ETFs to Join the Collateral Party?

ETFs Eyed as Collateral

ETFs to Join the Collateral Party?

ETFs Eyed as Collateral

June 2021

By Katy Burne

Intended for institutional, professional customers only

Institutions, faced with an increasing need to find diversified forms of collateral against securities loans and other trades, are turning their attention to exchange-traded funds (ETFs).

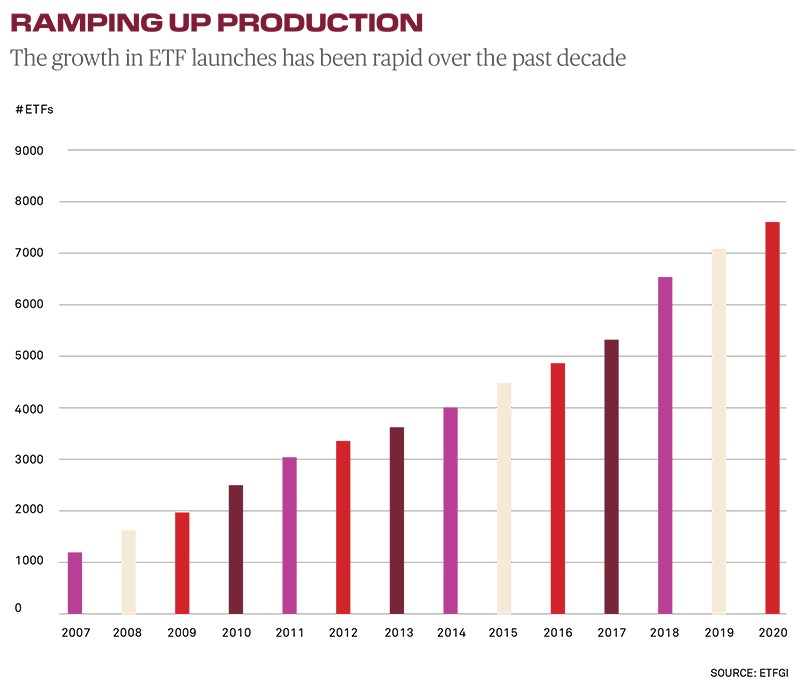

The market for exchange-traded funds (ETFs) has skyrocketed over the past quarter-century, thanks to the trillions of dollars investors are putting to work in passive, index-tracking strategies. What hasn’t yet exploded is the use of ETFs backing securities-financing arrangements and loans.

