The Growing Global Appeal of Islamic Finance

The Growing Global Appeal of Islamic Finance

March 2021

BNY Mellon would like to thank Dar Al Sharia for their contributions to this article.

Islamic finance is increasingly attracting attention among investors worldwide, especially in 2019 which saw a double-digit growth in assets. Despite the tumultuous year for global financial markets last year due to the COVID-19 pandemic, there is growing interest due to three reasons—greater appreciation around the role that Islamic finance plays in responsible investing; geographical interest in markets where Islamic finance is gaining prominence; as well as digital transformation, which makes Islamic investments more accessible.

A Growing Industry, Attracting New Interest Globally

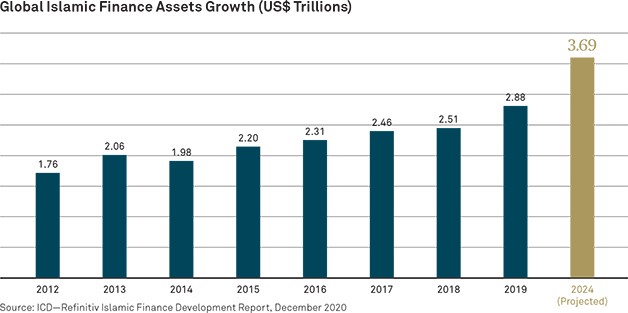

Islamic financing emerged 50 years ago, in countries with large Muslim populations who were keen to ensure their sources of funding were governed by the requirements of Shariah and the principles of Islam. In 2019, Islamic finance assets amounted to US$2.88 trillion, the highest recorded growth for the industry since the global financial crisis. The prospects look positive: by 2024, this is set to rise to US$3.69 trillion. While Muslim countries have turned to Shariah financing to fund their thirst for capital, another underlying reason for its popularity is that Shariah financing is beginning to broaden its appeal among non-Muslim countries too.

The acceleration of technology as a result of COVID-19 has also benefited the Islamic finance industry as more financial institutions are now offering their products via digital platforms, making it easier for Muslim and non-Muslim investors to access. Sustainability has also become a more important consideration for investors, which could potentially lead to increased take-up by non-Muslim investors who are drawn to the ethical and responsible investing dynamics of Islamic finance products and services.

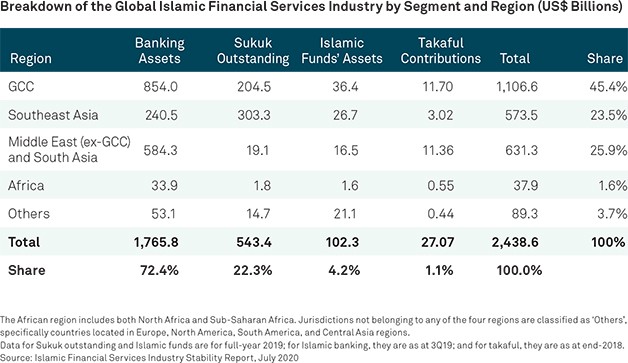

This broader appeal is necessary to drive growth in Islamic finance assets globally. Until now, investor demand has, understandably, been concentrated in jurisdictions where Islamic finance is of systemic importance. The Gulf Cooperation Council (GCC) region still accounts for the largest share of global Islamic finance assets (45.4%), followed by the rest of the Middle East and South Asia (25.9%) and Southeast Asia (23.5%).

But there remains significant opportunities elsewhere in the world. For instance, Africa offers growth potential as African sovereigns and financial institutions use Sukuks as alternative funding sources and issuance is supported by increasing financing needs in Africa, especially for infrastructure projects. Beyond Africa, the UK presents a huge prospect for the Islamic finance market. The country became the first western nation to issue a sovereign Sukuk in 2014 and is currently the biggest center for Shariah-compliant finance in the West. It is also home to the world’s first actively managed equity Shariah-compliant exchange-traded fund (ETF) launched in September 2020.

As more awareness and knowledge of Islamic finance starts to build up in non-Muslim countries, we expect to see steady growth in Islamic finance assets and expansion in Shariah-compliant investment products and services to cater to the rising demand.

A Natural Role for ESG in Islamic Finance

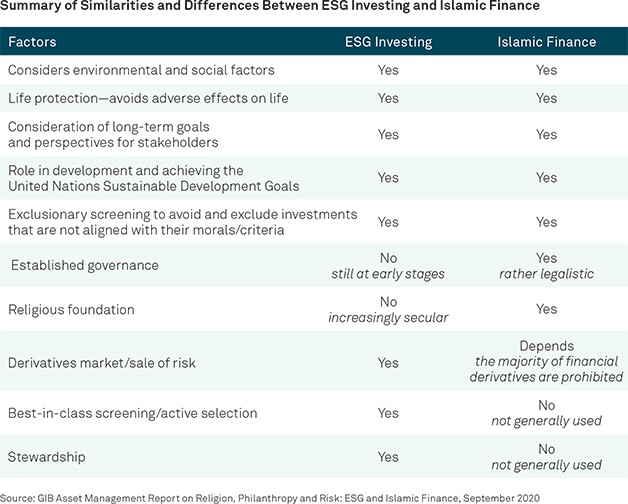

There is growing awareness among global investors of the synergy between ESG (environmental, social and governance) investing and Islamic finance, contributing to the rising appetite for Shariah-compliant investments as investors look for greater portfolio diversification and an alternative to more traditional ESG investments.

