The provisioning and pricing of various clearing models is likely to rapidly evolve given the urgent demand for access.

3. Adjust risk management practices

Market participants will need to discuss the implications of central clearing for margining and collateral management processes with the FICC or their clearing sponsors.

To guard against market risk in the event of a default, FICC collects margin from its direct members and from sponsors acting as a clearing intermediary for their clients. The rule changes allow sponsors to collect funds from their clients and be posted to FICC in segregated accounts for this purpose. Dealers acting as sponsors can also seek capital relief by doing so under the changes. Indirect participants should anticipate discussions with their sponsors about the process for collecting margin, which is normally calculated twice daily.

As trades move from bilateral to centrally cleared and the amount of margin increases, dealers and their clients are likely to seek to optimize their collateral management processes. These can be managed bilaterally or using a tri-party arrangement, which can reduce complex back-office processes and optimize the use of collateral and liquidity.

4. Change management

Managing the total portfolio of changes – including access, risk management and collateral management – is likely to demand a structured change management process for many participants, with resource and budget implications. Legal documentation should be a high priority given the typically long timelines required for repapering these arrangements, especially for sponsored access. Industry-wide efforts to develop standard documentation around access models could be particularly helpful. Institutions may need to make systems and process changes to implement central clearing as well.

Altering the economics of the Treasury market

The requirements and costs of central clearing will likely alter the economics of many transactions in the cash and repo markets, with far-reaching consequences.

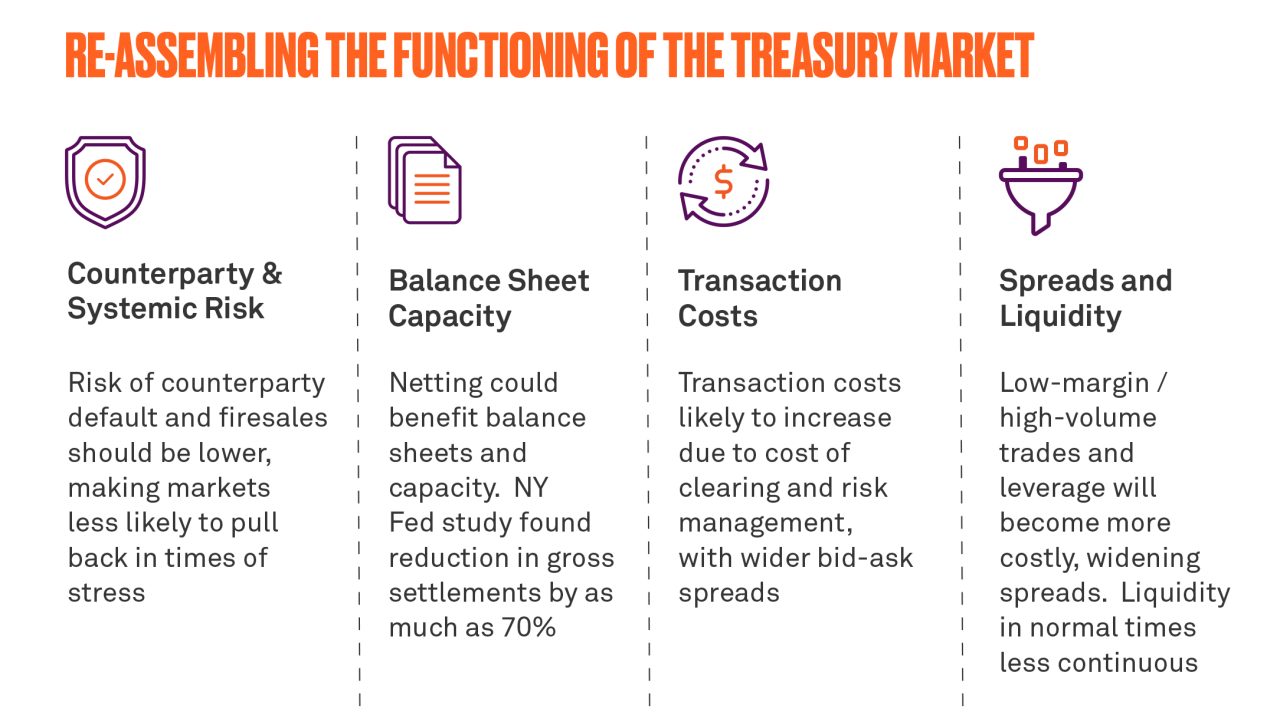

An analysis by the New York Fed found that central clearing could reduce the gross settlement obligations of primary dealers by as much as 70%. This may offer some additional balance sheet capacity for intermediaries and reduce settlement fails.

