We made significant progress in 2021 executing on a compelling agenda for transformation and growth, building on an already exceptional foundation.

A Letter From CEO Todd Gibbons

Having served BNY Mellon for over 36 years, I’m excited to see our company enjoying a renaissance. Early into my tenure as CEO, with a new leadership team in place and renewed clarity of purpose, we activated a compelling agenda for transformation and growth on an already exceptional foundation. Doing so required us to adopt a digital and data mindset and evolve our culture. This agenda and the strength of our franchise were tested by unprecedented global market volatility early in the pandemic. Our people stepped up and delivered, as they always have, allowing us to make significant progress in our journey to position BNY Mellon for the future.

Leading with innovation and earning trust every day — these principles guide us and fuel our purpose of powering individuals and institutions to succeed across the financial world. That’s why it’s rewarding to know that we have continued to become more strategic and relevant to our clients over the past year, and we now find ourselves uniquely positioned to deliver greater value and play an even more substantial role in the global financial ecosystem. BNY Mellon is a pioneer of modern-day capital markets, so this bold intention should come as no surprise.

I’m proud to share that we are successfully executing against our strategy — as our accomplishments and financial results will show.

A WINNING STRATEGY

The heart of our strategy is to be an open platform on which clients can build their businesses, offering best-in-class services, technology and data.

BNY Mellon plays a critical role as a central orchestrator in the global financial ecosystem, touching in excess of 20% of investable assets globally. We are the world’s largest custodian, with nearly $47 trillion assets under custody and/or administration (AUC/A); we clear about $10 trillion of securities and process over $2 trillion of payments per day; and we manage $2.4 trillion of assets on behalf of our Investment and Wealth Management clients. This unique view across the financial industry, along with exceptional client relationships that in many cases allow us to reach deep into their day-to-day operations, gives us breadth and insights that other companies can’t replicate.

The heart of our strategy is to be an open platform on which clients can build their businesses, offering best-in-class services, technology and data. As global markets become increasingly complex and data-centric, clients are looking to us to help them transform their operating models and orchestrate broader, front-to-back solutions — using data to power their front offices, and deliver efficiencies and reduce risks in their middle and back offices.

Our effectiveness in engaging clients more holistically about their needs opens the door for discussions about the complete set of solutions that only we can bring. Last year we introduced ONE BNY Mellon, an initiative that mobilizes cross-functional leadership teams in key markets to strengthen enterprise collaboration and deliver a unified market presence. Our aim is to facilitate information sharing and cross-company client referrals to help us deliver holistic solutions and deepen relationships with our largest vendors. In a recent example of ONE BNY Mellon in practice, our Data and Analytics Solutions, Pershing and Wealth Management businesses came together to help clients optimize product development and distribution.

Over the past year, we made a number of critical, strategic investments in innovation, and I am incredibly proud of the industry-leading products and services that we announced and launched to drive further growth.

- Digital Assets

- The Future of Collateral

- Real-Time Payments

- Pershing X

- Digital Assets

- The Future of Collateral

- Real-Time Payments

- Pershing X

Early in 2021 we formed an enterprise Digital Assets unit to accelerate the development of solutions and capabilities related to digital assets, including cryptocurrencies. In our quest to build the industry’s first multi-asset platform that bridges digital asset custody, execution and administration seamlessly with traditional assets, we are leveraging our digital expertise from across the firm and collaborating with leading tech companies. Distributed ledger technology has the potential to transform areas like custody, collateral management, equity and debt issuance, and we are making progress across a number of potential use cases.

In the meantime, we have become a leader in servicing digital asset funds. Currently, BNY Mellon is providing fund services for digital asset-linked products, including those from Grayscale Investments, the world’s largest digital asset manager, and we service most of the cryptocurrency funds in Canada.

As the world’s largest, truly global collateral manager, managing $5 trillion in collateral worldwide, we are leading the industry towards greater collateral mobility and optimization. Two years ago, we announced The Future of Collateral, an initiative to deliver new capabilities, new interoperability opportunities, and significant funding savings for clients. By the end of last year, we had launched a distinct, unified collateral management platform that enables clients to use their U.S.-based assets to support trading objectives in Europe and implemented “active/active” processing to help improve resiliency and recoverability. With these enhancements, clients can capitalize on full substitution capabilities between the U.S. and Europe, harmonized reference data and one unified credit model, helping to improve efficiency in their collateral activities.

