Watch the replay of ‘Growing Trends in Private Markets Investments for Asset Owners’ webinar.

Asset Owners Make Foray Into Private Markets

Asset Owner Academy | Insights Series

Asset Owners Make Foray Into Private Markets

Asset Owner Academy | Insights Series

May 2022

The desire for diversification among asset owners seeking new sources of return is fueling allocations to alternative assets. In turn, this requires a sharper focus on balancing exposure and liquidity within the overall portfolio, while managing a deluge of new data, according to a recent BNY Mellon webcast.

In an in-depth discussion to explore the growing appetite of asset owners for private markets investments, BNY Mellon’s Rohan Singh, Global Head of Asset Owners, Asset Servicing and Digital, was joined by Mohamad Hafiz Kassim, Chief Financial Officer of the Employees Provident Fund Malaysia (EPF), Marcus Frampton, Chief Investment Officer of the Alaska Permanent Fund Corporation (APFC) and Frances Barney, Head of Global Risk Solutions at BNY Mellon Asset Servicing.

The knock-on effect of the pandemic on listed markets since early 2020 has accelerated asset owners’ allocations to private equity, private debt, real estate and infrastructure.

And this trend is unlikely to change any time soon. “To ensure return objectives are being met, asset owners are diversifying to private markets and are planning to increase their allocations over the next few years, to potentially seek better return opportunities and hedge against inflationary risks,” explained Singh.

Alongside this increasing exposure to the major private markets investments, however, is the need to keep exposure balanced against the cost of liquidity, expected performance and allocations to public securities. Keeping track of this relies on access to the right data and forecasting models to manage new risks as well as governance.

Future Proofing with Private Markets

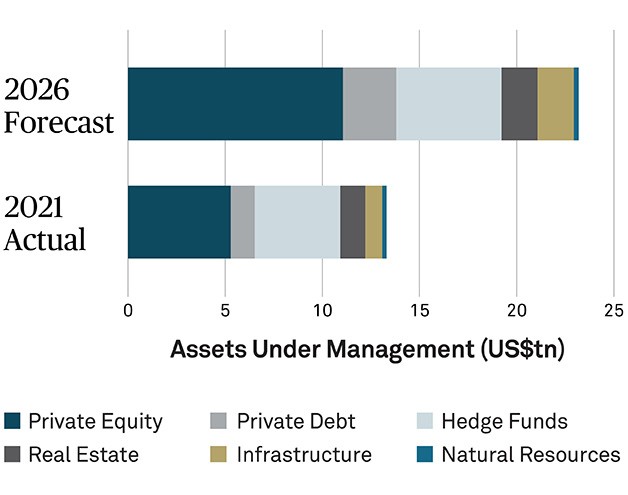

Research by Preqin reinforces the growing demand for alternative assets. The data provider forecasts growth in assets under management (AUM) in this space to reach US$23.21 trillion by 2026 (see Figure 1) . This is based on a compound annual growth rate of 14.8% for private capital AUM and 4.2% for hedge fund AUM.

Put simply, the landscape for these investments has evolved in line with the search by asset owners for ways to meet return objectives.

At APFC, for example, private markets exposure across equity, debt and real estate comprised around 20% of the overall portfolio a decade ago. This has risen to current levels of around 20% for private equity, 12% for real estate and 9% for private credit, explained Frampton.

EPF has also seen significant growth in its alternatives portfolio. From a relatively small allocation to private markets of around 3% just over 10 years ago, now has a target allocation of 10% today, mostly across private equity, infrastructure and real estate.

Mohamad Hafiz expects this trajectory to continue, with a greater focus in the coming years on access to private markets via direct investments rather than through funds. In line with this, EPF is seeking first-mover advantages in key sectors, based on its previous experience in securing attractive returns in less-trodden real estate assets such as warehouses and logistics.

For APFC, while tech has been its sector of choice within private equity over the past 10 years, Frampton foresees the next decade to be shaped by higher inflation and interest rates, plus global scarcity. “We are looking at energy, materials and private credit going forward,” he explained.

Figure 1: Alternative Assets under Management and Forecast, 2021 - 2026*

*2021 figure is annualized based on data to March. 2022-2026 are Preqin's forecasted figures.

