Looking ahead, it’s clear that that demand is percolating for active products across a range of vehicles and wrappers, particularly in niches that may offer a greater alpha opportunity to investors, such as small-cap or global strategies. Among active ETFs, anecdotally, track record and cost represent two significant factors that can either facilitate or stand in the way of adoption depending on the channel.

Conclusion

Given the volatility last year, it can be challenging to discern the signals from the noise. What the data is showing, however, is that the “money in motion” is translating into a more tailored approach in which retail investors and their intermediaries are looking to leverage both active and passive strategies through multiple wrappers.

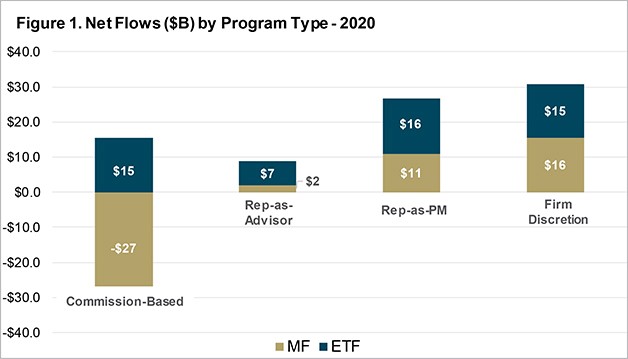

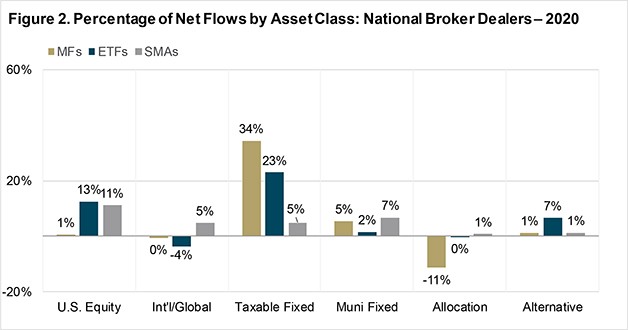

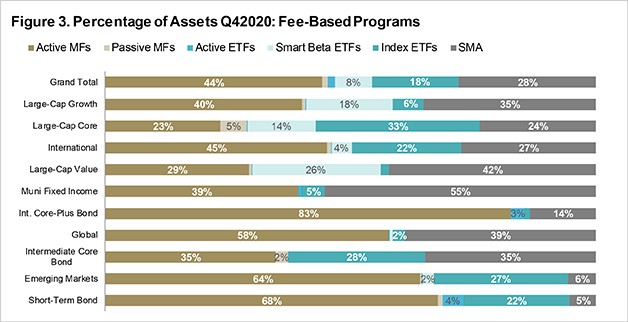

Among the more pertinent takeaways for distribution professionals from 2020, based on the data, was the relative stability and steady growth of firm discretionary programs, which stood in contrast to Rep-as-PM models that helped contribute to the volatility but also proved to be a strong growth engine as markets rebounded. Similarly, SMAs also proved to be a model of stability and growth, with balance across asset classes, while a broad rotation into active strategies helped to lift active ETF and smart beta strategies, in some cases, even in asset classes that have historically leaned passive, such as large-cap core strategies. One area distribution teams will want to continue to monitor is the momentum building in dedicated ESG strategies, across both mutual funds and ETFs. While market share for both product types remains under 2%, awareness and interest among retail investors continues to grow, particularly as these strategies prove out their investment theses over time.

The discussed insights represent just a taste of what’s available through BNY Mellon Data and Analytics Solutions to help inform distribution and marketing strategies and enhance how firms discern and pursue developing opportunities when engaging with financial advisors.