Advantages

Our integrated money market fund servicing capabilities across custody, transfer agency and fund accounting and administration streamline processes, enhance controls, and help mitigate risk.

- Reduce complexity: Single accountability with BNY Mellon delivering all services and one relationship manager acting as a single point of contact.

- Reduce operational risk: Automated processes between transfer agency, custody and fund accounting and administration reduce the risk of failure points across trading and reporting.

- High touch service: Experienced team supporting money market funds includes subject matter experts in all services with experience servicing some of the largest institutional money market fund structures in the industry totaling $1.4 trillion in assets under custody.

Better manage liquidity, credit and settlement with integrated solutions and real-time tools that expand your universe of liquidity.

- Enable shareholder payments: Linked accounts enable the faster release of shareholder payments.

- Reduce overdrafts in custody accounts: Through linked transfer agency and custody accounts, settled purchases received into the transfer agency account are automatically credited to the custody account.

- Maximize liquidity: The balances in the transfer agency and custody accounts are linked, this maximizes your balances and reduces the need for credit.

- Access credit quickly: Access to daylight credit on the transfer agency and custody accounts permits the fund to be fully invested while at the same time helping to facilitate settlement of all shareholder redemptions.

- Enhance trade and settlement reporting: Real-time trade reporting enables the portfolio manager to have access to the information required to better manage returns.

Expanded trading options through BNY Mellon Markets provides the potential to improve yield.

- Trade early: Ability to trade early provides the manager access to early-day rates available in the repo market. For flows that come in later in the day, the ability to trade later allows the manager to invest the late day cash maximizing yield.

- Pursue additional investment opportunities: Access opportunities from a highly-rated counterparty, sponsor for FICC-SMP repo.

- Synergies with custody: Integrated custody solution provides straight-through processing of trades, allows for real-time availability of cash upon trade settlement, potentially fewer trade fails, and reduction in overdrafts or need for the potential for credit on your custody account.

Grow assets and increase product visibility to new investors with access to BNY Mellon distribution portals.*

- Access to more investors: Added distribution potential with Liquidity DIRECTSM and Pershing portal.*

- Substitution for cash collateral: Potential for clients to use money market funds as a substitution for cash collateral.

*Subject to meeting criteria of portal.

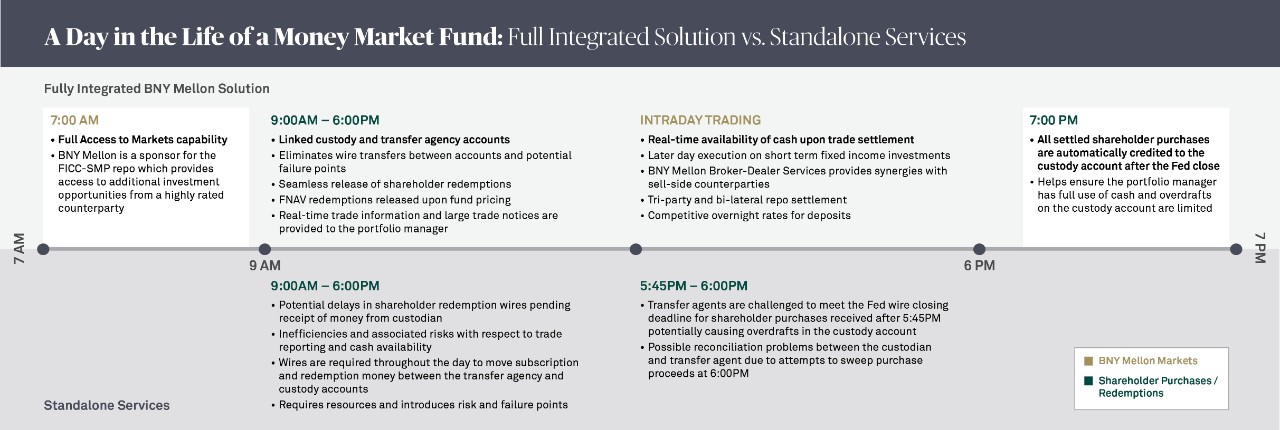

Money Market Fund Timeline

Money Market Advantage Helps the Fund be Fully Invested Throughout the Day

The above shows a comparison of the day in the life of a money market fund using Money Market Advantage and one using standalone services. Money Market Advantage combines custody, transfer agency, and capital markets services to provide institutional money market funds a better way to manage their liquidity, credit needs and settlement processes, helping to enable the fund to be fully invested throughout the day.