A New, Alternatives-Focused Investor Reality

The main trends in alternatives for Asian institutional investors

A New, Alternatives-Focused Investor Reality

The main trends in alternatives for Asian institutional investors

February 2018

This paper outlines the main trends in alternatives in the Asian institutional investor context, and explores how asset servicing can support new investor goals.

The quest for returns in a low-yield global environment has pushed more investors across Asia and globally into new territory. BNY Mellon’s recent report, The Race for Assets: Alternative Investments Surge Ahead, in association with FT Remark, surveyed 450 institutional investors and investment managers about their alternative asset allocations. More than half (53%) of respondents expect allocations to alternatives to increase in the next 12 months. The report also found that investment in alternative assets has reached a record high US$7.7 trillion and shows no signs of slowing. Not surprisingly, one of the main drivers for this is performance.

At the same time, in exploring alternative assets, many investors are sticking to traditional approaches, and contending with a lack of experience and expertise. Asset servicing is also in some ways still catching up to the changing demands created by the rush to alternatives.

“There is no doubt that financial innovation supported by disruptive technology is happening at a more rapid pace than ever, and that this innovation will also have implications for the alternatives space.”

— Rohan Singh Head of Asset Servicing, Asia Pacific, BNY Mellon

With Higher Stakes, a Shift to Risk

Many asset owners in Asia, particularly in the insurance and pension space, are seeking increased alpha performance against the backdrop of low to negative yields seen across most developed economies. This is due to a legacy of the low interest rate environment that has persisted since the global financial crisis.

Asia remains a largely under-insured region with premiums rising exponentially, fueled by a rising middle class. In fact, emerging Asia is seeing the strongest growth in non-life insurance premiums of any region globally1.

This exacerbates the hunger for yield as the insurance segment struggles with a flattening of long-term duration curves. Given the rapidly aging population in many Asian countries and a lower long-term nominal interest rate regime, insurers and pension funds allocation is expected to continue to favor riskier asset classes. The National Pension Service of Korea (NPS), ranked 4th largest globally, has shown increased appetite for alternatives. Its alternatives allocation increased from 10.7% to 11.4% over the course of 2016².

NPS is not alone. Japan’s Government Pension Investment Fund (GPIF), which manages one of the largest pools of pension assets globally, recruited asset managers focused on private equity, infrastructure and real estate. GPIF has continued to explore alternatives, setting a threshold allocation of 5% of its US$1.3 trillion asset base³.

These trends illustrate an increased demand for returns and has driven traditional asset managers into riskier asset classes traditionally financed by bank balance sheets. Conversely, increased risk capital requirements placed upon banks as part of Basel III have forced a retreat from risk and placed heavy capital burdens on their traditional balance sheet activities.

Growing Appetite for Private Equity

Worldwide, approximately US$820 billion remains unspent in the private equity space, of which US$100 billion is in Asia4. The private equity spend is expected to expand with more entrants into an increasingly crowded market. This figure excludes the growing private wealth segment forming part of the increasing demand. Asia’s ultra-high net worth population has surpassed Europe’s and is worth a total of US$2.6 trillion, according to Cap Gemini5.

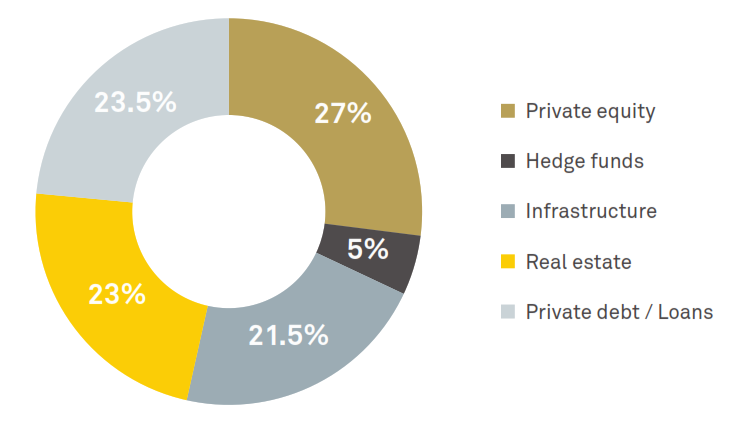

Of the alternative asset classes, private equity is what Asian institutions view as most promising. The participants surveyed in the BNY Mellon and FT Remark studies indicated that private equity is likely to receive the highest allocations in the next 12 months (27%) with private debt (23.5%) and real estate (23%) forming the top three investment allocation choices within Asia Pacific. (Fig1)

