Outsourcing Trends Drive Focus on NAV Oversight and Contingency

Outsourcing Trends Drive Focus on NAV Oversight and Contingency

May 2021

By Allen Cohen

Over the past decade the investment management industry has seen a growing trend of firms choosing to outsource key operations such as fund accounting and administration, with some managers having practical business reasons to diversify their books of business with multiple service providers. It appears this trend will continue, and in fact, in a recent survey conducted by BNY Mellon1, 90% of respondents state that if they were to explore or expand their outsourcing relationships in the next three years it would be in the back office area.

Outsourcing has many potential benefits – cost savings, scalability, and greater operational efficiency to name a few. But, with this outsourcing trend comes the need to support and oversee these sometimes-complex relationships.

While asset managers can outsource important aspects of their fund operations, they cannot delegate the responsibility for accuracy and resiliency. Service providers must deliver accurate and timely NAVs to the investment industry as asset managers monitor their providers and protect investors. The staff of the Securities and Exchange Commission2 in the U.S. and the Financial Conduct Authority3 in the UK have reinforced the need to have sound business continuity plans (BCPs) in place, and to consider having appropriate oversight in place regarding their outsourced fund operations. Business continuity planning is not only a regulatory issue; insufficient oversight and the lack of resiliency plans may expose funds to potential reputational risk, loss of competitiveness, and financial loss. The recent COVID-19 crisis has led to a renewed consideration of the sufficiency of such plans.

Regulators have encouraged asset managers to examine their own, as well as their critical service providers’ BCPs, assessing how natural disasters, acts of terrorism, hardware or software failures, or the unavailability of key personnel due to pandemics would impact them. Organizations with more robust planning have a greater chance to maintain operational continuity if and when these challenging circumstances arise.

Attaining NAV Resiliency

Asset managers need to consider a number of questions to help ensure that fund NAVs are available to the industry even if the primary calculation approach fails. These include:

- Is the calculation of a back-up NAV sufficiently insulated from the processes and infrastructure used to produce and disseminate the primary NAV?

- What is the strength of the provider’s BCP? Are its teams able to perform their tasks remotely, ensuring continuity when BCPs are enacted?

- To strengthen platform resiliency, is the solution platform fully independent of the primary NAV calculations?

- Is the back-up NAV derived from data sourced independently from the primary accounting platform?

Oversight as a Best Practice

The need for a back-up NAV is only one side of the coin. The independent verification of daily NAVs and portfolio valuations across providers is the other. Despite best efforts, errors in NAV calculations can occur. Even if NAV calculations are accurate 99.9% of the time, a 0.1% error rate can cause considerable headaches. In today’s operating environment, with market volatility causing the inflow of massive amounts of data, pricing exceptions and instances of fair valuing are increasing substantially.

When market volatility and uncertainty further intensify valuation challenges, manual approaches to determining and instructing the fair market value of an investment can add significant risk and complexity. Asset managers and fund valuation committees work closely with their service providers to determine the tolerances that drive when exceptions requiring further review are generated. Validations can be set at the instrument level and can allow certain variations from day to day. Frequently, for instruments such as equities or bonds, daily variations exceeding the norm flag exceptions and require investigation. As we navigate the uncertainty of a post pandemic economy, it is highly possible that the number of exceptions requiring further review and validation will increase, making the robust oversight of day-to-day operational continuity even more important to help ensure NAV accuracy.

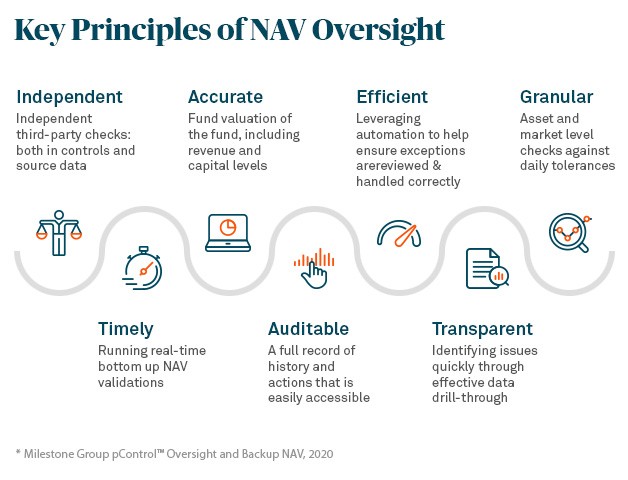

Key Principles of Oversight

Our recent survey of global asset managers reveals that 88% are likely to look to outsource components of operational oversight in the next 3 to 5 years. Regardless of the approach taken to perform this oversight, there are several key principles that should be considered.

- Independent: The creation of a NAV that can be calculated independently from the primary accounting system using independent data sources is imperative. In addition, controls and operational processes should be fully independent from the primary accounting function both from a technology and people perspective. This independently calculated NAV can then be used for a detailed comparison analysis with the primary NAV to identify and address any anomalies.

