Annual Report 2022

ONWARD TO

OPPORTUNITY

A Letter From Robin Vince

Dear fellow shareholders,

I’m writing my first letter to you six months into my tenure as CEO of BNY Mellon.

It’s an honor to be leading this institution, with a rich history and pivotal role in global markets.

Global reach and scale

$44T

Assets under custody and/or administration1

$1.8T

Assets under management2

$10T

Average daily clearance value3

$5.5T

Average tri-party balances3

$2.5T

Average daily U.S. Dollar payment value3

$270B

Wealth management client assets4

Leading market positions

#1

Global custodian5

#1

Global provider of issuer services6

#1

Provider of clearing and settlement for U.S. government securities

#1

Provider of global collateral services7

#1

Clearing firm for broker-dealers and Top 3 Registered Investment Advisor custodian8

TOP 5

Global U.S. Dollar payments clearer9

TOP 10

Global asset manager10

TOP 10

U.S. private bank11

1As of December 31, 2022. Consists of assets under custody and/or administration (“AUC/A”), primarily from the Asset Servicing business and, to a lesser extent, the Clearance and Collateral Management, Issuer Services, Pershing and Wealth Management businesses. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce,

of $1.5 trillion at December 31, 2022.

2As of December 31, 2022. Excludes assets managed outside of the Investment and Wealth Management business segment.

3Average for the quarter ended December 31, 2022.

4As of December 31, 2022. Includes assets under management and AUC/A in the Wealth Management line of business.

5Ranking based on latest available peer group company filings. Peer group included in ranking analysis: State Street, JPMorgan Chase, Citigroup, BNP Paribas, HSBC,

Northern Trust and RBC.

6Full-year 2022 figures by deal volume and count referenced herein include long-term program and stand-alone bond issuance in markets where BNY Mellon actively participates and for which public trustee and/or paying agent data is available. Sources include: Refinitiv, Dealogic, Asset-Backed Alert and Concept ABS. Transactions are credited based on trustee/paying agent appointments, depending on the product and market in question. Depositary Receipts ranking as of December 31, 2022. Ranked #1 based on market share sourced from BNY Mellon internal analysis.

7Finadium market analysis as of fourth quarter 2022.

8LaRoche Research Partners, “Clearing Firm Customer Composition 2022,” based on number of broker-dealer clients. Registered Investment Advisor rankings sourced from “Cerulli Report, U.S. RIA Marketplace 2022,” Cerulli Associates.

9The Clearing House. Based on CHIPS volumes for the year ended December 31, 2022.

10Pensions & Investments, June 6, 2022. Ranked by total worldwide assets under management as of December 31, 2021.

11Based on company filings and The Cerulli Report, 2022. Ranked by Wealth Management assets under management as of December 31, 2022.

We are proud of the trust clients and the industry place in us, although I’ve never thought of BNY Mellon as a typical “trust” bank. We touch around 20% of the world’s investable assets and hold many industry-leading positions across our broader set of complementary businesses. These synergistic businesses give us an end-to-end view of the investment lifecycle, allowing us to act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute or restructure investments. We see ourselves as a comprehensive platform for the financial markets of the world, a responsibility we take very seriously.

Since joining the firm, I’ve met with hundreds of clients and thousands of employees around the world to understand how they perceive our challenges and opportunities. I’ve also met with our regulators, other stakeholders and many of you. I’ll share a few of my observations.

First and foremost, it’s clear that our clients — including many of the world’s leading financial institutions, asset managers and governments — trust us deeply with some of the most sensitive aspects of their businesses. They value our at-scale platform, which allows them to operate more efficiently and focus on the core competencies that drive their growth.

