Entering a New ETF Era

Will active management be adopted in the ETF wrapper?

Entering a New ETF Era

Will active management be adopted in the ETF wrapper?

November 2019

Following the US Security and Exchange Commission’s (SEC) approval of Precidian’s ActiveShares™ model in May, proxy-based semi-transparent ETF structures have now been given notice of approval by the SEC. These new ETF structures could represent a world of new opportunities for investors.

On November 14th, the SEC’s Investment Management division noticed four new proxy-based semi-transparent active ETF structures filed by the New York Stock Exchange/Natixis, Blue Tractor Group, Fidelity, and T. Rowe Price. These new structures are additions to the Precidian ActiveShares™ structure approved earlier this year and discussed in our blog - “The Next Evolution of Actively Managed ETFs”. With these approvals the SEC is putting the decision in the hands of the investment manager in determining the model best suitable for their active investment strategy within an ETF wrapper.

Since the launch of the first active ETF in 2008, daily transparency has been a consistent requirement. This requirement has left many active managers on the sidelines due to concerns about transparency impacting their strategy. As a result, active ETFs in the U.S. continue to be small in comparison to their mutual fund counterparts. Through the end of October 2019, active ETFs held $94 billion in assets under management across 305 listings1. This represents just 2% of total U.S. ETF AUM.

How are these models different from ActiveShares™ and existing active ETFs today?

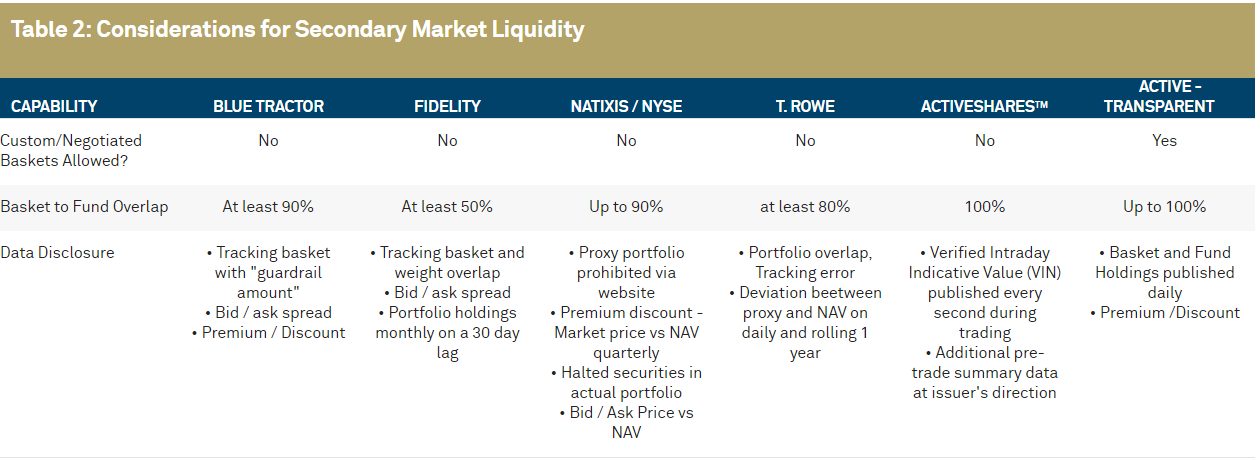

To mask daily transparency while facilitating price discovery, semi-transparent ETFs are going to rely on a proxy basket that represents the ETFs’ holdings. Using a proxy basket, the models are believed to provide enough transparency to allow liquidity participants such as Authorized Participants and Market Makers the ability to create markets, manage their exposure and at the same time alleviate concerns by portfolio managers of reverse engineering the investment strategy which can lead to front-running.