- Efficient: The process should be efficient. Leveraging automation provides consistent processes to help ensure exceptions are reviewed and handled correctly on T prior to NAV dissemination and can help firms achieve operational scale and an easily repeatable process.

- Transparent and Auditable: To support audit and regulator inspection, a full audit trail of controls performed, analysis and investigation made and flagging of exceptions is relevant. And, for those using multiple providers, aggregation of fund accounting data across service providers to deliver cross-provider validation and oversight should be strongly considered.

- Accurate and Timely: The accuracy and timeliness of NAVs is of significant importance. As already mentioned, firms will want to consider a contingent NAV strategy as part of their BCP to ensure that fund NAVs are available to the industry even if the primary calculation approach fails.

Combined in the right way, these principles demonstrate a robust framework that can provide fund boards, risk committees, regulators and investors with the comfort of knowing oversight over the NAV process is in place, while helping to drive greater transparency, efficiency and risk management for asset managers and asset owners.

As the outsourcing trend continues, and our economies re-open post COVID-19, we can expect there to be a continued focus by asset managers on oversight and operational resilience, making sure that they are well-positioned to continue their operations through any future crises.

12020 BNY Mellon survey of 200 global asset managers

2IM Guidance Update, June 2016

3Building operational resilience: impact tolerances for important business services and feedback to DP18/04, December 2019

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

The Bank of New York Mellon, a banking corporation organized pursuant to the laws of the State of New York, whose registered office is at 240 Greenwich St, NY, NY 10286, USA. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and is authorized by the Prudential Regulation Authority (PRA).

The Bank of New York Mellon operates in the UK through its London branch (UK companies house numbers FC005522 and BR000818) at One Canada Square, London E14 5AL and is subject to regulation by the Financial Conduct Authority (FCA) at 12 Endeavour Square, London, E20 1JN, UK and limited regulation by the Prudential Regulation Authority at Bank of England, Threadneedle St, London, EC2R 8AH, UK. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.

The Bank of New York Mellon SA/NV, a Belgian limited liability company, registered in the RPM Brussels with company number 0806.743.159, whose registered office is at 46 Rue Montoyerstraat, B-1000 Brussels, Belgium, authorized and regulated as a significant credit institution by the European Central Bank (ECB) at Sonnemannstrasse 20, 60314 Frankfurt am Main, Germany, and the National Bank of Belgium (NBB) at Boulevard de Berlaimont/de Berlaimontlaan 14, 1000 Brussels, Belgium, under the Single Supervisory Mechanism and by the Belgian Financial Services and Markets Authority (FSMA) at Rue du Congrès/Congresstraat 12-14, 1000 Brussels, Belgium for conduct of business rules, and is a subsidiary of The Bank of New York Mellon.

The Bank of New York Mellon SA/NV operates in Ireland through its Dublin branch at Riverside II, Sir John Rogerson's Quay Grand Canal Dock, Dublin 2, D02KV60, Ireland and is registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. The Bank of New York Mellon SA/NV, Dublin Branch is subject to limited additional regulation by the Central Bank of Ireland at New Wapping Street, North Wall Quay, Dublin 1, D01 F7X3, Ireland for conduct of business rules and registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E.

The Bank of New York Mellon SA/NV is trading in Germany as The Bank of New York Mellon SA/NV, Asset Servicing, Niederlassung Frankfurt am Main, and has its registered office at MesseTurm, Friedrich-Ebert-Anlage 49, 60327 Frankfurt am Main, Germany. It is subject to limited additional regulation by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, Marie-Curie-Str. 24-28, 60439 Frankfurt, Germany) under registration number 122721.

The Bank of New York Mellon SA/NV operates in the Netherlands through its Amsterdam branch at Strawinskylaan 337, WTC Building, Amsterdam, 1077 XX, the Netherlands. The Bank of New York Mellon SA/NV, Amsterdam Branch is subject to limited additional supervision by the Dutch Central Bank (‘De Nederlandsche Bank’ or ‘DNB’) on integrity issues only (registration number 34363596). DNB holds office at Westeinde 1, 1017 ZN Amsterdam, the Netherlands.

The Bank of New York Mellon SA/NV operates in Luxembourg through its Luxembourg branch at 2-4 rue Eugene Ruppert, Vertigo Building – Polaris, L- 2453, Luxembourg. The Bank of New York Mellon SA/NV, Luxembourg Branch is subject to limited additional regulation by the Commission de Surveillance du Secteur Financier at 283, route d’Arlon, L-1150 Luxembourg for conduct of business rules, and in its role as UCITS/AIF depositary and central administration agent.