Breadth of franchise

93%

of Fortune 100 companies

89%

of the Top 100 investment managers worldwide

94%

of the Top 50 U.S. life/health insurance companies

97%

of the Top 100 banks worldwide

Sources: Fortune 100: For 2022, Fortune, Time Inc. ©2022; Investment Managers: Pensions & Investments, worldwide assets under management as of December 31, 2021, P&I Crain Communications Inc. ©2022; Life and Health Insurance Companies: A.M. Best total admitted assets as of July 2022, A.M. Best Company, Inc. ©2022; Banks: S&P Global, total assets as of December 31, 2021, ©2022 S&P Global; client penetration assessment based on positive 2022 revenue with client company or parent/holding company.

It's also clear we have a collaborative and intensely client-focused culture, which we find special and differentiating. Our employees take real pride in delivering for our clients and the company.

In addition, resilience is essential to who we are. The strength and stability of our platform present a differentiated value proposition to the market that may not be fully appreciated. Clients can look to us for our demonstrated ability to operate through times of crisis, as well as a strong, well-capitalized and lower credit-risk balance sheet. These are important attributes, especially in turbulent markets and challenging environments like those we faced in 2022.

Despite these positives, let me be clear — our firm has not fully lived up to the promise afforded to us by our history, culture and client relationships. Among other external factors, deferred decisions, resulting in part from a lack of consistent execution over the past decade, have held our performance back. Today, we see real potential to materially improve the company’s operating model and drive profitable growth.

With this as a starting point, I’ll offer a candid assessment of the past and an early vision for the future. Recognizing that more work remains for us as a management team, I believe we are on solid footing to begin our next chapter.

LOOKING BACK

Over the past decade, we made progress across a variety of strategic initiatives that have strengthened our leading position at the intersection of trust and innovation.

At the same time, we also missed out on opportunities to deliver a stronger commercial proposition to the market. As a result, our track record for revenue and pre-tax income growth has not met our expectations. First, I’ll touch on what we have done well:

Resilience

As a key service provider to the U.S. government that plays an integral role in global markets, resilience is both a responsibility we take seriously and an attribute we see as highly commercial.

For these reasons, we have invested significantly in our infrastructure to provide a strong foundation from a security, resiliency and scalability perspective, enabling us to provide continuity of service to clients through the COVID-19 pandemic and the extraordinary moves we saw more recently with several government debt markets and volume surges. Our enhanced contingent capabilities support this solid foundation, which is continually tested against various stress scenarios. A few examples:

- We have systematically reviewed and moved over 90% of our distributed applications onto new, modern infrastructure.

- We’ve rationalized our data-center footprint into a limited but resilient set of state-of-the-art data centers, each hosting our global applications.

- We leverage our sophisticated Cyber, Technology and Operations Center that deploys advanced monitoring, artificial intelligence and machine learning for detection and rapid response, helping to protect clients and their assets.

Importantly, we know we are not done — nor will we ever be done — so we have embedded an approach for continual improvement of our systems in support of global market stability.

Sales momentum

The depth and longevity of our client relationships is a powerful advantage. More recently, we’ve elevated client dialogue while maintaining a strong focus on service quality, which has translated into higher-value deals and net new asset generation that better reflect the strength of our platform.

Innovation

Part of what attracted me to BNY Mellon a little over two years ago was its track record as a frequent first mover, tracing back to the company’s founding. In the past decade alone, BNY Mellon was the first bank to make a real-time payment in the United States using The Clearing House’s network, the first to offer real-time e-billing in the U.S. and, most recently, the first global systemically important bank to provide custody of digital assets.

While we’ve succeeded in many areas, we’ve also missed opportunities and fallen short of investors’ and our own expectations in others. Three interrelated examples come to mind:

Deepening Relationships

Across Our Platform

One resounding message I hear from clients is that they want to do more business with us. Making this easier for them presents a meaningful growth opportunity on which we have yet to properly capitalize. As the beginning of that new journey, we have launched 1BNY Mellon, a program that aims to generate new business across different products from existing client relationships. We have also drawn into the core of our firm some businesses that previously operated separately. While this is a start, there is more opportunity here. We must do a better job connecting the dots internally and externally, and we will.

