A Panoramic View for Treasurers

Treasurers are transforming their workstations with real-time feeds and automation

A Panoramic View for Treasurers

Treasurers are transforming their workstations with real-time feeds and automation.

November 2021

by Jeremy Grant

The pandemic highlighted the need among cash managers for automated workstations, with real-time feeds, analytics and a broader swath of investment choices.

For thousands of businesses, lockboxes have been a handy, secure way to manage payment documents, such as the humble check. But their analog simplicity was exposed as a weakness when the COVID-19 pandemic hit. Checks were delayed in the mail, receivables were not hitting the ledger when they should have, and cashflow modeling was disrupted.

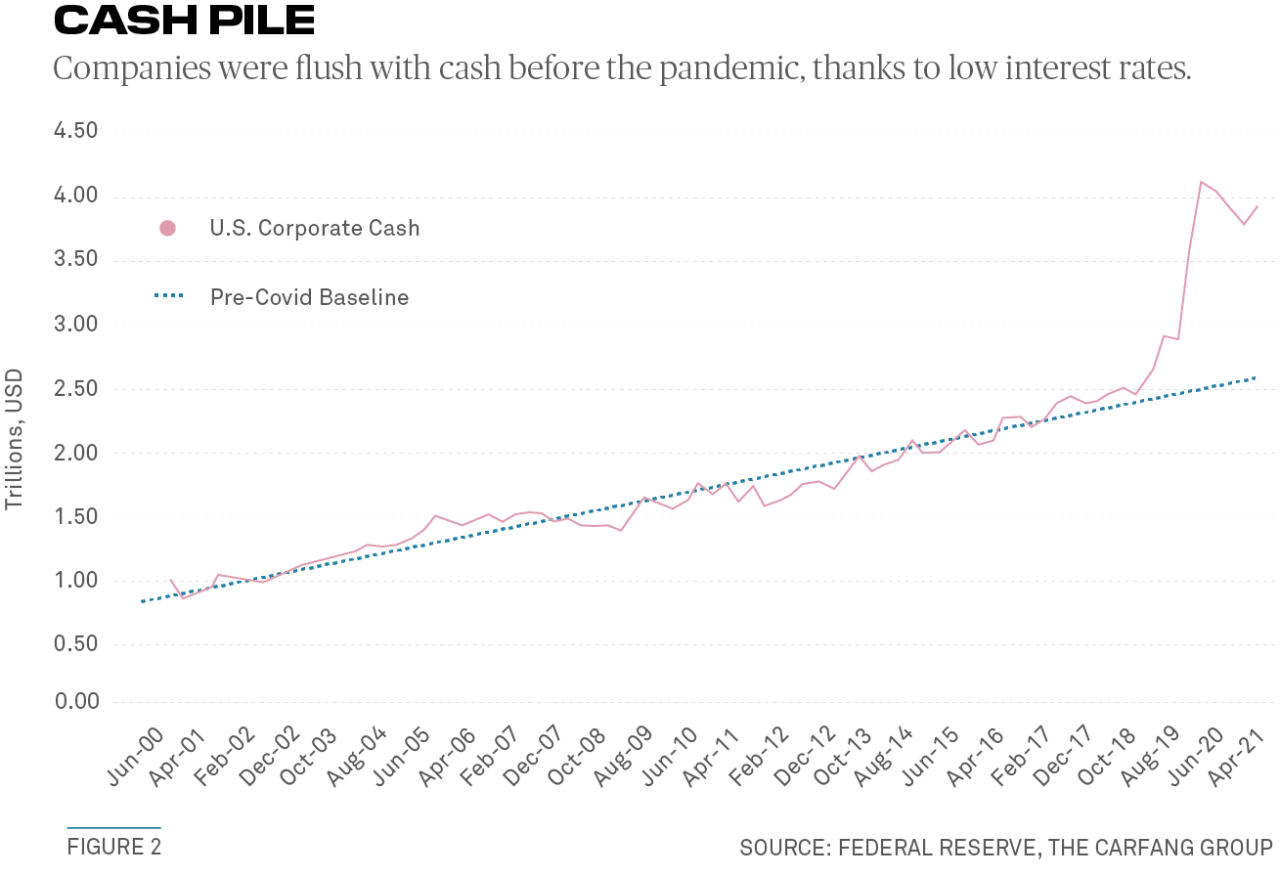

At the same time, the pandemic rendered obsolete the Excel spreadsheets that corporate treasurers had been relying upon for forecasting cash. The sheer velocity with which asset prices were changing caused treasurers to invest unprecedented amounts in government money market funds (see Figure 1) and draw down on revolving lines of credit, unsure whether they could roll over their commercial paper borrowings into the next business day.

