Investing In

and For Women

Empowering gender equality through thematic investing

Investing In

and For Women

Empowering gender equality through thematic investing

August 2023

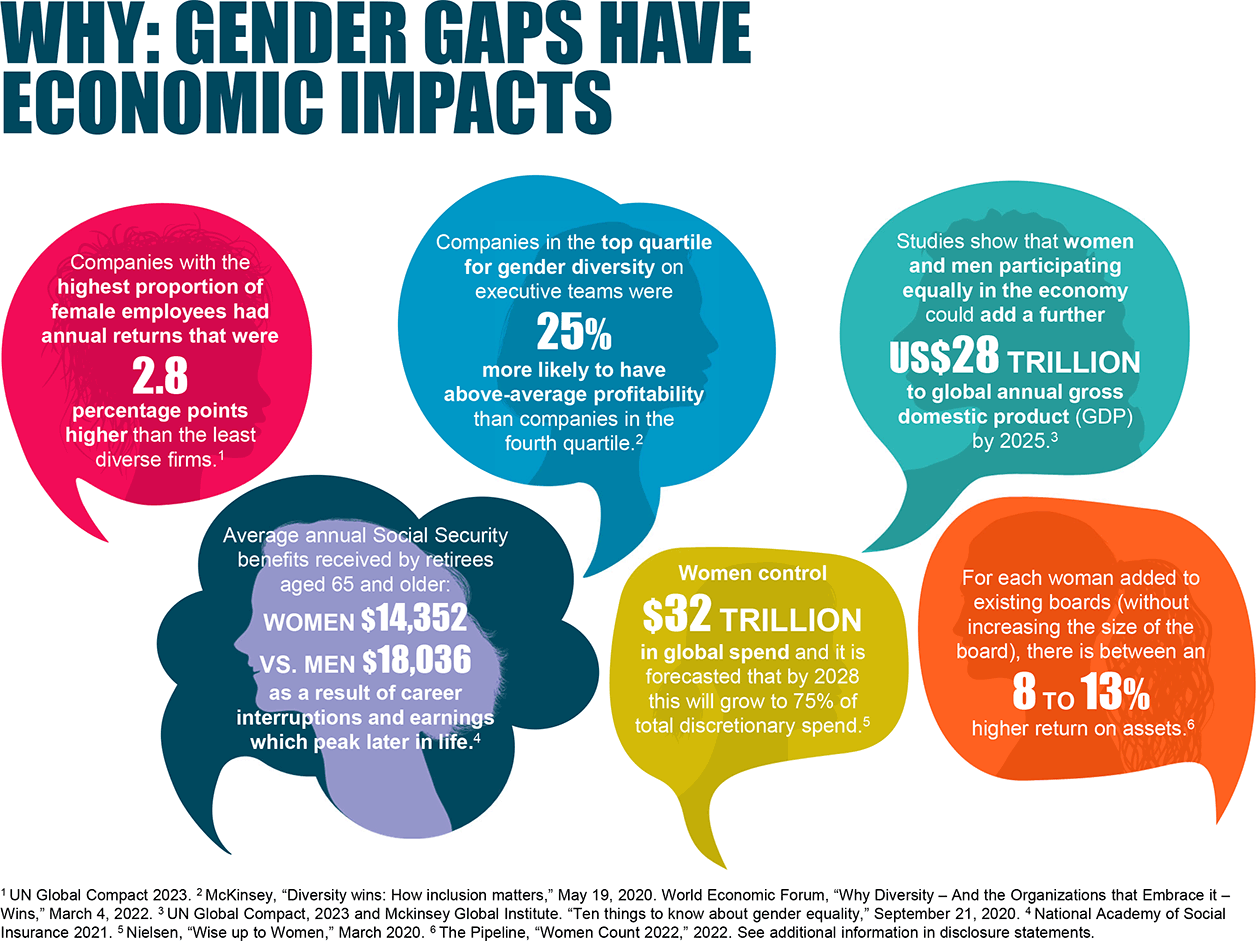

Gender equality is not only a focus for BNY Mellon, but for many of our clients. Research shows that companies with more diverse leadership teams tend to deliver higher levels of profitability over time. Not surprisingly, gender and ethnically diverse companies are 25% and 36% more likely, respectively, to outperform financially.1 Put simply, firms that do a good job recruiting, retaining and supporting women in the workplace tend to outperform firms that don’t.

Introducing the Women’s Opportunities Exchange Traded Fund (BKWO)

That’s why as part of our ongoing commitment to gender equality, BNY Mellon ETF Investment Adviser, LLC, part of BNY Mellon Investment Management, recently launched the BNY Mellon Women’s Opportunities ETF (BKWO), to help address societal gaps that can limit women and ultimately reduce economic productivity.

