Toronto | September 18-21, 2023

Your Mission.

Possible.

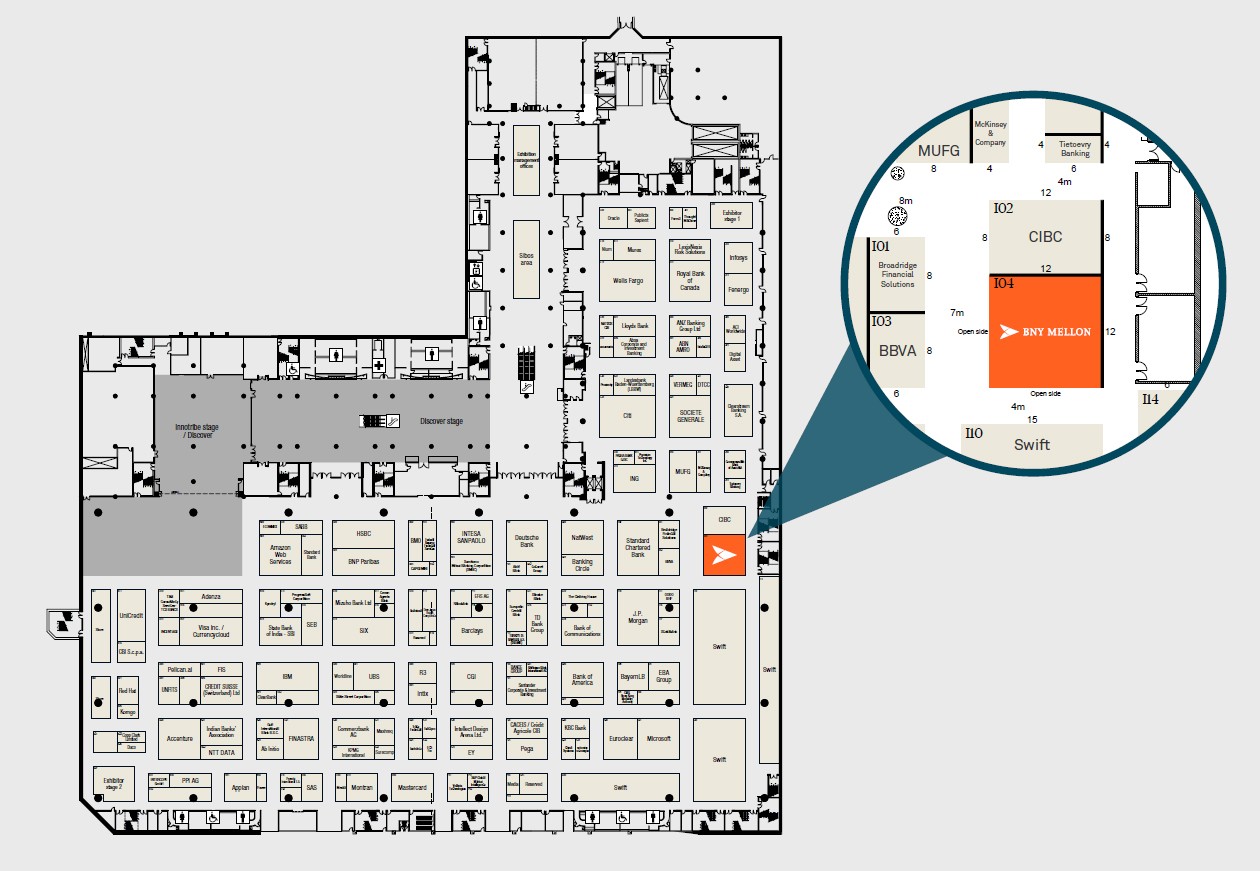

Sibos is the world’s premier financial services event organized by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). The annual conference and exhibition brings together thousands of business leaders, decision-makers and experts from across the financial ecosystem. Visit BNY Mellon at Booth I04.

Toronto | September 18-21, 2023

YOUR MISSION.

POSSIBLE.

Sibos is the world’s premier financial services event organised by SWIFT. The annual conference and exhibition brings together thousands of business leaders, decision makers and topic experts from across the financial ecosystem. Visit BNY Mellon at Booth I04.

SPEAKERS

Hear from

Our Experts

at Sibos

INSIGHTS

Aerial View Bites

NEWS

Visit Us at Sibos

BNY Mellon Booth I04

The BNY Mellon team looks forward to connecting in person in the exhibit hall. Join us for our booth reception on Wednesday, September 20 from 4:30 to 6:00 PM EDT.

Pre-, during and post-Sibos, we’re here to connect about making your mission possible.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY Mellon. BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

©2023 The Bank of New York Mellon Corporation. All rights reserved.