U.S. Fund Managers Launching ETFs in Europe and the UK

What Do You Need To Know?

U.S. Fund Managers Launching ETFs in Europe and the UK

October 2022

Exchange-Traded Funds (ETFs) continue to be incredibly popular investments for both active and passive investors alike. Year after year, assets invested in ETFs have climbed to increasingly loftier heights.

With ETF and exchange-traded product (ETP) assets in Europe topping $1.5 trillion in 20211 according to data released by ETFGI, it is a natural next step for U.S. fund managers to look across the pond for opportunity. However, the journey to Europe is not without pitfalls and key differences between the two locations could, if not skillfully navigated, obstruct and challenge managers.

The Three Major Differences Between U.S. and European/UK ETF Markets

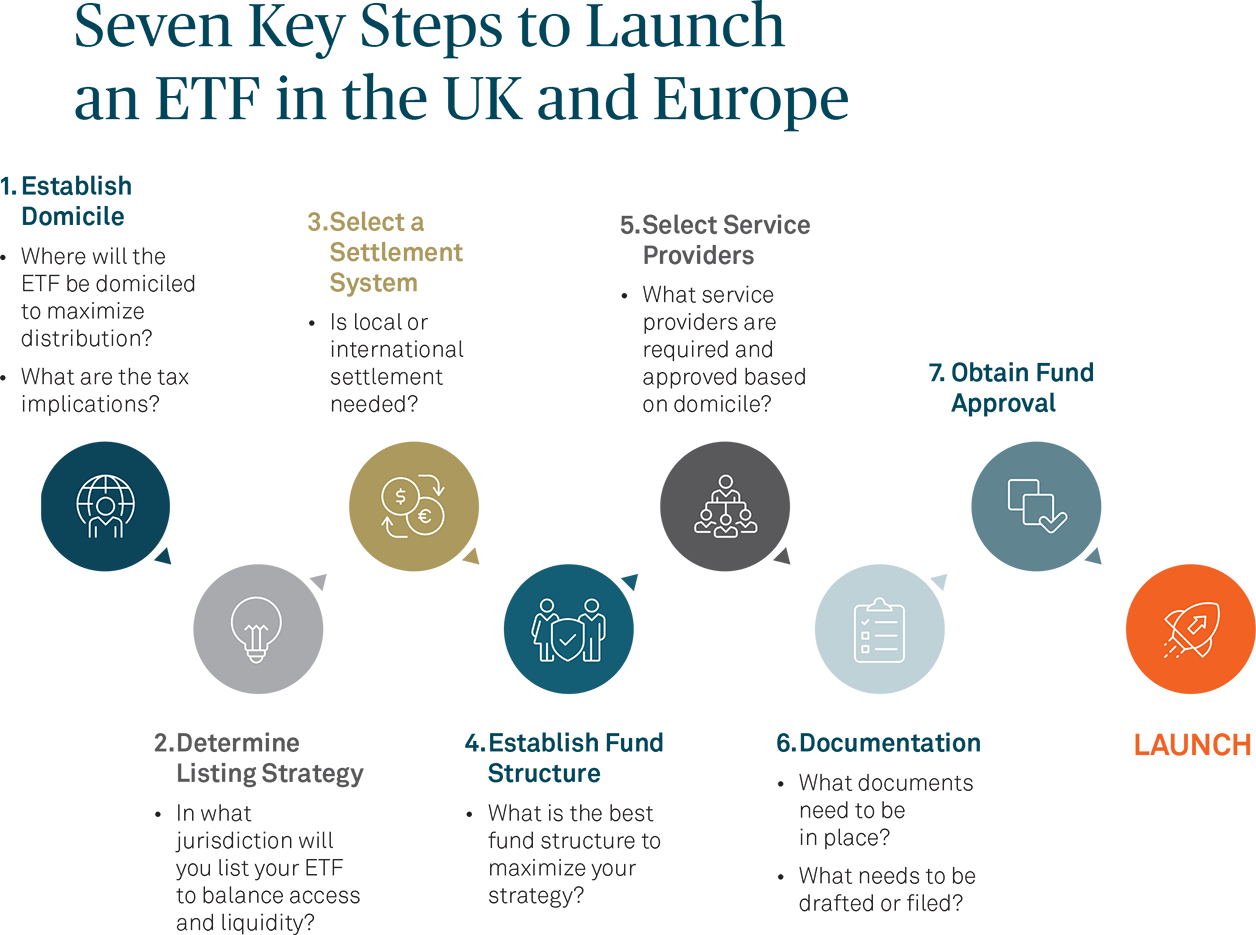

Many U.S. fund managers are unaware of what it takes to launch a successful ETF in Europe and the UK. Duplicating and listing an existing U.S. ETF in one or more jurisdictions is not enough to raise assets. There are critical differences in both the structure of the market and the process for launching a product that must be taken into consideration.

1. Institutions Drive Demand

Unlike in the U.S., investors in the UK and Europe aren’t self-directed, meaning institutions are almost the sole source of demand. This institutional bias requires a key shift in a fund’s marketing and distribution strategy, especially for U.S. funds that are driven by retail popularity.

2. Multiple Exchanges and Settlement Systems

Throughout Europe and the UK., 27 exchanges trade across 22 countries. That can create pockets of liquidity that present headwinds to the growth of a fund. As a result, there are now two methods for settlement:

- Local clearing – in this approach the issuer settles in the local settlement structure where the ETF is listed.

- International Central Securities Depository (ICSD) – This model allows for the use of a single clearing house for ETF settlement across multiple markets. The model removes many of the challenges experienced by liquidity providers in the past. This method is used by vast majority of ETF issuers.

- Europe’s complex web of exchanges and settlement systems can pose another potential challenge to U.S. fund managers who are accustomed to a simpler settlement process.

3. Different Structure

In Europe, ETFs are structured as Undertakings for Collective Investment in Transferable Securities (UCITS) versus the familiar U.S. trust structure. While this change in structure must be considered, it also provides a unique benefit. The UCITS structure allows funds to be sold on a retail basis to any investor within the European Union, under a unified regulatory framework. In addition, the UCITS brand is a globally recognized product.

Due to European watchdog regulations, funds in the UK and Europe are required to use a depository. Usually domiciled in Ireland or Luxembourg, the depository acts as a fiduciary to make sure the assets are accurate per the fund mandate, and where they should be—with a custody bank. They also provide due diligence to ensure that a fund’s net asset value (NAV) is tracking properly.

The Right Custodian Bank Can Be a Differentiator

European markets present an excellent opportunity for growth to U.S. fund managers who can successfully navigate the differences between the two markets. However, having a custodian bank that can act as a partner and advisor can provide invaluable assistance during the process.

BNY Mellon has helped launch more than 175 ETFs in the UK and Europe over the past 20 years, including the very first European ETFs. Our ETF Services team works closely with clients at every stage of the ETF lifecycle, offering deep industry perspectives and hands-on support to address their most complex needs.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice.

BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material. This material may not be reproduced or disseminated in any form without the prior written permission of BNY Mellon. Trademarks, logos and other intellectual property marks belong to their respective owners.

© 2022 The Bank of New York Mellon Corporation. All rights reserved.