LIBOR: The Time for Wait and See is Over

LIBOR: The Time for Wait and See is Over

April 2020

London Interbank Offered Rate (LIBOR) and other Interbank Offered Rates (IBOR) have been a cornerstone for the debt transactions of many financial institutions and corporations for decades.

In recent years regulators have made replacing IBORs a priority, particularly as a result of the credibility and reliability challenges that followed the 2008 financial crisis. The Financial Conduct Authority has made it clear that it will no longer compel banks to submit quotes for LIBOR from the end of 2021 and that it is not advisable to rely on LIBOR being available thereafter.

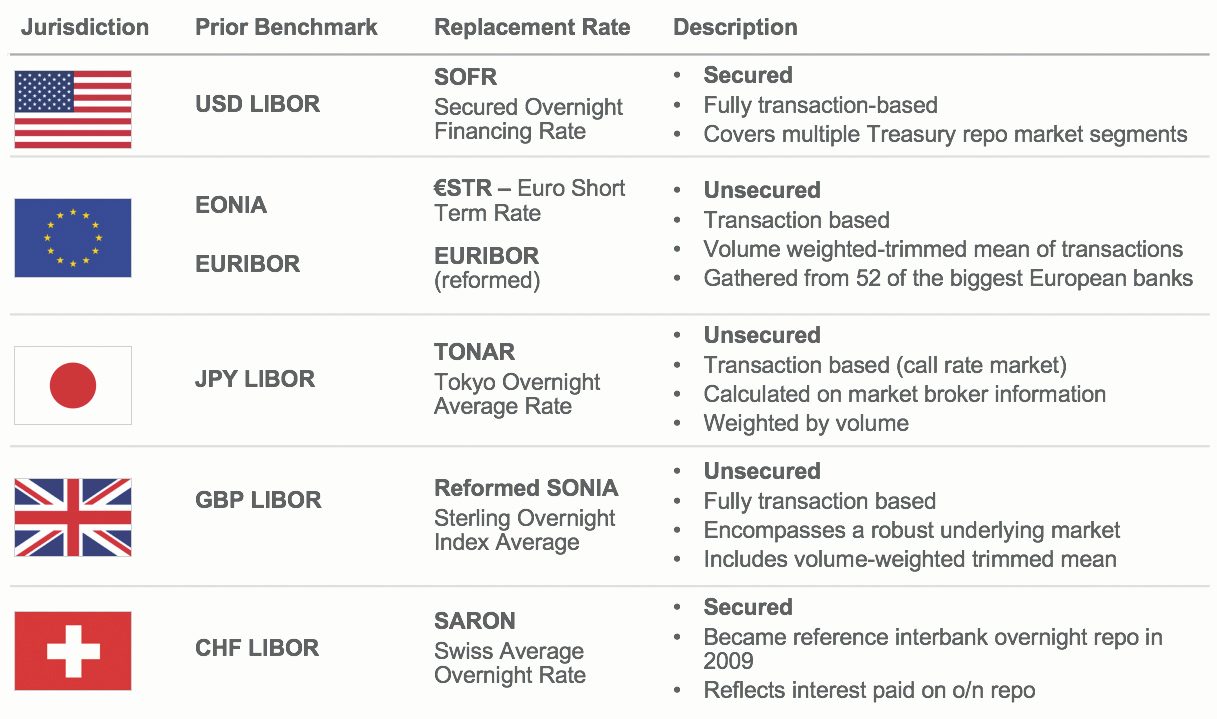

As alternatives to IBORs, the U.K., the European Union, Switzerland, Japan, and the U.S. have all developed alternative reference rates (ARRs). In recent months, they have started to make these available for use.

Source: BNY Mellon LIBOR Transition and Readiness Overview, December 2019

Source: BNY Mellon LIBOR Transition and Readiness Overview, December 2019

LIBOR Challenges for Debt Issuers

The discontinuation of LIBOR creates a critical situation for issuers. It is still referenced in at least US$864 billion of outstanding bonds due to mature beyond 20211. ARRs are now being published, but many existing transactions’ terms and conditions do not explicitly provide for the permanent discontinuation or severe malfunctioning of rates used for interest calculations (so called “benchmark events”). Using ARRs may have additional implications to the transaction’s terms and conditions, calculations and associated risks.