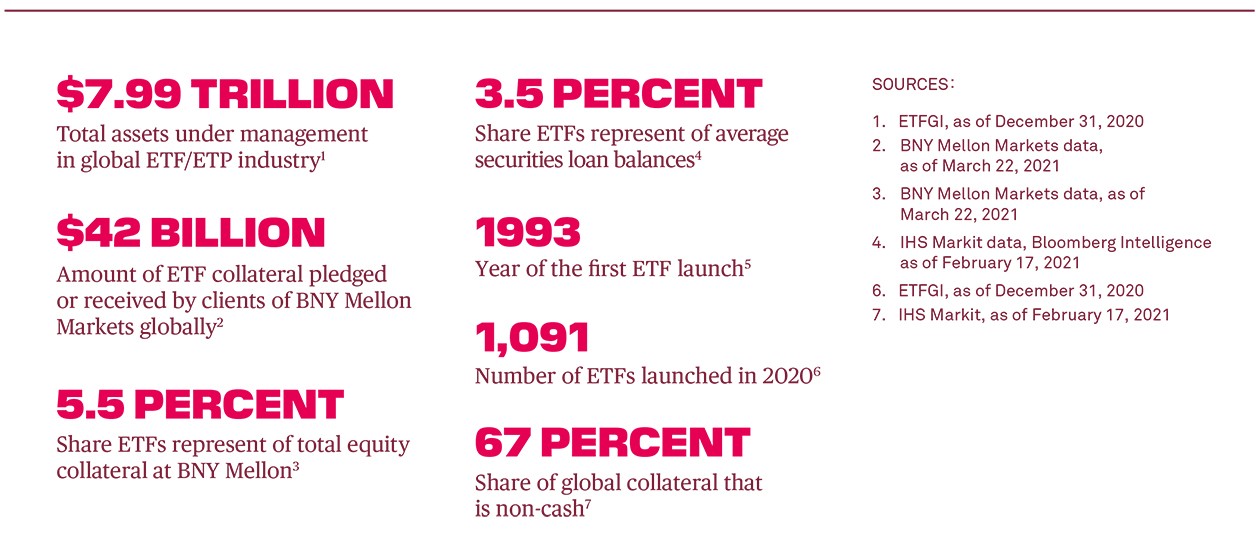

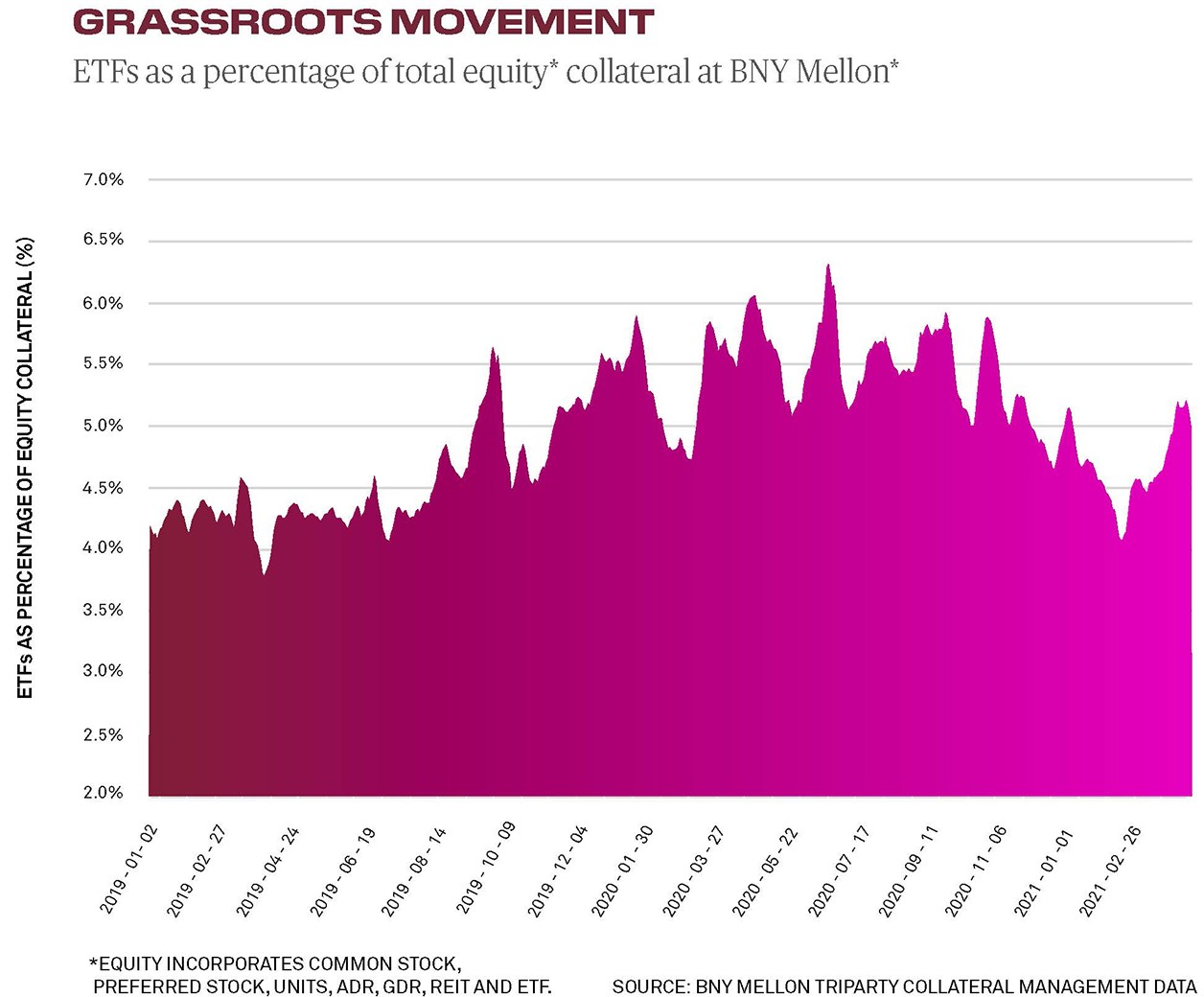

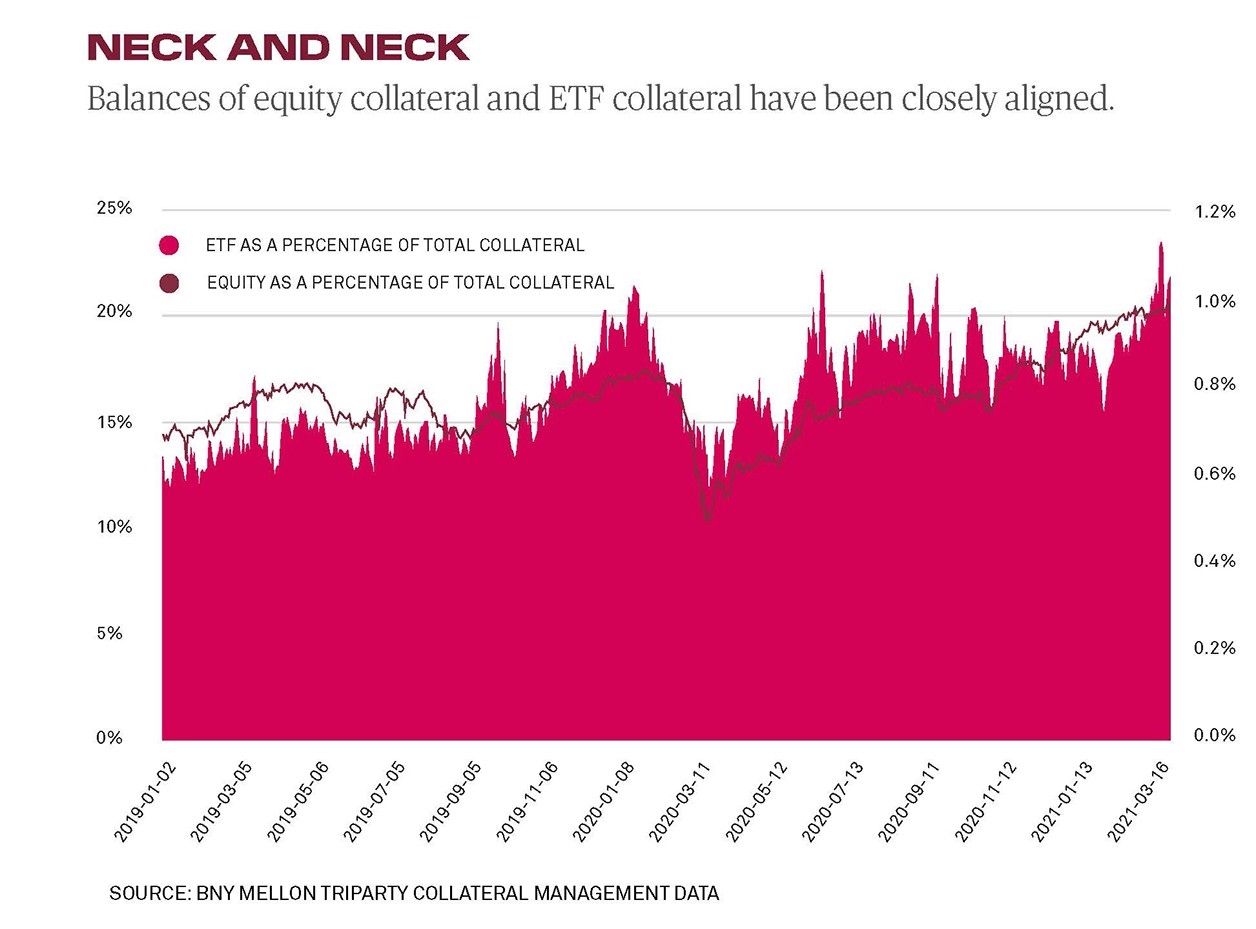

Clients of BNY Mellon were pledging and receiving $41.9 billion of ETFs daily as of late March, up from a low of $14 billion six years ago. The share those funds represent of overall equity collateral balances at BNY Mellon has barely budged, hovering around 5.5% of equity collateral and just 1% of total collateral.

Many participants say this could change, if participants can overcome their early skepticism toward ETFs and regulators can allow more favorable terms between those providing and receiving collateral. Indeed, change might be more likely for fixed-income ETFs containing securities that can be easily converted to cash or sold in the market.

Several signs point to a wider adoption of ETF collateral, even though some on the front lines are not currently pushing it. Some buy-side firms that previously rejected ETFs are now warming up to receiving them against securities loans and repurchase agreements or “repos” where their risk committees will allow.