We also see opportunities for tokenization to mobilize illiquid assets and improve transparency and efficiency, so our Collateral Management business is partnering closely with our Digital Assets unit to explore leveraging blockchain technology to increase collateral availability.

We continue to play a leading role in driving the proliferation of real-time payments in the U.S. You may remember that in 2017 we were the first bank to originate a payment on The Clearing House’s Real-Time Payments Network. Late last year we were the first to launch a real-time, electronic bill-pay solution for billers and their customers. We are live with Verizon, our first client, and the long list of prospects for this particular capability is growing. Due to our unconflicted role as the bank of banks, we are also uniquely positioned to white-label real-time payments and ancillary services to regional banks across the country. We are pleased with the initial uptake and see a compelling revenue opportunity over the next few years, not only with other large billers and regional banks, but also brokerage firms and insurance companies.

BNY Mellon’s Pershing is a leading wealth technology and platform provider and a valuable distribution engine, helping our clients distribute over $1 trillion of assets. Last fall, we embarked on one of our most ambitious, multiyear initiatives yet and launched Pershing XSM, a new business unit that will design and build innovative solutions to transform the growing advisory marketplace.

Pershing X is our answer to the challenges clients have in managing multiple and disconnected technology tools and data sets for their advisors. Our comprehensive set of advisory capabilities — from models to trading to performance reporting — will be fully integrated with Pershing’s clearing and custody services to create exceptional experiences for clients. Over time, we believe that the Pershing X offering will be a meaningful source of incremental growth for the firm.

We made significant progress across our enterprise in 2021, but we have a lot more to do. You can expect to see ongoing innovation as we develop new products and services, while collaborating with third parties and investing in strategic alliances to complement our offerings.

At the same time, we must also continue to optimize our operating model. In 2021, we made some progress here, for example, generating over $300 million of efficiency savings across the company and driving higher productivity in Operations. We also sold certain sub-scale, lower-growth businesses in Pershing and Wealth Management. In Investment Management, we streamlined our investment firms offering to enhance their respective specialist capabilities and strengthened their research platforms and global reach to deliver the outcome-focused solutions that our clients expect. We remain laser focused on opportunities that will drive greater efficiency, reduce bureaucracy and enable sustainable growth in 2022 and beyond.

