Consumer Duty

New Heights in Retail Consumer Protection

Consumer Duty

January 2023

The Financial Conduct Authority’s (FCA) Consumer Duty represents a significant shift in the treatment of retail customers across the Financial Services industry. It introduces a new Consumer Principle, supported by rules and guidance, which requires firms to “act to deliver good outcomes for retail customers” 1, including identifying and preventing foreseeable harm before it can occur. The FCA rules and guidance on the Consumer Duty were published on 27 July 2022 and will become effective on 31 July 2023.

Below is a summary of the key takeaways from the FCA for market participants to keep in mind:

1. What are the proposed changes?

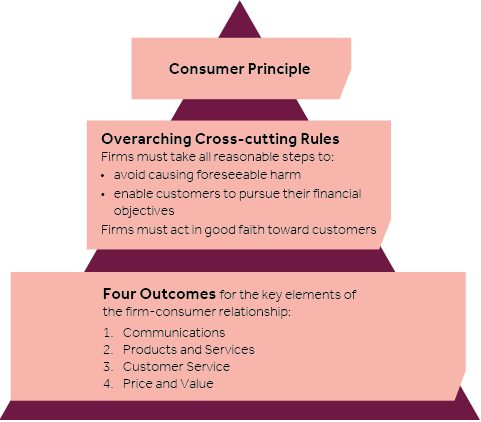

- The Consumer Principle will be underpinned by a set of cross-cutting rules that include to act in good faith, avoid causing foreseeable harm and enable and support customers to pursue their financial objectives.

- The Consumer Duty applies to all firms (including wholesale firms) that can determine or have a material influence over retail customer outcomes.

- The rules and guidance further explain how firms should act to deliver good outcomes for retail customers related to:

- Governance of products and services

- Price and value

- Consumer understanding

- Consumer support

Consumer Duty Structure

- Firms must notify the FCA if they become aware that another firm in the distribution chain is, or may be, in breach of the Consumer Duty.

- Firms are expected to appoint a “Consumer Duty Champion” at board level (and from the independent non-executive directors, where possible) to help ensure that the Consumer Duty is discussed regularly and raised in all relevant fora. Firms need to be prepared to share with the FCA the content of these discussions.

- The FCA emphasises that Consumer Duty does not create a fiduciary duty (good faith/trust relationship) where one does not already exist. They are proposing an objective element such that its rules and guidance should be interpreted in line with the standard that could reasonably be expected of a prudent firm carrying on the same activity in relation to the same product or service, and with the necessary understanding of the needs and characteristics of its clients.

2. Scope: to whom, and when does the Consumer Duty apply?

The Consumer Duty applies to UK-authorised firms undertaking activities in the UK that ultimately have a material impact on retail clients. Firms not authorised under the Financial Services and Markets Act 2000 (FSMA) are not subject to the requirements.

The Consumer Duty rules will apply on a forward-looking basis to existing products and services that are either currently being sold or renewed, or that are no longer being sold or renewed but are still used by existing customers. It will not apply retrospectively to products and services which are no longer in use by customers.

3. What are the Consumer Duty key transition milestones?

The FCA set five milestones to help meet higher and clearer standards of consumer protection across financial services:

4. Are firms responsible for both types of relationships with retail customers - direct and indirect?

The Consumer Duty captures firms that provide services to retail customers, even where those firms do not have a direct relationship with the retail client (e.g., there is no contractual relationship with a retail client), if the firm is able to have a material influence over, or determine, a retail customer outcome relating to:

(i) Products and services

(ii) Price and value

(iii) Consumer understanding, and

(iv) Consumer support

5. How is BNY Mellon preparing for the anticipated implementation of the Consumer Duty?

BNY Mellon has established a Consumer Duty programme with the purpose of assessing the impact of the Consumer Duty rules and guidance on the firm.

Actions for Consideration

It is important to note that the Consumer Duty is underpinned by reasonableness and firms are only required to do what can be reasonably expected of a prudent firm carrying on the same activity in relation to the same product or service. The FCA has further expressed that it will apply its rules in a proportionate manner.