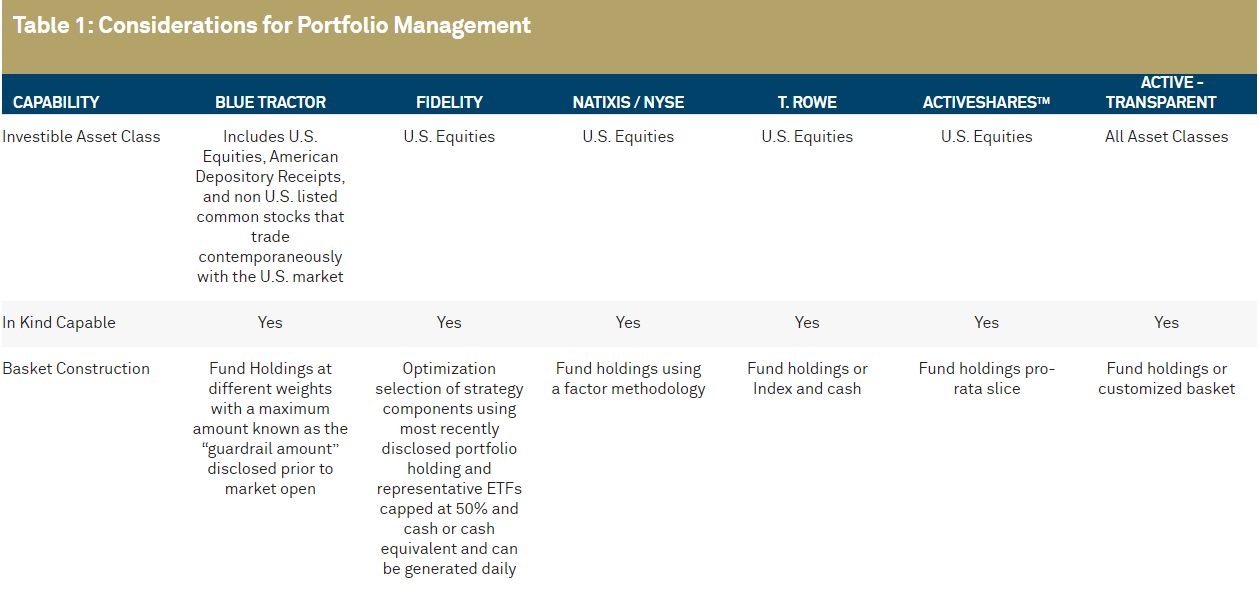

Proxy based or semi-transparent models will only be allowed to hold U.S. listed equity securities, American Depository Receipts (ADR), or non U.S. listed common stocks that trade contemporaneously with the U.S.2 BNY Mellon has been working closely with the industry to refine these operating models in heading towards final approval. To assist our colleagues within the asset management industry in their decision making process, below is a comparison chart of the models highlighting both differences and similarities. With a full suite of services available to ETF issuers, BNY Mellon is prepared to help investment managers navigate these new models in order to best determine what makes sense based on their investment strategies.

Comparison of New Structures3

Can I launch under one of these models today?

A few hurdles need to be cleared before these new product structures can be brought to market. While SEC notices were received, formal approval from the Investment Management division is expected December 9th, at the earliest. Since ETFs are listed on a national stock exchange, additional listing approval is required from the SEC’s division of Trading and Markets which can take up to 240 days. To get a sense of how long approval may take, we have been tracking the approval for the first ActiveShares™ listing. On September 23rd, Trading and Markets instituted proceedings to either approve or disapprove the rule change on CBOE, known as 14.11(k) which seeks public commentary on the rule change. As of November 25, there has been no further updates to the rule proposal by the division of Trading and Markets.

1 ETFGI.com; October 2019 Market Landscape

2 Common stock must trade in the same time period as the U.S. equity market

3 BNY Mellon internal research, November 2019

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. Products and services may be provided under various brand names and in various countries by subsidiaries, affiliates, and joint ventures of The Bank of New York Mellon Corporation where authorized and regulated as required within each jurisdiction. The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide or construed as legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such.

BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material. This material may not be reproduced or disseminated in any form without the prior written permission of BNY Mellon. Trademarks, logos and other intellectual property marks belong to their respective owners.

This document, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such.

The views expressed within this article are those of the author(s) only and not those of BNY Mellon or any of its subsidiaries or affiliates.

© 2019 The Bank of New York Mellon Corporation. All rights reserved.