The Great China Convergence

Expert Insights from Asset Servicing Live Webcast Series

The Great China Convergence

Expert Insights from Asset Servicing Live Webcast Series

December 2018

By Magdalene Tay

In October, BNY Mellon hosted a live webcast, The Great China Convergence. Eugenie Shen from ASIFMA and Tae Yoo from HKEX shared their insights on the various China access schemes, the challenges and milestones, as well as how the future landscape is shaping up. Magdalene Tay served as moderator.

Over the past year, we have witnessed further liberalization of China’s capital markets. Across the five China access schemes – namely Renminbi ("RMB") Qualified Foreign Institutional Investor ("RQFII"), Qualified Foreign Institutional Investor ("QFII"), Stock Connect, Bond Connect and the China Interbank Bond Market ("CIBM") Direct Route schemes - we are seeing significant steps taken towards the harmonization of the gateways to the country’s domestic markets.

BNY Mellon Asset Servicing hosted a live audio webcast titled "The Great China Convergence" in October. Eugenie Shen from Asia Securities Industry & Financial Markets Association (ASIFMA) and Tae Yoo from Hong Kong Exchange and Clearing Limited (HKEX) shared their insights on the various China access schemes, the challenges and milestones, as well as how the future landscape is shaping up. Magdalene Tay from BNY Mellon, moderated the discussion.

Key Challenges and Potential Solutions

At present, global investors accessing China through these schemes are faced with regulatory, market structure and overall enhancement challenges associated with increased investor demand for access, complying with on-shore China market regulation and structural differences to international market practice in operation and regulatory guidelines.

First. The first challenge arises from the discrepancy between the regulatory regime in mainland China and international practices for short selling, block trading, and holiday trading arrangements. For example, true DvP is not available for onshore QFII and RQFII schemes. In addition, market participants and global investors would like block trading to be made available under Stock Connect where currently the transfer of China securities must be conducted on the stock exchange. Holiday trading restriction also limits trading opportunities as global investors are not allowed to trade via Stock Connect one day before a public holiday in Hong Kong or mainland China.

Second. The second challenge is around market structure. The same-day (T+0) trade settlement for China A-shares presents an operational burden for global investors, global custodians and market participants to complete the settlement obligations. In comparison, CIBM (China Interbank Bond Market) Direct/Bond Connect, has the flexibility of a T+1 and T+2 settlement, and hence trade confirmation is not an issue. Implementing changes to a T+0 settlement cycle for Stock Connect is however not an easy task.

Offshore CNH and onshore CNY funding are options available for investment in China bonds. However, there is a limited number of RMB FX settlement banks to support onshore CNY for Bond Connect transactions and most global custodians are not currently able to provide CNY funding. Moreover, global investors can only engage one RMB FX settlement bank for both capital inflows and outflows which raises best execution issues.

Third. Lastly, the complexities behind the market adaptation of future schemes continue to pose challenges. With FTSE and Bloomberg announcing inclusion of China A-shares and bonds into their index franchise, foreign investment in China’s capital markets is expected to grow. This means that Chinese regulators will need to work closely with industry players to address funding issues and ensure that the settlement system is robust and performing at a zero-error level to continuously gain investors’ confidence.

Key Developments

Technology as an Enabler

With the advancement in technology, post trade services can be enhanced to provide efficiency and resiliency. Market participants and regulators are developing innovative solutions to address challenges including different time zones, short settlement cycle and post-trade processing.

In October this year, HKEX confirmed its partnership with Digital Asset to develop a blockchain platform. This digital initiative aims to allow global asset managers to complete post-trade allocations and processing for Stock Connect almost instantaneously. All market participants and counterparties will have real time visibility of the post trade status, allowing for immediate actions to be undertaken. This can mitigate risk of buy-ins while complying with the no-fail T+0 trade settlement requirement for China A-shares, which only allows four hours of operation on post-trade confirmation and allocation after market close.

