Data & Analytics

An investment data advantage for unparalleled connectivity, insights and competitive differentiation.

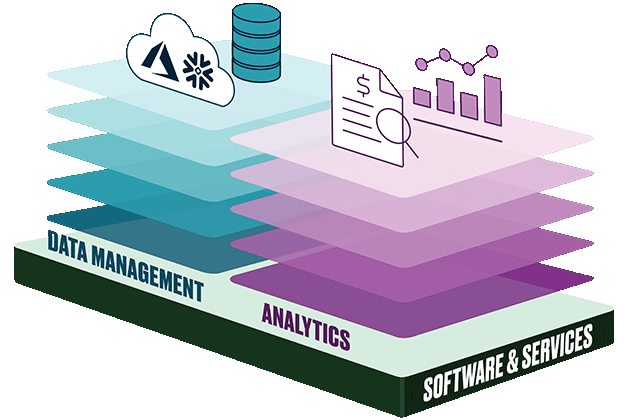

Financial institutions are grappling with consuming and managing large quantities of data–from investment and market data to client data. Today’s fast-evolving landscape requires robust data management tools and advanced analytics capabilities, powered by cloud-based solutions, to make data-driven investment decisions with granularity and agility.

BNY Mellon’s data management and analytics are delivered through world-class software and services. Focused on the unique needs of financial institutions, the suite of solutions ranges from data management, accounting and performance to risk analytics, compliance monitoring and reporting for public and private markets.

Our Expertise in

Financial Data Management

Providing security and scale in software, analytics and services

25+ Years

as a leading fintech provider in

investment data management

$47.6T

in data assets

under management

200+

integrations with

external sources

10+ Years

in managed data services for

financial services in cloud

25+ Years

of global implementations,

consulting and advisory services

BNY Mellon Data & Analytics integrates investment data management, software and analytics expertise with security and scale for the financial ecosystem.

We bring together a 240-year track record of safeguarding assets with decades of experience managing data and investment operations for $47.6 trillion in financial assets today.

- From asset managers and wealth managers to asset allocators and market infrastructure players

- Any investment strategy–from mainstream equities to complex alternatives

- Any operating model–from insourced to outsourced

- Cloud-first, both public and private, for scale and flexibility

Designed to improve productivity and focus on returns

- Ingest diverse and complex data in real-time, from multiple sources

- Rely on a centralized source of quality data for investment analysis and enhanced decision-making

- Simplify data discovery with artificial intelligence and other technologies to uncover new and actionable insights for the front office to leverage

Help achieve operational and cost efficiencies

- With the advantages of the cloud, clients are able to connect, blend, analyze and distribute data from internal and external sources easily with security measures in place

- Leverage leading-edge technology, powered by Microsoft Azure, Snowflake and other fintech leaders

- Best-in-class platform allows clients to keep pace with technology advances with a predictable cost model, enabling you to scale your business

Keep pace with an evolving investment and regulatory landscape

- Increasing client demand for new investment structures and alternative assets–in particular, private markets

- Meet regulatory and reporting requirements across different jurisdictions and stakeholders

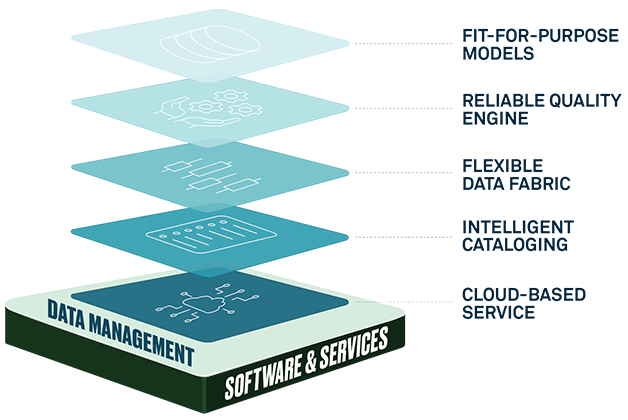

Data Management

Integrated data platform that is open, flexible and transformative–for scale

Leading data management technology platform for asset managers, wealth managers, asset allocators and market infrastructure players