Some of the Consumer Duty considerations we are taking into account as part of our programme include2:

• Effective prioritisation:

Focus on reducing the risk of poor consumer outcomes and assessing where firms are likely to be furthest away from the requirements of the Consumer Duty.

• Embedding the substantive requirements:

Carefully consider the substantive requirements of the Consumer Duty, as set out in the FCA’s final rules and guidance. Ensure the review of communications and customer journeys are part of the products and services review needed to meet the new standards, where applicable.

• Risk-based approach:

Deploying a risk-based approach in areas where meeting deadlines is likely to be most challenging and ensuring that decision-makers take into consideration the potential for customer harm when prioritising.

• Working with other firms:

Work and share information with other firms in the distribution chain, as required.

• Monitoring and governance:

Consider ongoing compliance with Consumer Duty post implementation date and engagement with board and senior managers as part of this framework.

Further Queries

If you have further questions regarding the expected Consumer Duty transition, please contact your BNY Mellon representative.

1 FCA Finalised Guidance; FG22/5, p. 24

2 This is not intended to be an exhaustive list.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names of BNY Mellon in various countries by duly authorized and regulated subsidiaries, affiliates, and joint ventures of BNY Mellon, which may include any of those listed below:

The Bank of New York Mellon, a banking corporation organized pursuant to the laws of the State of New York, whose registered office is at 240 Greenwich St, NY, NY 10286, USA. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and is authorized by the Prudential Regulation Authority (PRA) (Firm Reference Number: 122467).

In the UK., a number of services associated with BNY Mellon Wealth Management’s Family Office Services – International are provided through The Bank of New York Mellon, London Branch. The Bank of New York Mellon also operates in the UK through its London branch (UK companies house numbers FC005522 and BR000818) at BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA, UK and is subject to regulation by the Financial Conduct Authority (FCA) at 12 Endeavour Square, London, E20 1JN, UK and limited regulation by the PRA at The Bank of England, Threadneedle St, London, EC2R 8AH, UK. Details about the extent of our regulation by the PRA are available from us on request.

Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd.

BNY Mellon Fund Services (Ireland) Designated Activity Company is registered with Company No 218007, having its registered office at One Dockland Central, Guild Street, IFSC, Dublin 1, Ireland. It is regulated by the Central Bank of Ireland.

The Bank of New York Mellon operates in Germany through its Frankfurt am Main branch (registered in Germany with Registration No. HRB 12731) at Friedrich-Ebert-Anlage 49, 60327 Frankfurt am Main, Germany. It is under the supervision of the German Central Bank and the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, Marie-Curie-Str. 24-28, 60439 Frankfurt, Germany) under registration number 10100253.

The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at Boulevard Anspachlaan 1, B-1000 Brussels, Belgium, authorised and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, a subsidiary of The Bank of New York Mellon.

The Bank of New York Mellon SA/NV operates in Ireland through its Dublin branch at Riverside II, Sir John Rogerson's Quay Grand Canal Dock, Dublin 2, D02KV60, Ireland and is registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. The Bank of New York Mellon SA/NV, Dublin Branch is subject to additional regulation by the Central Bank of Ireland for Depository Services and for conduct of business rules.

The Bank of New York Mellon SA/NV operates in Germany as The Bank of New York Mellon SA/NV, Asset Servicing, Niederlassung Frankfurt am Main, and has its registered office at MesseTurm, Friedrich-Ebert-Anlage 49, 60327 Frankfurt am Main, Germany. It is subject to limited additional regulation by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, Marie-Curie-Str. 24-28, 60439 Frankfurt, Germany) under registration number 122721.

The Bank of New York Mellon SA/NV operates in Poland as The Bank of New York Mellon SA/NV (Joint-stock Company) Branch in Poland with Statistical Number 524311310, whose registered office is at Sucha 2, 50-086 Wroclaw, Poland. The Bank of New York Mellon SA/NV (Joint-stock Company) Branch in Poland is a non-contracting branch.