Source: Preqin Alternatives in 2022 Report

Balancing Expectations

Determining the appropriate and comfortable level of private market investments is part of a balancing act against the target returns for an asset owner’s strategic asset allocation (SAA).

At APFC, the long-term mandate target of CPI (Consumer Price Index) + 5% is aligned with many state pension funds and endowments. In recent years, however, only private equity has shown a 10-year capital markets expectation of sufficient returns to meet the target.

Investors such as APFC are also careful to not rush into assets with different risk-return dynamics without considering the overall portfolio mix.

“Week to week, we have internal discussions on where we want to be relative to our target allocations,” explained Frampton. “We have chosen to be overweight cash and underweight equities for the past two years, which has cost us returns but we prefer a more cautious approach.”

Balancing the illiquidity premium has been particularly relevant for EPF since the start of the pandemic. For example, amid the economic pain from COVID-19, the unprecedented decision in Malaysia to allow members to access their funds led to the equivalent of around US$25 billion in withdrawals.

“For the first time, we have become focused on balancing the liquidity risk in our SAA against our exposure to private markets assets,” said Mohamad Hafiz.

Adapting Allocations to Alternatives

One of the key challenges for asset owners when investing in private markets is the difficulty in acquiring and managing the relevant data, and also in understanding what it means, to make the right portfolio decisions.

“Investors need data transparency to give them the confidence to manage the risks and invest to their full potential,” explained Barney at BNY Mellon.

Indeed, she sees data quality as critical to effective performance and risk monitoring, particularly for alternative investments where the data is sometimes not available for several months, and can be redefined, after the fact, in a way that changes the return calculations.

As an example, the ability to see lagged returns, which aligns with when the data was available, alongside non-lagged returns, which aligns with the final valuations, is really helpful to enable appropriate due diligence. It takes specialized expertise to interpret the data that comes different ways from different sources.

As allocations to alternative assets increase, the need for customization can often result in hundreds of different – and non-standard – data points.

APFC looks to tackle this with a constant investment in data and technology resources to ensure it can assess valuations and any associated risk of the underlying positions as part of making sound and informed allocation decisions.

At EPF, meanwhile, two of the key requirements it has as part of its private markets exposure are the customization and timing of its reporting.

Such examples reflect the importance of asset owners striving to implement infrastructure and processes to keep track of payments to meet capital calls, of valuations and of the various risks given different levels of transparency of private markets assets.

It’s important for investors to establish expectations about the level of transparency needed to enable ongoing monitoring. “These institutions need visibility over data, including underlying exposures as well as detailed transactions and expenses. This information is needed for analyzing risk effectively as well as for anticipating liquidity requirements. There is a great need for additional data management and administrative support related to alternative investing,” said Barney, reinforcing what asset owners like EPF and APFC acknowledge is a complementary role for asset servicing providers to play.

Ultimately, asset owners will seek to plug these gaps as they look to extend and expand their exposure to various private markets investments. As they do so, they need to ensure their focus on diversification, high absolute returns and also high risk-adjusted returns is in sync with their preparedness to manage allocations amid considerations over liquidity, valuations and total portfolio weightings.

Learn more by visiting BNY Mellon Asset Owner Academy, a platform to share bold ideas, insights and learnings to help asset owners stay agile as they transform their operating models.

This article is based on a discussion shared by Mohamad Hafiz Kassim, Chief Financial Officer of the Employees Provident Fund Malaysia (EPF), Marcus Frampton, Chief Investment Officer of the Alaska Permanent Fund Corporation (APFC), Rohan Singh, Global Head of Asset Owners at BNY Mellon Asset Servicing and Digital and Frances Barney, Head of Global Risk Solutions at BNY Mellon Asset Servicing at BNY Mellon, at the webcast ‘Growing Trends in Private Markets Investments for Asset Owners’ on April 28, 2022.

The views expressed herein may not reflect the views of BNY Mellon. This does not constitute legal, tax, accounting, investment, financial or other professional advice on any matter and does not constitute a recommendation by BNY Mellon of any kind.

Asset Servicing Global Disclosure

© 2022 The Bank of New York Mellon Corporation. All rights reserved.