Figure 1. Asia Pacific Institutional investors’ allocation to Alternatives in the next 12 months

Source: Survey conducted by FT Remark in association with BNY Mellon, 2017

A recent report from Bain & Company showed private equity deals in Asia Pacific reached US$92 billion in 2016 and that average returns continued to outperform other asset classes6.

The Promise of Infrastructure

According to the Asian Development Bank, infrastructure requirements in developing Asia Pacific will exceed US$22.6 trillion through 2030, representing a gap of US$1.7 trillion a year to maintain economic productivity7. This clearly shows a funding shortfall which the combined financial markets cannot meet, and points to further potential opportunities for institutional investor participation. However, these opportunities need to be approached carefully. Investors should note that the risks around infrastructure assets are high during the greenfield and brownfield stages.

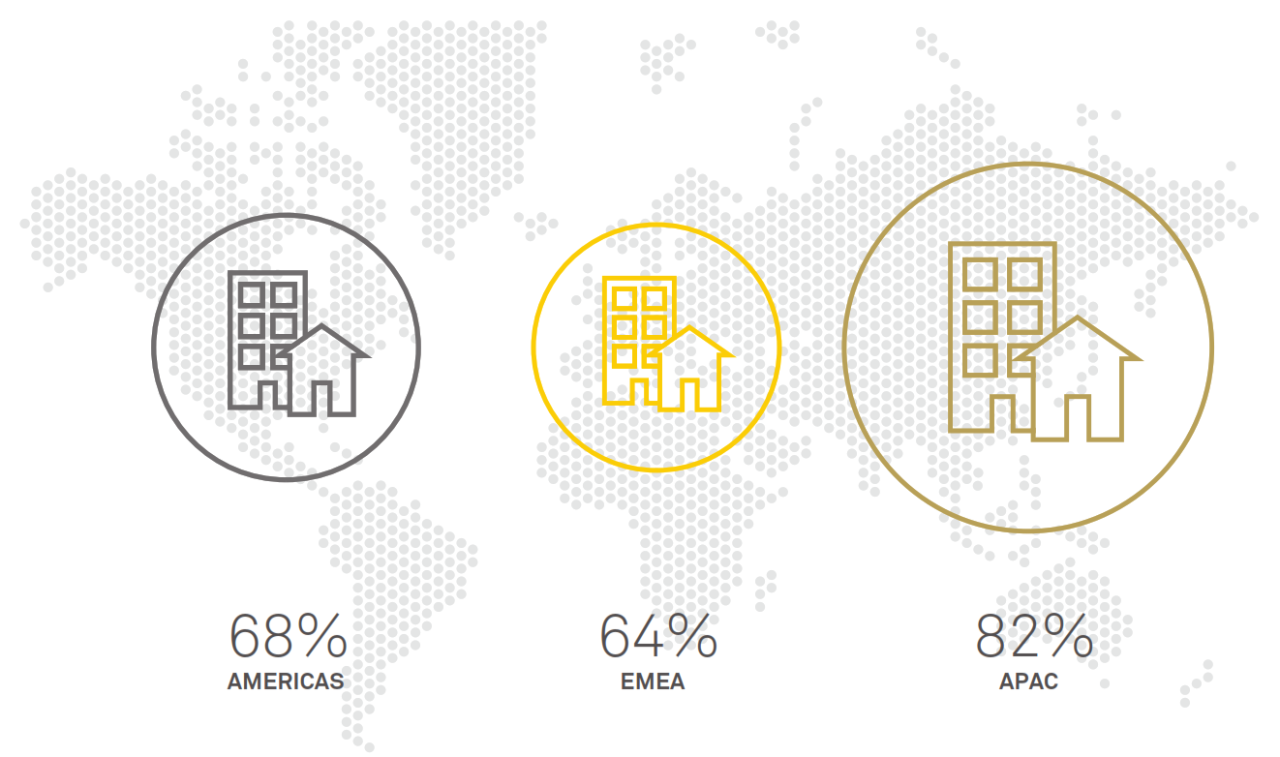

The new era of asset diversification has also encouraged the development of innovative financing structures such as infrastructure bonds, with an aim to provide access to long-term investors to such illiquid asset classes. Appetite for these assets is particularly robust in Asia. The BNY Mellon and FT Remark study showed that 82% of Asia Pacific institutional investors have some form of exposure to infrastructure debt well above the global average of 70% (Fig 2). However, this represents less than 1% of total Assets Under Management globally8.

Fig 2. Geographical representation of institutional investors’ exposure to infrastructure debt

Source: Survey conducted by FT Remark in association with BNY Mellon, 2017 (Survey sample size: 233 in Americas, 61 in APAC and 90 in EMEA)

Typically, development banks and export credit agencies will provide loans or credit guarantees to help attract financial institutions to these assets. "However, we have seen regulators in the Asia Pacific region looking to support innovative structures such as infrastructure and green bonds to attract participation from long-term asset owners,” notes Rebecca Terner Lentchner, Head of Government Relations and Public Policy, Asia Pacific at BNY Mellon.

