A Letter from Our

CEO Todd Gibbons

From any vantage point, and by any measure, 2020 was an unprecedented year. Yet for all of its unique challenges, the year also inspired exceptional levels of innovation, collaboration and determination.

From any vantage point, and by any measure, 2020 was an unprecedented year. Yet for all of its unique challenges, the year also inspired exceptional levels of innovation, collaboration and determination.

Through it all, BNY Mellon adapted and adjusted to ensure we continued to deliver on our commitments. I am so proud of how our company rose to the occasion — demonstrating, again, why we are a trusted steward for our clients and the global financial markets. That trust has been earned over the course of our rich 236-year history, and is the foundation of who we are and what we do.

Throughout the pandemic, we have supported our employees, clients and communities. We were proud to provide the infrastructure for several critical government programs for COVID-19 relief, including the Term Asset-Backed Securities Loan Facility, the Municipal Liquidity Facility, the Primary Dealer Credit Facility and the Payment Protection Program. In addition, given our strong capital and liquidity position, we used our balance sheet to support our clients through this period, including by accommodating elevated deposits and funding increased loan demand.

We take great pride in the unique and important role we play in the global capital markets ecosystem, and we are confident in our business model, our value proposition and our prospects.

Read the Annual Report

Read the Annual Report

See how we've making an impact and powering a world of difference.