Transaction costs will increase as clearing costs go up for many market participants that do not centrally clear their transactions today. In a recent survey conducted prior to the final rule, the FICC estimated that the amount of additional margin as a result of centrally clearing more indirect participants could be $27 billion. That number could be higher because it is based on a subset of market participants. FICC also maintains sizeable liquidity resources – in the form of member funding commitments – that could be used to fund a defaulting member’s transactions. The survey was inconclusive on whether expanded central clearing would increase the size of these liquidity commitments.

The improvements in risk management expected to come from greater central clearing should increase the market’s resilience by lowering counterparty credit risks in the event of market stress or a counterparty default. Consistent and transparent risk management should make market participants less likely to pull back from counterparties in times of stress, allowing the market to remain more liquid under such conditions. In the event of a default, the default management process, and margin and liquidity resources, should help avoid contagion and fire sales, and perhaps may forestall the need for official sector intervention. And from the official sector’s perspective, these benefits should come at the price of a modest increase in trading costs and somewhat lower liquidity in normal times.

But for market participants, these changes are likely to feel more profound.

Participation and pricing in interdealer cash markets, which today rely on a large volume of high-frequency trading by non-FICC members, will change as the costs and requirements of clearing are passed along to non-FICC liquidity providers. Prices in interdealer markets are widely used as benchmarks for pricing transactions in other market segments.

Highly levered or low-margin trading strategies, like many basis and relative value trades, may become uneconomical at current levels as a result of the costs of clearing, contributing to basis-widening, for example, between futures and cash markets, or between on- and off-the-run securities. This could reduce the demand for Treasury securities for market participants engaged in these strategies, contributing to a rise in bid-ask spreads or outright yields.

In repo markets, netting should reduce some balance sheet costs, but additional margin and the costs of sponsorship are likely to push bid-ask spreads wider, increasing the cost of repo funding and leverage. On net, in both Treasury cash and financing markets, liquidity in normal times is likely to be less continuous than many have come to expect.

A big bullet, but not a silver one

As many have highlighted, central clearing alone will not be sufficient to ensure the market’s resiliency in the future, nor would it have fully solved for prior periods of dysfunction. Some forms of dysfunction, like the one-way selling during the pandemic “dash-for-cash,” can only be solved through official sector intervention and liquidity. But a more resilient Treasury market would have broad benefits. To realize these, reforms of the Treasury market will need to extend beyond central clearing and will require investment from both the public and private sectors.

These should include innovation that bolsters the safety and liquidity of the market – it’s two foundational attributes – so that Treasury securities can be converted to cash at a fair market price in all conditions. Debt buybacks and new forms of repo, including intraday, could help. Regulatory and market structure changes designed to increase the capacity of intermediaries and ensure a safe and level playing field to promote competition and broad participation would also be welcome.

The SEC rule to expand central clearing will reduce counterparty credit and systemic risks associated with clearing in the Treasury market, especially in times of stress. Yet the requirements and costs of the mandate will change pricing and liquidity in normal times and reassemble the way the Treasury market functions at a time when its liquidity and safety are deeply important for the public and private sectors. Advanced preparation by market participants can help ensure that the most significant change in market structure in decades goes smoothly for the world’s most important market.

- Alexander Hamilton consolidated the nation’s debt to pay for the costs of the revolutionary war and fund the federal government. He insisted that national debt should be honored by the government on its original terms and be transferred from one holder to the next at a fair market price, ensuring that it would be both safe and liquid. In his first report as Treasury Secretary to Congress in January 1790, Hamilton noted: “The nature of the contract in its origin is that the public will pay the sum expressed in the security to the first holder, or his assignee. The intent, in making the security assignable, is that the proprietor may be able to make use of his property by selling it for as much as it may be worth in the market, and that the buyer may be safe in the purchase.” Report Relative to a Provision for the Support of Public Credit

- The Office of Financial Research found that 70% of not-centrally cleared bilateral repo is transacted with zero haircut. https://www.financialresearch.gov/briefs/files/OFRBrief_23-01_Why-Is-So-Much-Repo-Not-Centrally-Cleared.pdf