“In our various meetings with market participants, policy makers and regulators, the creation of information platforms for infrastructure investments that can monitor construction risks as these assets move through the various stages of construction and development will be a critical step,” she adds. “The challenge lies as these new monitoring tools may be unfamiliar to the traditional structure of the asset servicing business. Service providers who are agile and able to respond quickly to these needs will be ahead of the competition.”

Using a greenfield bond as an illustration, this instrument represents a loan towards an underlying project that is paid back only when the asset is fully developed and generating positive cashflow. “To ensure the proceeds are deployed for intended purposes, a trustee is typically appointed to administrate the loan. This ensures all disbursements to contractors, service providers and other parties are made accurately, on time, and subject to conditions stipulated to protect creditors” says Kenneth Cheong, Managing Director, Asia Pacific, Corporate Trust, at BNY Mellon. He further adds that “in this capacity, we frequently manage complex payment waterfalls to ensure the integrity of the cashflow is tight, and creditors are kept informed.”

The administration process generates vast amounts of transactional data that not only creates transparency but also the ability to manage investment risk. For example, investors could mitigate their bond risk by taking long-short positions in the underlying companies by overlaying data between the financial markets (equities and credit default swaps), instrument (underlying bond) and project exposure.

The Evolving Role of Asset Servicing Providers

The traditional role of asset servicing needs to evolve rapidly to meet the challenges facing clients entering the alternatives space and to enable them to capitalize on its full potential. As investors push into more illiquid and opaque asset classes, the availability and timeliness of data, and the ability to manage and use that data, become crucial.

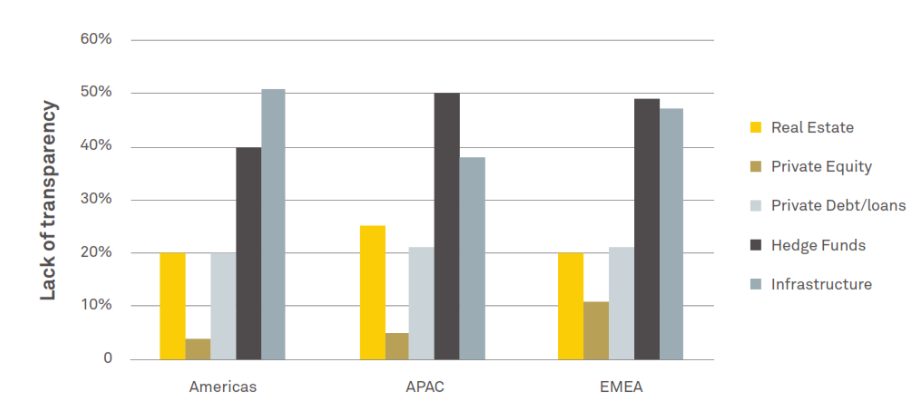

According to the study, a resounding 84% of Asia Pacific investors are dissatisfied with the levels of transparency in their fund investments. In alternatives, the lack of transparency was most keenly felt in hedge fund (50%) and infrastructure investments (38%) (Fig 3).