Profitable New Business Growth

While sales momentum has picked up in recent years, that business has too often come at relatively low margins, with pricing concessions and deals structured in bespoke, complex ways that underestimate operating costs or do not lend themselves to scale. An honest reckoning of the past tells us that sometimes, we have had insufficient focus on margin and re-engineering. Going forward, we must do a better job of focusing crisply on the bottom line and the true cost to serve.

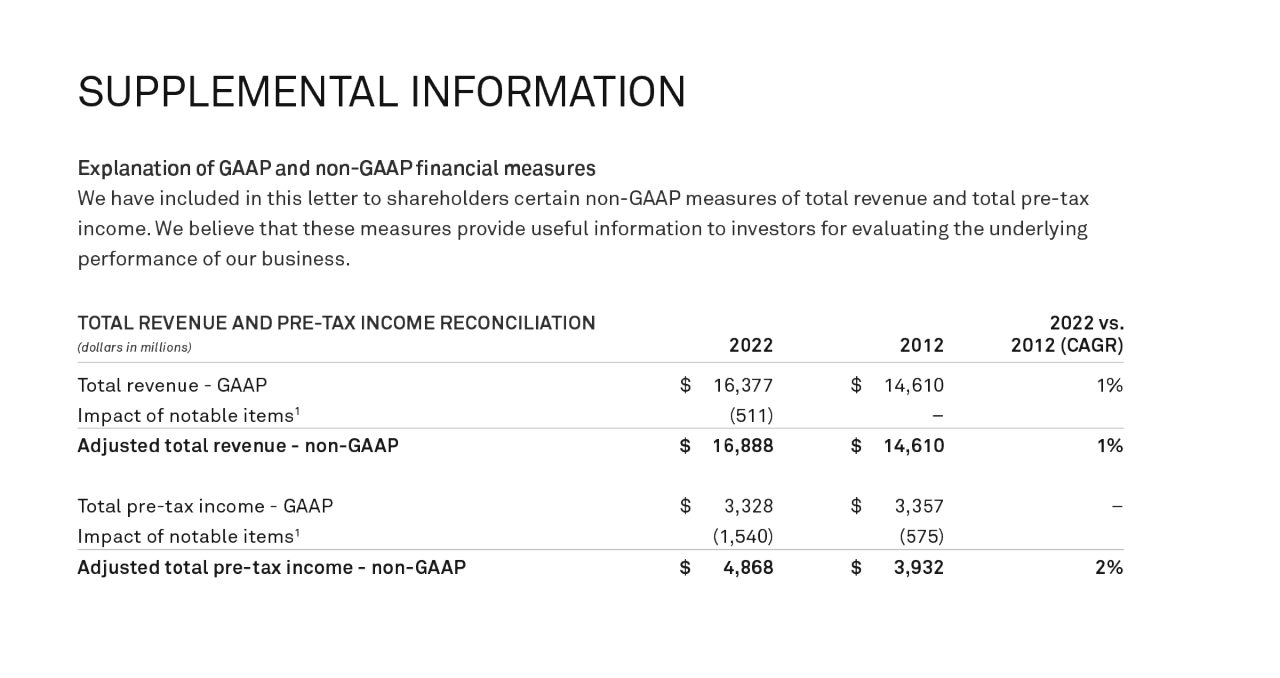

Long-Term Financial Performance

Over the past decade, excluding notable items, our revenue and pre-tax income have grown by low single digits annually.1 Additionally, over this period, we incurred over $2 billion of net charges related to notable items, which impacted our reported results. More recently, our expenses excluding notable items have grown by more than 5% in both 2021 and 2022 — 5% and 13%, respectively, on a reported basis — a rate of growth we consider too high.2 We are therefore increasing our focus on expense accountability and driving meaningful operational efficiency while also focusing on profitable new business in 2023 and beyond.