At the same time, there is a growing interest on the part of some lenders and brokers to provide ETFs as collateral rather than other assets in their inventory. There is also an opinion, on the part of some traders, that regulators might one day allow ETFs full of short-dated Treasury bills to be counted as high-quality liquid assets (HQLA) for regulatory collateral purposes. This could increase the demand for fixed-income ETFs in general.

Proponents say the more ETFs are mobilized as collateral, the more it will increase the funds’ liquidity and reduce market friction. ETFs could be easier to move and manage than other assets and provide additional liquidity into the market.

Our discussion will be presented in four categories: the background, the arguments for ETF collateral, the roadblocks, and a path forward.

Green Shoots

As of December 31, there were 8,607 ETFs or exchange-traded products globally with assets of $7.99 trillion across 75 exchanges in 60 countries, according to ETFGI. But while ETFs have grown since their invention in the early 1990s, the perception of the funds’ safety has not.

They remain a rounding error in collateral terms, accounting for $41.9 billion or 5.5% of the $777 billion in equity collateral across BNY Mellon’s global client balances as of March 22 this year. Those are on trades where BNY Mellon sits in between two parties as a middleman or “triparty” agent, agnostic to which collateral clients use.

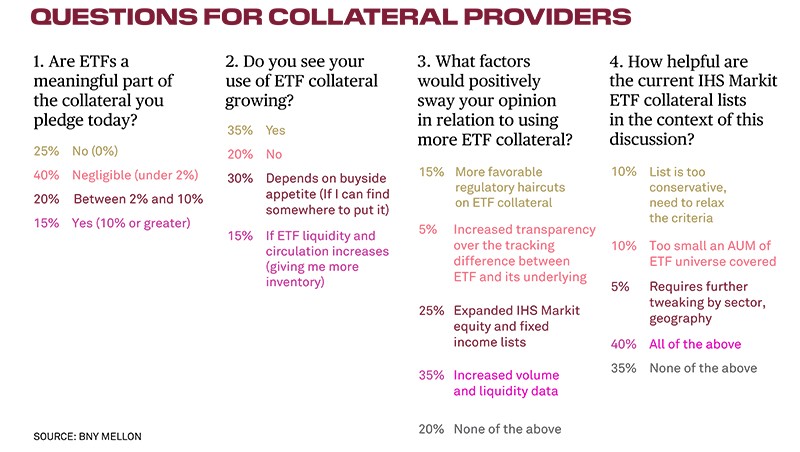

When a host of lenders and broker dealers were asked in an informal BNY Mellon poll in the spring of 2019 whether ETFs were a meaningful part of the collateral they provide today, they indicated it was negligible (see survey). Most said they would have an appetite to provide more collateral, however, especially if liquidity increases and collateral receivers are open to it.

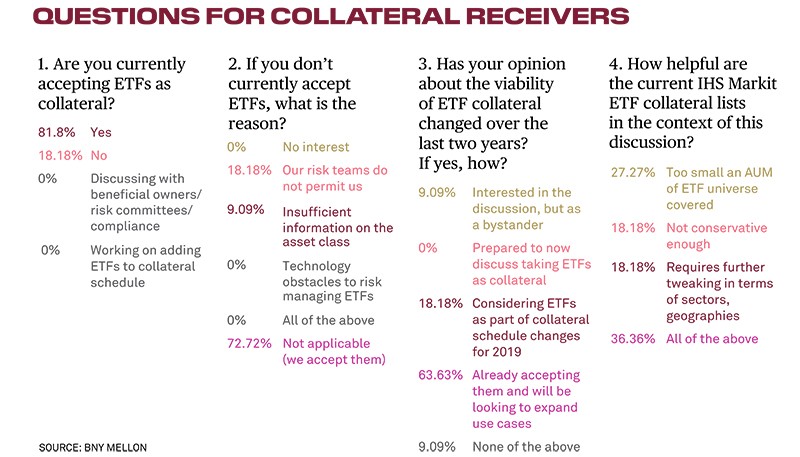

The picture is different on the collateral receiver side. Our survey suggested the majority of firms on the buy-side are willing to take ETFs and many larger ones already are. In practice, however, many smaller clients still are not. Some do not have explicit permission from their risk teams.

