Capabilities

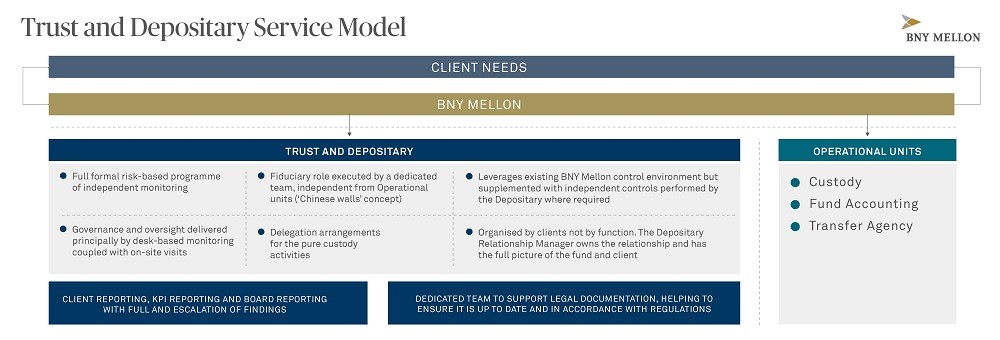

We deliver responsive technology and an agile service model that are built to handle your complete depositary needs today, and grow with you as the investment landscape and your business needs evolve. Our service is optimised to provide the information you need to fully understand your operations and make decisions with confidence.

- Services are delivered through a comprehensive and harmonised approach and operating model across our various jurisdictions aimed at ensuring full compliance with the applicable regulatory framework.

- Dedicated technology solutions optimise our review process in relation to specific supervision duties such as assets safekeeping and cash monitoring, allowing us to track risky items at different stages of the transaction cycle.

- Services delivered through a team acting independently, with on-the-ground presence in all major European markets.

Our Investment and Borrowing Power reviews are performed regularly on every fund to ensure compliance with the investment, borrowing and leverage limits as detailed in the fund’s offering documents.

- Each fund monitored in line with the investment rules, eligible markets and limits prescribed in the prospectus.

- Automatic feed from custody records provide details of actual cash positions to determine overdrafts.

- Security and market data supplied by Bloomberg and supplemented using in-house systems.

- Post-trade review of all portfolios using independently “coded” rules.

- Automated reporting.

- “Alerts” and “warnings” coded to allow for early detection of potential breaches.

- Trustee breaches database used to record all breaches. Peer and trend analysis available.

Our Valuation services provide an oversight review of the fund accountant's Net Asset Value (NAV) review process and regular independent checks on the fund’s price structure.

- Comparison of independent price sources.

- Independent view of valuation errors.

- Formal risk-based physical site visit to each fund accountant and transfer agent is undertaken.

- Fully automated reporting tools allow for easy delivery of queries/issues/concerns as well as ongoing query tracking and peer analysis.

- Fair value pricing process for individual stocks and portfolios.

- Ability to address issues in advance of mid-year/year-end accounts.

- Assessment of distributable amount payable and production of Report and Accounts.

Where we delegate the function of safekeeping to a global custodian, we undertake due diligence on them. Our Safekeeping service includes:

- Ongoing due diligence of custody.

- Consideration of custodian’s expertise, market reputation, adherence to regulatory requirements/permissions, credit worthiness, other activities performed, results of external auditor reviews.

- Risk-based on-site visit to the custodian, together with the completion of a due diligence questionnaire.

- NAV reviews to determine key aspects of the performance of the custodian.

- Delivery of a “toolkit” that provides a standardised suite of compliance assurance reviews that meet the requirements of harmonised EU directives, whilst retaining flexibility to meet the requirements of different regulators.

Under Alternative Investment Fund Managers Directive (AIFMD) and Undertakings for Collective Investment in Transferable Securities (UCITS V) regulations, as the depositary, BNY Mellon performs cash monitoring and cash reconciliations. Services include:

- Maintenance of a database of all cash accounts opened on behalf of the fund.

- Identification and review of all cash flow movements for significant and inconsistent cash flows.

- Emphasis on unknown transactions and fee payment transactions and initiate further investigation where necessary.

- Cash reconciliations performed for all cash accounts held by a fund.

- Automated fund accounting and custody feeds used to perform daily cash monitoring and reconciliation functions.

Our Offsite Monitoring service is designed to supplement ongoing oversight through a focused review on the operations of the fund manager and its delegates:

- Governance and oversight delivered principally by desk-based monitoring coupled with onsite visits.

- Comprehensive onsite monitoring programme with devoted time during visits to matters which cannot be reviewed in BNY Mellon offices.

- In-depth risk-based programme of independent monitoring.

- Thematic reviews as required.

- Pre take-on due diligence offsite visits.

- Ongoing risk assessments.

- Pre-visit questionnaires and review worksheets.

- Close-out meeting and final review discussions.

- RAG rated report (rated 1-9) providing details of any findings along with clear remedial actions.

- Issue tracking and follow up meetings where required.

- Thematic functional/industry specific reviews.

Technical Expertise and Exceptional Service Delivered Through a Collaborative Approach

Our agile service model and responsive technology are built to handle your complete depositary needs today, and grow with you as the investment landscape and your business needs evolve. Our flexible service model allows us customise and scale our capabilities to your business strategy. Whether you need an exceptional technical provider or a proactive collaborator, we meet you where you need us most.