Disconnect Between Wall Street and Main Street

Investment Update

Disconnect Between Wall Street and Main Street

Investment Update

June 2020

By Jeff Mortimer

The apparent disconnect taking place between the U.S. stock market and economy continues to be the major question posed to me in recent client meetings. Up until now, it appeared that the stock market was seemingly ignoring the bleak economic headlines and making substantial gains from its late-March low. But the stock market is a forward-looking discounting mechanism, able to look past current headlines and ahead to the eventual recovery. Now, the data are also beginning to affirm that the economy is on the mend. The biggest example of that was the May jobs report, which showed a surprising decline in the unemployment rate from 14.7% to 13.3% and the addition of 2.5 million jobs.

Let’s take a closer look at what has helped to lift the markets to date, and more importantly, where markets may be headed in the months and quarters to come.

A Fiscal Bridge

Investors should not underestimate the work that governments around the world have done to provide support for those affected by this pandemic. In fact, financial markets are monitoring the building of a fiscal bridge needed to get us to the other side of this economic recession. Markets realize that a new normal waits for us there, but are expecting the government to supply fiscal aid, through unemployment assistance, keeping jobs in place, and helping companies pay expenses.

As of this writing, the U.S. Congress has approved three pieces of relief legislation, including the $2.2 trillion CARES Act, passed on March 27. An additional stimulus package, the HEROES act, is currently going through Congress, but the surprise May employment report could reduce the sense of urgency.

Monetary Support

The Federal Reserve has done an impressive job delivering a massive amount of support that has brought liquidity back to much of the fixed income market. Over the course of two announcements in March, the Fed lowered short-term interest rates by a combined 1.5% to near zero. Additionally, the Fed encouraged the use of its discount window, loosened bank capital requirements, and expanded the municipal lending facility and Main Street lending programs, just to name a few. It also launched a massive quantitative easing program, expanding its balance sheet by purchasing Treasury and mortgage-backed securities and for the first time in history, agreed to buy corporate bonds. Lastly, the Fed made a move to provide forward guidance once again as it communicates its future plans for short-term interest rates to the public.

Needless to say the financial markets have been impressed by the Fed’s willingness and ability to provide liquidity in these uncertain times. History teaches us that whenever the lender of last resort steps in to support markets, you are traditionally near a low, as relief (and buyers) typically come into markets once participants know that a buyer sits behind them.

The Message of the Market

Unprecedented fiscal and monetary actions have provided the liquidity and confidence needed to support and propel global equity markets. But there also seems to be more to the rally than just that. The stock market is also beginning to separate those firms that will not only survive this pandemic, but may also thrive once it is over. For example, large firms with excellent growth prospects are being rewarded, while firms that may struggle for the foreseeable future are being punished. And the overall rally has been powerful. In fact, when looked at through the lens of history, this rally bodes well for the future of the stock market and our economy.

But it’s not only the stock market that has recovered. Credit spreads are defined as the difference between the interest rate demanded on a lower quality corporate bond versus a comparable maturity U.S. Treasury bond. Credit spreads are often seen as a barometer of the health of the economy. In times of uncertainty and stress the spreads naturally widen, while in times of calm these spreads begin to tighten and can end up being relatively tight (close) to one another. The uncertainty around coronavirus caused credit spreads to widen substantially. But, beginning around the time equity markets bottomed, spreads began to tighten.

The Treasury yield curve is also beginning to steepen, with the long end of the curve rising more than the short end. Last week alone, after the better-than-expected jobs report, the 10-year Treasury bond yield increased roughly 25 basis points to reach 0.90%. This suggests improved economic growth ahead.

Historically, a recovery in spreads and the steepening of the yield curve are excellent signals for the health of the overall economy and have provided an early indicator of the direction of equity markets as well.

Is This Just a Bear Market Rally?