Islamic finance and ESG investing are complementary investment approaches sharing significant common ground, such as being a good steward to the society and the environment. Both offer products that appeal to Muslim and non-Muslim investors alike, and hold strong practices and policies that each can learn from the other.

The fundamental teachings of Shariah in finance can be summarized in three broad ways:

- Prohibition of interest - The ban on interest-based borrowing or lending in a financial transaction means capital cannot be borrowed or lent on interest.

- Type of contracts - Shariah provides guidelines on acceptable and permissible forms of entering into contractual agreements. For example, certain conventional financial contracts such as forwards and futures are deemed not to be in accordance with the guidelines of Shariah. Similarly, contracts on notional amounts, treating currencies as asset classes, purchase and sale of risk and options, are viewed as non Shariah-compliant. Contracts are based on principles of risk sharing, avoidance of excessive uncertainty, and real asset-backed or asset-based transactions.

- Restrictions on activities that are not in the public interest - These guidelines are set to preserve life and honor humankind. In line with this, Islamic financial institutions do not deal with any entity nor transact in areas that intersect with the restricted activities. These include participating in betting and gambling, along with its restrictions on alcohol, drugs, weapons and industries or activities that have a negative impact on societies.

In line with these practices, societal values are at the forefront with Islamic finance, just as they are with ESG investing. In addition, Shariah restrictions on activities or industries that are not in the public interest are consistent with the negative screening that forms part of the ESG approach.

Beyond these evident socially focused similarities between ESG investing and Islamic finance, there is also convergence in environmental objectives. For example, green Sukuks, a Shariah-compliant financial instrument similar to a bond, are designed to finance sustainable, climate-resilient and environmentally friendly projects, generating returns in line with Shariah principles. In terms of governance, Islamic institutions are automatically subject to an additional layer of oversight compared with their conventional counterparts as they are being regulated by Shariah boards that are responsible for providing guidance and issuing opinions on whether a product or service conforms to Shariah principles.

With growing consensus that the objectives of generating returns and prioritizing global social welfare are not mutually exclusive, investors are exploring Islamic finance to complement their ESG investments for enhanced overall risk-adjusted returns and greater portfolio diversification while building more sustainable economies.

Digital Transformation in Islamic Finance

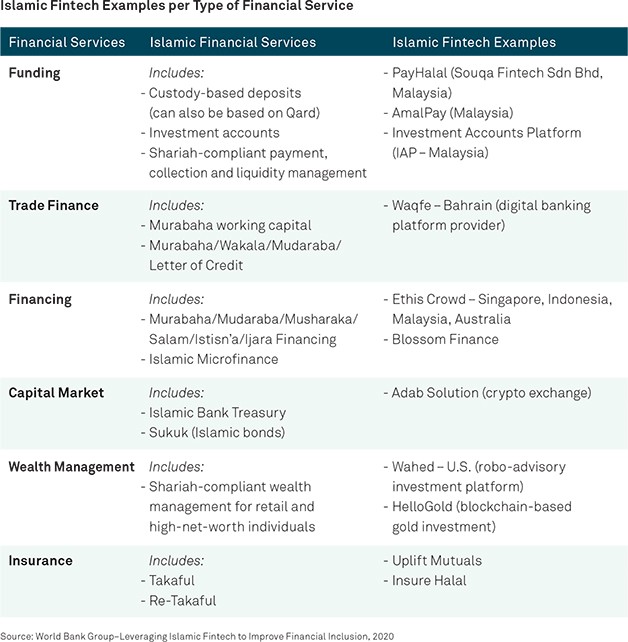

Just as how fintech has already disrupted the way traditional financial services operate, this new breed of tech enablers has also accelerated digitalization of Islamic finance products and services, making it more accessible to investors globally and redefining client experiences.

Countries across Asia, Europe, the Middle East and the U.S. have created dedicated start-up hubs, venture capital initiatives, regulatory sandboxes and funding programs to develop Shariah-compliant fintech innovations, helping to fuel this trend. These include launching new Islamic robo-advisors using artificial intelligence to determine optimal investments based on a set of criteria to ensure Shariah compliance. In the crypto space too, industry stakeholders have taken various initiatives to create alternatives for digital assets and trading platforms that are in accordance with the Shariah principles.

