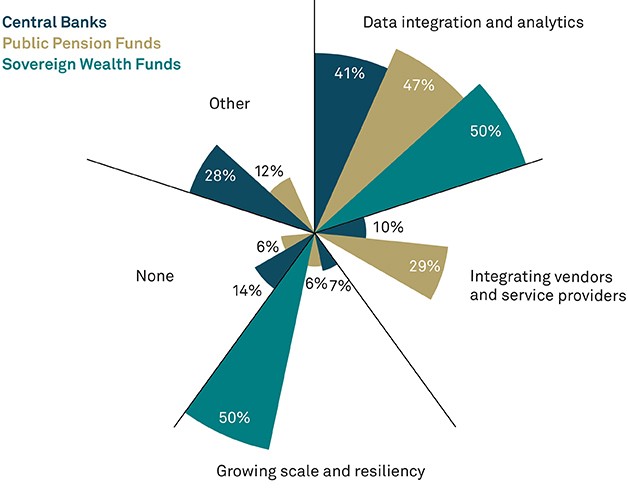

Survey respondents cited data integration and analytics as by far the greatest operating model challenge across all public asset owner types, sizes and geographies. Optimal data integration allows data to move seamlessly from the portfolio manager to the front and middle office and then to the custodian and back office, informing decision-making throughout.

Data Must Move to the Core

Data Must Move to the Core

The Evolution of Public Asset Owners

June 2022

Watch a short video.

As public asset owners manage the shift in their investment strategies and the transformation of their operating models, data is the foundation of their future. There are a number of challenges to overcome and best practices to consider as institutions seek to build a data-centric organization.

Are you an explainable AI company that we should know about?

Learn More [link to accelerator program page]

Interested in learning more about emerging technologies for the financial services industry?

Sign-up for The Quarterly Update

Figure 1: Data Integration and Analytics Is by Far the Most Significant Operating Model Challenge

What is the main challenge in public asset owners’ current operating model? (Select one)

Source: BNY Mellon/OMFIF operating model survey

Note: “Other” responses included cost reduction and granularity of performance attribution

Interview Perspectives

“If we have better transparency in the portfolio and timely and accurate data, we can design new strategies and get better returns. But it’s not just about better returns. We want efficient data management so we don’t have to second guess and recalculate our accounting records. And we want non-investment data too, so we can better understand our beneficiaries.”

— Public Pension Fund

“Given the size of our portfolio and strategies that span asset classes, we need to look at exposures not just across geographies, capital structures and issuers, but also securities lending, so we have a true view of our risks.”

— Sovereign Wealth Fund

“We can figure out what the front-office return is on investing in one country over another. But I also want the fully baked cost, taking into account sub-custody fees, for example. When yields are low, knowing the true operational implications of activities can make a difference.”

— Public Pension Fund

Tackling Five Key Data Challenges

Data management and aggregation is often an arduous manual process, with analytics still often performed on individual spreadsheets and within organizational silos. Some public asset owners have only just started to digitize their records and find the task overwhelming. Maturity ranges from the most advanced asset owners building sophisticated analytics structures, supported by advanced data-management platforms and moving toward IBORs, to laggards or small public asset owners that cannot marshal resources to address data challenges holistically. Overall, five challenges are most common.

- Clarifying purpose: Institutions want a comprehensive data model for their organization but frequently struggle to articulate precise objectives and a guiding framework for their efforts. Such institutions risk embarking on complex efforts to build a data warehouse or a single source of truth with ill-defined parameters.

- Addressing fragmentation: Public asset owners often face uncertainty about how to break down silos to bring their data together - from front-office analyses to fundamental back-office information from multiple sources.

- Accounting for diverse data types: Unlike basic equities market data, more qualitative information, such as ESG reports or the tone used in analyst calls, is harder to incorporate. 80% of survey respondents have some form of unstructured data (PDFs, images, video) but the majority (60%) can only “somewhat” incorporate this data into their analyses, while 20% cannot use it at all.

