Features

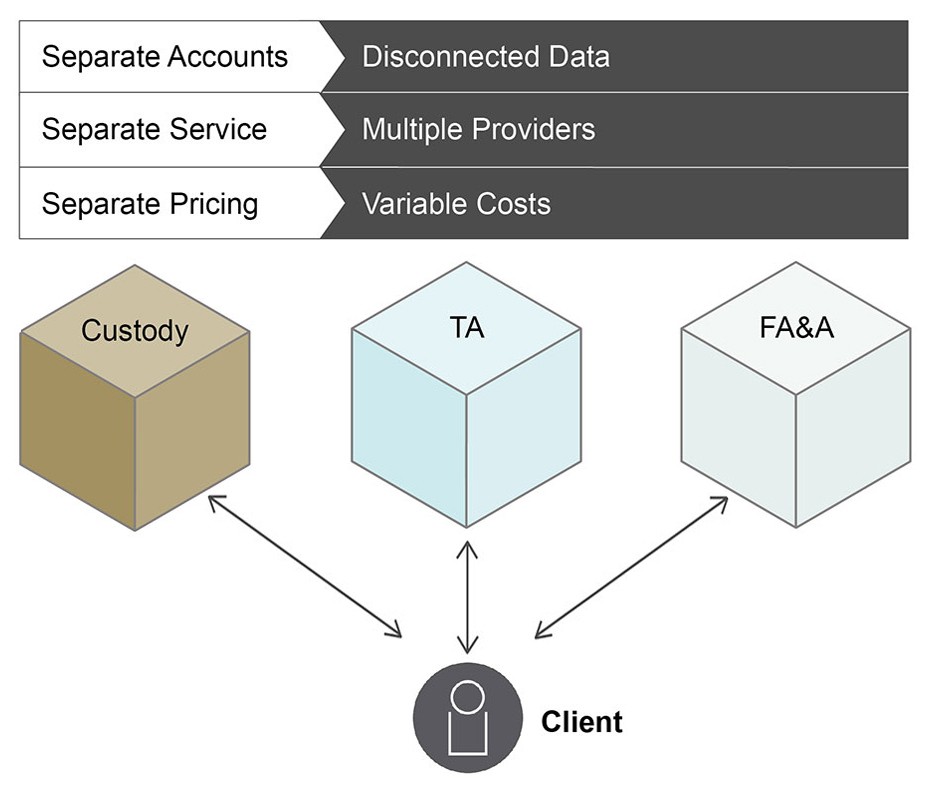

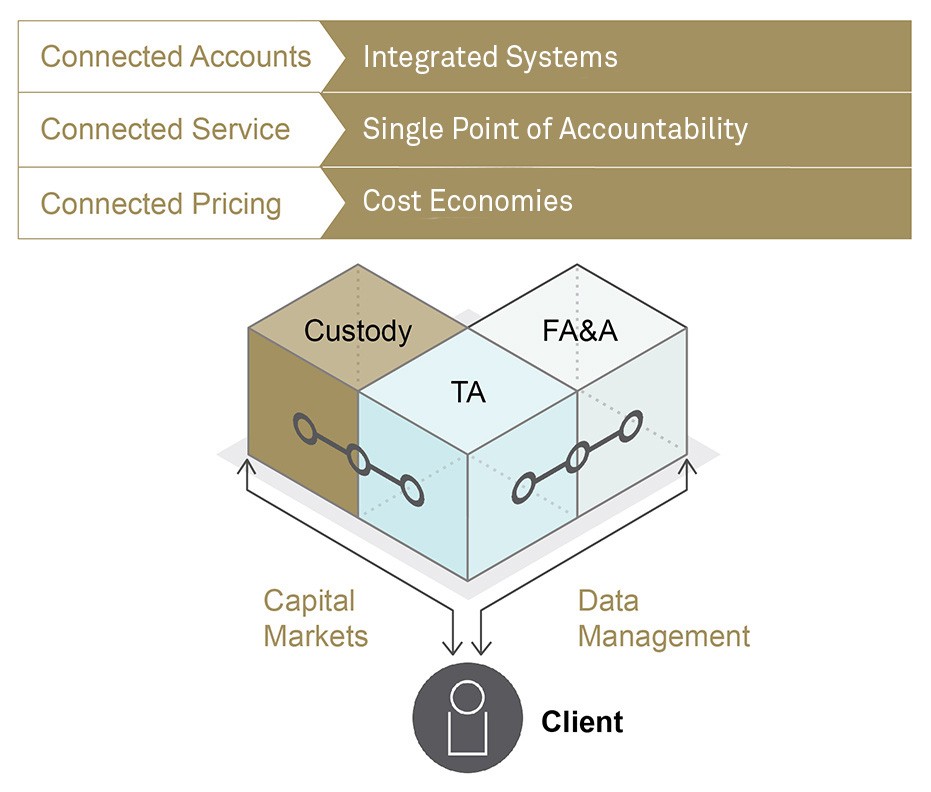

Connected services deliver a holistic solution to improve the management and operation of your funds.