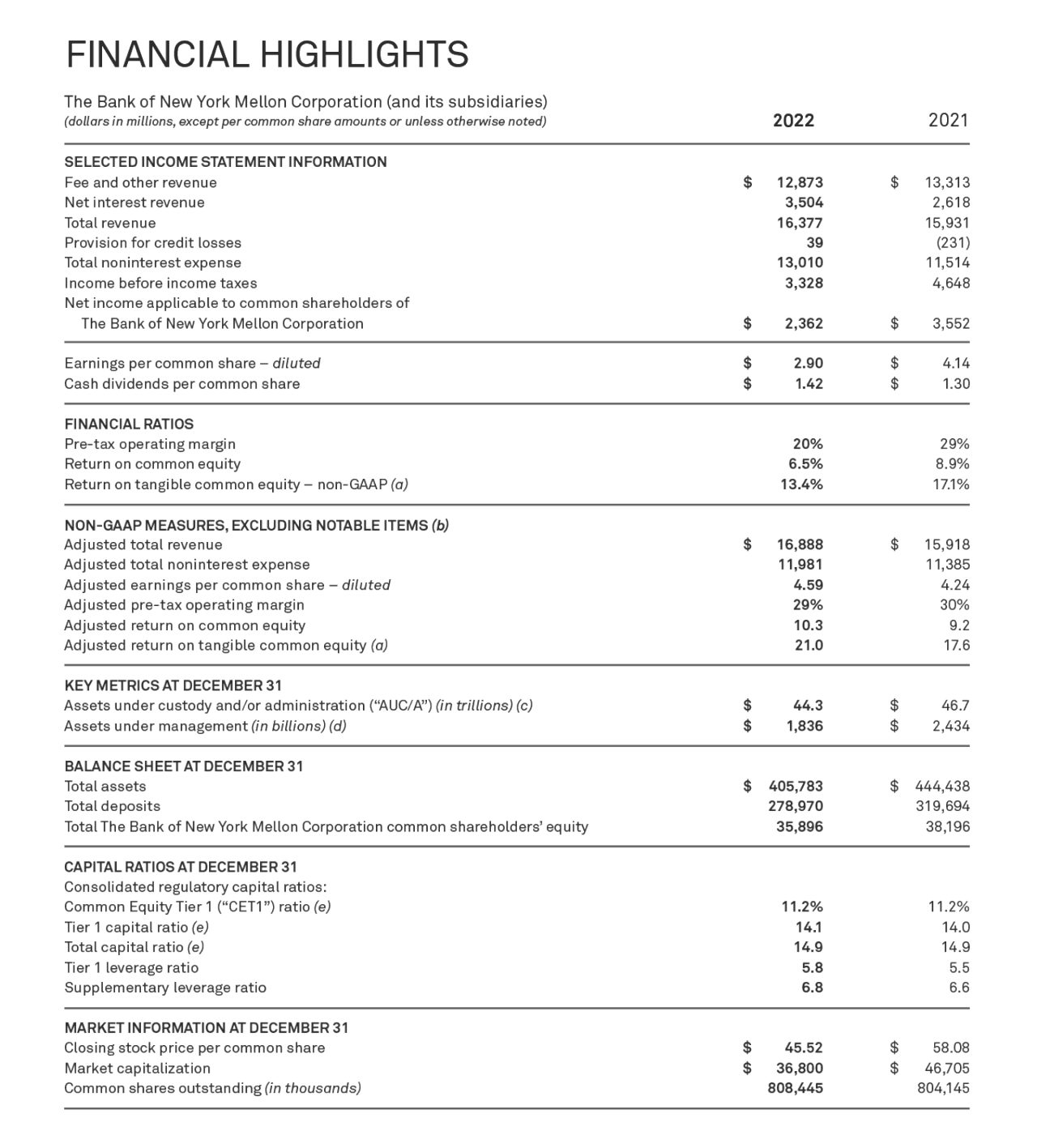

1Compound annual growth rate. See "Supplemental Information: Explanation of GAAP and non-GAAP financial measures" for reconciliation of these non-GAAP measures. On a reported basis, revenue grew by 1%, and pre-tax income was flat.