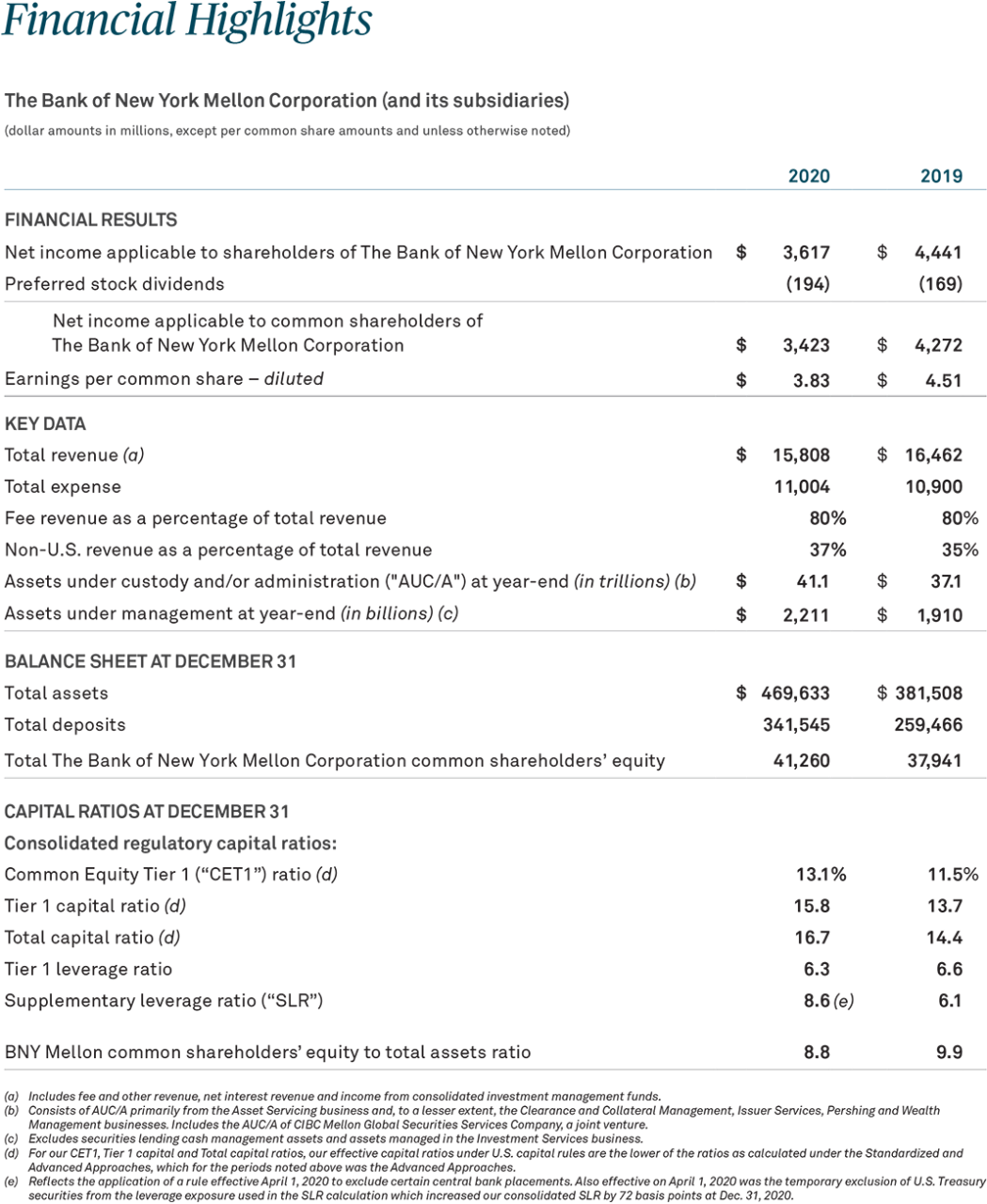

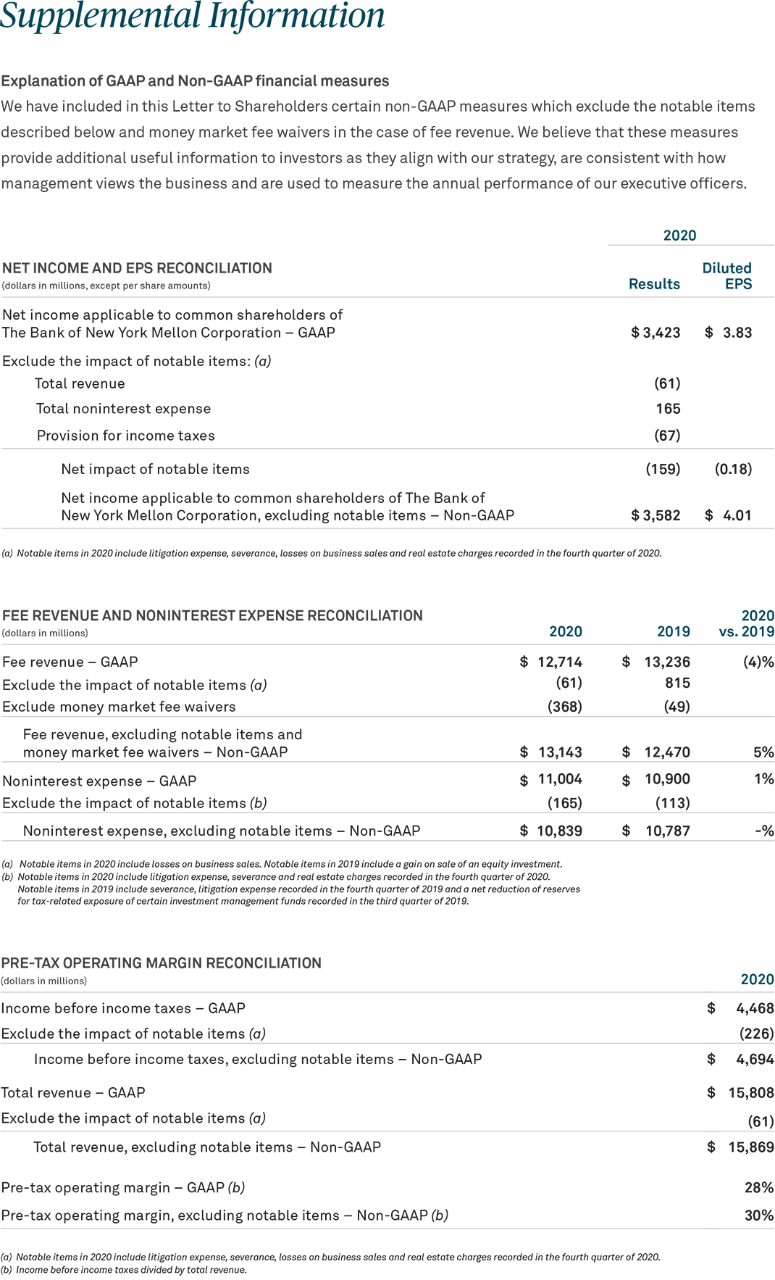

Our 2020 Financial Results

Our lower-risk, fee-based business model and stable franchise positioned us well for the conditions in 2020, with resilient results despite the challenged interest rate and credit environment. For the full year, reported earnings per share (EPS) were $3.83. On an adjusted basis (excluding notable items), EPS of $4.011 was flat year over year.

Reported revenue of $15.8 billion was down 4%, primarily as a result of a gain on the sale of an equity investment in 2019, as well as the impact of the lower interest rate environment. At the same time, excluding the impact of notable items and fee waivers during 2020, fee revenue increased 5%,1 reflecting underlying growth within our businesses.

We controlled overall costs well, keeping adjusted full-year expenses flat1 as our cost discipline and productivity gains essentially offset incremental investments. Excluding notable items, we maintained a solid pre-tax operating margin of 30%.1 Our investments in operations and technology remain at the core of our strategy, with the profile of this spend now shifting toward initiatives to grow the business and make it more efficient.

During 2020, we generated significant capital and ended the year with a CET1 ratio of 13.1%, up from 11.5% at the prior year-end as regulators suspended share buybacks between the second and fourth quarter of 2020. We are pleased that the industry can resume share repurchases in the first quarter of 2021 in line with the Federal Reserve’s modified limitations. We remain committed to attractive levels of shareholder returns with an aim to return at least 100% of earnings to shareholders over time. Through the combination of organic growth and share buybacks, we also remain committed to drive meaningful future EPS growth.

Our Businesses:

Amid volatile and uncertain market conditions, we gained meaningful momentum in driving our long-term growth strategy across all of our businesses with examples below.

Click on each business to learn more:

- Asset Servicing

- Pershing

- Treasury Services

- Investment Management

- Wealth Management

- Asset Servicing

- Pershing

- Treasury Services

- Investment Management

- Wealth Management

The strength of our offerings was evidenced by the sustained improvement of our win-loss ratios and client retention rates in 2020. We are focused on expanding beyond traditional servicing to help our clients through digital- and data-driven solutions across their front, middle and back office, while continuing to invest in the core services that have made us a leader in the industry. For example, our new Digital Assets unit will build the industry’s first multi-asset digital platform, to support both traditional and digital assets, expanding our addressable market, diversifying fees and fueling growth. Our leading data management and analytics business is building on our 20-year track record in software and services to create robust, cloud-based data and analytics capabilities that are being selected by some of the world’s largest financial institutions to solve for their most complex data needs.

