Real Estate: Q4 Confirms Sharp Sector Divergence

Real Estate: Q4 Confirms Sharp Sector Divergence

February 2021

By Dermot Finnegan, Neal Armstrong

The COVID-19 crisis has accelerated a number of existing trends in real estate, especially in retail, but uncertainty still overshadows much of the market.

The COVID-19 crisis continues to cause disruption in many countries, albeit with significant regional disparities. In Q3, many countries lifted lockdown measures allowing economic and social activity to resume, albeit at a ‘new normal’ level. To some extent, these developments fed through to sentiment in real estate. However, there were subsequent renewed COVID-19 outbreaks and lockdowns in many territories, with EMEA and the U.S. especially affected and Asia less so; a handful of countries started vaccinations at the end of the quarter.

The swift change in circumstances in Q3 and Q4 underscores that disruption is likely to continue for some time, with uncertainty remaining paramount for real estate throughout 2021. Nevertheless, the latter three-quarters of 2020 have revealed a number of clear trends that are likely to endure.

Most notably, much of the retail market has come under pressure from repeated lockdowns and the migration of activity from bricks-and-mortar stores towards online shopping. At the same time, industrial has been resilient given the increased need for logistics space (due to online shopping) and data center capacity (due to home working and schooling). Residential has been largely flat in many countries, with government support measures postponing the impact of slower economies on jobs and incomes. Meanwhile, there seems little prospect of recovery in hospitality and travel until vaccination programs have made greater headway, while uncertainty prevails in the office sector.

Low transaction volume hampers visibility

One prominent feature of the property market since COVID-19 began is low transaction volumes. During Q4, volumes recovered with 264 U.S. transactions reported by NCREIF members compared to a typical volume of between 100 and 200 sales of properties each quarter1. However, this recovery comes after just 50 sales in Q3 and 30 in Q2 of 2020. In other words, over the latter three quarters of 2020 combined, transaction volumes remain well below average. In Q4 2020, European investment volumes were €89.2 billion, down 27% on Q4 2019. CBRE expects that European commercial real estate investment volumes will end 2020 down 25%2.

Transaction volumes have been low for a number of reasons. Firstly, during lockdowns, it is difficult to gain access to properties, which hinders due diligence and therefore makes it difficult for transactions to proceed; while virtual due diligence has been used in some instances, it is not a replacement for more traditional practices. Secondly, given the uncertain outlook for much of the real estate market, only those owners requiring liquidity or to exit an asset class are willing to sell. In this sense, low transaction volumes potentially become self-reinforcing. Nevertheless, the general improvement in sentiment and the speed of economic recovery in some markets in recent quarters have provided some reassurance that the impact to valuations for certain property types may ultimately be less than had been anticipated during the initial turmoil of February and March 2020.

One other emerging trend among investors – perhaps indicating a broader concern for more transparency and tailored risk profiles – is a growing interest in separately managed accounts as investors look for more control in a more turbulent market.

The cautious recovery continues

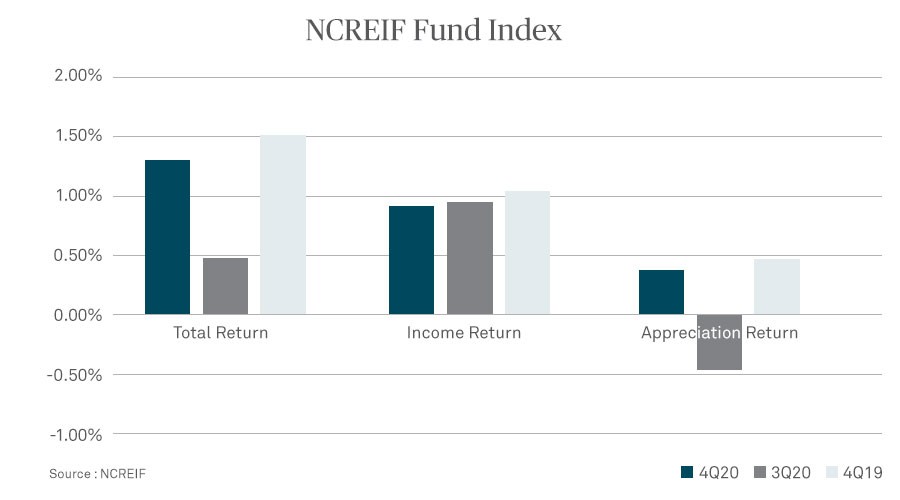

The NCREIF Property Index (NPI), which reflects investment performance for 9,289 U.S. commercial properties, totaling $700 billion of market value, delivered a total return of 1.15% in Q4, up from 0.74% in the prior quarter – the highest for any quarter of 2020, although lower than the highs of 20193. Similar changes in value occurred in real estate funds. The NCREIF Fund Index of 26 funds, totaling $270.9 billion of gross real estate assets, generally showed stronger returns in Q4 than in Q3, but did not return to Q41 2019 levels.