2See "Supplemental Information: Explanation of GAAP and non-GAAP financial measures” for the reconciliations.

2022 FINANCIAL PERFORMANCE

Acknowledging the prior decade’s financial performance has been underwhelming, in 2022 we delivered solid results against the backdrop of a complex operating environment.

We ultimately reported EPS of $2.90, revenue of $16.4 billion and return on common equity (ROE) of 7%. Adjusting for the impact of notable items, EPS increased by 8%, to $4.59 on $16.9 billion of revenue, which was up 6% year-over-year, and return on tangible common equity (ROTCE) was a very healthy 21%.1 Fees were up 1% excluding notable items, or flat on a reported basis, despite significant headwinds from both markets and a stronger U.S. dollar.1

Growth benefited from lower money market fee waivers and we drove incremental business with new and existing clients, saw organic growth in assets under custody and/or administration (AUC/A) and net inflows into assets under management (AUM).

Across our diversified portfolio of businesses, we saw healthy underlying growth in our Securities Services and Market and Wealth Services segments while our Investment and Wealth Management segment felt the strain of a continued decline in global market values and client de-risking. Firmwide, we continuously positioned ourselves to derive meaningful benefit from the upward move in interest rates.

Strong Capital

and Liquidity Position

Over the course of the year, we returned $1.3 billion of capital to shareholders, primarily through our quarterly cash dividends on common stock, which we increased by 9%, to $0.37 per share beginning in the third quarter. The sharp move upward in interest rates this past year impacted our ability to return capital through common stock buybacks, but we ended 2022 in a position of capital and liquidity strength.

Our Tier 1 leverage ratio of 5.8% and Common Equity Tier 1 ratio of 11.2% were higher and flat, respectively, versus year-ago levels, and comfortably above regulatory requirements and our more stringent management targets. Our liquidity coverage ratio ended the year at 118%, up from 109% a year ago. And over the course of 2022, we meaningfully reduced the duration and improved the risk and liquidity profile of our securities portfolio while keeping over 60% of the book designated as available-for-sale, which we viewed as a more prudent approach given the environment. Together, we expect these actions will provide us with ample flexibility as we move through 2023 to adjust to changing market and interest rate conditions, and to return a healthy amount of capital to our shareholders this year.

Securities Services

Our Securities Services segment includes our Asset Servicing, Corporate Trust and Depositary Receipts businesses. We enjoy industry-leading positions across most of the segments in which these businesses operate.

Revenues were up 11% in 2022, reflecting the benefit from higher interest rates as well as healthy underlying growth. Asset Servicing growth came from existing clients and higher-value sales wins, with particular strength in ETFs and Alternatives. In Issuer Services, the businesses mitigated stiff headwinds from lower issuance volumes in Corporate Trust, and managed the exceptionally complex landscape resulting from sanctions on Russia and our decision to cease new banking business in the country.

Although we were pleased with our revenue momentum, our pre-tax margin of 21% for this business in 2022 remains too low for some of the reasons mentioned above. We are executing against a multiyear plan to achieve our target of 30%-plus pre-tax margin in this business over the medium term. It will come from a combination of higher interest rates, driving “profitable” growth and becoming meaningfully more efficient across our operations: consolidating and integrating technology platforms, better standardizing middle-office and data offerings, digitizing engagement with clients and automating onboarding.

Market and

Wealth Services

Our Market and Wealth Services segment includes our industry-leading Pershing and Clearance and Collateral Management businesses, and our scaled Treasury Services business. This segment enables us to drive multi-business solutions and equips us as a premier market infrastructure provider, distinguishing us in the marketplace from our closest peers.