SOLID AND IMPROVED FINANCIAL PERFORMANCE

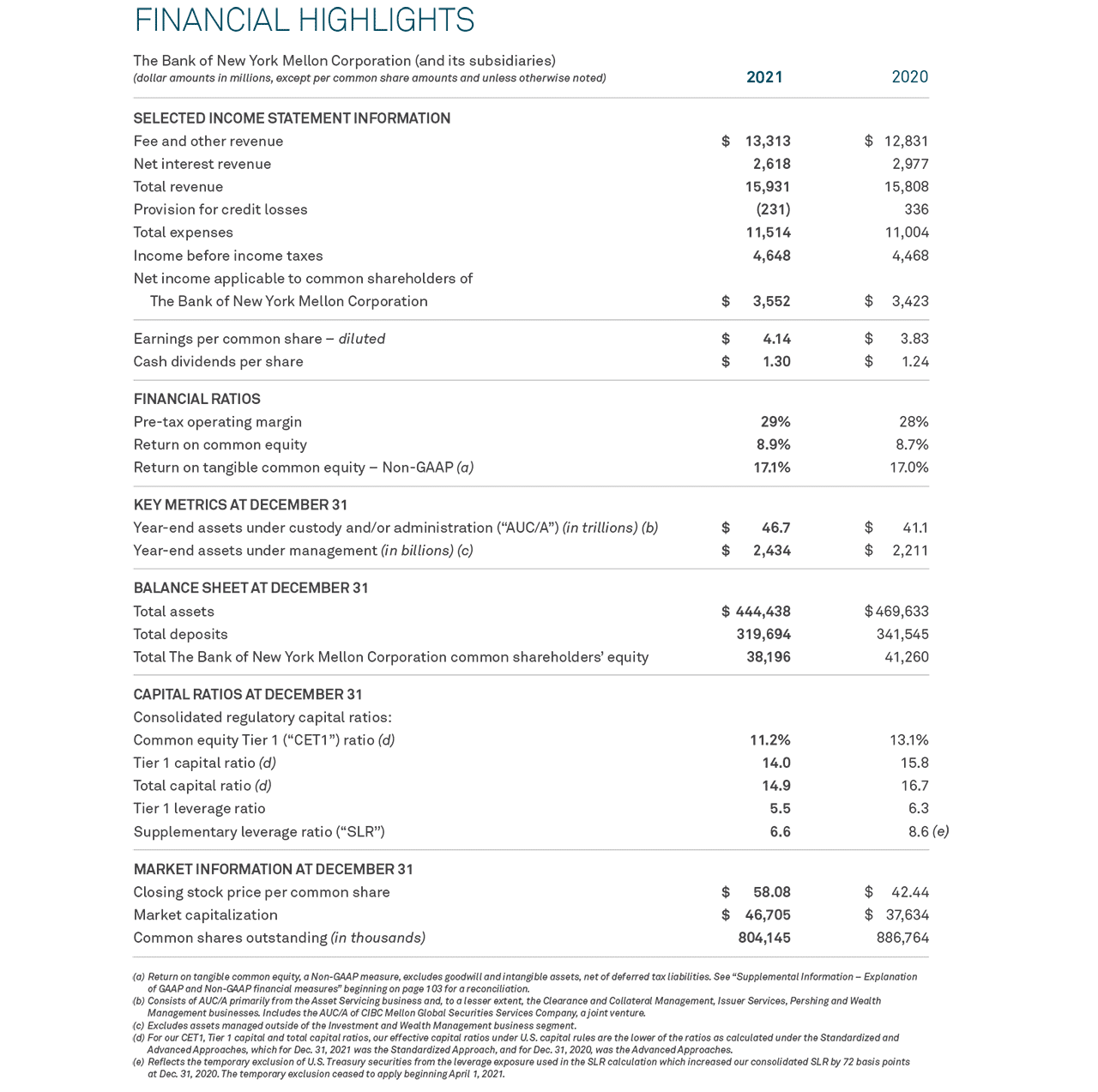

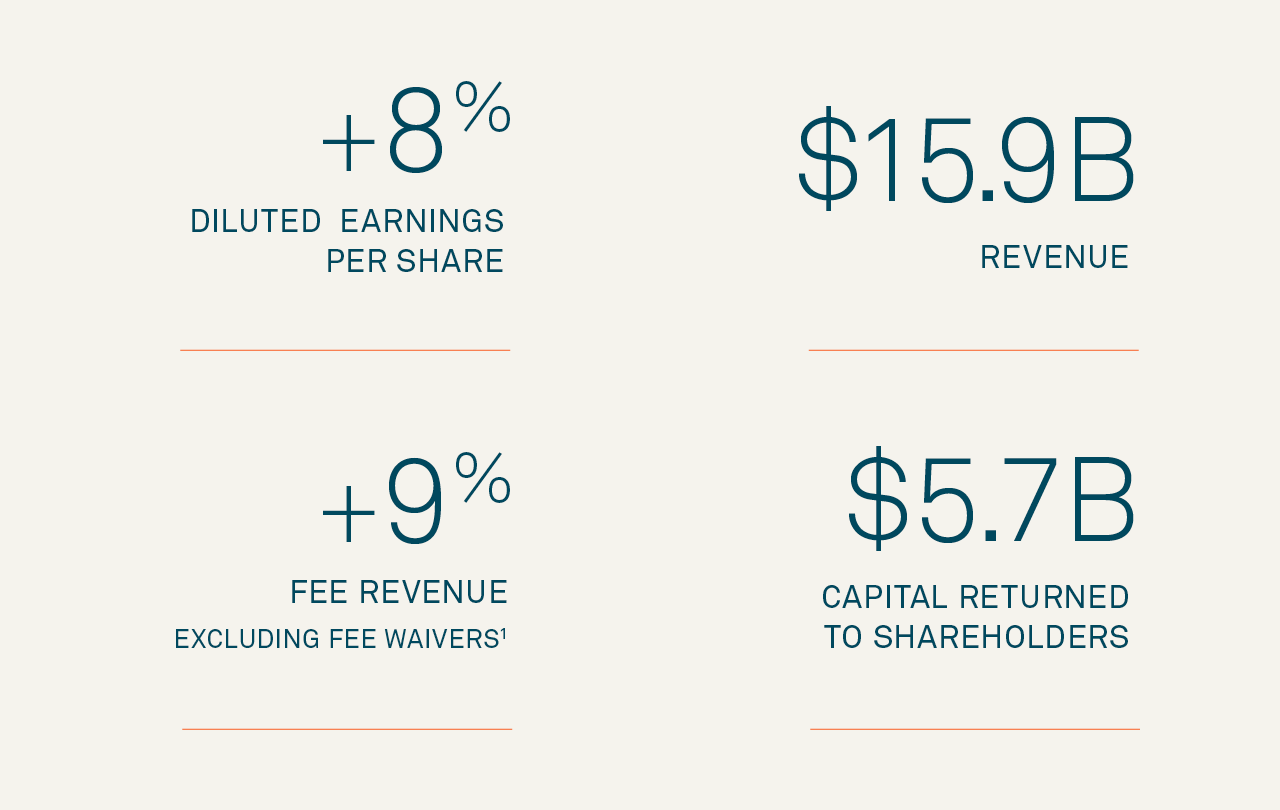

In 2021, we benefited from strong equity markets, a significantly improved credit environment and, importantly, a meaningful step-up in organic growth across our businesses, while we weathered the impact of a full year of low interest rates. Overall, we delivered a solid and improved financial performance. Diluted earnings per share increased by 8% to $4.14.

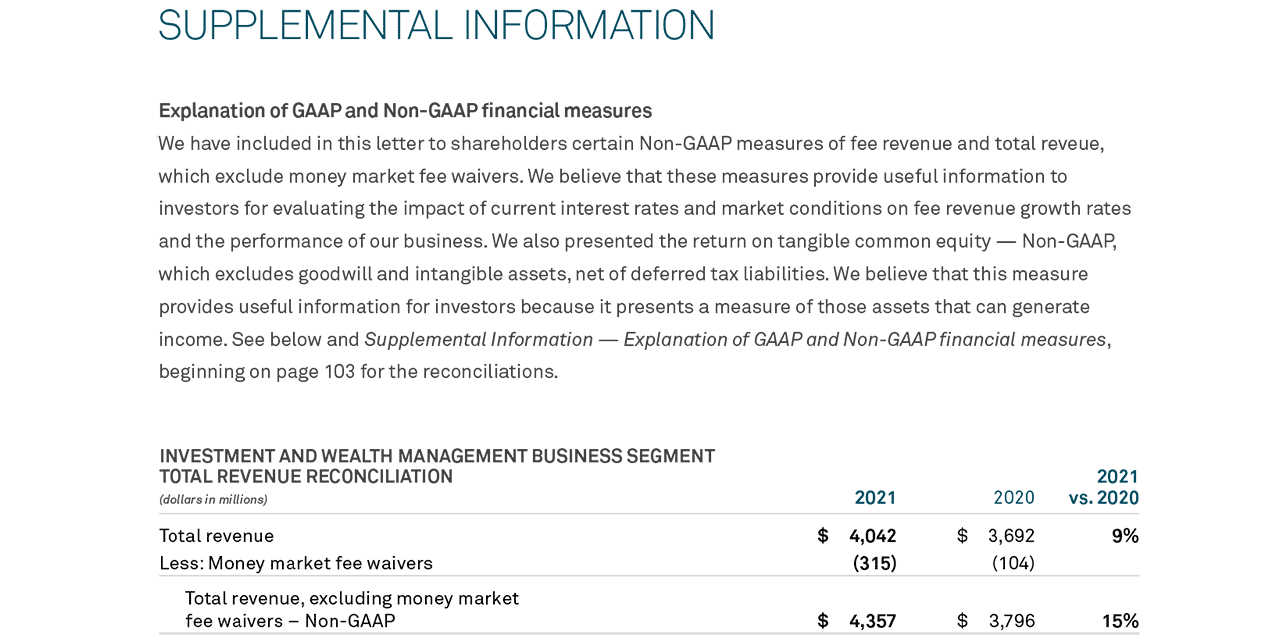

Revenue of $15.9 billion was up 1%, as the benefit of higher equity markets and accelerated organic growth more than offset the negative impact of lower interest rates on net interest revenue and fee revenue in the form of higher money market fee waivers. Fee revenue was up 4%, or 9% excluding the impact of fee waivers,1 highlighting the strong and broad-based underlying growth across our businesses. We are also very pleased with the performance of our strategic equity investments. Our solutions-oriented investments and strategic alliances with Fintechs continued to drive efficiency and offer more powerful solutions for our clients. They are yielding compelling financial returns, as well.