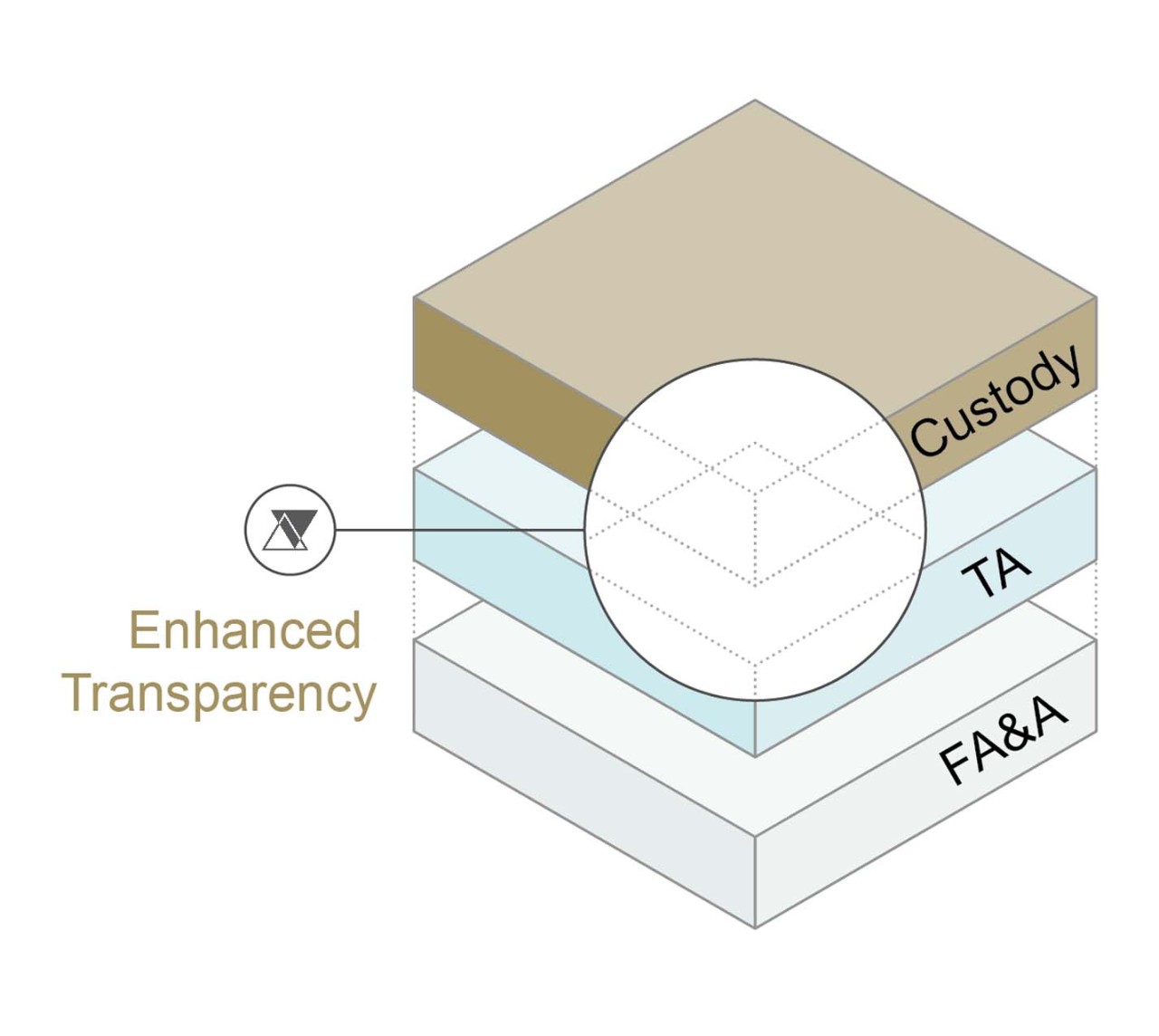

A comprehensive view enables asset managers to:

- Enhance responsiveness during unscheduled market events and regulatory changes.

- Streamline operations and minimize failure points by automating processes between Custody, Transfer Agency, Fund Accounting, and Subaccounting.

- Increase transparency and gain better insight into fund activity and compliance requirements.

Capture and capitalize on data-driven insights with a complete view across fund services.

Connecting fund data across services can help your firm:

- Strengthen security by containing data within a single highly regulated G-SIFI firm.

- Improve reporting across all aspects of the registered fund process, including value-added data on distribution channels and sales trends.

- Simplify workflows and increase speed by enabling straight-through processing between core fund services.

Manage liquidity across the lifecycle of your trade from investor to investment.

Linking Custody and Transfer Agency makes it easy to:

- Maximize liquidity and eliminate wire fees from multiple providers by linking cash accounts.

- Access credit so the fund can be fully invested and settle shareholder redemptions quickly.

- Ensure efficient settlement for NSCC transactions with BNY Mellon as DTCC settlement bank.

- Manage returns with enhanced trade settlement reporting.

