Navigating a

Real-Time World in Treasury Management

How to drive efficiency and open possibilities for corporate treasuries

Navigating a

Real-Time World in Treasury Management

How to drive efficiency and open possibilities for corporate treasuries

November 2023

By Kevin Barr and Eric Peterson

Today’s Challenges and the Shift Toward Real-Time

Trapped liquidity. Cut-off times. Lost yield. Stale data. These are just some of the typical challenges corporate treasuries and cash management professionals face.

Yet, most of these legacy issues can be solved by eliminating the constraints of today’s operating hours and out-dated infrastructure underpinning transactions.

The Rise of Real-Time Payments Globally

The journey to 24/7 real-time payments (24/7RT) and corporate treasury management has been underway for some time now, with most progress made in economies that have emerged over the past two decades. Many developed countries have seen a continued introduction of new domestic payment rails: in the United States, for example, the first ever real-time payment was enabled through The Clearing House’s RTP® platform in 2017 and the FedNow Service ® payment rail followed six years later with its first real-time transaction on July 20, 2023. As the initiating bank for these transactions, BNY Mellon played an active role in the launch of both industry platforms.

Despite these developments, it is emerging markets that remain the forerunners when it comes to real-time payments adoption.

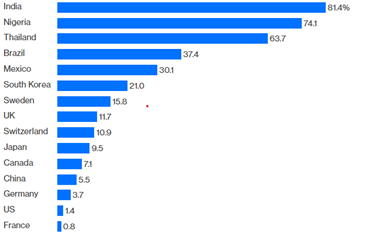

Figure 1: U.S. Lags World in Adopting Instant Payments

Real-time payments as a percent of all electronic transactions in 2022

Source: ACI’s Worldwide 2023 Prime Time for Real-Time Global Payments Report

Why There is a Lag in 24/7 Real-Time Payment Adoption?

Data from 2022 (Figure 1) reveals that, even as real-time payments offerings become more readily available, they still only account for a fraction of the electronic payments made in many developed markets. For example, RTP in the U.S. had by this point been established for five years but only 1.4% of payments were real-time payments; in the UK, although its Faster Payments rail launched in 2008, only around 12% of transactions were real-time in 2022.

Overcoming Technical Complexities in Real-Time Liquidity Management

So, what is behind the low volumes and rate of adoption? While 24/7 real-time payment offerings can provide a host of benefits, they can also introduce technical and operational complexity, slowing widespread uptake of solutions that solve industry-wide cash management challenges.

Benefits of a Real-Time Ecosystem

What’s needed to overcome these and for the industry to take the next step towards near-instant treasury and cash management capabilities? An open, real-time ecosystem, with a clear implementation roadmap and a strategic financial services collaborator to help navigate changes to treasury operating models will help drive adoption of 24/7RT operations. Movement in this direction can set the stage for the future of corporate treasury management to encompass:

- A single, holistic, real-time view into global liquidity pools through the front-end of the clients’ choice.

- Near-instantaneous payment initiation and smart-routing across high/low-value domestic and cross-border rails.

- Transparent management of financing with additional borrowing options from existing and emerging lenders.