Revenues were up 11% in 2022, with all three businesses growing at 10%-plus. Despite a difficult environment for the wealth market, Pershing brought in net new assets of over $120 billion, reflecting healthy 5% growth. Treasury Services added new business across strategic payment solutions and liquidity products, and drove higher payment volumes while also generating strong initial traction as we built our Digital Payments and related FX and Trade businesses. Clearance and Collateral Management revenue primarily grew on the back of higher U.S. government clearance volumes, driven by continued demand for U.S. Treasury securities due to elevated volatility amid evolving monetary policy. The business also continued to drive client migration and balances to our triparty platform, which reached a record for our business of $5.5 trillion in the second half of 2022.

In this segment, pre-tax income improved by 10%, and pre-tax margin remained a healthy 44%.

Investment and

Wealth Management

The impact of weaker markets and a stronger U.S. dollar had a material impact on this business segment, comprising Investment Management — one of the world’s largest asset managers — and Wealth Management — which ranks among the top 10 private banks in the United States. This was felt both directly and indirectly, as the uncertain environment caused some investors to rebalance and maintain liquidity, ultimately moving their investments into lower-fee, risk-off solutions. As a result, revenues declined by 12% and the business essentially broke even with a pre-tax margin of 1%, though it was 24% after adjusting for notable items, primarily a goodwill impairment.1

Despite these lower financial results, both Investment Management and Wealth Management made progress against our strategic priorities and performed well in areas under our control. In Investment Management, our differentiated, specialist investment firms displayed resilience, and performance was solid, improving from the prior year, with about two-thirds of our top 30 strategies ranked in the top two quartiles versus peers.2 AUM flows were positive, and the business impressively navigated significant turbulence in the U.K. gilt (government securities) market. In Wealth Management, investment performance also remained solid, and the business acquired more clients, particularly with ultra-high-net-worth and family-office segments, while continuing to deepen existing relationships through our expanded banking offering.

1 See “Supplemental Information: Explanation of GAAP and non-GAAP financial measures" for the reconciliations

2 Rankings are relative to their respective Morningstar peer categories on a three-year basis.

LOOKING FORWARD

In 2023, a sense of purpose, execution and efficiency will be key to driving long-term profitable growth and improved pre-tax margins for our company.

Here are some of the key questions on my mind as we consider the future:

How do we become more effective at delivering the whole

firm to our clients?

We recognize a need to better connect the dots for our clients around the world, so they can leverage the combined strength and interconnectedness of our platform to focus on alpha generation. Through 1BNY Mellon, our focus is on training and incentivizing our people to collaborate across the firm and developing deliberate approaches to multiproduct solutions. We’ve mobilized cross-business sales teams around specific client segments to facilitate opportunities, and we’ve established cross-functional market leadership teams to increase client penetration.

How can we make better use of our vast amount of data?

With $48 trillion in data assets, we have access to one of the world’s most expansive data sets.1 Each day, we track trading activity for around $15 trillion in global equity assets and $30 trillion in fixed-income securities. The richness of our data enables us to translate unique insights for our clients into opportunities and risks. Moving forward, we see potential to better use our data-centric platform to inform client decision-making.

1. Data is as of December 31, 2022 unless otherwise noted.

Each day, we track trading activity for around

$15 Trillion

in global equity assets and

$30 Trillion

in fixed-income securities

What does it take to truly transform our operating model toward more efficiency?

Our company operations are not as streamlined as they need to be. Like other large institutions, we have certain legacy processes and redundant systems overdue for a refresh. For example, we have multiple custody, loan and deposit platforms, and we operate numerous different call centers. Recognizing opportunities to digitize and automate, we launched an initiative in 2022 through which we solicited more than 1,500 ideas from those who see items ripe for improvement most clearly and closely — our people. Beyond formal measures, we’re also encouraging a culture shift to think more commercially and question the status quo, which has the additional key benefit of improving the client experience.

Are we making the right investments in our future?