- Standardizing reference data: Differing formats for reference data, such as information that identifies securities, also pose problems. Extracting unique insights from data often requires analysis that cuts across multiple sources, and combining standard data from different providers into a single format could reduce costs without impacting data users. Although few data providers support easy interoperability, the industry is moving in this direction.

- Fostering a data culture: Although interviewees acknowledge the importance of data, many organizations have not adopted a data-driven mentality. An executive at one pension fund said its board perceived data as a topic that “sits with the technical people.” Other interviewees described data as being seen as a niche or “ivory tower” topic.

Adopting Data Best Practices: Purpose, Process, People

A range of best practices has emerged from these discussions and our experience guiding both public and private asset owners through data-centric transformation projects. They fall under three rubrics: purpose, process and people.

To avoid “boiling the ocean,” our discussions highlighted a series of questions that public asset owners can use to clarify their data needs and purpose.

- What do I want my data to tell me? Specific data needs will vary, but there are four areas most asset owners need to address: total portfolio exposure to asset classes or sectors that can inform investment strategy; cost per trade analysis to identify opportunities to reduce operational costs (e.g., for specific markets or asset classes); ESG impact and performance; and insights for external stakeholders such as pension fund beneficiaries or the broader public.

- Which users need data, and in which format? Data serves not only senior decision-makers and the front office but also many user groups across and outside the organization – including business unit leaders, managers leading special projects, analytical champions and the public. Understanding these needs, and the formats required, helps public asset owners focus on outcomes and guide their selection of data tools and providers.

- What are the non-negotiable data outputs and where should I focus after addressing them? Prioritizing user groups and their data needs identifies the most critical outputs to address first, typically for senior decision-makers. Thinking more long-term and holistically, public asset owners should map data needs against their mandates and business strategy.

- What visibility do I really need into my portfolio? Speed can be more important than accuracy in certain circumstances. For example, many asset owners complain that data for alternatives is less up to date than for equities, but timelines may not impede a total portfolio view for real estate data. Similarly, data preferences can differ by user group: Some data consumers need raw data, others require it checked, while others need official released data.

The transformation process is also critical. A data transformation is a journey whose conditions and objectives often evolve. While multi-year and multi-million-dollar programs focus on the initial data problems to solve, data needs change and new challenges emerge.

- The baseline: Understand how processes, people and data intersect from end to end

- Public asset owners need a clear and holistic view of their processes and how multiple data user groups, inputs and outputs intersect. Creating this view helps the institution break down organizational silos.

- The endpoint: Establish the end state and the transition state

A typical path to designing the end-state data model is to establish a target information model (TIM), a target architecture model (TAM) and a target operating model (TOM), along with a transition systems architecture (TSA) that bridges the gap between the baseline and the end state.

- The mindset: Be agile and focus on outcomes

Successful institutions adopt an agile or outcome-focused approach to design and implementation instead of tackling the entire universe of data. They focus, for instance, on a specific security’s flow throughout the organization, identify problems and solutions from this analysis and apply these lessons elsewhere as appropriate. This approach also enables adaptation as an institution’s data needs evolve over time.

Finally, transformation initiatives require people engagement - from institutional leaders to end-users to service providers. Each of these groups plays an instrumental role.

- Leadership provides vision

Interviewees at several public asset owners emphasized the critical role of leadership in driving data transformation projects. Although there is no consensus among interviewees about the value of a single institutional data czar, it is clear the C-suite must be fully onboard, if not leading data transformations. - Cultural change is important

While a central data function can serve as a helpful incubator of data initiatives, data should be integral to everyone’s work. Public asset owners that have successfully transformed data use in their organizations have invariably deployed purposeful initiatives that encourage and reinforce data-driven decision making. - The right providers contribute to success

A successful data strategy involves collaborating with the right external entities, from data providers to custodians to key technology vendors. Success often depends on selecting the providers that are willing and able to collaborate in building a data-centric future. In particular, the right custodian can play a critical role as the source of an institution’s most fundamental data. Recently, custodians have enhanced their business models by integrating deeply with best-of-breed technology to deliver data integration, harmonization, aggregation and analytics.

Asset Servicing Global Disclosure

© 2022 The Bank of New York Mellon Corporation. All rights reserved.