Eyeing China Markets in 2022

Highlights from our China capital markets webcast

Eyeing China Markets in 2022

Highlights from our China capital markets webcast

December 2021

When considering investment opportunities in China, investors would do well to evaluate China’s geopolitical, policymaking and market access nuances as they consider diversification opportunities in both equities and bonds, according to a recent BNY Mellon webcast.

In an in-depth discussion on opportunities ahead for investors in China in 2022 and beyond, BNY Mellon’s Magdalene Tay, China and Hong Kong Regional Product Lead for Asset Servicing, was joined by Andrew Tong, Senior Portfolio Manager, China-A Quant at Invesco and Sandor Steverink, Head of Treasuries and Inflation Linked Debt at APG Asset Management.

Both Tong and Steverink agree that despite market, macroeconomic and regulatory challenges, China’s rapidly developing financial markets and ever-closer integration with global standards may warrant foreign investors taking another look at China for diversifying their portfolios.

Confidence a Potential Force Driving Demand

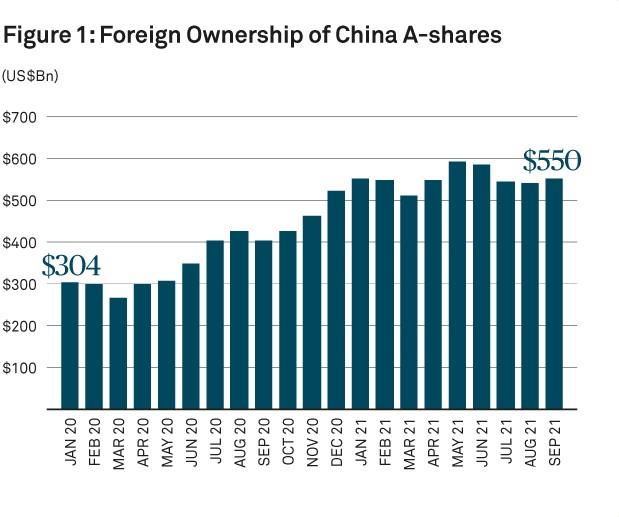

“In general, the flows in 2021 appear to highlight the confidence of equity investors in China,” said Tong. “The cumulative net foreign inflows in China A-shares have continued to grow to an all-time high. Foreign investors often like companies that have stronger profitability, higher quality and lower leverage, plus investors are taking a tactical approach by buying on dips.”

Tong also noted there has been growing diversification potential between large and small-cap stocks, with mid-cap names potentially providing appeal for investors in the long run due to policy measures being enacted to curb monopolies and spur common prosperity.

“When you look at the Chinese market, you have to understand that it is really a hybrid of a market-based economy and a market-based system with strong policy hands at the top. So for investors, understanding that major trends are going to be shaped by policies, but a lot of the stock picking may be driven by market-based performance is an important principle,” explained Tong.

Source: PBOC (The People's Bank of China) and BCCL (Bond Connect Company Limited)

Despite volatility in credit spreads in the property sector, overall there has been credit tightening. Appreciation in the Renminbi (RMB) has also benefitted foreign investors.

“The real estate situation has shown that defaults by large companies can happen in China, which is a positive sign as it suggests there will be greater credit differentiation going forward,” explained Steverink.

But on the flip side, Steverink emphasized, “One of the things that’s important now for investors in the Chinese bond market is to focus on credit risk. It’s becoming more and more important. And not only for smaller companies, also big companies. Investors have to be aware that the government may not cover all institutions anymore.”

Clearing a Path For Greater Access

Although China has taken significant steps over the years to ease access for foreign investors (see figure 3), certain challenges remain for global investors looking to access the onshore market. For example, different public holidays in Hong Kong and China stock markets make trading impossible for investors via Stock Connect on a China public holiday, a Hong Kong public holiday as well as the day prior to the Hong Kong public holiday. This increases risk exposure due to potential price fluctuations and funding cost.

Figure 3. China's Capital Market Liberalization in 2021

“While these and other technical issues don’t prevent us from investing in China, they add a degree of complication for our investment strategies,” Tong explained.

From a fixed income perspective, poor ratings quality and limited liquidity compared with other international bond markets are two key issues. “Despite the vast size of China’s bond market, there is still work to do to enhance liquidity, plus bid-offer spreads are wider than other developed markets,” said Steverink.

Furthermore, China still lacks a liquid derivatives market in terms of swaps and bond futures. This continues to create a challenge for foreign investors, with no widely accepted international standards like the International Swaps and Derivatives Association (ISDA).

“Progress in these areas will help in attracting more foreign investors into China’s bond market,” added Steverink.

Planning China Allocations

Regardless of these hurdles, investors may want to continue to consider China, according to Tong, who noted that while major index providers have slowed the pace of China A-share inclusion into major indices, institutional investors are still allocating to China.

“We would argue that the current level of allocation from foreign investors to China remains much lower than a true representation that China A-share should deserve, considering the size of the Chinese economy and pace of its growth.” said Tong.

Instead of waiting for index providers to increase their allocation by global emerging market indices, Tong said a GDP-weighted exposure to China A-shares is an approach that some investors may want to consider using now.

For bondholders, Steverink believes that although there remains a gap between an average 4% allocation to China relative to the size of China compared to global GDP of 18%, allocations to China may continue to increase, including being spurred by inclusion in global bond indices.

More broadly, if yields continue to decline that will influence bond investment decisions in China in 2022 and beyond, most recently impacted by the turmoil in China’s property sector.

“The impact of the property sector will be that we expect more risk diversification. At the moment we don’t think that credit risk is particularly well priced in China, meaning that some high-risk companies are almost priced at the same level as low-risk companies,” Steverink explained, adding that APG Asset Management’s strategy is focusing on the solid and low-risk companies with decent yield.

Learn more by visiting the Greater Gateway to China series page.

The views expressed herein may not reflect the views of BNY Mellon. This does not constitute legal, tax, accounting, investment, financial or other professional advice on any matter and does not constitute a recommendation by BNY Mellon of any kind.

Asset Servicing Global Disclosure

© 2021 The Bank of New York Mellon Corporation. All rights reserved.