We have identified and begun shifting investment toward calculated growth opportunities while simultaneously continuing to invest in capabilities that support our resilience. Our long-term growth initiatives have clear and specific targets that we expect the teams to hit over the course of the year. While some investments may not see profitable growth in the very short term, we believe early developments in the infrastructure of the future will secure our position as an industry leader. We are being disciplined in the number of investments we take on, with an eye on our ambition and what we can achieve, while also staying grounded to a sensible expense spend. In 2022, we made progress across the various initiatives that follow, and we will continue these in 2023.

Wealth Technology

There’s a productivity problem in the wealth advisory industry, presenting a growth opportunity for firms that can solve it. Just one year after launching Pershing X, our proprietary advisory solution that aims to transform the marketplace, we released a preliminary version to select clients. This is a testament to our ability to execute on a tight timeline. We have set our sights high for 2023, with a broader rollout expected later this year.

Reimagining of Collateral

Three years ago, we announced the Future of Collateral, an initiative to enhance our capabilities to meet the increasingly complex demands of clients. Following investments in state-of-the-art technology, our collateral platform is more resilient, supports harmonization, and helps clients to optimize, mobilize, and connect collateral around the world. Our enhanced capabilities, together with the complementary services we deliver with leading fintechs, will benefit our clients and should create opportunities in the years to come.

Faster Payments

We see real-time payments as enabling a more efficient, transparent and frictionless future for clients, while also saving them money and reducing the financial industry’s carbon footprint. As the first bank to execute a real-time payment in the United States using The Clearing House’s network, BNY Mellon is positioned to help institutions and people around the world make payments instantly and take ownership of their finances. We enjoy a relatively unconflicted position in the U.S. payment industry, without attachment to interchange fees or the bricks and mortar that can inhibit self-disruption. We also see possibilities in the growth of request-for-payment technology for consumers, and we intend to continue making investments in this space.

Blockchain and Tokenized Assets

Our teams consider the broader opportunity that exists across blockchain technology and tokenized assets as a potential way to make financial markets faster, more efficient and more resilient. Uncertainty in the cryptoasset space only further highlights the need for trusted, regulated providers in this ecosystem. We went live with our Digital Asset Custody platform for select institutional clients in the United States in October 2022, the first global systemically important bank to do so. This is a starting point in what we see as a decades-long journey for blockchain and tokenization.

Do we have the right talent, culture and incentives to accomplish our ambitious goals?

Our potential as a company depends on cultivating a high-performing and diverse culture. We are focused on empowering employees to act as owners of their individual roles and shareholders of the company as a whole. We recently initiated an equity grant program called “BK Shares” so that almost all employees now own BNY Mellon stock, helping align the firm with our vision. We also took a closer look at annual compensation to commensurately reward the people who consistently deliver commercial success, while ensuring the appropriate shape of our workforce for the road ahead. These changes allow us to run the organization more efficiently and reinvest in new benefits programs and emerging talent — and we expect to break our record for college recruitment in 2023.

How can we leverage our role in global financial markets and our resources to make a positive impact on society?

Not only is helping more people access wealth-generating opportunities and benefit from our capabilities the right thing to do; it’s also a commercial endeavor. Uplifting historically underserved communities and finding opportunities for collaboration with specialized market players benefits the long-term health of our company and the broader society around us. Over the past year, we were proud of the impact we made on our communities and intend to expand these initiatives in 2023.

Exporting Capabilities

Market access for communities

Our scale and significance place us in a privileged position, but also grant us the responsibility of helping the financial system work better for everyone. From Treasury Services to Clearance and Collateral Management to Pershing, we can export our industry-leading positions and global capabilities to communities around the world through strategic alliances with other financial firms. We are proud to work with South Carolina-based Optus Bank to expand its capacity, market reach and community reinvestment opportunities with BNY Mellon products, services and infrastructure. In the months ahead, we intend to share more about collaborations like this that bring our suite of services to communities far removed from major centers of capital, doing our part to democratize quality financial services to an increasing number of market participants.