As a result, issuers and their advisors must carefully review existing terms and conditions to determine the way forward. Making changes to the relevant benchmark position will most likely require the solicitation of noteholder consent.

According to The Working Group on Sterling Risk-Free Rates, ensuring an efficient and methodical consent solicitation process is required to give investors sufficient time to review a proposed amendment. All parties to a consent solicitation should bear in mind the timing deadlines set out in the relevant bond documentation including, but not limited to, delivery of notices and consent solicitation documentation to investors.2

Three Point Plan for an Efficient Transition

For debt issuers with transactions that reference LIBOR or other IBORs, here is a three-point plan for an efficient transition:

- Work with their advisors to identify appropriate successor ARRs and any adjustment calculations, and then determine any necessary document amendments.

- Establish what level of consent is needed from noteholders to approve the proposed benchmark updates. While some issuers may already have robust fallback provisions built into their transactions, others will require consent from noteholders to make any changes required for the transitions to ARRs.

- Make a plan to ensure a smooth transition. In cases where noteholder approvals are required and where issuers must solicit consent, they will need to pass notifications to noteholders through the custody chain.

How Can We Help Navigate Consent Solicitation?

The consent solicitation process can be lengthy and complex. BNY Mellon can help navigate this process with efficient consent solicitation and tabulation agency services.

Via the main clearing systems, BNY Mellon:

- Communicates proposed changes to the terms of the transaction to noteholders and other required stakeholders

- Processes and tabulates votes

- Determines the count and/or percentage of noteholders agreeing to the changes

- Verifies that the number of votes meets the identified threshold for consent

- Communicates resultant changes via the clearing systems

- If needed, disburses required consent payments via clearing systems

Existing clients of BNY Mellon may not need to enter into any new additional documentation to conduct consent solicitations.

These services are a logical extension of our role as a Trustee and Paying Agent, acting as an intermediary between issuers and noteholders. We are a neutral, trusted and experienced party that can service a wide range of complex cross-border debt transactions.

EURIBOR, EONIA and €STR

The ECB began to publish €STR as an alternative rate on 2 October 2019.

- EURIBOR is expected to coexist with €STR.

- EURIBOR has been adapted to a calculation method based on real transactions wherever available.

- EURIBOR has effectively been transformed into a hybrid of an interbank rate and a risk-free rate.

- By contrast, EONIA will gradually be replaced by €STR.

- EONIA’s methodology has been linked to €STR and EMMI has announced that EONIA will be discontinued by end of 2021.

- Both EONIA and EURIBOR will use €STR as a fallback.

Source: This information is based on materials from the report by the working group on euro risk-free rates on €STR fallback arrangements, published by the ECB in November 2019.3

1https://www.icmagroup.org/assets/documents/Regulatory/Benchmark-reform/FINAL-ICMA-Banque-de-France-September-2019-CW-160919.pdf

2Progress on the Transition of LIBOR Referencing Legacy Bonds to SONIA By Way Of Consent Solicitation, January 2020.

https://www.bankofengland.co.uk/-/media/boe/files/markets/benchmarks/rfr/lessons-learned-from-recent-conversations-of-legacy-libor-contract

3https://www.ecb.europa.eu/pub/pdf/other/ecb.wgeurofr_eurostrfallbackarrangements~86a6efeb46.en.pdf

BNY Mellon is the corporate brand for The Bank of New York Mellon Corporation. Products and services referred to herein are provided by The Bank of New York Mellon Corporation and its subsidiaries. Content is provided for informational purposes only and is not intended to provide authoritative financial, legal, regulatory or other professional advice. No representations or warranties are made. These materials have been prepared solely for private circulation, and may not be reproduced or disseminated in any form without the express permission of BNY Mellon. For more disclosures, click here