Similar figures are not available in EMEA, although performance is likely to be broadly in line to the U.S. given the universal impact of COVID-19. However, there may be some national exceptions. German funds, for example, do not receive external appraisals and tend to follow a conservative, long-term approach; they are therefore likely to have suffered a more limited hit to valuations. Meanwhile, in the U.K. some open-ended real estate funds that were gated during the peak of the COVID-19 crisis have now allowed investor exits, although others are still preventing exits4. In the longer term, proposals by the U.K.’s Financial Conduct Authority for a notice period of up to 180 days for real estate funds to address liquidity concerns could well result in a shift toward REITs. Under the proposals, the consultation for which closed on November 3, investors’ redemption requests would be processed at the end of a notice period, with the price received relating to the value of the investment at the first valuation point after the end of their notice period5.

Retail sees mixed fortunes

Even where lockdown measures were eased during Q4, non-food retail – and in particular covered retail areas – in both the U.S. and EMEA have continued to be heavily impacted by the pandemic, due to:

- continued rise in online shopping;

- concerns about contracting COVID-19 in enclosed environments;

- social distancing requirements (the inconvenience of which has dissuaded some shoppers);

- the sharp rise in unemployment (which is reducing consumer discretionary spending);

- increased cleaning costs; and

- lower parking income.

Returns for U.S. retail fell by 1.24% in Q4 – the second largest fall by sector (after hotels with a 3.31% fall) – according to the NCREIF Property Index6.

COVID-19 did not initiate this trend, however. The decline of malls has been underway for a number of years, as retail has gravitated toward e-commerce. The pandemic simply crystallized this change in terms of valuations. As the trend was already well underway, asset managers had begun to diversify away from non-food retail – although they believed the trend would play out over a decade rather than nine months. Consequently, this diversification softened the impact of COVID-19.

The acceleration of this trend does not mean that non-food retail is headed for extinction. As banks sell off retail real estate debt, a restructuring and repurposing of these assets will get underway, creating new opportunities for unique developments that can take advantage of opportunistic or value-add designated capital. New owners are likely to undertake brownfield conversions of malls into apartments or other viable mixed-use facilities. Value-add funds are already stepping into the market, as core real estate funds exit or sharply reduce their exposure.

It is important to note that not all retail has suffered. Grocery has performed strongly and grocery-anchored centers have suffered less than other retail.

Industrial is showing resilience

In contrast to retail (and especially hotels), U.S. industrial remained strong: returns for industrial properties were 4.68% in Q4 (over 17% annualized), as measured by the NCREIF Property Index7. There are a number of reasons for this outperformance.

First, while non-grocery retail has suffered during the pandemic, e-commerce growth has accelerated. Consequently, the need for warehousing, which was already growing, has increased dramatically. In the U.K., which has some of the world’s highest levels of e-commerce activity, record quarters of logistics take-up in Q2 and Q3 were followed by a further strong quarter, which resulted in 10.4m sq ft of additional capacity, bringing the annual total to 43m sq ft – a new record8. Though U.K. supply is responding, there has been a significant decrease in availability, which fell 15% from Q3 to Q4.

Second, demand for data centers – including cloud capacity for companies facilitating remote working and capacity for home streaming, education and other consumer-focused services – has also increased. Just as in the retail sector, a digital transformation that many expected to gather pace over the coming decade was telescoped into nine months during the pandemic.

Given investor confidence in these fundamental shifts, no significant negative impact on pricing is anticipated and valuations of many warehouse and data center assets have received a boost.

The office sector is in a state of limbo

While there is now some clarity about the trajectory of non-grocery retail and industrial, the outlook for the office sector remains uncertain, as the return to work has been extremely slow. Many market participants appear to be adopting a wait-and-see approach, which is being reflected in performance. Prime central business district (CBD) office yields in the U.K. have experienced no change while those in Germany have only marginally compressed9.