Uptake on Stock Connect Scheme

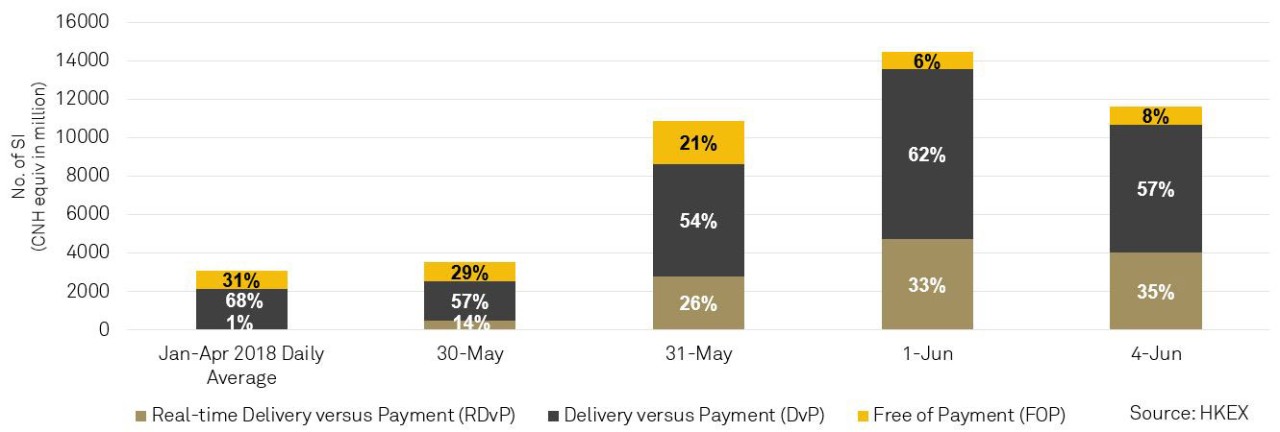

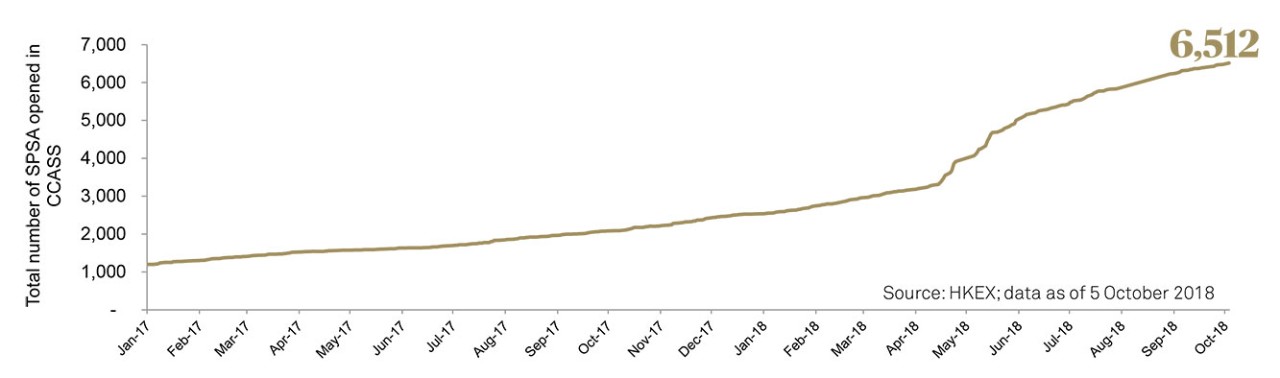

There are indications that the industry is welcoming and adapting Stock Connect. We see significant uptake for real-time Delivery versus Payment (RDvP), which facilitates securities and cash to be exchanged simultaneously and on a real time basis. From January to April this year, few investors used RDvP. The surge in RDvP usage began when passive funds started to invest when China A-Shares were first included in the MSCI index in May (Figure 1). In addition, there was also an increase in the number of Special Segregated Accounts (SPSA) opened (Figure 2). The number of SPSA accounts have grown by 157% since January 2018. As of 5 October 2018, there were 6,512 accounts set up.

Figure 1: MSCI China A-Shares Inclusion - Key Observations on RDvP usage

Figure 2: Special Segregated Accounts (SPSA) Highlights

Choice of Schemes for Foreign Investors

There are investors who prefer CIBM Direct route, QFII or RQFII access schemes because of their investment strategies. For some foreign investors, they are looking for ease of access and a cost-efficient way to invest in the China domestic market.

With Bloomberg adding Chinese RMB-denominated government and policy bank securities to the Bloomberg Barclays Global Aggregate Index in April 2019, there will likely be more interest around Bond Connect.

Working Towards Greater Inclusion

Ultimately, for the Great China Convergence to take place, there are considerations that mainland regulators and market participants need to work together to meet foreign investors’ needs. While the merger of the five schemes is not something that can be addressed in the immediate future, we do expect the schemes to evolve in the upcoming years as China continues to open up its capital markets to foreign investors.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names in various countries by duly authorised and regulated subsidiaries, affiliates, and joint ventures of BNY Mellon, which may include any of the following. The Bank of New York Mellon, at 240 Greenwich Street, NY, NY 10286 USA, a banking corporation organised pursuant to the laws of the State of New York, and operating in England through its branch at One Canada Square, London E14 5AL, registered in England and Wales with numbers FC005522 and BR000818. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon, London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at 46 Rue Montoyerstraat, B-1000 Brussels, authorised and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, a subsidiary of The Bank of New York Mellon, and operating in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, registered in England and Wales with numbers FC029379 and BR014361. The Bank of New York Mellon SA/NV (London Branch) is authorised by the ECB and subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority. Details about the extent of our regulation by the Financial Conduct Authority and Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, operating in Ireland through its branch at Riverside 2, Sir John Rogerson’s Quay, Grand Canal Dock, Dublin 2, D02 KV60, Ireland, trading as The Bank of New York Mellon SA/NV, Dublin Branch, which is authorized by the ECB, regulated by the Central Bank of Ireland for conduct of business rules and registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. If this material is distributed in or from, the Dubai International Financial Centre (DIFC), it is communicated by The Bank of New York Mellon, DIFC Branch, (the “DIFC Branch”) on behalf of BNY Mellon (as defined above). This material is intended for Professional Clients and Market Counterparties only and no other person should act upon it. The DIFC Branch is regulated by the DFSA and is located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. BNY Mellon also includes The Bank of New York Mellon which has various subsidiaries, affiliates, branches and representative offices in the Asia-Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction. Details about the extent of our regulation and applicable regulators in the Asia-Pacific Region are available from us on request. Not all products and services are offered in all countries.

The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. The contents may not be comprehensive or up-to-date, and BNY Mellon will not be responsible for updating any information contained within this document. If distributed in the UK or EMEA, this document is a financial promotion. This document and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. Similarly, this document may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorised, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this document in their jurisdiction. The information contained in this document is for use by wholesale clients only and is not to be relied upon by retail clients. Trademarks, service marks and logos belong to their respective owners.

BNY Mellon assumes no liability whatsoever for any action taken in reliance on the information contained in this material, or for direct or indirect damages or losses resulting from use of this material, its content, or services. Any unauthorised use of material contained herein is at the user’s own risk. Reproduction, distribution, republication and retransmission of material contained herein is prohibited without the prior consent of BNY Mellon.

© 2018 The Bank of New York Mellon Corporation. All rights reserved.