Pershing, which services approximately 1,200 broker-dealers and registered investment advisory firms globally, is one of the unique businesses that differentiates us from our peers in the fast-growing wealth space. Interest rates will have an adverse effect on Pershing in 2021, but the outlook for the business remains very strong as we expect secular industry trends, our investments and our integrated platform to drive meaningful future growth.

We delivered good performance and grew liquidity balances and new business. We continue to invest in automation and are working with clients to transition them from paper to electronic processes. We are also furthering developments in real-time payments. We are actively working on an exciting payments initiative that is a large-scale commercial pilot with one of the world’s largest billers. This capability is expected to reach tens of millions of consumers via their retail banks throughout 2021, leveraging continued adoption across the real-time payments system.

We are encouraged by the strong investment performance and improved flows in our leading active equity and absolute return strategies that complemented strong inflows in our fixed income, cash, and liability-driven investment (LDI) strategies, where we command leading positions. We continued to expand our investment capabilities to meet evolving client demand in areas such as thematic and sustainable strategies, that benefit from our heritage in environmental, social and governance (ESG) research; alternatives; and launching an ETF range for clients to access our strategies in a new product vehicle. Hanneke Smits became CEO of our Investment Management business, and we also appointed new leaders in several of our specialist investment firms. Under this leadership, the business is well positioned to drive performance as clients increasingly turn to investment managers with deep specialist expertise. To meet that growing trend, we recently announced that Mellon will transition its capabilities in fixed income, equities and multi-asset, and liquidity management to enhance the specialist capabilities within a number of our other investment firms. Once completed, Mellon will become a dedicated index manager. We believe the added breadth and depth of specialist research within these investment firms will help drive investment outcomes and product innovation for clients.