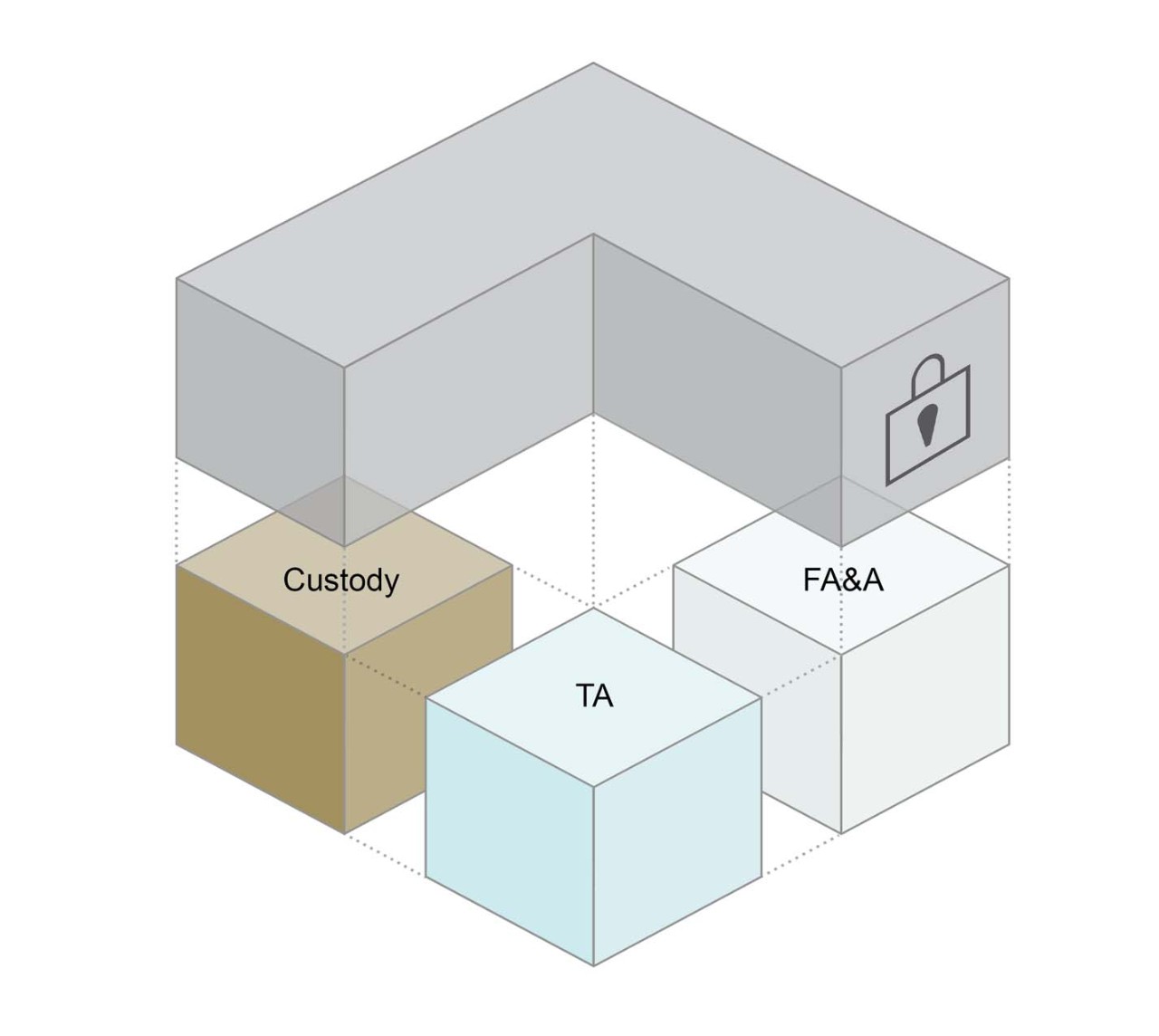

Access our extended capabilities to enhance distribution and grow assets.

Leverage the scale of BNY Mellon to build your business*:

- Increase liquidity by using our Markets capabilities to execute trades, which provide access to cash upon trade settlement.

- Expand your solution set with a highly-rated counterparty, sponsor for FICC-SMP repo.

- Maximize assets by leveraging BNY Mellon’s securities leading capabilities.

- Reach more investors through Liquidity Direct and the Pershing portal**.

*Capabilities available through BNY Mellon Markets and/or Pershing

**Subject to meeting criteria of portal

Empower enterprise-level decision making across your business lines.

Integrating BNY Mellon’s core fund services helps you harness the full power of the bank and:

- Get high-touch service from a single Relationship Manager.

- Reduce costs through a transparent and efficient fee structure*.

- Simplify contract management with straightforward agreements through one service provider.

- Expand relationships by accessing our network of distributors.

*Relationship pricing structure is only currently available for Custody and Transfer Agency

VIDEO

Gain Efficiencies with Integrated Fund Services

Improve the oversight, security and management of your funds by integrating our Custody, Transfer Agency, and Fund Accounting services. Our core capabilities can help address your complex challenges, whether you need access to liquidity or enhanced data-driven insights to help drive better business outcomes.