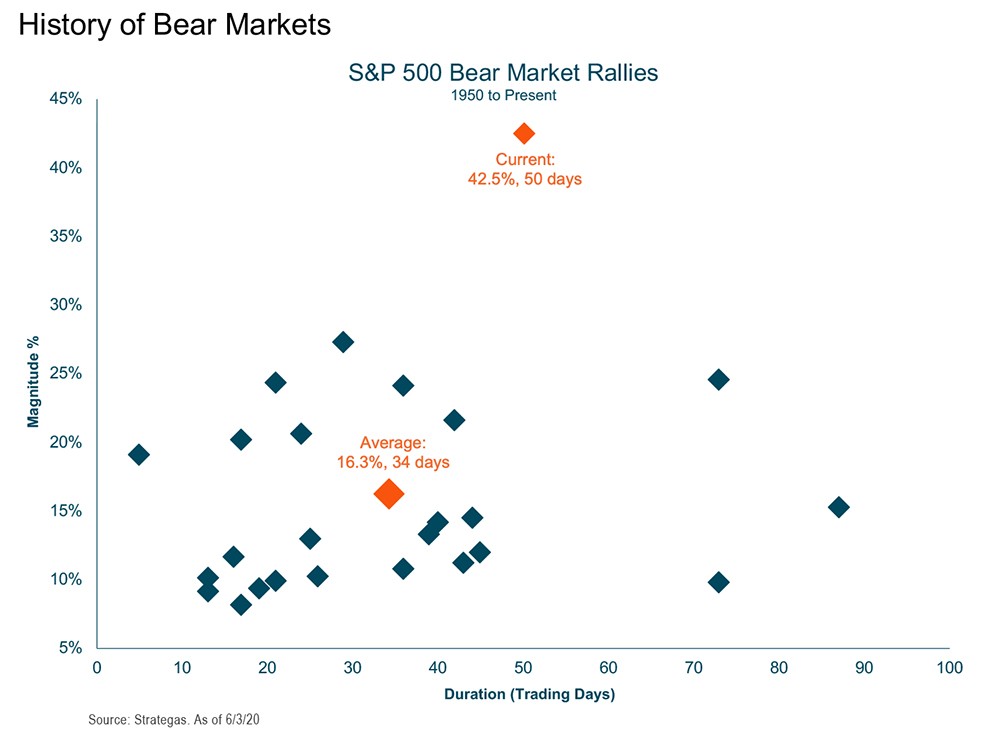

That belief is becoming highly unlikely. As Exhibit 1 illustrates, this rally doesn’t look like your typical bear market rally. If we look at rallies that have taken place during bear markets going back to the 1950s, this one stands out in terms of both its duration and strength. In fact, you could argue that this rally has been so strong that it seems to have taken a retest of the lows off the table as it does not fit the pattern of prior bear market rallies that subsequently reversed. Of course, only time will tell if this rally proves to be false, but with each passing day a retest becomes less likely.