Managed by two female portfolio managers, Julianne D. McHugh and Karen Miki Behr at BNY Mellon affiliate Newton Investment Management, the fund provides our clients with an opportunity to improve gender equality outcomes and earn attractive investment returns. In addition, the ETF includes a charitable dimension through our collaboration with the national non-profit organization, Girls Inc., whereby the fund’s Investment Adviser will contribute 10% of its management fee annually to Girls Inc.2 in support of furthering their mission -- to inspire all girls to be strong, smart and bold through direct service and advocacy.

To celebrate the launch of the NASDAQ listed BNY Mellon Women's Opportunities ETF (BKWO), we invited participants of Girls Inc. of New York City to join us in ringing the NASDAQ closing bell on July 31, 2023. Pictured L to R: Miadaly Camilo, Aleha Syed, Aniya Germany, Elizabeth Bun and Jade Enyenihi. As part of the BNY Mellon Women’s Opportunities ETF, the Fund's investment adviser will contribute at least 10% of the management fee to Girls Inc. Photo courtesy of Nasdaq.

To celebrate the launch of the NASDAQ listed BNY Mellon Women's Opportunities ETF (BKWO) and the BNY Mellon Innovators ETF (BKIV) Newton Investment Management CEO Euan Munro and BNY Mellon Investment Management CEO of ETFs Stephanie Pierce rang the NASDAQ Closing Bell on July 31, 2023. Photo courtesy of Nasdaq.

To celebrate the launch of BNY Mellon Investment Management's thematic ETFs, employees of BNY Mellon Investment Management and Newton Investment Management rang the NASDAQ closing bell on July 31, 2023. They were joined by representatives and participants of the non-profit Girls Inc. As part of the BNY Mellon Women’s Opportunities ETF, the Fund's investment adviser will contribute at least 10% of the management fee to Girls Inc. Photo courtesy of Nasdaq.

Employees of BNY Mellon Investment Management, Newton Investment Management and participants and representatives of Girls Inc. pose for a photo beneath the NASDAQ marquee in Times Square after ringing the NASDAQ closing bell on July 31, 2023. The event celebrated the launch of BNY Mellon Investment Management's thematic ETF suite. Photo courtesy of Nasdaq.

To celebrate this initiative, we rang the NASDAQ closing bell on July 31, 2023, with members of Girls Inc. and its New York City program participants -- young women like Aleha Syed and Aniya Germany, whose stories of how Girls Inc. helped them find their own voice and build leadership skills are nothing short of inspiring.

Inspiring Stories of Growth and Confidence through Girls Inc.

Syed, now an alumna of Girls Inc. of New York City, joined during the COVID-19 pandemic when she was 15. She is the firstborn of an immigrant mother, who is also a widow.

“Girls Inc. provided a safe and respectful environment where I felt like I could do anything. I learned about creating boundaries and the uniqueness I bring to the table through my intersectional identity as a Pakistani-American female navigating my teen years in NYC," Syed said of her experience.

Syed is looking forward to starting her pre-med studies at Cornell University in the fall and says because she learned about financial independence and sustaining generational wealth through Girls Inc. programming, she has also enrolled in a few finance classes at college.

Germany is a lifelong New Yorker and rising high school senior who joined Girls Inc. of New York City as a freshman. She says her relationships with Girls Inc. mentors have expanded her outlook on life and helped her to establish healthy relationships by keeping her accountable. She also attributes learning data analysis and financial literacy skills to the learning opportunities she participated in with Girls Inc.

“Girls Inc. helped me tap into my confidence, helped me be more accountable for my actions, and encouraged me to follow my dreams," Germany explained, adding, “I am ready to lead.” After high school graduation, Germany plans to study business and economics with the goal of becoming an entrepreneur one day.

As a woman who has worked in the financial services industry for over three decades, I’m honored to play a role in building this solution for our clients. With the BNY Mellon Women’s Opportunities ETF, we are delivering on the needs of our clients and having a positive impact on society -- a powerful combination.

- McKinsey & Company, Diversity wins: How inclusion matters, May 2020

- The Adviser and/or certain of its affiliates intend to make financial contributions, after any fee waivers or expense reimbursements, to one or more charitable or non-profit organizations, which are tax-exempt under section 501(c)(3) of the Internal Revenue Code of 1986, as Amended (the Code), and seek to promote the development, advancement and/or leadership of women and/or Girls (Organizations).

Investors interested in an ETF should consider the investment objective, risks, charges, and expenses of the ETF carefully before investing. To obtain a prospectus that contains this and other information about the ETF, investors should contact their financial representatives or visit im.bnymellon.com/etf. Read the prospectus carefully before investing.

ETF shares are listed on an exchange, and shares are generally purchased and sold in the secondary market at market price. At times, the market price may be at a premium or discount to the ETF’s per share NAV. In addition, ETFs are subject to the risk that an active trading market for an ETF’s shares may not develop or be maintained. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions.