Expenses were up 5%. We made significant investments to drive further growth, for example in areas such as digital assets, data and analytics, and real-time payments, while we continued to optimize our operating model to drive further efficiencies.

Our pre-tax operating margin of 29% and our return on common equity and return on tangible common equity1 of 9% and 17%, respectively, were solid and roughly in line with the prior year.

Meaningful Return of Capital

Throughout the year we continued to generate significant capital, and when the Federal Reserve ended restrictions on bank holding company dividends and share repurchases at the end of June, we accelerated our return of excess capital to shareholders. In July we increased our quarterly dividend by 10% to $0.34 per share and, in the second half of the year, we repurchased $3.2 billion of common stock. Overall, we returned $5.7 billion of capital — 160% of earnings — to you through $1.1 billion of dividends and $4.6 billion of share repurchases in 2021.

Strong Underlying Growth Across Our Exceptional Businesses

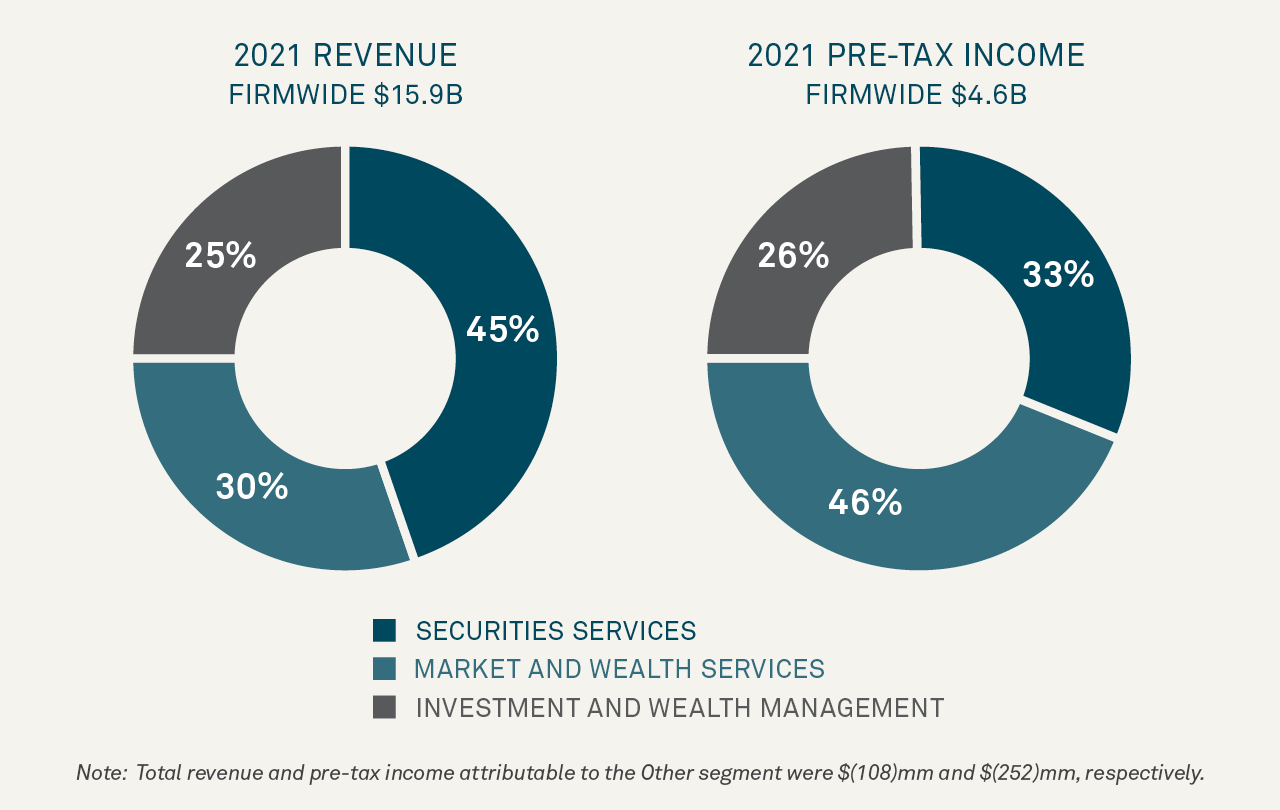

In the fourth quarter of 2021, we began reporting our financial performance along new business segments — Securities Services, Market and Wealth Services, and Investment and Wealth Management — that align closer to how we manage the firm. Our new segmentation further highlights the breadth of our businesses, which is a true competitive differentiator, and enables you to track our performance against our strategic priorities at a more granular level going forward.