Fig 3. Institutional investors’ view on the level of transparency across alternatives investment types

Source: Survey conducted by FT Remark in association with BNY Mellon, 2017 (Survey sample size: 91 in Americas 49 in APAC and 87 in EMEA)

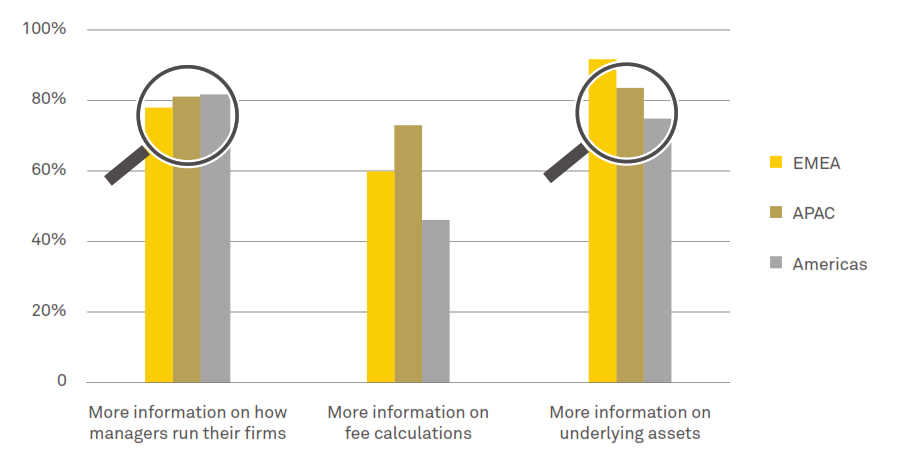

Fig 4. Type of information required on transparency by Institutional Investors

Source: Survey conducted by FT Remark in association with BNY Mellon, 2017 (Survey sample size: 72 in Americas, 37 in APAC and 72 in EMEA)

Over 80% of Asia Pacific institutional investors want to receive more information both on the funds’ underlying assets and insights into how managers run their firms. All of these pointing to the demand for a platform to meet those needs.

Pressure for further transparency around fees and standardization in the dissemination of information is coming not only from investors, but also regulators. The US Securities and Exchange Commission (SEC) is among those globally urging the industry to review and improve disclosures around fees and expenses.9

The need for clear valuation processes and benchmarks to ascertain performance will lead to increased demands for solutions that are not only multi-asset in nature, but more importantly, capable of making cross-asset correlations. Unlike a portfolio of listed securities which can be hedged with financial instruments, most investors will need to control their exposure risk via multiple asset managers to remove concentration and portfolio risks.

As allocations grow, investors will seek to overlay statistics such as macroeconomic and sector data against a single or a pool of investment mandates. With different asset managers providing valuations at different points over different time brackets across the financial year, it will be critical to develop a dynamic platform capable of producing not only a traditional monthly snapshot of valuations but displaying multiple time slices on an enterprise view.

Meeting the Needs of Asset Owners

The growing appetite for, and complexity of, alternative investments puts the pressure on asset servicing providers to develop fuller and more transparent partnerships with the institutions they serve. Since areas like private equity are relatively new to many Asian institutions and they may lack the relevant capabilities and knowledge in-house, it will also be important for investors to team up with providers with well-established track records and expertise in the sector.

As general partners (GPs) are called upon to share and standardize more information on the composition of fees charged back to funds, asset servicing should contribute to the process by consolidating related best practices among GPs, keeping clients informed of emerging disclosure requirements or recommendations, and practicing consistency in collecting and accounting for this data.

