White papers, opinions and policy pieces

Proprietary data-driven research and surveys

Macro and markets commentary, investing strategy

Views from around our industry with the latest insights on trading, collateral, funding and liquidity

Introducing Sponsored Cleared Repo

Introducing Sponsored Cleared Repo

September 2019

Since the financial crisis, regulators from around the world have agreed a series of capital reforms that, while strengthening the loss-absorbing capability of the banking sector, have also reduced the funding capacity available to repo market participants.

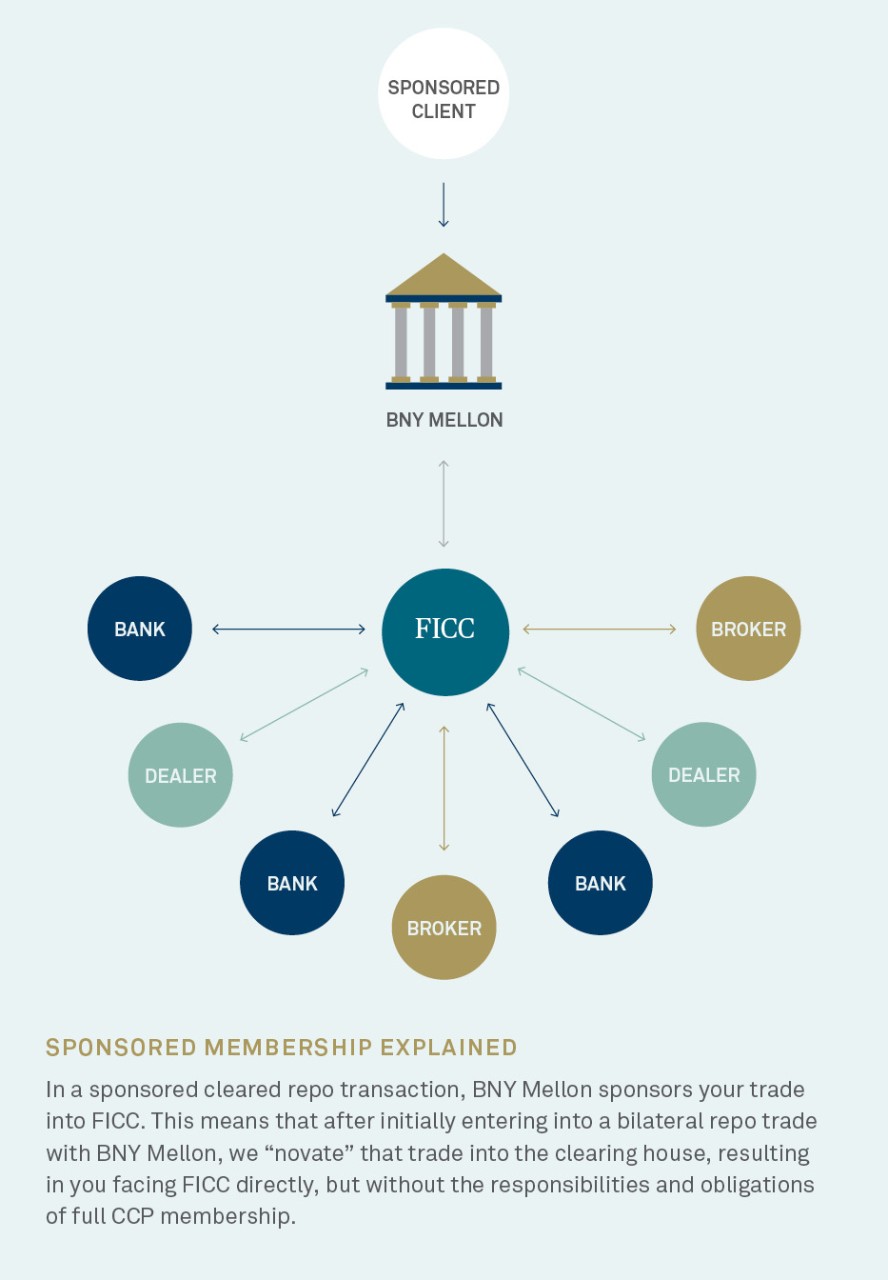

This is where central clearing and sponsored cleared repo access come into play. Consolidating repo activities through industry utilities such as central counterparties (CCPs) offers a highly efficient means to counter the increased capital burden created by the regulations. BNY Mellon is a market leader in facilitating direct CCP access, providing the risk mitigation and capacity benefits of repo clearing to qualifying cash investors and borrowers through a mechanism called “sponsored membership.”