We are optimistic about our Wealth Management business and its potential within the fastest growing segment of financial services. We are focused on high-net worth and ultra-high net worth individuals; family offices; and the Outsourced Chief Investment Officer (OCIO) community. We are investing in talent, technology, and our banking and investment platforms. We have built a proprietary advice-based planning framework, Active WealthTM, and goals-based planning tool, AdvicePathSM, to bring institutional disciplines to the wealth market. Wealth Management ended 2020 with client assets at an all-time high and 95% client satisfaction scores, which we believe are a strong foundation for the future.

Our business is incredibly strong and interconnected, and our resilient franchise offers a compelling value proposition to clients and shareholders alike. The future of our business will focus on data, connectivity and openness. We will also focus on growing our securities services business and, in particular, our data and analytics capabilities. We also plan to expand our presence in wealth and capital markets infrastructure, and optimize our Wealth Management and Investment Management businesses.

Making an Impact: Powering a World of Difference

Finally, I would be remiss if I did not touch on the impact of 2020 beyond the financial results. It was a year that will forever have a profound effect on society as we consider the gravity of COVID-19 and social justice movements around the globe.

As a major global financial institution, BNY Mellon is committed to using our reach, market influence and resources to address pressing global ESG issues. We strive to contribute to sustainable economic growth that helps protect healthy markets; enhances our own business resiliency and longevity; and aims to deliver positive impact for key stakeholders, including clients, employees, shareholders and communities.

We embrace this responsibility with great accountability, transparency and integrity, and it permeates every aspect of our culture. In 2020, we issued our three new enterprise ESG (then titled corporate social responsibility or CSR) pillars — Culture & Purpose, Responsible Business and Global Citizenship — with associated goals and key performance indicators. As part of our ESG work, we are embedding an ESG lens into our company operations, thereby addressing the business impacts of global issues and contributing to opportunities that help communities thrive.

We are committed to addressing climate-related risks and opportunities throughout our operations and in our business activities. As a key global provider of services to capital market participants, we help our clients manage their ESG-related risks and opportunities — such as those relating to climate — by continuing to develop and offer ESG products and services. This includes the BNY Mellon ESG Data Analytics cloud-based application that uses crowdsourcing to customize investment portfolios to clients’ individual ESG factor preferences. We have set goals to ensure we are offering leading ESG investment solutions, empowering ESG investors globally, and enabling ESG financing.

The importance of supporting diversity, inclusion and equity was on full display in 2020. We are proud to have one of the most diverse Fortune 500 boards, and our Executive Committee has become increasingly diverse — with strong gender and ethnic/racial diversity. In addition, we set concrete, short-term representation goals in the U.S. for Black and Latinx recent graduates and experienced professionals. These efforts are intended to help accelerate progress in our most underrepresented ethnic/racial talent populations, as well as to position our firm as a competitive choice for top talent.

Over the course of our history, we have been a trusted steward to our clients and communities, and we will continue with our relentless ambition to have a more profound impact on the world around us. As we close out an unprecedented chapter in that history, I am grateful for the contributions of our employees, the support of our board of directors, and the collaboration of our clients and other stakeholders.

We are on an exciting journey as a company — one that will define BNY Mellon for years to come. I am incredibly optimistic about our business and the contributions we will make to all of our stakeholders.

Sincerely,

Thomas P. (Todd) Gibbons

Chief Executive Officer

[1] Represents a non-GAAP measure. See pages below for a reconciliation of this non-GAAP measure. Compared to 2019, fee revenue decreased by 4% and noninterest expense increased by 1%. Pre-tax operating margin was 28% for 2020.