Similarly, regtech has the potential to be a game changer for the Islamic finance industry. It aims to solve regulatory and compliance barriers using robust digital tools to achieve compliance with Shariah requirements. Smart contracts on blockchain, for example, provide a level of transparency by enhancing traceability of underlying assets, cash flows and investors, making them attractive as they provide both surety and security. Several Islamic banks are already using or testing blockchain to assist with payments and remittances.

Higher Level of Standardization Needed to Drive International Adoption

Harmonization in Islamic finance practices and the adoption of global best practices have enabled Islamic finance to evolve from being a boutique offering initially, to being recognized by the International Monetary Fund (IMF) as systemically important in over 14 jurisdictions, and is now offered by more than 300 financial institutions across 60 countries.

The efforts of industry bodies have largely reduced differences in the interpretation and practice of Shariah principles to ensure soundness, stability and integrity of the Islamic finance industry.

IFSB / Islamic Financial Services Board

Provides governance and disclosure requirements for Shariah-compliant institutions

AAOIFI / Accounting and Auditing Organization for Islamic Financial Institutions

Provides standardization of Shariah rules through the publication of standards for Shariah contracts and principles

IIFM / International Islamic Financial Market

Provides standardization of contracts in key areas such as risk participation, interbank transactions and money markets

Yet, continued efforts are needed to homogenize industry practices to drive a set of globally accepted standards. In cases where it requires greater clarity, institutions would rely on the Islamic ruling or Fatwa, issued by a recognized authority such as an Islamic scholar to provide legal guidance and greater assurance of Shariah compliance among stakeholders within a transaction.

Uniformity in standards will also bring about scalability of services and industry efficiencies; improve public confidence; as well as increase cross-border marketability, enhanced transparency and consistency in financial reporting.

Regulators are increasingly aware of the importance of developing an international, comprehensive and more structured legislative framework for Islamic finance, with the goal of accelerating growth and reducing discrepancies around the globe.

An Overlooked Asset Class?

Today, Islamic finance is a multi-trillion dollar industry that is no longer operating on the fringes of global financial markets. In the coming years, Shariah-compliant assets are expected to keep growing, driven by rising interest from investors beyond Muslim economies due to:

Increasing demand for a sustainable, stakeholder-focused and socially responsible financial system, emphasizing synergies between ESG investing and Islamic finance

Greater digitalization and fintech collaboration creating new avenues for growth and enhancing transparency

Opportunities for scalability and industry efficiencies via greater harmonization of Shariah practices and standards

When moving in this direction, investors will require the infrastructure, insights and related solutions to safeguard and manage their Islamic finance assets across every stage of the investment life cycle.

Glossary of Islamic terms

Shariah - Guidelines or law prescribed by Islamic scriptures

Sukuk - Shariah-compliant fixed income instruments (used as an alternative to conventional bonds)

Takaful - Shariah-compliant cooperative form of insurance

Halal - Means permissible. In the context of Shariah, any permissibility is referred to as ‘Halal’

Fatwa - Shariah opinion or guidance issued by a Shariah scholar or a board of scholars on a specified matter

Qard - Loan

Mudarabah/Musharakah - Forms of partnership contracts between two entities for sharing profit and loss from the underlying investment or business activity

Wakalah - Form of an agency where the agent undertakes certain tasks for and on behalf of the principal for a fee and a performance incentive if mutually agreed

Murabahah - A sale contract where the seller is required to disclose the cost. Both buyer and seller agreed on the profit upfront and the sale price accordingly

Istisn’a - A sale contract for manufacturing, constructing or procurement of assets based on agreed specification, price and delivery date

Ijarah - A leasing contract adopted for both operating lease and financial lease

Salam - A sale contract for described fungible commodities where price is required to be paid upfront for delivery on a specified future date

Waqf - Creation of trust by endowment of assets for the benefit of a beneficiary or purpose including but not limited to public welfare and charitable causes

Source: Dar Al Sharia Internal

Questions or Comments?

Reach out to Claudia.Fellhauer@bnymellon.com or contact your usual relationship manager.

BNY Mellon Asset Servicing Global Disclosure

The material was developed jointly with Dar Al Sharia. Dar Al Sharia Limited is a full service Sharia advisory firm based in DIFC, Dubai, UAE (https://daralsharia.ae | info@daralsharia.ae).

The information contained in this material is solely for learning and awareness purposes and nothing in this material shall be construed as Shariah advisory or guidance.

Reliance must not be placed on this material for any decision making with respect to Shariah compliance. Dar Al Sharia or any of its associates shall not be responsible for any decisions made by entity relying upon any information contained in this material.

Due to diversified approach towards interpretation of Shariah, some of aspects provided in this material may not be universally acceptable.