Creating the 24/7 Real-Time Ecosystem

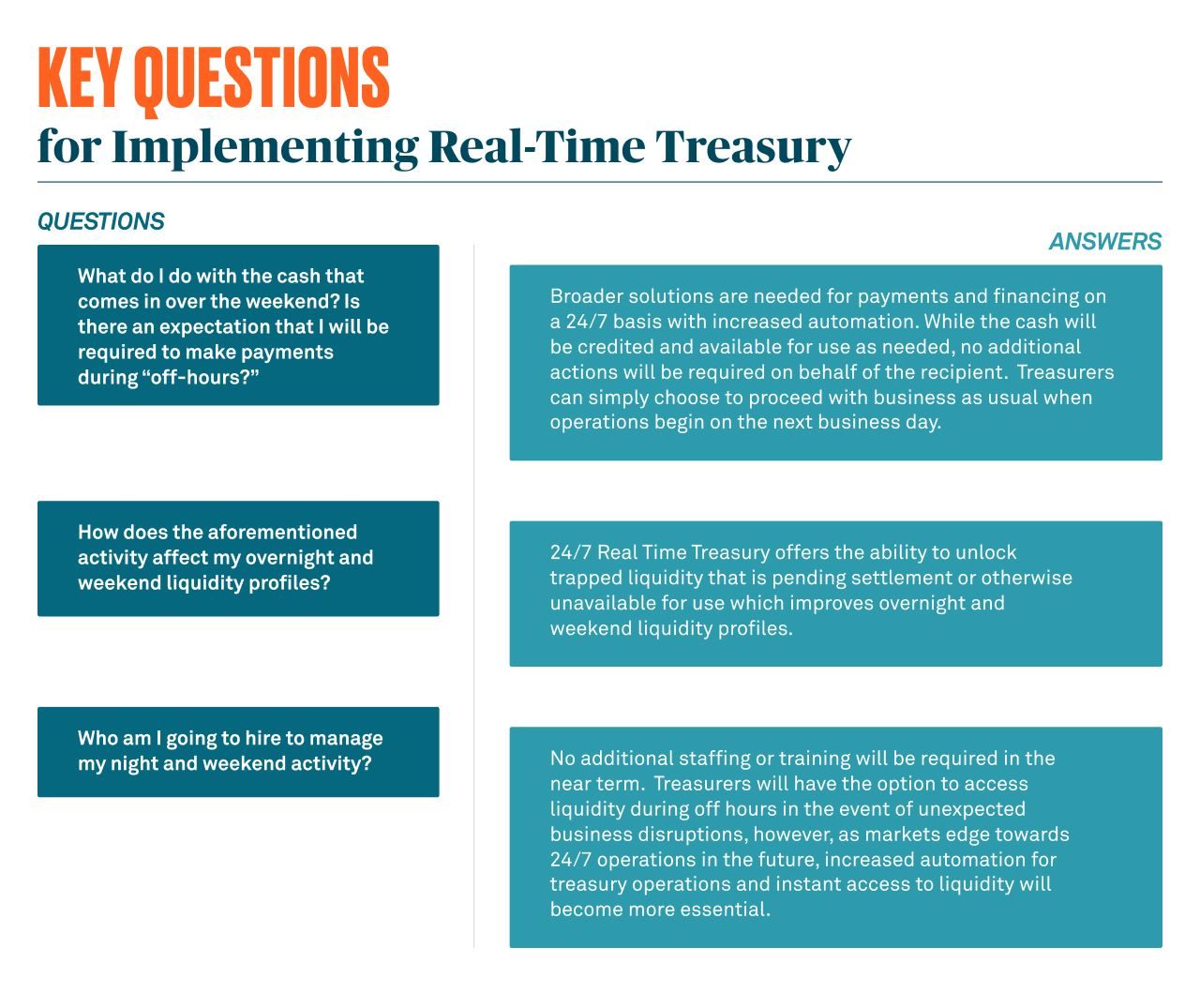

The complexity introduced by 24/7 real-time payments is not necessarily in the new capability itself, nor the integration. Consider a leading U.S. treasurer who is excited to begin using real-time payments as an alternative to low-value domestic wires. As part of the planning and implementation process, that treasurer will be seeking answers to key questions.

Addressing Real-Time Challenges

With all answers involving a significant technology build and subject matter expertise, this creates a recipe for more challenges for that treasurer.

Foundational Capabilities for Real-Time Treasury

To understand how best to address the accompanying complexities of adopting real-time payments, it’s important to set aside the treasurer’s staffing concerns temporarily and examine three broader capabilities needed to support 24/7 real-time payments – and in turn, enable 24/7 real-time treasury management:

Payments and Routing Complexity

As payment options proliferate (along with settlement timing), clients need the tools and channels to help manage this complexity. Consider a U.S. e-commerce client moving to 24/7RT, with operations in the U.S. and APAC. The client now needs to make and accept high and low value payments across at least six payment rails in the U.S., and multiples of this in APAC, across jurisdictions.

In response, leading payment providers will make smart routing available, which will direct payments through the appropriate rail – based on factors such as: the transaction value, the need for settlement immediacy and cost appetite of the treasury – at the appropriate time, with the applicable fraud mitigants. In addition, while not all payment rails are designed or need to be settled in real-time, (ACH is still largely undefeated for recurring, low-value payments with pullback protection, while leading banks are already providing 24/7 wires amongst their clients), transparency regarding status and notifications of payment settlement will become real-time on these rails. In turn, this will better inform cash management optimization.