Integrate, blend, enrich, explore and distribute data from inside and outside your firm with confidence in data quality–all from a foundation built with 25+ years of data lineage and a cutting-edge technology stack

Data management solutions include BNY Mellon Data Vault and Eagle Data Management

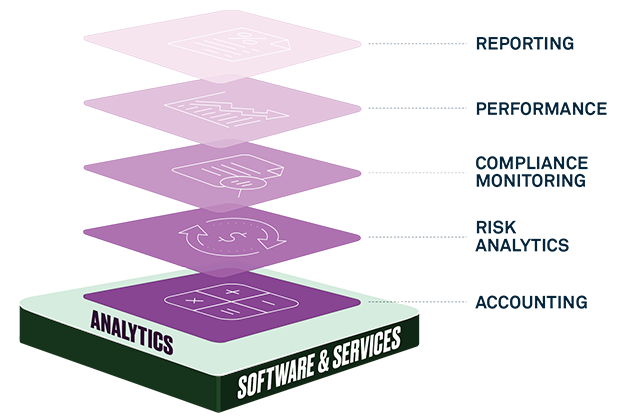

Analytics

Turn insights into action–faster

Use an industry-leading, comprehensive set of solutions on a single data management platform to calculate accounting and performance, analyze investment decisions, manage risk and monitor portfolio compliance across public and private markets–before, during and after taking action

Analytics solutions include Eagle Accounting, Eagle Performance Measurement, Risk Analytics, Compliance Monitoring and Reporting

Managed Services, Implementation Services

10+ years providing managed data services for financial services in the cloud

25+ years executing global software implementations and providing consulting and advisory services

We help clients manage and prepare investment data for key stakeholders across the enterprise, from management and the front office to investment operations and compliance–all to help you meet oversight and regulatory needs so you can redeploy capital to fuel innovation and growth.

Break down data silos for operational efficiency

- Connects our data-driven applications, Eagle software suite, and BNY Mellon data with your data and your global ecosystem of data providers

- Open and flexible, it is designed to simplify data acquisition, consumption, governance, and access to provide you with an accurate, integrated view

- Deliver fit-for-purpose data to stakeholders across your organization and beyond

Manage data at scale; operationalize for insights to help accelerate growth

- Keep your data pipeline flowing smoothly with an integrated technology stack to eliminate roadblocks to achieving innovation

- With our intelligent catalog, using the power of Snowflake and Microsoft and artificial intelligence, users across the enterprise can acquire, discover and access data to help make timely, data-driven decisions

Cloud-first and flexible

- Built for integration, our platform can ingest, blend and distribute data across your organization and ecosystem of providers without needing to move or copy datasets, reducing risk and improving efficiency

- Flexibility to store your data on our public cloud-based platform or our secure private cloud, or use hybrid approach based on your preferences and requirements. In any case, you can access your data all day, every day.

Evaluate the effectiveness of your investment program with data insights

Intuitive dashboards and interactive visualizations provide transparency and multi-dimensional client position analytics:

- Analyze concentrations

- Identify tax optimization opportunities

- Model contribution/redemption impacts

- Simulate trading scenarios pre-execution

Flexible reporting tools allow customizable views of portfolio valuation, balances, transactions, and other metrics to suit each client.

Advanced quantitative modeling and predictive analytics leverage machine learning to help deliver alpha-seeking simulations, inform position sizing, and spot emerging trends early.

Data quality and validation with robust security protocols

Built-in data validation checks support the integrity of accounting and performance data, while robust audit logs track asset valuation methodology and user activity for transparency. Bank-grade security protocols safeguard sensitive information.

- With Eagle Accounting, you can empower your investment operations by streamlining and centralizing operations across financial processes with one consolidated view of your global accounting and investment books of records.

- With Eagle Performance Measurement, you can obtain a real-time investment view of assets, exposures, and risks.

- With our Risk Analytics and Compliance Monitoring, you can gain strategic agility before and after you make investments.