Exhibit 1

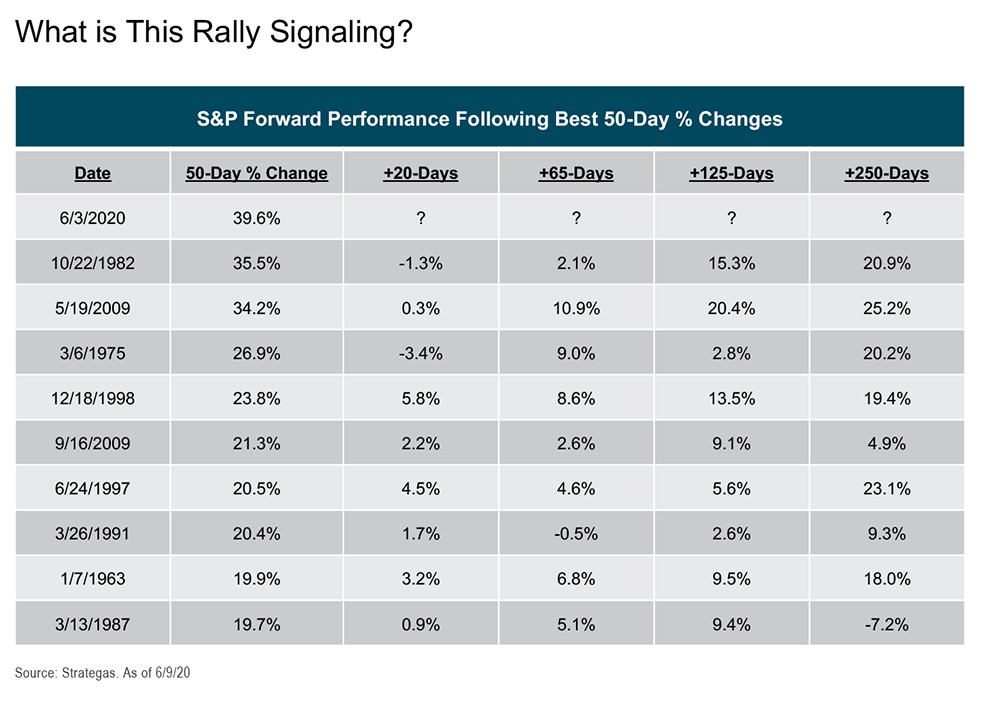

So if this isn’t likely a bear market rally, then what is it? Exhibit 2 looks at equity market gains over 50-day periods, including the rally since the March 23 bottom. It then looks at the market’s subsequent returns. These returns illustrate that equity markets are generally higher — sometimes substantially so — after six to 12 months. The interim period can prove choppy, but better times tend to lie ahead after this period of digestion. Seasonality may also come into play as markets tend to historically move sideways, or in a trading range, in the summer months. It is also interesting to note that most of these strong historical 50-day periods have appeared after significant corrections or bear markets, and show how strongly stocks tend to perform in the early stages of recovery.

Exhibit 2

What Could Go Wrong?

The road to the new normal will be anything but smooth. But, the worst of the economic data may be behind us with a jobs recovery already underway as seen in the May jobs report. The ever-present risk of a second wave will certainly hang over markets until a much better treatment or even a vaccine is invented. And the virus has put strains on everything from US-China relations to the price of oil. To make matters even more uncertain, we are in an election year.

But we also must remember that in uncertain times in the past, new opportunities have always arisen. Science and technology, and even changes in human behavior (i.e. social distancing), have rescued us in the past, and probably will do so again.

From an investment standpoint, I will leave with the following: Historically, all other crises have proven to be eventual buying opportunities. We believe this unprecedented event will prove to be no different. Perhaps the market is also beginning to agree with this assessment.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, Hong Kong branch is an authorized institution within the meaning of the Banking Ordinance (Cap.155 of the Laws of Hong Kong) and a registered institution (CE No. AIG365) under the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong) carrying on Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. The services and products it provides are available only to “professional investors" as defined in the Securities and Futures ordinance of Hong Kong. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm") is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management's Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E1C 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. BNY Mellon Wealth Management, Advisory Services, Inc. is registered as a portfolio manager and exempt market dealer in each province of Canada, and is registered as an investment fund manager in Ontario, Quebec, and New Foundland & Labrador. Its principal regulator is the Ontario Securities Commission and is subject to Canadian and provincial laws. BNY Mellon, National Association is not licensed to conduct investment business by the Bermuda Monetary Authority (the “BMA") and the BMA does not accept responsibility for the accuracy or correctness of any of the statements made or advice expressed herein. BNY Mellon is not licensed to conduct investment business by the Bermuda Monetary Authority (the “BMA") and the BMA does not accept any responsibility for the accuracy or correctness of any of the statements made or advice expressed herein. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. © 2020 The Bank of New York Mellon Corporation. All rights reserved.