In the fourth quarter of 2021, we began reporting our financial performance along new business segments that align closer to how we manage the firm.

Securities Services

Our Securities Services segment includes our Asset Servicing business, which provides global custody, fund accounting, integrated middle-office solutions, transfer agency and data and analytics solutions. It also includes Issuer Services, comprising Corporate Trust, one of the world’s largest trustees for corporate, municipal and structured credit securities, and Depositary Receipts, one of the leading administrators for sponsored depositary receipts programs globally.

Securities Services is our largest segment by total revenue, and we are intensely focused on enhancing its profitability in the coming years.

Low interest rates continued to weigh on revenues in 2021, both net interest revenue and fee revenue, as most of the fees related to the distribution of money market funds were waived to protect the investors in these funds from negative returns.

That being said, we saw a meaningful uptick in organic growth across our Asset Servicing and Issuer Services lines of business.

All of the below translated into a pre-tax margin of 21% in 2021. We have developed an ambitious but realistic plan to reach an over 30% pre-tax margin in the medium term. We expect a more normal interest rate environment will get us about halfway there, but we also plan to accelerate growth in higher-margin areas, such as alternatives and ETFs, and we are doubling down on initiatives to drive further efficiencies.

In Asset Servicing our consistent investments in digitization, an open-architecture platform and higher service quality are increasingly paying off and driving new business with existing and new clients. Wins were up almost 50% compared to 2020, producing a meaningful pipeline of AUC/A for 2022 and beyond. We are winning larger and more complex business, which reflects the value of our broader capabilities, including our differentiated data and analytics offering.

Issuer Services solidified its position as a global leader across Corporate Trust and Depositary Receipts. Amid record collateralized loan obligation issuance activity, we reaped the benefits of the actions we took over the last couple of years to enhance our sales and service teams and to upgrade our technology platforms. We also benefited from a normalization of depositary receipt issuance activity and the resumption of dividend payments to above pre-pandemic levels.

Market and Wealth Services

Market and Wealth Services comprises industry leaders Pershing and Clearance and Collateral Management, and our scaled Treasury Services business. Our highest-margin segment, it produced roughly 30% of the firm’s revenue but over 45% of the firm’s pre-tax income in 2021.

Pershing is an exceptional business that enables us to differentiate ourselves in several ways. We have an open-architecture approach to technology and products, and offer both bank and brokerage custody through a single front end to accommodate sophisticated investor requirements. Backed by BNY Mellon, Pershing can offer enterprise solutions like lending. And we are the only business-to-business service provider in the market — put differently, we do not compete with our clients for business as other providers do. The strength of our capabilities and our unconflicted role in the market continue to resonate with clients. In 2021, we gathered record net new assets of $160 billion and active clearing accounts continued to grow in the mid-single digit percentage range.

Our Clearance and Collateral Management business plays a central role in the global financial ecosystem as the largest provider of both clearance and collateral management in the world. Our position in clearance is truly unique: we are the primary provider of settlement services for U.S. Treasury securities. In 2021, we processed approximately $10 trillion of clearance value per day and ended the year with a record $5 trillion of collateral on our platform. As noted above, following investments in state-of-the-art technology, our collateral platform enables the movement of assets across all BNY Mellon regions and helps clients mobilize new asset classes all over the world. Our enhanced capabilities, together with the complementary services we deliver through alliances with leading Fintechs, will benefit our clients and fuel growth for years to come.

Treasury Services provides global payments, liquidity and trade finance solutions for banks, non-bank financial institutions, corporates and public sector entities. Amid a growing, high-margin and still highly fragmented global market, Treasury Services is increasingly recognized for its innovative solutions. Following a number of significant investments over the last couple of years, we successfully reinvigorated this business and positioned it for sustainable growth, most notably by modernizing our U.S. dollar payments platform, enhancing liquidity tools and embracing real-time payments early on. As payment volumes recovered to above pre-pandemic levels last year, we processed $2.3 trillion in payments on an average daily basis, up 20% compared to the prior year. We continued to help our clients accelerate their digital journey, and we are shifting our product mix towards higher value-added channels.

Investment and Wealth Management

Our Investment and Wealth Management segment comprises Investment Management, one of the world’s largest asset managers, and Wealth Management, which ranks among the top 10 private banks in the U.S.