ETFs trade like stocks and are subject to investment risk, including possible loss of principal. The risks of investing in ETFs typically reflect the risks associated with the types of instruments in which the ETFs invest. Diversification cannot assure a profit or protect against loss.

ETFs generally have lower expenses than actively managed mutual funds due to their different management styles. Most ETFs are passively managed and are structured to track an index, whereas many mutual funds are actively managed and thus may have higher management fees. Since buying or selling ETF shares on an exchange may require the payment of brokerage commissions, trading activity may increase the cost of ETFs.

The ETF will issue (or redeem) shares to certain institutional investors known as “Authorized Participants” (typically market makers or other broker-dealers) only in large blocks of shares known as “Creation Units.” BNY Mellon Securities Corporation (“BNYMSC”), a subsidiary of BNY Mellon, serves as distributor of the ETF. BNYMSC does not distribute shares in less than Creation Units, nor does it maintain a secondary market in shares. BNYMSC may enter into selected agreements with Authorized Participants for the sale of Creation Units of shares.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

Past performance is no guarantee of future results.

Although an ETF’s shares are listed for trading on an exchange and may be listed or traded on other U.S. and non-U.S. stock exchanges as well, there can be no assurance that an active trading market for such shares will develop or be maintained. Trading in an ETF’s shares may be halted due to market conditions or for reasons that, in the view of the listing exchange, make trading in the ETF’s shares inadvisable. In addition, trading in an ETF’s shares on an exchange is subject to trading halts caused by extraordinary market volatility pursuant to exchange "circuit breaker" rules. There can be no assurance that the requirements of the listing exchange necessary to maintain the listing of the ETF will continue to be met or will remain unchanged or that the ETF’s shares will trade with any volume, or at all, on any stock exchange.

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees.

Small and midsized company stocks tend to be more volatile and less liquid than larger company stocks as these companies are less established and have more volatile earnings histories.

Healthcare sector risk. The healthcare sector is subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability. Furthermore, the types of products or services produced or provided by healthcare companies quickly can become obsolete. In addition, companies in the healthcare sector can be significantly affected by patent expirations, pricing pressure, and product liability claims.

Information technology sector risk. The information technology sector has been among the most volatile sectors of the stock market. Information technology companies involve greater risk because their revenue and/or earnings tend to be less predictable (and some companies may be experiencing significant losses) and their share prices tend to be more volatile. Certain information technology companies may have limited product lines, markets or financial resources, or may depend on a limited management group. In addition, these companies are strongly affected by worldwide technological developments, and their products and services may not be economically successful or may quickly become outdated. Investor perception may play a greater role in determining the day-to-day value of information technology stocks than it does in other sectors. Fund investments may decline dramatically in value if anticipated products or services are delayed or cancelled.

BNY Mellon Women’s Opportunities ETF (BKWO): The ETF’s incorporation of Women’s Opportunities considerations into its investment approach may cause the ETF to make different investments than funds that invest principally in equity securities, but do not incorporate Women’s Opportunities considerations when selecting investments. Under certain economic conditions, this could cause the ETF to underperform funds that do not incorporate Women’s Opportunities considerations.

The ETF is non-diversified, which means that the ETF may invest a relatively high percentage of its assets in a limited number of issuers. Therefore, performance may be more vulnerable to changes in the market value of a single issuer or group of issuers and more susceptible to risks associated with a single economic, political, or regulatory occurrence than a diversified fund.

The Adviser and/or certain of its affiliates intend to make financial contributions to one or more charitable or nonprofit organizations, which are tax-exempt under section 501(c)(3) of the Internal Revenue Code of 1986, as amended, and seek to promote the development, advancement and/or leadership of women and/or girls.

This material has been distributed for information purposes only and should not be considered as investment advice or a recommendation of any particular investment, strategy, investment manager or account arrangement and should not serve as a primary basis for investment decisions. Please consult a legal, tax or financial professional in order to determine whether an investment product or service is appropriate for a particular situation. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

“Newton” and/or the “Newton Investment Management” refers to Newton Investment Management North America LLC and Newton Investment Management Limited (NIM). Newton is registered with the U.S. Securities and Exchange Commission as an investment adviser. The fund's investment adviser is BNY Mellon ETF Investment Adviser, LLC. (“Adviser”). BNYM ETF Investment Adviser, LLC has engaged its affiliate, Newton Investment Management North America, LLC (NIMNA), to serve as the ETF’s sub-adviser. NIMNA has entered into a sub-sub-investment advisory agreement with its affiliate, Newton Investment Management Limited (NIM), to enable NIM to provide certain advisory services to NIMNA for the benefit of the ETF.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally. BNY Mellon ETF Investment Adviser, LLC is the ETF’s investment adviser, Newton is the ETF’s sub-adviser and BNY Mellon Securities Corporation is the distributor of the ETF. Each are subsidiaries of BNY Mellon.

BNY Mellon and Girls Inc., are unaffiliated entities.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-411049-2023-08-02