White papers, opinions and policy pieces

Proprietary data-driven research and surveys

Macro and markets commentary, investing strategy

Views from around our industry with the latest insights on trading, collateral, funding and liquidity

The Separately Managed Account Opportunity for ADR Issuers

The Separately Managed Account Opportunity for ADR Issuers

August 2019

By Emily Gamble Bush-Brown

This report provides insights into the opportunity for issuers with or considering ADR programs to access a growing segment of U.S. investment, Separately Managed Accounts.

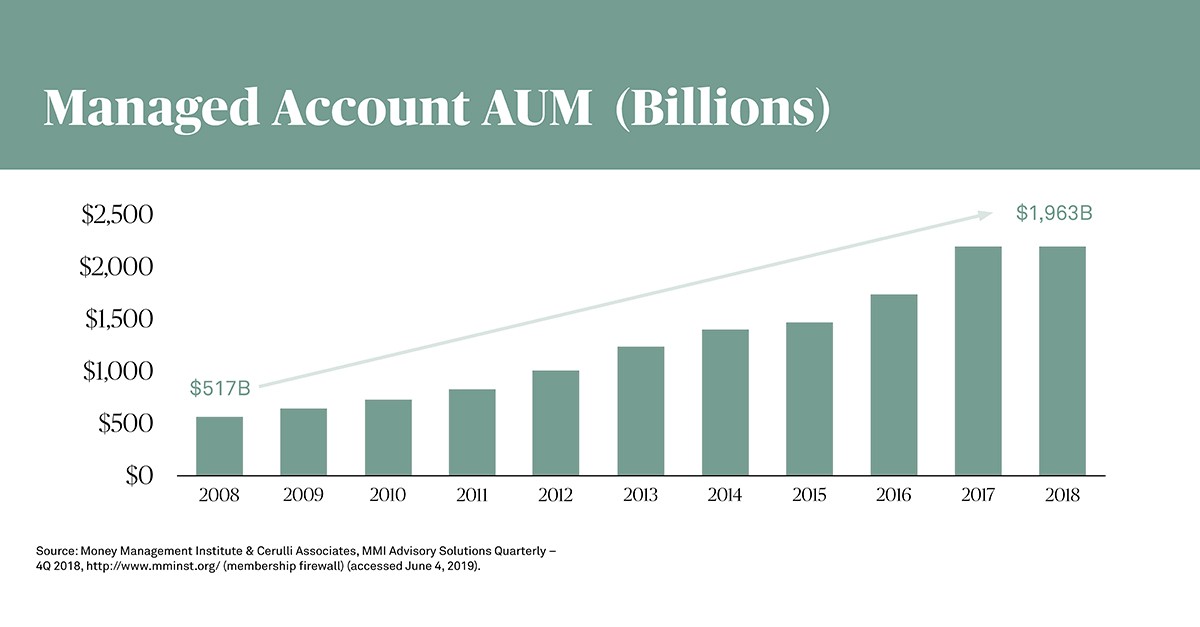

While flows into Exchange-Traded Funds (ETFs) and mutual funds tend to get headlines, an area demonstrating growth is the Separately Managed Accounts (SMAs) industry. The Managed Account industry now represents almost $2 trillion in assets under management (AUM) in the United States, a 280% increase over the past 10 years.

One of this industry’s fastest growing segments is Separately Managed Accounts (SMAs).

The Role of ADRs for SMAs

Features of the ADR product make it well suited to meet investment managers’ goals of providing investors with global diversification. Two factors have resulted in the ADR emerging as a solution for investment managers offering international equity investment via managed accounts:

- The individual investor is the registered owner

- They are priced in USD and are DTC-eligible

Investment managers frequently have both individual managed accounts and institutional clients subscribing to the same investment strategy, with the institutional clients often holding the foreign shares underlying the ADRs. Given that the investment strategy is the same, the investment manager strives to reduce the tracking error between the two portfolios, with the breadth of the ADR market helping them achieve this. The increase in popularity of SMAs represents a growing opportunity for issuers with ADR programs.

The SMA Opportunity for ADR Issuers

For over 15 years, BNY Mellon Depositary Receipts has raised awareness and understanding of the ADR product through ongoing communication and support of SMA managers as these investment managers have developed, launched and administered their managed account portfolio offerings. Through our efforts to support and inform the SMA community, we are able to support our DR issuer clients with insights into how SMAs utilize ADRs, who is managing these products, and the opportunities SMAs can present for additional diversification of issuers’ U.S. shareholders.