“Right now ETF collateral is underutilized and trapped,” says Gesa Benda, head of clearance and collateral management in EMEA for BNY Mellon. “Making it more mainstream would increase liquidity and provide more choice for clients in their funding strategies.”

There are several reasons for the hesitation. While ETFs are useful baskets that allow investors to get broad-based exposure through one security, few understand how the funds trade under severe market stress and how they would be redeemed. That’s why many investors tend to sell their ETFs as whole units through exchanges. It then becomes the job of Wall Street service providers or “authorized participants” to deconstruct the basket and deliver cash back to the investor.

“Right now, ETF collateral is underutilized and trapped. Making it more mainstream would increase liquidity and provide more choice for clients in their funding strategies.”

— Gesa Benda, BNY Mellon

Some risk managers would rather take a single share of Apple stock than a share of an ETF that exposes them to a plethora of blue-chip corporate names — or even a bunch of short-term Treasury bills — to avoid some of those steps. They tend not to have the bandwidth to sort through how the funds’ liquidity works or what securities are in the underlying basket.

This is despite there being relatively few instances of ETF disruption. Some firms have had a stab at addressing the perception problem. In 2015, IHS Markit introduced a list of equity and fixed-income ETFs that had broadly conservative parameters, such as not holding derivatives. ETF collateral balances at BNY Mellon Markets rose around 40% the year after those lists came out.

“It’s just a matter of time before we see ETFs as an established security in the collateral ecosystem,” says Siamak Mashoof, director in ETF and equity sales at IHS Markit. Today, he added, “It still remains a difficult sell to the risk officers, who ultimately determine collateral schedules.”

In February, IHS Markit launched ETF Collateral Lists 2.0, which enables collateral receivers to identify ETFs based on their risk criteria. According to Brian Ruane, chief executive officer of BNY Mellon Government Securities Services Corp., Clearance and Collateral Management and Credit Services, “BNY Mellon stands ready to work with clients to expand their use of ETFs as collateral in secured transactions. Providing custom eligibility capabilities, leveraging IHS Markit ETF Collateral Lists 2.0, is a recent example of this.”

“It is just a matter of time before we see ETFs as an established security in the collateral ecosystem.”

— Siamak Mashoof, IHS Markit

The expectation is that the new universe will cover more than 50% of the total global ETF assets under management that are eligible to be accepted as collateral today, versus only 15% before.

“The first two [Markit] lists were very vanilla,” says Matthew Fowles, director in iShares Global Markets for EMEA at BlackRock. “But they were a proof of concept to assist risk managers to understand their construct and promote adoption. That’s happened now, and hence there was a real need for a second generation of these lists.”

BlackRock accepts physically replicating ETFs as collateral from a number of issuers including iShares as collateral in its securities lending program. As of February 17, ETFs make up 3.5% of average global securities loan balances, up from 2.6% in 2019, according to IHS Markit data.

Time is Ripe

There are several market forces that might increase the potential for ETF collateral use. Many institutions are growing more comfortable with how ETF baskets are built and dismantled, and collateral flexibility is becoming increasingly important.

“ETFs have become more ubiquitous throughout the financial system, so it’s natural that collateral would be another use,” says Samara Cohen, co-head of iShares Markets and Investments at BlackRock. “People are just now really becoming aware of the desire to do this and figuring out the best way.”

A second factor is how much easier ETFs are to move through the plumbing underneath Wall Street’s securities markets than cash. Money market fund shares, while safe, settle through the individual fund companies that issue them, whereas ETFs settle like equities.

“The world is better piped to move equities than money market funds,” says James Slater, global head of business solutions for asset servicing at BNY Mellon. “The need to collateralize transactions is increasing, and in some cases regulations restrict the use of cash.”

The International Swaps and Derivatives Association, a trade group, has supported market participants in recent years, as they have been required to post collateral against derivatives that cannot be cleared through clearinghouses. This work continues as the industry prepares for the final two phases of implementation in September 2021 and September 2022.

As of September 1 this year, any financial firm trading $50 billion or more of these non-cleared derivatives will be required to post a percentage of its trading exposure as collateral. Global regulators also are pushing financial firms to hold more high-quality liquid assets or “HQLA” to meet various new capital and leverage tests.

One discussion is around the potential for additional forms of non-cash collateral. Clive Ansell, head of market infrastructure and technology at ISDA, says this might include money market funds and UCITS funds, and some market participants have inquired about using ETFs as collateral.