The drive to receive more standardized information from GPs has encouraged limited partners (LPs) to band together. Associations like the Institutional Limited Partners Association (ILPA) have developed standards for capital calls, distribution and quarterly reporting that GPs are being encouraged to follow. Related to this is the AltExchange Alliance, which aims to define and maintain a set of common data standards for the industry.

Again asset servicing providers will play a key part in this movement by driving standardization in the data they collect and process on behalf of clients. The technology solutions they bring to bear can also facilitate adherence to a standard set of practices and protocols.

“This is an exciting time for both asset owners and service providers. The drive for yields, Asia Pacific nuances in alternatives assets, investor demand for transparency and the focus on operational efficiencies – are great opportunities for both asset owners and their service providers.”

— Mark Nelligan Managing Director, Head of Alternative Investment Services and Structured Products, Asia Pacific, BNY Mellon

1 http://institute.swissre.com/research/library/Global_insurance_review_2017_outlook_2018.html

2 http://www.avcj.com/avcj/news/3005353/koreas-nps-boosts-alternatives-allocation-to-114

4 As reported “Private equity market ‘set to boom in Asia’” in Business Times Singapore in May 19, 2017

5 https://www.capgemini.com/wp-content/uploads/2017/07/The_Global_State_of_Family_Offices.pdf

6 http://www.bain.com/publications/articles/asia-pacific-private-equity-report-2017.aspx

7 https://www.adb.org/publications/asian-development-outlook-2017-update

8 https://www.iesingapore.gov.sg/Media-Centre/News/2016/3/Singapore-pushes-for-private-investments-in-infrastructure

9 http://compliancefocus.com/private-equity-fees-and-expenses-best-practices-for-disclosure/

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names in various countries by duly authorised and regulated subsidiaries, affiliates, and joint ventures of BNY Mellon, which may include any of the following. The Bank of New York Mellon, at 225 Liberty St, NY, NY 10286 USA, a banking corporation organised pursuant to the laws of the State of New York, and operating in England through its branch at One Canada Square, London E14 5AL, registered in England and Wales with numbers FC005522 and BR000818. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon, London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at 46 Rue Montoyerstraat, B-1000 Brussels, authorised and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, a subsidiary of The Bank of New York Mellon, and operating in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, registered in England and Wales with numbers FC029379 and BR014361. The Bank of New York Mellon SA/NV (London Branch) is authorised by the ECB and subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority. Details about the extent of our regulation by the Financial Conduct Authority and Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, operating in Ireland through its branch at 4th Floor Hanover Building, Windmill Lane, Dublin 2, Ireland, trading as The Bank of New York Mellon SA/NV, Dublin Branch, which is authorized by the ECB and registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. If this material is distributed in or from, the Dubai International Financial Centre (DIFC), it is communicated by The Bank of New York Mellon, DIFC Branch (the “DIFC Branch”) on behalf of BNY Mellon (as defined above). This material is intended for Professional Clients and Market Counterparties only and no other person should act upon it. The DIFC Branch is regulated by the DFSA and is located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. BNY Mellon also includes The Bank of New York Mellon which has various subsidiaries, affiliates, branches and representative offices in the Asia-Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction. Details about the extent of our regulation and applicable regulators in the Asia-Pacific Region are available from us on request. Not all products and services are offered in all countries.

The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. The contents may not be comprehensive or up-to-date, and BNY Mellon will not be responsible for updating any information contained within this document. If distributed in the UK or EMEA, this document is a financial promotion. This document and the statements contained herein are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. Similarly, this document may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorised, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this document in their jurisdiction. The information contained in this document is for use by wholesale clients only and is not to be relied upon by retail clients. Trademarks, service marks and logos belong to their respective owners. The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. The contents may not be comprehensive or up-to-date, and BNY Mellon will not be responsible for updating any information contained within this document. If distributed in the UK or EMEA, this document is a financial promotion. This document and the statements contained herein are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. Similarly, this document may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorised, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this document in their jurisdiction. The information contained in this document is for use by wholesale clients only and is not to be relied upon by retail clients. Trademarks, service marks and logos belong to their respective owners.

The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such.

© 2018 The Bank of New York Mellon Corporation. All rights reserved.