increasing inclusion

Collaborations with diverse businesses

Our commitment to improving diversity and inclusion extends to the markets in which we operate. We were fortunate to work with joint lead bookrunners Loop Capital, Ramirez & Co. and Siebert Williams Shank — all clients that also happen to be minority-owned investment firms — on a bond issuance in the second quarter of 2022. In November, eight veteran-owned broker-dealers participated in an offering of senior bank notes. In 2023, we plan to continue making proactive and deliberate efforts to include more communities in successful commercial outcomes.

supporting talent

BOLD initiative benefiting Howard University

Speaking further to our focus on recruiting high-performance talent, we began an exciting collaboration with Howard University, one of the leading historically Black colleges and universities in the United States, with the launch of the Black Opportunity for Learning and Development (BOLD) share class of the Dreyfus Government Cash Management fund. The program helps translate our clients’ liquidity solution investments through BOLDSM to supporting Howard University’s Graduation Retention Access to Continued Excellence (GRACE) Grant, which aids in removing financial obligations and improving graduation rates for at-need students. According to Howard University, to date, recipients saw an average 15% increase in retention and an average four-year graduation rate of 78%, a 32% increase compared with students who did not receive these funds.

IN CONCLUSION

Given our prominent position in global markets, our businesses are naturally sensitive to valuation and activity levels to varying degrees. I’m encouraged by the positive long-term developments we are seeing in the U.S. economy around self-sufficiency, ranging from improved energy independence to chip development, and excited about the innovations and new technologies underpinning blockchain and tokenization that will offer benefits to the financial system and broader economy. At the same time, geopolitical strains, uncertainty around inflationary policy and the path of interest rates, as well as liquidity concerns, are likely to continue to temper the near-term global outlook.

Acknowledging that these uncertainties will carry some challenges, it’s important to underscore a renewed sense of optimism running through our company. We see opportunities in these trends and, more broadly, we recognize opportunities to do more across our extensive suite of products and services for our clients.

While I’m conscious of the work that remains, I strongly believe in our long-term potential.

Over the near term, executing with surgical precision and urgency will be critical to our success.

We have a highly engaged Board supporting us and appropriately challenging our strategy, plans and execution. Transparency will remain a constant theme with our management team, and we intend to bring all stakeholders along on our transformation journey with regular updates demonstrating our progress and frank assessments of the work that remains.

I’ll conclude where I began: BNY Mellon has a great deal of potential, and I feel privileged to be in the position to lead us toward our future opportunities. I’m proud of our people, grateful for our clients and for all of you as our investors. On behalf of our company, I am excited for what comes next.

Onward,

Robin Vince

President and

Chief Executive Officer

a Return on tangible common equity, a non-GAAP measure, excludes goodwill and intangible assets, net of deferred tax liabilities. See “Supplemental information: Explanation of GAAP and non-GAAP financial measures” for a reconciliation.

b Adjusted measures exclude notable items. See “Supplemental information: Explanation of GAAP and non-GAAP financial measures”.

c Consists of AUC/A, primarily from the Asset Servicing line of business and, to a lesser extent, the Clearance and Collateral Management, Issuer Services, Pershing and Wealth Management lines of business. Includes the AUC/A of CIBC Mellon Global Securities Services Company, a joint venture.

d Excludes assets managed outside of the Investment and Wealth Management business segment.

e For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for Dec. 31, 2022 was the Advanced Approaches, and for Dec. 31, 2021 was the Standardized Approach.

1 Notable items impacting total revenue in 2022 include the net loss from repositioning the securities portfolio, the accelerated amortization of deferred costs for depositary receipts services related to Russia and net gains on disposals. Notable items impacting total pre-tax income in 2022 also include the goodwill impairment, severance expense and litigation reserves. Notable items impacting total pre-tax income in 2012 include merger and integration charges, litigation reserves, restructuring charges and a charge related to investment management funds, net of incentives.