Pre-crisis, cash accounted for 63% of all collateral, whereas today 67% of collateral is non-cash, according to IHS Markit.

A third driver is the new breed of ETFs coming to market containing short-term Treasuries. Their attractiveness to asset managers who typically provide short-duration instruments as collateral is clear:

Treasury bills need to be replaced or “rolled” on routine dates when those securities mature, whereas ETFs live on perpetually until they are switched out for something else.

“ETFs have become more ubiquitous throughout the financial system so it’s natural that collateral would be another use. People are just now really becoming aware of the desire to do this and figuring out the best way.”

— Samara Cohen, BlackRock

“If you’re a global macro hedge fund, and you don’t have fixed-income expertise, you don’t necessarily want to spend time on this,” says Steve Sachs, head of capital markets at Goldman Sachs Asset Management, which created one of the Treasury bill ETF products. “It’s operational and not an alpha-generation exercise.”

The genesis of Goldman’s idea was to deliver a money market fund experience in an ETF format, says Sachs. The Goldman fund, called “GBIL,” launched in 2016, invests in Treasuries out to one year in duration. Users of GBIL are mostly registered investment advisors today. But Sachs says, “We do have a number of [institutional] clients that are using it for collateral purposes—the collateral usage aspect of GBIL was absolutely contemplated from day one.”

One current sticking point is that regulators determining what collateral can be provided against derivatives currently treat GBIL no differently than an ETF containing Russell 2000 stocks. When traders provide $100 of collateral, the regulators guide the receivers of that collateral about how to discount its value in case one side goes belly up. With the typical equity-like haircut for ETF collateral, the requirement today can be north of 15%.

Invesco Ltd., which runs a Treasury collateral ETF with the ticker symbol “CLTL,” received a waiver from the Securities and Exchange Commission in March 2018 to apply a 2% haircut for collateral posting. Next, the firm is waiting on a decision from the Commodity Futures Trading Commission, which currently does not allow any ETFs to be used for collateral on cleared derivatives.

Jason Bloom, head of fixed income and alternative product strategies at Invesco, explains that recent periods of volatility for fixed-income ETFs, including a liquidity stress scenario in March and April 2020, have proven that in many cases fixed income ETFs can offer liquidity superior to the underlying bonds themselves.

This validation of the ETF technology through those periods when markets have been most challenged is opening doors for further use cases for the ETF structure, he says.

Goldman is separately working with regulators to allow GBIL to be posted as collateral in cleared trades as well as exchange traded derivatives, and to lower the haircut to 2% or less from its current 15-50% range.

Rough Turf

For all these developments, the constraints to broader adoption of ETF collateral are not small. For securities dealers, they may be a question of prioritization. For an asset manager, they may be the risk management of ETFs or convincing a board of directors.

On top of that, very few ETFs are alike. Even the same ETF can trade on a dozen different exchanges. In the U.S., trading volumes have been easy to come by, but in Europe, under MiFID II, there was no requirement to post trading volumes for ETFs until January 2018, so volumes were scarce.

Traditional approaches of tracking ETF trading volumes are typically problematic because ETFs tend to trade across multiple exchanges at once and have significant off-exchange activity. This results in understated liquidity for ETFs and overly restrictive concentration limits for those collateral providers that want to use ETFs as collateral.

Bloomberg LP has an analytics tool called PORT that allows investors to drill down into an ETF’s characteristics, based on the fund’s underlying portfolio. In addition, Bloomberg Terminal users can access fund flow data and metrics that provide average aggregate trading volumes in ETFs globally across multiple trading venues. BNY Mellon plans to use these aggregate trading volumes as part of its collateral management service in the near future.

ETF proponents believe that industry practitioners should be looking at the liquidity of the components anyway, not how often the fund trades. “The key collateral quality metric should be underlying liquidity and the collateral receivers’ ability to liquidate through a liquidation agent,” says Jean-Christophe Mas, head of ETF trading at BNY Mellon Capital Markets LLC, which is a broker dealer affiliate of the bank and authorized participant or “AP” for such funds.

Not all firms that receive ETFs as collateral have appointed an AP to help them liquidate those holdings in a turbulent market, so they may not be able to price the ETFs themselves or have the ability to create or redeem shares. If more firms were familiar with the redemption process, perhaps the fuller benefits of ETF collateral could be realized, Mas points out.