On the back of strong equity markets and continued delivery against our growth initiatives, the business delivered good results in 2021. Despite the headwind from higher fee waivers, Investment and Wealth Management revenue grew by 9%, or 15% excluding the impact of money market fee waivers.2 We also delivered a meaningfully improved pre-tax margin of 30%, compared to 26% in the prior year.

AUM increased by 10% to $2.4 trillion, benefiting from higher equity market levels and strong net inflows into fixed income, liability-driven investments and cash strategies. Overall, net inflows into long-term strategies were the highest since 2017, and our cash strategies saw the highest net inflows in over a decade. Similarly, client assets in Wealth Management increased by 12% to $321 billion, reflecting higher equity market levels and strong net inflows, too.

Investment Management continued to deliver consistently strong investment performance. Our commitment to offering clients more product choice is resonating, and the investments we’ve made to optimize our investment firm line-up and modernize our operating model leave us well positioned to drive organic growth. Our initial suite of passive ETFs, launched in 2020, surpassed $1.1 billion of AUM and assets in our responsible investment funds increased by almost 60%.

Wealth Management continued to progress our strategy to accelerate client acquisition, expand the investment and banking offering, and invest in technology to drive efficiency. In 2021, we acquired significantly more new-client relationships than in the prior year and gained further traction in the larger, faster-growing client segments. Our expanded banking offering, on both the lending and deposit sides, drove a meaningful uptick in the percentage of Wealth Management clients who also bank with us, and our excellence in innovation, advice, thought leadership and digitalization was recognized by industry awards throughout the year.

COMMITMENT TO EXCELLENCE

Time and time again, clients have told me that our employees are BNY Mellon’s greatest asset, and I couldn’t agree more.

Our people play a critical role in advancing BNY Mellon’s growth agenda. It’s up to us to realize our vision to be the trusted financial institution for clients and employees. Trust shapes our value proposition, deepens relationships, and grants us opportunities to grow the business. Few are in a position to define trust. But we are.

We’re creating more opportunities for career development and mobility — in fact, this is a ONE BNY Mellon value proposition for employees — and we’re improving experiences by investing in new technology capabilities that drive performance. We also introduced the Meeting You in Your Life Moments initiative, which encompasses programs that enable life balance, resilience and productivity.

We refreshed and codified our values, and the behaviors expected of each of us, so that no matter our role, we know how to deliver exceptional outcomes.

Perhaps our biggest priority is to foster a diverse, inclusive environment that reflects our vibrant society, inspires a sense of belonging and gives everyone a fair opportunity to achieve their potential.

We have tangible metrics to attract, advance and retain diverse talent. We set concrete, short-term goals to accelerate progress in our most underrepresented ethnic/racial talent populations in the U.S. and position our firm as a competitive choice with Black and Hispanic/Latino graduates and experienced professionals. As I stated in our 2020 report, our goals are to increase the following in the U.S. by year end 2023:

- Increasing Black representation by 15% to 12%

- Increasing Black representation of senior leaders by 30% to over 4%

- Increasing Latinx representation by 15% to almost 8%

- Increasing Latinx representation of senior Leaders by 30% to over 5.5%

We’ve also pledged to increase women's representation in the EMEA region to 33% by 2025, from 28%, with an emphasis on improving senior and mid-level leader pipelines.

Our gender equity efforts have led to some bright spots, with year-over-year growth in women among new hires and senior leaders globally, and an increase in women representation on our Board. In fact, our slate of independent directors is one of the most diverse in the industry and among large public companies, with 31% women and 39% of underrepresented ethnic/racial backgrounds. Among the members of my leadership team, 39% are women and 28% are from underrepresented ethnic/racial backgrounds. I’m proud of the diversity in our leadership, and aware we have much work to do to make similar progress throughout our workforce.

Since increased diversity alone won’t improve an organization, we have been equipping our people with the skills to recognize when others are missing or excluded and to bring them into the conversation. For example, we offered additional training for managers to strengthen inclusive hiring and performance management capability, and delivered continuous learning at scale through Diversity, Equity & Inclusion Academy courses, best practice guides and team-building resources. This year, we will be initiating inclusion efforts to better engage with and create career paths for neurodiverse talent, including those on the autism spectrum.