Liquidity in Real-Time Environments

Clients (both corporates and financial institutions) need banking infrastructure that provides a real-time view into liquidity. There should be no delay between the time a payment hits an account or when interest accrues and when a client has visibility into the impact on their liquidity position. In turn, this should reduce the need for reconciliation between banks and front-end tools (e.g., employee resource planning systems which are used to manage day-to-day business activities such as accounting, reporting, etc.) as the infrastructure on which the liquidity is managed and viewed are synced in real-time as well.

Equipped with these tools, clients will be able to go beyond the in-house bank models that have gained traction. In fact, treasurers can become singular, programmatic managers of global cash, driving additional yield1 and working capital efficiency through a holistic view of global pooling and sweeping structures, while creating efficiencies in the operations of the treasury itself.

The Future of Real-Time Financing

As clients have a real-time view into liquidity and expected cash flow via payments/receivables, they now need a 24/7RT view of their core credit and trade/supply-chain financing. Having this enhanced visibility into exposure, interest costs and available lines of credit will be key to optimizing working capital and putting this cash to the most productive or highest yielding uses.

Clients should also expect that the nature of their credit providers may shift over time, as non-bank financial institutions (NBFIs) gain exposure to traditionally less-liquid assets, such as bank and trade loans, through the increased use of technology primed to maximize liquidity, like tokenization. This change in the tech stack, which stores, moves and services assets, will also drive the need for liquidity and payments infrastructure that supports the atomic settlement of those assets and associated repayment of outstanding debt. The focus on the use of tokenized capabilities will be even more relevant to the largest multi-national corporates, who may have their own trading and funding desk.

These foundational capabilities also necessitate that the data is real-time, which offers additional opportunities to harness actionable insights – likely using generative AI and potentially supercharged using quantum computing in the years to come. This will help clients make meaningful advances in areas like liquidity optimization, FX hedging, managing cost of capital and improving the efficiency of their operations, with the aim of freeing up time for treasury staff to focus on the strategic tasks with which they are increasingly asked to lead.

Key to achieving any of the above is also adopting modern, inherently real-time technologies, some of which may leverage fundamental upgrades to financial market infrastructure, including tokenization of deposits and assets. With this tech upgrade and 24/7RT capabilities, it’s possible to solve our treasurer’s leading real-time payments challenge.

The Transformation Towards Automated Treasury Management

Receiving a phone call at 7 p.m. on a Saturday regarding a payment that didn’t go out as expected isn’t a call most, if any, treasurers want to receive. The treasurer could choose to hire additional staff to cover these hours, but this increases costs for what is likely not a core operating hour. Alternatively, the treasurer can choose to not do business during these hours, though the markets they participate in certainly won’t stop for their leisure.

The answer to operating in a 24/7RT environment is not to hire more ops staff, nor is it to ignore the realities of operating in a global marketplace. Instead, investments in business analysts and leveraging firm-wide engineering talent are key to driving success. If payments need to be disbursed after a certain level of expected collections happen over the weekend/during off hours, a trigger (or smart contract, if using distributed ledger technology) can be built to automatically initiate payments, leveraging the smart routing capabilities previously described.

The Role of Automation and Data in 24/7 Operations

This model becomes more powerful as treasuries ingest additional banking and market data to create algorithmic decision making, enhanced by AI. Although this sounds futuristic, it is not; ask any quant fund in the market today – these technologies are quickly becoming a reality. While the range of financial instruments involved in running a treasury may be less than a macro quant fund, the same lessons from trading becoming algorithmic can be applied to treasuries, and de-risked by leveraging best practices from the investment management space to accelerate adoption in corporate treasuries.

Just as the trading pits of history have faded into the past, so will the line between treasury ops staff and the technology teams that support them. Treasury operations in a 24/7RT world doesn’t mean staffing weekends and holidays, it means higher levels of automation and straight-through processing; it means that harnessing data isn’t downloading reports or managing spreadsheets, it is data embedded in workflows and updated at the speed of the markets in which we operate. Ultimately, it also means less time focusing on operational activities related to cash management, and more time spent thinking about how best to optimize and deploy that cash, with the most up-to-date information available.