The Bank of New York Mellon SA/NV operates in the Netherlands through its Amsterdam branch at Tribes SOM2 Building, Claude Debussylaan 7, 1082 MC Amsterdam,, the Netherlands. The Bank of New York Mellon SA/NV, Amsterdam Branch is subject to limited additional supervision by the Dutch Central Bank (“De Nederlandsche Bank” or “DNB”) on integrity issues only (registration number 34363596). DNB holds office at Westeinde 1, 1017 ZN Amsterdam, the Netherlands.

The Bank of New York Mellon SA/NV operates in Luxembourg through its Luxembourg branch at 2-4 rue Eugene Ruppert, Vertigo Building – Polaris, L- 2453, Luxembourg. The Bank of New York Mellon SA/NV, Luxembourg Branch is subject to limited additional regulation by the Commission de Surveillance du Secteur Financier at 283, route d’Arlon, L-1150 Luxembourg for conduct of business rules, and in its role as UCITS/AIF depositary and central administration agent.

The Bank of New York Mellon SA/NV operates in France through its Paris branch at 7 Rue Scribe, Paris, Paris 75009, France. The Bank of New York Mellon SA/NV, Paris Branch is subject to limited additional regulation by Secrétariat Général de l’Autorité de Contrôle Prudentiel at Première Direction du Contrôle de Banques (DCB 1), Service 2, 61, Rue Taitbout, 75436 Paris Cedex 09, France (registration number (SIREN) Nr. 538 228 420 RCS Paris - CIB 13733).

The Bank of New York Mellon SA/NV operates in Italy through its Milan branch at Via Mike Bongiorno no. 13, Diamantino building, 5th floor, Milan, 20124, Italy. The Bank of New York Mellon SA/NV, Milan Branch is subject to limited additional regulation by Banca d’Italia - Sede di Milano at Divisione Supervisione Banche, Via Cordusio no. 5, 20123 Milano, Italy (registration number 03351).

The Bank of New York Mellon SA/NV operates in Denmark as The Bank of New York Mellon SA/NV, Copenhagen Branch, filial af The Bank of New York Mellon SA/NV, Belgien, and has its registered office at Tuborg Boulevard 12, 3. DK-2900 Hellerup, Denmark. It is subject to limited additional regulation by the Danish Financial Supervisory Authority (Finanstilsynet, Århusgade 110, 2100 København Ø).

The Bank of New York Mellon SA/NV operates in Spain through its Madrid branch with registered office at Calle José Abascal 45, Planta 4ª, 28003, Madrid, and enrolled on the Reg. Mercantil de Madrid, Tomo 41019, folio 185 (M-727448). The Bank of New York Mellon, Sucursal en España is registered with Banco de España (registration number 1573).

The Bank of New York Mellon SA/NV operates in England through its London branch at 160 Queen Victoria Street, London EC4V 4LA, UK, registered in England and Wales with numbers FC029379 and BR014361. The Bank of New York Mellon SA/NV, London branch is authorized by the ECB (address above) and is deemed authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.

The Bank of New York Mellon (International) Limited is registered in England & Wales with Company No. 03236121 with its Registered Office at BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. The Bank of New York Mellon (International) Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Regulatory information in relation to the above BNY Mellon entities operating out of Europe can be accessed at the following website: https://www.bnymellon.com/RID.

For clients located in Switzerland: The information provided herein does not constitute an offer of financial instrument or an offer to provide financial service in Switzerland pursuant to or within the meaning of the Swiss Financial Services Act ("FinSA") and its implementing ordinance. This is solely an advertisement pursuant to or within the meaning of FinSA and its implementing ordinance. Please be informed that The Bank of New York Mellon and The Bank of New York Mellon SA/NV are entering into the OTC derivative transactions as a counterparty, i.e. acting for its own account or for the account of one of its affiliates. As a result, where you enter into any OTC derivative transactions with us, you will not be considered a "client" (within the meaning of the FinSA) and you will not benefit from the protections otherwise afforded to clients under FinSA.

The Bank of New York Mellon, Singapore Branch, is subject to regulation by the Monetary Authority of Singapore. For recipients of this information located in Singapore: This material has not been reviewed by the Monetary Authority of Singapore.

The Bank of New York Mellon, Hong Kong Branch (a branch of a banking corporation organized and existing under the laws of the State of New York with limited liability), is subject to regulation by the Hong Kong Monetary Authority and the Securities & Futures Commission of Hong Kong.