Employees themselves are leading the way for better inclusion and visibility. One in four employees is a member of a BNY Mellon employee or business resource group (E/BRG), which are formed around shared characteristics and open to all. E/BRGs collaborated with our Office of Diversity, Equity and Inclusion to host meaningful conversations and workshops about implicit bias, intersectionality, allyship and belonging. The groups also engaged with professional organizations, nonprofits and institutions such as historically Black universities and colleges to widen our recruiting, develop top talent and make an impact in our communities.

In an increasingly diverse world, the future belongs to the inclusive enterprise. That’s the challenge we’re rising to, and why we are ensuring that diversity, equity and inclusion are woven into the fabric of our organizational culture.

OUR POSITIVE BUSINESS IMPACT

BNY Mellon has a significant opportunity to make a positive impact on the environment and our society, which in turn, supports our business objectives.

As a major global financial institution, BNY Mellon has a significant opportunity to make a positive impact on the environment and our society, which in turn supports our business objectives. Through our culture and purpose, and responsible business and global citizenship initiatives, we strive to be agents of change and a catalyst for the betterment of our company and our communities.

We are using our reach, market influence and resources to address pressing global environmental, social and governance (ESG) concerns. Last year, we launched our holistic Future FirstSM ESG framework, which guides our own enterprise practices and conduct, underpins the strength of our client solutions and establishes a platform for thought leadership. We also announced a collaboration with the Yale Initiative on Sustainable Finance to address the need for quality, relevant and transparent ESG information — which ultimately benefits the investing interests of asset owners, institutional investors, corporates and issuers in depositary receipts, many of which are clients.

BNY Mellon is committed to addressing the data challenges that can hinder the acceleration of the global transition to net zero emissions. Last year, we joined OS-Climate’s community of Fortune 500 businesses and financial services firms building a public platform of open data and open-source decision-making tools that will help users to align financial and investment portfolios to climate goals.

We take pride in addressing our global challenges proactively. We achieved carbon neutrality in our operations for the seventh consecutive year and paper neutrality in India and the U.S. for the fifth consecutive year via a certified offset program and by planting over 100,000 trees. Our Corporate Trust business continues to be the leading trustee for green bonds by deal volume, administering more than 100 new green bond issuances totaling close to $65 billion in 2021.

Last year, BNY Mellon was once again included on the CDP Climate Change “A-list”, a prestigious list recognizing exceptional leadership in corporate sustainability, having reduced our greenhouse gas emissions by an incremental 16% in 2020 compared to a 2018 baseline. We were one of only 200 companies of 13,000 respondents to make the list, and the only U.S.-based financial institution to earn the “A” grade for nine consecutive years.

In addition, we were included in the S&P Dow Jones SustainabilityTM Index for the eighth consecutive year; the FTSE4GOOD Global Benchmark Index for the 10th consecutive year; the Bloomberg Gender-Equality Index for the seventh consecutive year; the Disability:IN Disability Equality Index for the third consecutive year; and the Human Rights Campaign Corporate Equality Index for the 15th consecutive year.

We continued delivering pay equity for both women and U.S. employees from underrepresented ethnic/racial backgrounds, and, as noted previously, made progress against our expanded representation goals and accountability framework for underrepresented ethnic/racial populations.

We embrace our responsibilities and strive to contribute to sustainable economic growth that protects healthy markets, enhances our own business resiliency and longevity, and delivers positive impact for you, our clients, employees and communities.

THE NEXT CHAPTER

We work together every day to deliver the best possible outcomes to our stakeholders and realize the full potential of our great company.

Looking ahead to 2022, our business is strong, and our focus is clear. We’re building on an already great franchise, one with a unique and differentiated business model, an enviable client roster and a talented and diverse global workforce. We remain deeply committed to our purpose of being a trusted steward of our clients’ businesses and to supporting the efficient functioning of global markets.

We have an amazing journey ahead of us, and I am confident in our ability to continue to deliver sustainable growth for our shareholders.

I’d like to thank our highly engaged Board of Directors for their support and counsel — their diverse perspectives have proven invaluable to our team. And I am incredibly grateful to and proud of my talented colleagues around the world, including my partners on the Executive Committee, all of whom work together every day to deliver the best possible outcomes to our stakeholders and realize the full potential of our great company.

Sincerely,

Note: All percentage changes are against full-year 2020 results, unless otherwise noted.

[1] See Supplemental Information — Explanation of GAAP and Non-GAAP financial measures, 2021 Annual Report PDF, beginning on page 103 for the reconciliations.

[2] See Supplemental Information below for reconciliation of Non-GAAP measures.