Those were just two examples of COVID-19 exposing a lack of automation in the corporate treasury function. Working from home, cash managers at times had difficulty accessing the most secure parts of their treasury management systems (TMS) and were hobbled by their sudden inability to use faxes and printers. “They had to transform to a remote network, without a dress rehearsal,” says Anthony Carfang, a longtime treasury consultant.

Although some calm returned to markets and there was a significant reversal out of government money market funds, the stark realities of the COVID-19 market meltdown altered treasurers’ methods of cash forecasting and investing forever, much like the changes that were made in the aftermath of the 2007-2009 financial crisis for different reasons.

There was a fresh recognition that treasury workflows were outdated or suffering from under-investment. One problem was that TMS technology did not publish updated data feeds throughout the day on everything from money market fund prices to where cash might be under-utilized. Cash managers were used to going through multiple procedural hoops to invest their cash — transferring money from bank accounts to investment portals and manually inputting data along the way, sometimes risking human error.

The COVID-19 crisis drove home the need for new tools and TMS modules that could pull together a single panoramic view of a company’s liquidity position, without the need to jump between different web portals or search for unallocated pools of cash across multiple entities.

Today, the improvements in data visualization are giving companies the ability to dramatically impact their working capital in a positive way. “Companies are now much more serious about cash utilization,” says Jeff Diorio, managing director at PMC Treasury, an advisory firm. “COVID thrust these issues to the forefront at a time when cashflow was under stress and the remote work environment enhanced the need for more automated solutions.”

Age of Automation

Fortunately, corporate treasurers have shifted their behaviors, heralding a new era of sophistication. Visibility into liquidity positioning, and monitoring the excess cash available for investing, is now an even higher priority. So is the automation of functions such as investment requests from excess cash pools. Cash forecasting has gone from being a monthly project to a daily one.

“The industry was already moving toward implementing more and more automation and doing more with less. COVID pushed that along,” says Greg Malosh, managing director and global head of liquidity products for BNY Mellon’s Treasury Services.

In a July survey by BNY Mellon, roughly half of the CFO, treasurer and investment professional respondents said they were using a TMS, and 95% of the ones who said they anticipated a review of their treasury solutions cited a plan for workflow improvements.

Cash managers are also keen to get a closer, more real-time view of the margin they owe or are due to collect from financial counterparties, as well as the rates on securities they have on loan.

“The move to virtual environments in the pandemic highlighted what was ripe for change in treasury workflows, and the opportunities to advance digital ecosystems are endless.”

— George Maganas, BNY Mellon

Jason Hubschman, chief operating officer at Lyxor Asset Management, Inc., said when the market was falling 20-30% in the pandemic, having such tools allowed for a much clearer, see-through picture of clients’ counterparty risks, collateral positions, margin and balances. That, in turn, helped the firm to make much quicker allocation decisions, such as whether to recall excess collateral, substitute assets or decrease counterparty exposure. “It was being able to provide that type of transparency all the way through to the investment at the asset, liability, collateral and treasury side,” he notes.

Bringing all of that functionality into one workstation, as part of the daily positioning, was key — as was reviewing the process for who would approve what, when people were working remotely.

“Overall, there was a need and desire to get away from spreadsheets and Excel into cloud systems that consolidated, secured and made that information consistent across all users,” says Jonathan Spirgel, managing director at Hazeltree, a cloud-based treasury solutions provider.

Corporates recognized a need to access information across multiple banking relationships from one dashboard. This accelerated tie-ups between banks, cash management platforms and technology companies, and drove a wider adoption of application programming interfaces (APIs) and artificial intelligence (AI), as well as third-party integration between different digital ecosystems.

Last year, treasury and risk management platform provider GTreasury collaborated with BNY Mellon’s LiquidityDirect short-term investing portal to give clients greater visibility into their cash, counterparties and money market fund positions across multiple time zones. “We saw a very big uptick in terms of the number of upgrades or improvement projects we did,” notes Terry Beadle, global head of corporate development at GTreasury. “Treasurers wanted to use the full automation capabilities of the product,which in the past they hadn’t been so focused on.”

Another buy-side treasury workstation and analytics specialist, Indus Valley Partners (IVP), provides an enterprise view of clients’ counterparty relationships on its platform to clients who want to better understand their deployment of cash, collateral, financing, leverage and use of third-party balance sheets. The platform became integrated with LiquidityDirect over the summer.