ABN AMRO Clearing brought its collateral activity to BNY Mellon’s triparty systems after going live on the platform in 2018. Valerie Rossi, global head of securities finance of ABN AMRO Clearing based in Hong Kong, says she has noticed more widespread industry adoption of ETF collateral than there was four to five years ago, especially for ETFs that replicate main indices.

But she said there is still a reluctance on the part of some participants. “If the average traded volume of that ETF is significantly lower than its components, then firms may exercise caution and limit exposure to those instruments,” says Rossi. For any “synthetic,” leveraged or inverse ETFs, she says, “The conversation becomes a lot more restrictive.”

ABN AMRO Clearing primarily provides ETFs and other forms of collateral to receive high-quality assets such as government bonds in an arrangement known as a “collateral transformation” trade designed to optimize its balance sheet.

In 2018, BNP Paribas Securities Services, a unit of BNP Paribas Group, was an early mover in starting to accept ETFs as collateral against securities lending arrangements in which it acts as the principal lender. Yannick Bierre, head of principal lending, says the firm is now authorized to accept a predetermined list of ETFs—primarily ones it can reuse as collateral itself—from a handful of issuers, but the list may evolve over time. “The ETF market is growing, so we are changing our approach to the product,” he says.

Also in 2018, Citigroup added ETFs to its list of acceptable collateral against agency securities lending transactions, in which the bank acts as an intermediary between a borrower and lender.

On the Radar

The rise in ETF collateral is on the minds of sophisticated players in the securities lending and collateral markets. Agreeing with trading counterparties to add ETFs to their collateral schedules will take some time. Once agreed in principle, the process of executing the collateral schedule amendments is made easier with a new BNY Mellon tool called RULE ™, which enables clients to agree changes to their existing collateral schedules to include ETFs.

Educating participants about the uses and behaviors of ETFs is one near-term focus, closely followed by getting regulatory attention on ETFs in the context of high-quality liquid assets, proponents say. Some commenters in the months leading up to the U.S. iteration of the Basel III Liquidity Coverage Ratio final rule argued that ETFs tracking indices of HQLA assets should be classified as HQLA. However, the final rule does not include ETFs, as U.S. regulators indicated that they do not consider the liquidity characteristics of ETFs and their underlying components as identical.

“BNY Mellon agency lending is now live in accepting ETFs as collateral and is starting to see traction with borrowers.”

— Simon Tomlinson, BNY Mellon

Another conversation under way is designed to benefit clearing risk managers, and to educate clearinghouses about how to think about ETFs as a new form of margin. A critical step from regulators would be allowing ETFs to back swaps that are not suitable for such clearinghouses. Eurex Clearing is one that has already extended the scope of its admissible collateral for margin purposes to include five ETFs in Europe back in April 2016.

Eurex Clearing is one of the clearinghouses that has already expanded the scope of its eligible collateral for margin purposes to include the ETF asset class. However, there is currently no single ETF that meets the European Market Infrastructure Regulation (EMIR) requirements to serve as margin collateral.

BNY Mellon agency lending is now live in accepting ETFs as collateral and is starting to see traction with borrowers, which are building balances collateralized by them.

Simon Tomlinson, global head of agency lending trading at BNY Mellon, says ETFs will no doubt form an important part of the bank’s collateral options going forward. In the first quarter of 2021 alone, ETF collateral balances in the agency program have risen some 65%. “We expect this growth to continue throughout 2021 as we look to further expand our offering,” he notes.

In the meantime, backers of GBIL and CLTL are in a wait-and-see mode to see if non-leveraged, physically backed Treasury bill ETFs will be viewed as similar enough to cash collateral.

Survey

BNY Mellon Markets quickly polled a sample of collateral providers and receivers, indicative of the broader marketplace, about their current perspectives on ETF collateral and its usefulness. The 2019 survey of 20 collateral provider clients by BNY Mellon Markets found that, by and large, firms use a negligible amount ETF collateral today. Many see their usage growing, however, especially if liquidity and circulation of the funds increase or they can find buy-siders to accept the funds.

We also polled 11 large collateral receivers. Many big buy-siders were already using ETFs as collateral and planning to expand their use cases. But the overwhelming feeling was that the existing IHS Markit collateral lists are only a starting point because they are currently too restrictive.

Katy Burne is editor of Aerial View Magazine at BNY Mellon in New York.

Questions or Comments?

Write to Ben Slavin in BNY Mellon Asset Servicing and John Fox in BNY Mellon Markets, or reach out to your usual relationship manager.