The Bank of New York Mellon, Seoul Branch, is a licensed foreign bank branch in Korea and regulated by the Financial Services Commission and the Financial Supervisory Service. The Bank of New York Mellon, Seoul Branch, is subject to local regulation (e.g. the Banking Act, the Financial Investment Services and Capital Market Act, and the Foreign Exchange Transactions Act etc.).

The Bank of New York Mellon is regulated by the Australian Prudential Regulation Authority and also hold an Australian Financial Services Licence No. 527917 issued by the Australian Securities and Investments Commission to provide financial services to wholesale clients in Australia.

The Bank of New York Mellon has various other branches in the Asia-Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction.

The Bank of New York Mellon, Tokyo Branch, is a licensed foreign bank branch in Japan and regulated by the Financial Services Agency of Japan. The Bank of New York Mellon Trust (Japan), Ltd., is a licensed trust bank in Japan and regulated by the Financial Services Agency of Japan. The Bank of New York Mellon Securities Company Japan Ltd., is a registered type 1 financial instruments business operator in Japan and regulated by the Financial Services Agency of Japan.

The Bank of New York Mellon, DIFC Branch, regulated by the Dubai Financial Services Authority (DFSA) and located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE, on behalf of The Bank of New York Mellon, which is a wholly-owned subsidiary of The Bank of New York Mellon Corporation.

Pershing is the umbrella name for Pershing LLC (member FINRA, SIPC and NYSE), Pershing Advisor Solutions (member FINRA and SIPC), Pershing Limited (UK), Pershing Securities Limited (UK), Pershing Securities International Limited (Ireland), Pershing (Channel Islands) Limited, Pershing Securities Canada Limited, Pershing Securities Singapore Private Limited, and Pershing India Operational Services Pvt Ltd. Pershing businesses also include Pershing X, Inc. a technology provider, and Lockwood Advisors, Inc., an investment adviser registered in the United States under the Investment Advisers Act of 1940. Pershing LLC is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at sipc.org. SIPC does not protect against loss due to market fluctuation. SIPC protection is not the same as, and should not be confused with, FDIC insurance.

Past performance is not a guide to future performance of any instrument, transaction or financial structure and a loss of original capital may occur. Calls and communications with BNY Mellon may be recorded, for regulatory and other reasons.

Disclosures in relation to certain other BNY Mellon group entities can be accessed at the following website: http://disclaimer.bnymellon.com/eu.htm.

This material is intended for wholesale/professional clients (or the equivalent only), is not intended for use by retail clients and no other person should act upon it. Persons who do not have professional experience in matters relating to investments should not rely on this material. BNY Mellon will only provide the relevant investment services to investment professionals.

Not all products and services are offered in all countries.

If distributed in the UK, this material is a financial promotion. If distributed in the EU, this material is a marketing communication.

This material, which may be considered advertising, (but shall not be considered advertising under the laws and regulations of Brunei, Malaysia or Singapore), is for general information purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional counsel or advice on any matter. This material does not constitute a recommendation or advice by BNY Mellon of any kind. Use of our products and services is subject to various regulations and regulatory oversight. You should discuss this material with appropriate advisors in the context of your circumstances before acting in any manner on this material or agreeing to use any of the referenced products or services and make your own independent assessment (based on such advice) as to whether the referenced products or services are appropriate or suitable for you. This material may not be comprehensive or up to date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given. BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be distributed or used for the purpose of providing any referenced products or services or making any offers or solicitations in any jurisdiction or in any circumstances in which such products, services, offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements.

BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

Any references to dollars are to US dollars unless specified otherwise.

This material may not be reproduced or disseminated in any form without the prior written permission of BNY Mellon. Trademarks, logos and other intellectual property marks belong to their respective owners.

The Bank of New York Mellon, member of the Federal Deposit Insurance Corporation (FDIC).

Trademarks and logos belong to their respective owners.

bnymellon.com Please click here for additional information regarding disclaimers and disclosures.

© 2023 The Bank of New York Mellon. All rights reserved.