However, in the medium-term, some change seems inevitable. What form that change might take has evolved since the beginning of the pandemic. In the early stages of COVID-19, there was a widespread assumption that companies would need additional office capacity in order to facilitate social distancing. However, the success of remote working for many companies has challenged this assumption. Many high-profile technology companies, for instance, have indicated that employees will not have to return to the office in the foreseeable future – or even at all.

More recently, this trend has begun to spread to financial services. In November, Lloyds Banking Group announced that it would redeploy 700 U.K. staff into full-time homeworking roles from 202110. A CBI/PwC survey of U.K. financial services in October found that 74% of companies – particularly banks and insurance firms – are taking stock of their office requirements with a view to either using the space differently, or reducing it: nearly half of those surveyed said that more than 90% of their workers could do their job without being in the office11.

At the same time, businesses are aware of the benefits of office working such as collaboration between coworkers, which can drive innovation. Companies may therefore ultimately seek to return employees to the office when it is deemed safe to do so. The most likely outcome is that employees will eventually return to offices but that many will work part of the week (possibly even a majority) from home; hot desking will therefore become the norm in offices, potentially implying lower demand for space in the future.

Another question as yet unresolved is where that office work will take place. Class A-type property – especially high-rise trophy offices – poses particular problems given the use of elevators and the need for employees to reach buildings via public transport. In contrast, smaller low-rise offices – perhaps located closer to employees’ homes – could benefit from a change in working patterns. At the least, offices will need changes such as:

- reconfiguration to eliminate the risk associated with open-plan spaces;

- costly improvements in air quality and cleanliness; and

- measures such as automated temperature checks or automated doors that can confirm if a mask is being worn.

The outlook remains unclear for much of the market

Various COVID-19 support measures, such as the Paycheck Protection Program in the U.S. and the furlough scheme in the U.K., have been extended in recent months. At some point, probably as infections subside and vaccinations reach critical thresholds, these measures will be withdrawn. Any subsequent increase in unemployment could have repercussions for consumer and business spending, economic activity, residential rent collections and real estate valuations: the 0.99% return for apartments in the Q4 NPI – supported by both government stimulus measures and limited supply, as construction has slowed due to COVID-19 – may not be sustainable.

While the trends accelerated by the pandemic in the retail and industrial sectors are likely to endure – driving the continued recovery in transaction activity – there may yet be additional impacts in other real estate sectors. Certainly, the challenging economic outlook combined with limited business and tourism travel will hamper the recovery of the hotel sector. According to the Magid HTL Forecast Tracker, there will be a 29% decline in annual U.S. hotel occupancy in the 12 months to August 2021, resulting in a projected revenue loss for the industry of about $75 billion in room revenue alone12. There seems little prospect of a recovery in the hospitality and travel sector until late in 2021 or even until 2022, not least because many potential holidaymakers will remain cautious. Greater clarity may emerge in the second half of 2021 for the office sector once vulnerable groups have been vaccinated and large corporations begin to make decisions about the extent to which they will require employees to work in the office.

1 https://www.ncreif.org/news/npi-4q2020/

2 https://www.cbre.co.uk/research-and-reports/2021-EMEA-Real-Estate-Market-Outlook

3 https://www.ncreif.org/news/npi-4q2020/

4 https://www.morningstar.co.uk/uk/news/208462/property-funds-in-2021.aspx

6 https://www.ncreif.org/news/npi-4q2020/

7 https://www.ncreif.org/news/npi-4q2020/

8 https://www.cbre.co.uk/research-and-reports/UK-Logistics-Market-Summary-Q4-2020

9 https://www.cbre.co.uk/research-and-reports/2021-EMEA-Real-Estate-Market-Outlook

10 https://bmmagazine.co.uk/news/lloyds-to-move-700-bank-staff-into-full-time-homeworking-roles/

11 https://bmmagazine.co.uk/news/nearly-three-quarters-of-city-firms-reviewing-office-space-provision/

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names in various countries by duly authorised and regulated subsidiaries, affiliates, and joint ventures of BNY Mellon. Not all products and services are offered in all countries. This material may not be comprehensive or up-to-date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given. BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material. This material may not be reproduced or disseminated in any form without the prior written permission of BNY Mellon. Trademarks, logos and other intellectual property marks belong to their respective owners.

© 2021 The Bank of New York Mellon Corporation. All rights reserved.