Custom Baskets Come of Age for the ETF Industry

Custom Baskets Come of Age for the ETF Industry

June 2021

By Miguel Alvarez

Custom basket and negotiated orders - two terms that have historically represented key factors for asset growth for legacy ETF firms and that could be implemented today to help firms maximize their ETF efficiency.

Are you an explainable AI company that we should know about?

Learn More [link to accelerator program page]

Interested in learning more about emerging technologies for the financial services industry?

Sign-up for The Quarterly Update

In late 2019, the passing of the ETF rule (6c-11) in the U.S. added custom baskets and negotiated orders to the industry’s toolbox, regardless of when the issuer entered the ETF arena. With a little over a year now passed since the first issuers started to list under these new guidelines, the ETF industry is demonstrating rapid adoption of custom baskets.

What are Baskets?

The majority of ETFs in the U.S. use in-kind order settlement to manage subscriptions and redemptions. Operationally this is done by providing a list of securities (i.e., a basket) that the liquidity participant (i.e., Authorized Participant) delivers free of payment to the ETF in exchange for ETF shares as part of a creation, and vice versa for a redemption. Prior to the ETF rule, the majority of ETF issuers were required to use a basket that was a pro-rata slice of the fund’s holdings on the day the basket was constructed. As a result, any portfolio changes were managed by the portfolio manager outside of the ETF’s creation/redemption mechanism, thereby reducing the ETF’s ability to maximize tax efficiency, which the creation/redemption mechanism affords ETFs.1

For a refresh on what issuers need to contemplate in employing negotiated orders, see U.S. ETF Rule: Are You Ready for Custom Baskets?

Is the Market Gravitating Toward the Shiny New Feature?

