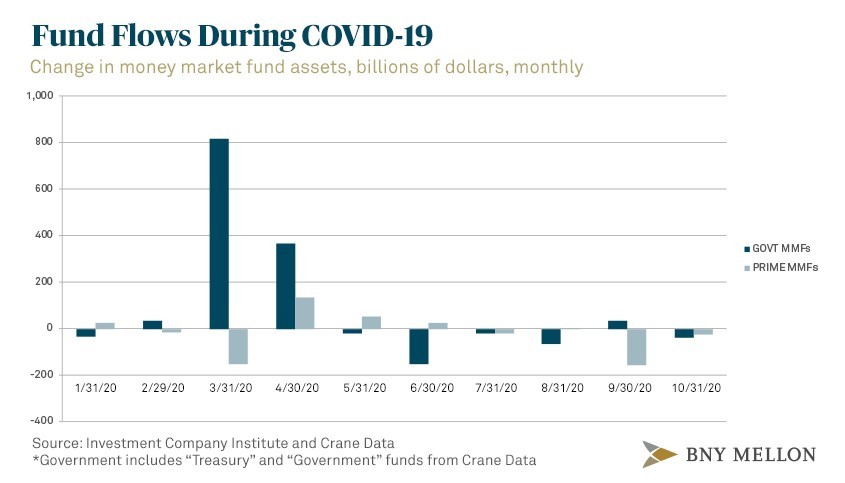

While investors were putting money into Treasury and government money market funds, they were also pulling money out of Prime money market funds during the same period earlier this year. Real-time knowledge of incoming trades would have been particularly helpful for fund managers during this time of extreme market volatility. If money managers have immediate transparency into the creation and redemption of funds, they would be able to more quickly react to the market.

A Network Like No Other

Building a network that would enable true transparency for stakeholders across the life cycle of a trade is no small task. Doing so will require a trusted institution like BNY Mellon to develop an evolutionary approach to the revolutionary future state. Digitizing legacy systems will enable controls of real-time, transparent workflows in order to radically improve the client experience by removing as much friction from workflows to become more operationally efficient. Standardizing data thus eliminating reconciliation and creating a more straight-through process will allow all participants from the ultimate beneficial owner to the fund manager and custodian.

Think of how Starbucks taught their customers how to speak their language so everyone orders coffee the same way. It’s all about efficiency. Now think about something as simple as a date field in a transaction that maintains integrity and consistency as the trade flows through the fund servicing value chain and gets settled at the transfer agent. This will significantly improve the data quality throughout the fund servicing life cycle and will eliminate the need for reconciliation.

BNY Mellon is determined to remain a leader in this space. We’re out front not only because blockchain is part of a technological revolution, but because applying it to functions like digital asset custody and token issuance will add true value for our clients-- we’re providing a service to clients who are looking to issue digital assets across the value chain.

Distributed Ledger Networks can remove friction and standardize data across the value chain. Risk reduction is key, but so are the bigger benefits that come through tokenization of the fund units. Additional benefits, like increasing liquidity and transferability of mutual fund units will lead to many more opportunities including the possibility of using fund tokens as collateral in other financial transactions.

In the second part of this two-part series, we’ll delve deeper into how we believe our role in the functions of digital asset custody and tokenization will further transform the capital markets.

Subhankar Sinha is Head of Blockchain at BNY Mellon. He is responsible for setting the overall strategy relating to the adoption of Distributed Ledger Technology (DLT) and digital assets. In this role, Sinha prioritizes opportunities and identifies possibilities to collaborate with clients, startups, accelerators, incubators and other business partners to drive enterprise innovation and build a DLT ecosystem. He is particularly focused on the impact of DLT and tokenization on fund servicing and currency.