The Bank of New York Mellon SA/NV operates in France through its Paris branch at 7 Rue Scribe, Paris, Paris 75009, France. The Bank of New York Mellon SA/NV, Paris Branch is subject to limited additional regulation by Secrétariat Général de l’Autorité de Contrôle Prudentiel at Première Direction du Contrôle de Banques (DCB 1), Service 2, 61, Rue Taitbout, 75436 Paris Cedex 09, France (registration number (SIREN) Nr. 538 228 420 RCS Paris - CIB 13733).

The Bank of New York Mellon SA/NV operates in Italy through its Milan branch at Via Mike Bongiorno no. 13, Diamantino building, 5th floor, Milan, 20124, Italy. The Bank of New York Mellon SA/NV, Milan Branch is subject to limited additional regulation by Banca d’Italia - Sede di Milano at Divisione Supervisione Banche, Via Cordusio no. 5, 20123 Milano, Italy (registration number 03351).

BNY Mellon Fund Services (Ireland) Designated Activity Company is registered in Ireland No 218007, VAT No. IE8218007 W with a registered office at One Dockland Central, Guild Street, IFSC, Dublin 1. BNY Mellon Fund Services (Ireland) Designated Activity Company is regulated by the Central Bank of Ireland.

The Bank of New York Mellon (International) Limited is registered in England & Wales with Company No. 03236121 with its Registered Office at One Canada Square, London E14 5AL. The Bank of New York Mellon (International) Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Regulatory information in relation to the above BNY Mellon entities operating out of Europe can be accessed at the following website: https://www.bnymellon.com/RID.

The Bank of New York Mellon has various subsidiaries, affiliates, branches and representative offices in the Asia-Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction. Details about the extent of our regulation and applicable regulators in the Asia-Pacific Region are available from us on request. Among others, The Bank of New York Mellon, Singapore Branch is subject to regulation by the Monetary Authority of Singapore. The Bank of New York Mellon, Hong Kong Branch (a banking corporation organized and existing under the laws of the State of New York with limited liability) is subject to regulation by the Hong Kong Monetary Authority and the Securities & Futures Commission of Hong Kong. The Bank of New York Mellon, Shanghai and Beijing branches are subject to regulation by the China Banking and Insurance Regulatory Commission. The Bank of New York Mellon, Seoul Branch is subject to regulation by the Financial Services Commission, the Financial Supervisory Service and The Bank of Korea.

Whilst The Bank of New York Mellon (BNY Mellon) is authorised to provide financial services in Australia, it is exempt from the requirement to hold, and does not hold, an Australian financial services license as issued by the Australian Securities and Investments Commission under the Corporations Act 2001 (Cth) in respect of the financial services provided by it to persons in Australia. BNY Mellon is regulated by the New York State Department of Financial Services and the US Federal Reserve under Chapter 2 of the Consolidated Laws, The Banking Law enacted April 16, 1914 in the State of New York, which differs from Australian laws.

The Bank of New York Mellon Securities Company Japan Ltd, subject to supervision by the Financial Services Agency of Japan, acts as intermediary in Japan for The Bank of New York Mellon and its affiliates, with its registered office at Marunouchi Trust Tower Main, 1-8-3 Marunouchi, Chiyoda-ku, Tokyo 100-1005, Japan.

If this material is distributed in, or from, the Dubai International Financial Centre (“DIFC”), it is communicated by The Bank of New York Mellon, DIFC Branch, regulated by the DFSA and located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE, on behalf of The Bank of New York Mellon, which is a wholly-owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients and Market Counterparties only and no other person should act upon it.

Past performance is not a guide to future performance of any instrument, transaction or financial structure and a loss of original capital may occur. Calls and communications with BNY Mellon may be recorded, for regulatory and other reasons.

Disclosures in relation to certain other BNY Mellon group entities can be accessed at the following website: http://disclaimer.bnymellon.com/eu.htm.

This document and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. This material is intended for wholesale/professional clients (or the equivalent only), is not intended for use by retail clients and no other person should act upon it. Persons who do not have professional experience in matters relating to investments should not rely on this material. BNY Mellon will only provide the relevant investment services to investment professionals.

Not all products and services are offered in all countries.

If distributed in the UK, this material is a financial promotion. If distributed in the EU, this material is a marketing communication.

This material, which may be considered advertising, is for general information purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter. This material does not constitute a recommendation or advice by BNY Mellon of any kind. Use of our products and services is subject to various regulations and regulatory oversight. You should discuss this material with appropriate advisors in the context of your circumstances before acting in any manner on this material or agreeing to use any of the referenced products or services and make your own independent assessment (based on such advice) as to whether the referenced products or services are appropriate or suitable for you. This material may not be comprehensive or up to date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given. BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be distributed or used for the purpose of providing any referenced products or services or making any offers or solicitations in any jurisdiction or in any circumstances in which such products, services, offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements.

© 2021 The Bank of New York Mellon Corporation. All rights reserved.