Taking The First Steps Toward 24/7 Real-Time Treasury

When evaluating how to take the first step into a 24/7 real-time future, finding pockets of value-add adoption are the first port of call, since an entire treasury function is unlikely to be ready for a total renovation tomorrow. Identify areas or functions that would benefit most from leapfrogging an incremental upgrade, on the path to 24/7RT. Measured progress is a prudent and risk-based approach to enable real-time treasury and a necessity for the industry to embrace the next wave of transaction banking.

1. Source: Bloomberg Opinion, “Banking is going 24/7. Mind the Risks.” https://www.bloomberg.com/opinion/articles/2023-07-07/fednow-is-coming-here-are-some-of-the-risks

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names in various countries by duly authorized and regulated subsidiaries, affiliates, and joint ventures of BNY Mellon, which may include any of the following. The Bank of New York Mellon, at 240 Greenwich Street, New York, NY 10286, USA a banking corporation organized pursuant to the laws of the State of New York, and operating in England through its branch at 160 Queen Victoria Street, London, EC4V 4LA, UK, registered in England and Wales with numbers FC005522 and BR000818. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon, London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at 46 Rue Montoyerstraat, B-1000 Brussels, Belgium, authorized and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, and a subsidiary of The Bank of New York Mellon. The Bank of New York Mellon SA/NV operates in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, UK, registered in England and Wales with numbers FC029379 and BR014361. The Bank of New York Mellon SA/NV (London Branch) is authorized by the ECB and subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority. Details about the extent of our regulation by the Financial Conduct Authority and Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV operating in Ireland through its branch at 4th Floor Hanover Building, Windmill Lane, Dublin 2, Ireland trading as The Bank of New York Mellon SA/NV, Dublin Branch, is authorized by the ECB and is registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. The Bank of New York Mellon, Singapore Branch, subject to regulation by the Monetary Authority of Singapore. The Bank of New York Mellon, Hong Kong Branch, subject to regulation by the Hong Kong Monetary Authority and the Securities & Futures Commission of Hong Kong. If this material is distributed in Japan, it is distributed by The Bank of New York Mellon Securities Company Japan Ltd, as intermediary for The Bank of New York Mellon. If this material is distributed in, or from, the Dubai International Financial Centre (“DIFC”), it is communicated by The Bank of New York Mellon, DIFC Branch, regulated by the DFSA and located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE, on behalf of The Bank of New York Mellon, which is a wholly-owned subsidiary of The Bank of New York Mellon Corporation. This presentation, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. BNY Mellon does not warrant or guarantee the accuracy or completeness of, nor undertake to update or amend the information or data contained herein. We expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon any of this information or data. This material is intended for Professional Clients and market counterparties only and no other person should act upon it. The information contained in this presentation is for use by wholesale clients only and is not to be relied upon by retail clients. Not all products and services are offered in all countries.

The Bank of New York Mellon is regulated by the Australian Prudential Regulation Authority and also holds an Australian Financial Services License No. 527917 issued by the Australian Securities and Investments Commission to provide financial services to wholesale clients in Australia.

This material does not constitute an offer to sell or the solicitation of an offer to buy any products or services in the People’s Republic of China (PRC) to any person to whom it is unlawful to make the offer or solicitation in the PRC. BNY Mellon does not represent that this material may be lawfully distributed, or that any products may be lawfully offered, in compliance with any applicable registration or other requirements in the PRC, or pursuant to an exemption available thereunder, or assume any responsibility for facilitating any such distribution or offering. In particular, no action has been taken by the issuer which would permit a public offering of any products or distribution of this material in the PRC. Accordingly, the products are not being offered or sold within the PRC by means of this material or any other document. Neither this material nor any advertisement or other offering material may be distributed or published in the PRC, except under circumstances that will result in compliance with any applicable laws and regulations. Products may be offered or sold to PRC investors outside the territory of the PRC provided that such PRC investors are authorized to buy and sell the products in the offshore market. Potential PRC investors are responsible for obtaining all relevant approvals from the PRC government authorities, including but not limited to the State Administration of Foreign Exchange, and compliance with all applicable laws and regulations, including but not limited to those of the PRC, before purchasing the products.

Trademarks and logos belong to their respective owners.

© 2023 The Bank of New York Mellon Corporation.