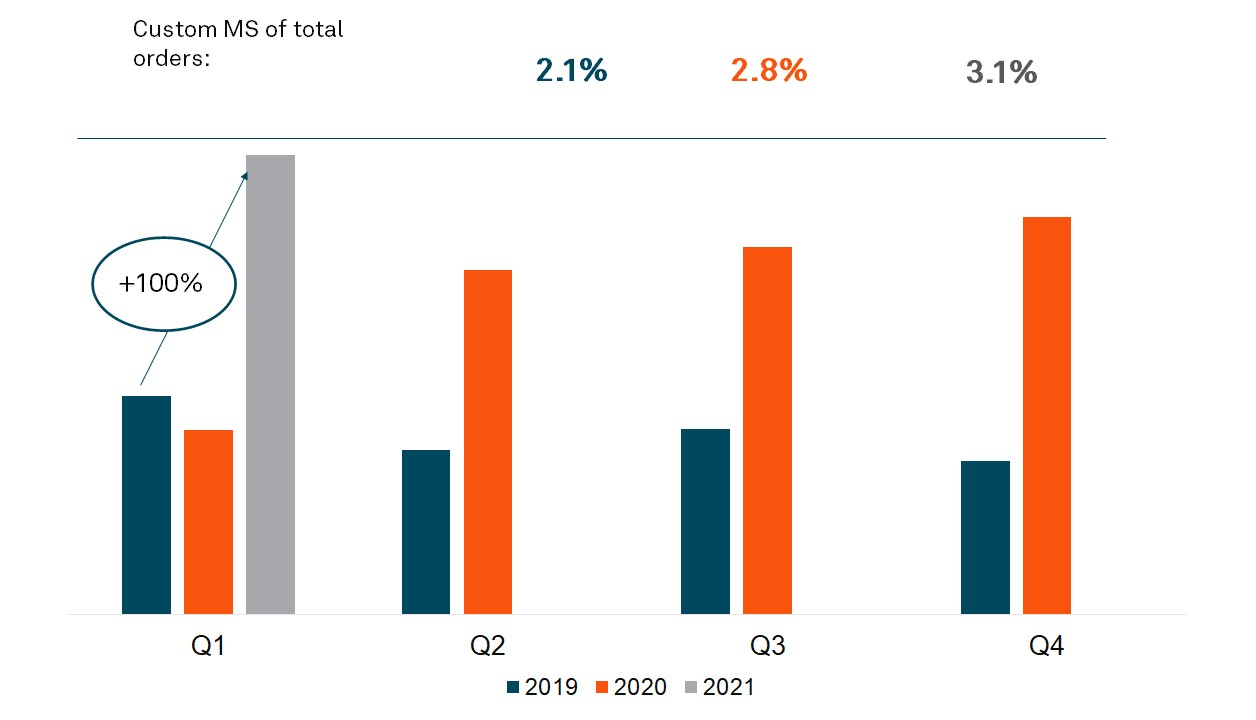

Overall, more issuers and primary market participants are taking advantage. In fact, volumes jumped 100% between Q1 2019 and Q1 2021 (see Figure 1). However, while ETF issuers in the U.S. listed under the ETF rule have access to the tool, the percentage of orders that are negotiated vs the total volume of primary market trading remains small.2 Even more telling is that while volumes have increased dramatically, the number of ETF issuers using negotiated orders has increased only marginally at 3% YoY. In the first quarter of 2021, 25% of the ETF issuer community serviced by BNY Mellon used negotiations vs 22% in 2020.

Figure 1: ETF Negotiated Order Volume Between 2019 – Q1 20213

Breakdown of Negotiations by Asset Class

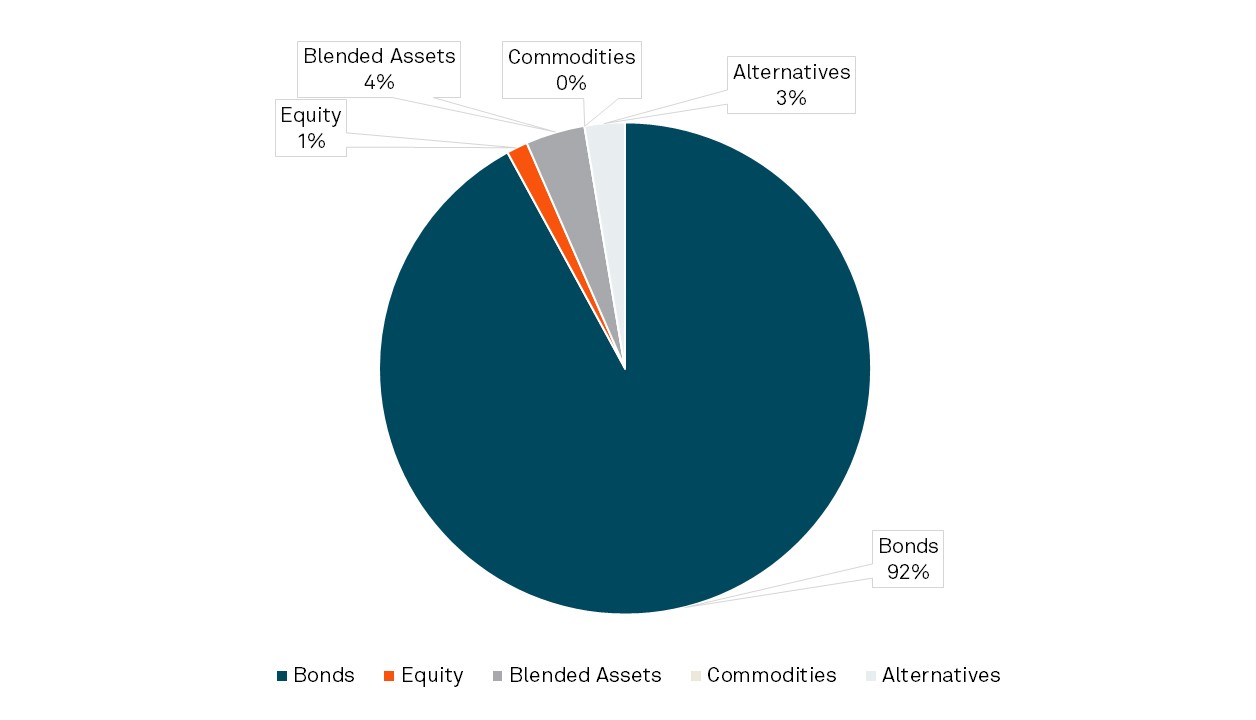

Diving deeper into our analysis, fixed income portfolios continue to be the main benefactor of negotiations. In the 1st quarter of 2021, 92% of the activity was executed on fixed income portfolios (see Figure 2) followed by blended asset portfolios in a distant second with a 4% market share. Given the trends for Q1 2021 and what we have seen so far in Q2, it is not far-fetched that 2021 could see negotiated order volume grow 42% or more YoY vs 2020.