Other alliances also focused on improved system-to-system integration. Michael Kolman, chief product officer at treasury management systems provider ION, says that while integration itself isn’t new, the speed with which interfaces can now talk to each other is. Data can now be requested and fed immediately into a customer’s TMS in real time, whereas previously batch files would have been sent intraday, without the ability to update those files in between. “With API and more modern integration techniques, real-time integration is now possible,” Kolman explains.

Behavioral Change

Digital initiatives, including the use of advanced technologies such as AI, are only likely to continue. In a survey of treasurers last year, the Association of Financial Professionals found that nearly 70% of treasurers believed that, in the next three years, treasury-specific technology would be critical to the success of treasury organizations.

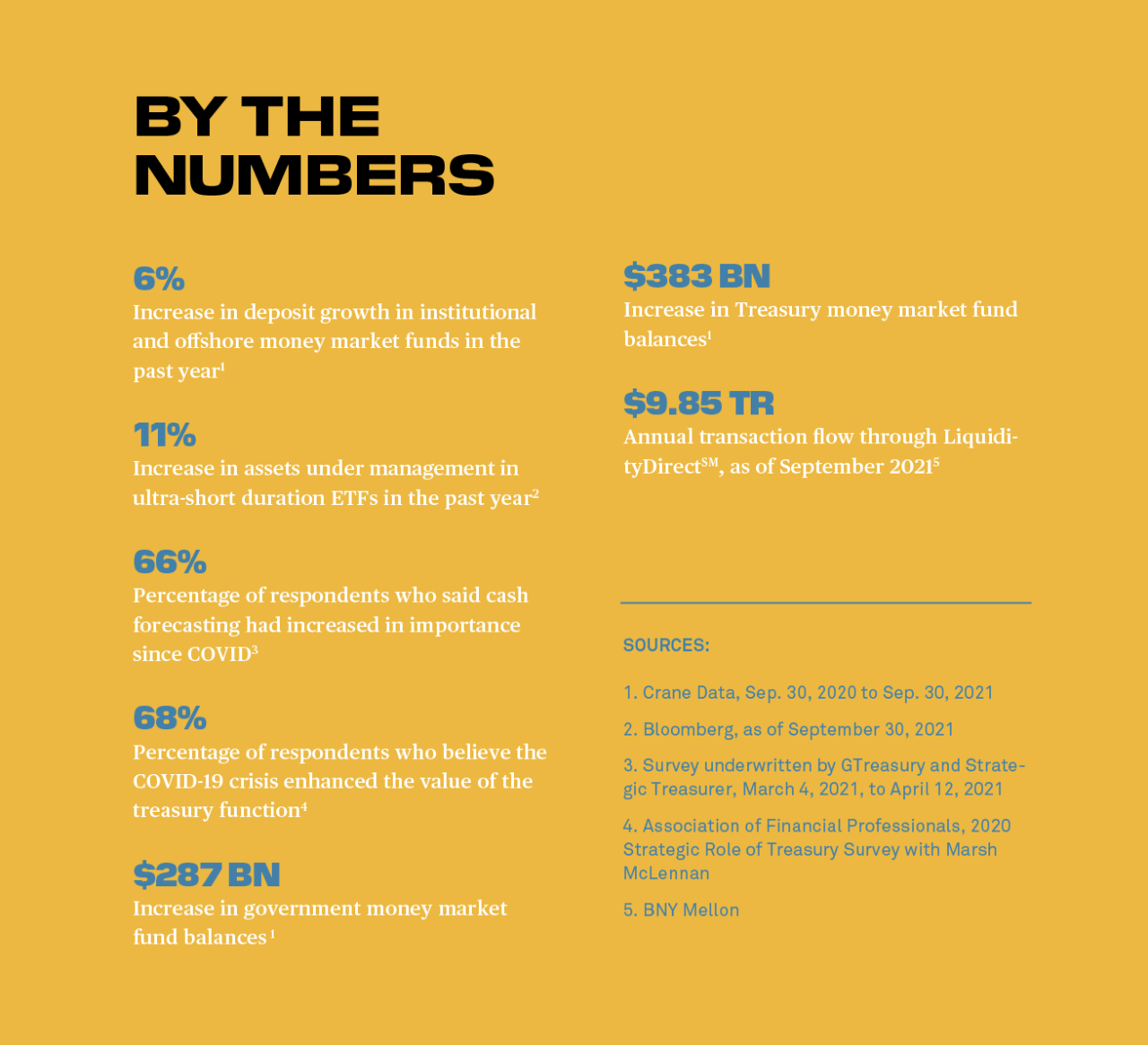

Take cash forecasting: For businesses that were suffering amid a slump in demand, getting a more frequent fix on their cash was nothing less than a matter of survival. Some 66% of the respondents to a survey earlier this year by Strategic Treasurer, and underwritten by GTreasury, said forecasting had increased in importance in the past year.