What is Sponsored Membership?

Sponsored membership enables you to face a CCP directly in repo transactions without the requirements of full membership of the clearing house, such as making default fund contributions, being part of the loss mutualization waterfall and the obligation to provide contingent liquidity.

In short, sponsored membership allows you to enjoy the upside of CCP membership without many of the associated responsibilities because BNY Mellon takes care of a number of those obligations for you.

The Fixed Income Clearing Corporation is a highly rated CCP that specializes in the matching, clearing and netting of transactions in U.S. Treasuries and Agency debt securities, including repo trades involving U.S. Treasuries as collateral.

How Does Sponsored Membership Work?

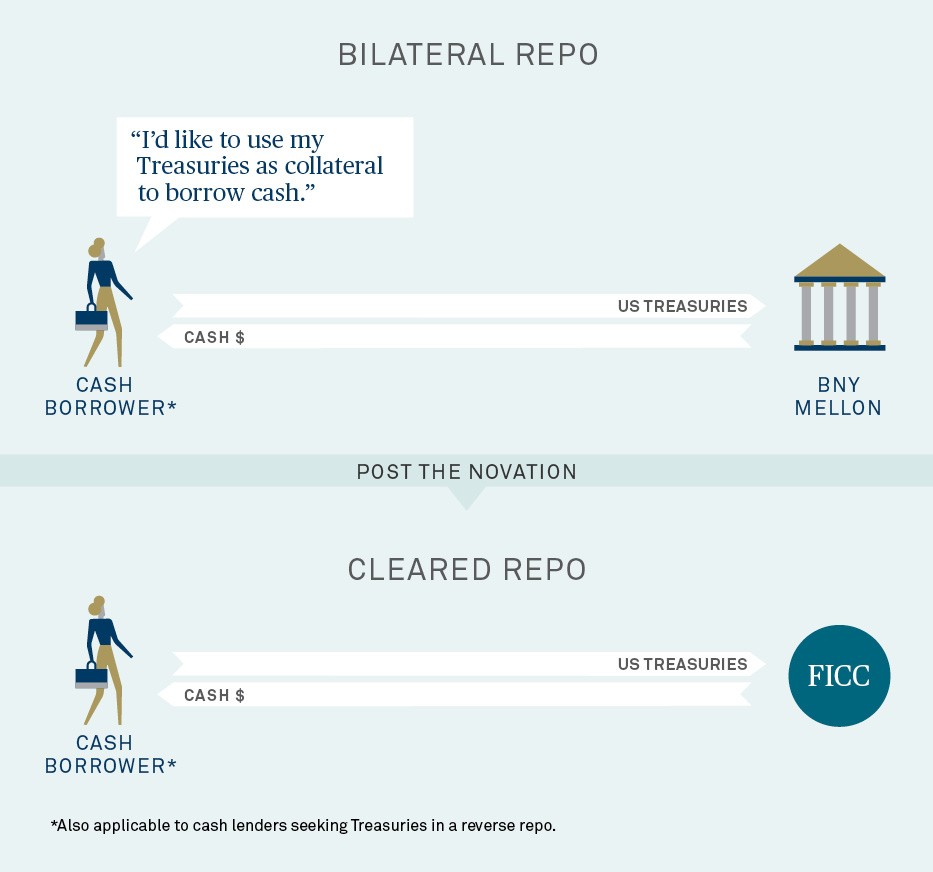

In a typical bilateral repo, a cash borrower posts U.S. Treasuries to its dealer counterparty in exchange for cash. Similarly, cash investors seeking increased liquidity can lend cash in exchange for U.S. Treasuries via a reverse repo.

Since the transactions typically result in an increase in the dealer’s balance sheet, there is an increased capital requirement that drives the cost of repo higher, while also broadly reducing industry capacity.

For a sponsored member, a cleared repo starts out like a bilateral repo trade with BNY Mellon. However, after a trade has been agreed and settled between BNY Mellon and the sponsored party, BNY Mellon then “steps out” of the trade via a novation.

This means FICC replaces BNY Mellon as the counterparty to the repo for the remainder of the transaction’s lifecycle.

Why Choose BNY Mellon?

Questions or Comments?

For more information on our suite of FX algos and to learn what they can do to help you meet your currency trading goals, email us or call us on 212-815-7166 and +44 207 570 0892.