Figure 2: Market Share of Negotiated Orders by Asset Class; Q1 20215

Are Issuers Hesitating to Take Up Negotiations?

Based on data from 2020 and through the first quarter of 2021, there is some hesitancy. It is not due to the issuers’ product suite, but rather their comfort in making changes to their operating model to support negotiations at the same time managing the structural changes asset managers are undergoing outside of ETFs. From a direct standpoint, the issuer’s operating model and in-house technology capabilities to ease negotiations is critical. Without a clear policy and procedure backed by strong technology and their ecosystem partners, issuers are likely to be hesitant. Breaking down the use of negotiations is, at its core, building intraday baskets. Capital flow management for ETFs takes place predominantly through in-kind transactions using baskets. While a portfolio manager produces a basket the night prior that can be applied to any creation/redemption order, market conditions may change throughout a trading day requiring a portfolio manager and liquidity provider to agree on a new list of securities to be exchanged for ETF shares on that day.

Since the initial rule, BNY Mellon’s group of ETF specialists has had numerous conversations with ETF issuers and liquidity providers. It is clear that many issuers, while excited to use the tool, were in need of capabilities that allow for ease of negotiating the list of securities in a basket – for example, a list of bonds with an authorized participant (AP)or market maker that is in the best interest of shareholders and also attainable by the AP or market maker. That said, the data we have analyzed is promising that more issuers and liquidity providers are coming into their own with comfort in using custom baskets.

Now is the Time to Take Advantage of Negotiations

In considering how to utilize the negotiation tool, here are a few questions to consider.

- Do you have the right liquidity participants?

A common belief is that the liquidity participant community will take on just about any negotiation. In fact, this is not the case and as volumes have increased, the resources available in the primary market to take on negotiations has become more selective driving a scarcity premium to having these firms at the ready. Your ETF capital markets personnel should have well-established relationships with this community, including an understanding of each desk’s strength across asset classes.

- Do you have the right technology stack in place to streamline correspondences between you and the liquidity participant on the securities to include?

For many, the use of email and/or Bloomberg chat continues to be the main path of negotiation. However, with increases in volumes and fast-moving markets, the ability to negotiate baskets of securities within minutes is critical to completing the trade. From an ETF issuer perspective, there are a few options in the market today, with more expected to come in 2021. With an expected ramp-up in volumes, portfolio managers and CTOs should consider how easy it will be to integrate their IBOR or portfolio risk engine into the process.

- Can your ETF service provider connect your team to the primary market liquidity providers for ease of transacting in an automated environment?

Ultimately, any negotiation that takes place must get over to your ETF service provider for full completion of the trade; often referred to as the post-order. This includes order placement in the primary market and connecting your finalized basket with said order for appropriate trade generation. For some, having to rely on emailing baskets into an ETF service provider’s technology stack increases operational risk and chances that there will be invalid data transmitted for a particular order. This impacts not only the fund’s ETF records but can have an impact on the liquidity participant’s records as well.

For many ETF issuers, the implementation of policies and procedures alongside technology that is seamlessly integrated into their technology stack is daunting, particularly when considering that the investment management industry is undergoing a revolution in technology solutions. But given the benefits negotiations allow portfolio managers in terms of the potential operational and tax efficiency, now is the time to take negotiations head on.

1 May 2020. ETF.com. “Why are ETFs so tax efficient”; etf.com/etf-education-center/etf-basics/why-are-etfs-so-tax-efficient

2 Volumes for primary market trading are limited to activity facilitated through BNY Mellon ETF services

3 BNY Mellon internal data (2019 – Q1 2021)

4 Market share percentage determined based on the total volume of orders placed for the calendar year

5 BNY Mellon internal data (Q1 2021)

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

©2021 The Bank of New York Mellon Corporation. All rights reserved.