Integrating treasury systems with other departments also became critical. Purchasing departments may have been keeping details about suppliers, but the information on orders and when payments were due was even more crucial to the treasury department during the COVID-19 market collapse. As a result of communicating more efficiently across these functions today, suppliers are now more likely to get an automated electronic payment than a check going into a corporate lockbox, according to Tom Deas, chairman of the National Association of Corporate Treasurers (NACT).

In fact, some companies are eliminating checks altogether in a move to paperless payments. Previously, a large portion of the corporate checks’ remittance advice information had to be matched with some manual processing of the data slips, so that the money could be applied to the right accounts.

BNY Mellon Treasury Services, for example, this year delivered an array of new global liquidity management solutions that support clients’ needs to efficiently manage counterparty and currency risk, as well as optimize liquidity across all providers.

Other trends coming into play are the greater use of “virtual accounts” and faster payment systems. Virtual accounts — sub-ledgers under one master account with their own purposes and identification codes — have been around for some years, but treasurers in the U.S. have been starting to use them as a way of consolidating their banking relationships and reducing cash sweeps between standard bank accounts.

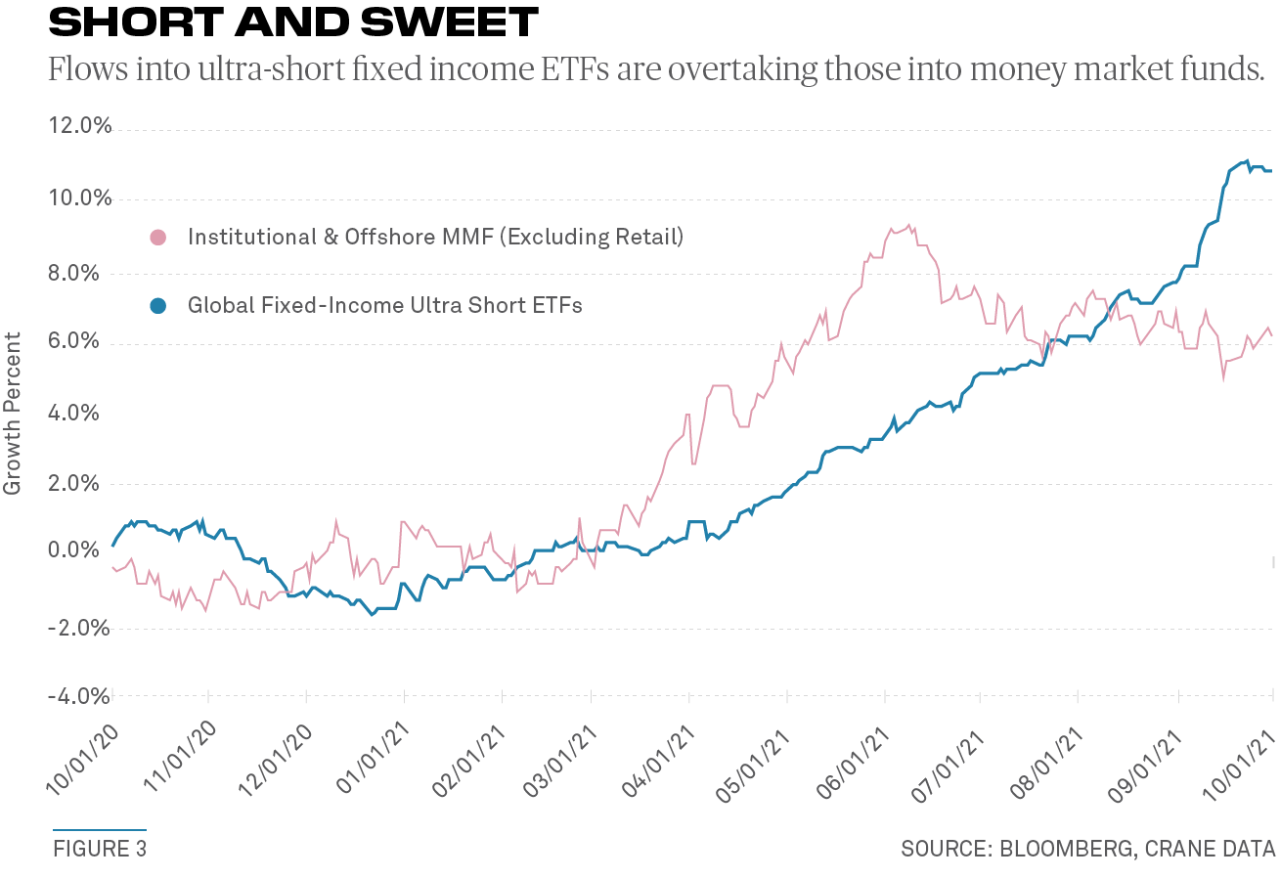

Separately, there are opportunities in portfolio optimization and tools for tracking environmental, social and governance (ESG) investing. This fall, BNY Mellon added a host of new products to its LiquidityDirect portal, including an ESG data analytics app, cleared repo, commercial paper, brokered certificates of deposit and short-duration exchange-traded funds (ETFs).

Ultra-short duration ETFs held $130 billion in assets as of September 30, according to Bloomberg, up 11% in the past year, whereas assets in institutional and offshore money market funds grew 6% (see Figure 3).

In the months ahead, LiquidityDirect, which processed $9.85 trillion in transaction flows in the 12 months ended September 30, will cater to investments in mutual funds and FDIC-insured deposits offered through the ICS and CDARS banking networks.

The moves are taking the portal from one historically dedicated to money market funds to one that delivers a broad range of investment options integrated with the bank’s collateral management, treasury services and custody platform, all from one central repository.

These enhancements have helped the amount of cash deposited into LiquidityDirect to grow 65% since January 1, 2020, compared to 38% for assets into institutional and offshore money market funds. “The move to virtual environments in the pandemic highlighted what was ripe for change in treasury workflows, and the opportunities to advance digital ecosystems are endless,” says George Maganas, head of Margin and Liquidity Services at BNY Mellon.

Dawn Budd, treasurer for Educational Testing Service in Princeton, N.J., says she used to telephone five banks every morning to buy her short-duration fixed-income securities. The process took one to two hours a day, and sometimes it took two months to get a statement confirming what she had purchased. Today, she does all her overnight money market fund investing through LiquidityDirect and can see confirmations of her Treasury and overnight cash investments the next day. “One stop for all our working capital investments is the easiest thing,” she explains.

The availability of new products, analytics and methods is becoming more and more important as the Fed’s footprint in money markets grows, potentially shrinking the yield they can earn.

The next big problem, also influenced by the Fed, is how to stay on top of reference rate changes. With regulators pushing financial firms to cease issuing new products based on the London interbank offered rate (LIBOR) by the end of this year, there are complexities with all the LIBOR alternatives, according to Deas at the NACT.

A survey earlier this year from Duff & Phelps revealed that 45% of respondents had plans to complete their LIBOR transition before the December 31 deadline, up from 30% a year ago.

Such complexities will be easier for cash managers to handle now that they are working with newer tools, with access to same-day reporting, compliance and cash projections. “I think we are going to see a complete rethink and convergence of Treasury technology tools, along with investment technology platforms and bank platforms,” said Carfang.

Real-time Payments

Next, the pandemic experience is expected to accelerate a pre-pandemic move toward real-time payment systems, which brings its own challenges for treasurers — even as they ultimately bring obvious gains in efficiency.

“There is more money going in and out of accounts every day, and more real-time activity, which can make cash management more complicated for the treasurer,” says Naresh Aggarwal, Associate Director, Policy and Technical, at the Association of Corporate Treasurers in the U.K.

Changes in payments systems have traditionally been rare. However, given the scale and breadth of newer, faster payment systems across the globe, treasurers also need to be more aware of how this is affecting other countries and markets that may be important to the business. “If you’re sitting in London, you may need to know how payments systems are changing in Vietnam, whereas in the past it would have been safe to assume that nothing would be changing,” Aggarwal says.

BNY Mellon in 2017 became the first bank to originate a real-time payment (RTP) over the RTP network owned and managed by The Clearing House, followed by request-for-payment messaging technology in 2018. This year, the bank, in collaboration with.Citibank, also launched the first real-time bill payments system for retail customers in the U.S.

While banks are just beginning to enable corporates with RTP capabilities, treasury workstations will now need to integrate information about real-time payments and requests in the near future, giving liquidity managers better visibility into their intraday cash positions.

In short, as such payment infrastructure starts to evolve more quickly, it will drive the need for liquidity platforms to catch up.

“Real-time treasury is an evolving process,” explains Jennifer Erickson, a treasury management consultant for commercial real estate at Capital One. “We have a lot of clients who want to get there, but we are not yet there as an industry. Getting more information on how is a desire for everyone.”

Jeremy Grant is a freelance writer based in Edinburgh.

Questions or Comments?

Write to Stephen.Gill@bnymellon.com or reach out to your usual relationship manager.