At the same time, the UK pensions regulator has sharpened authorization requirements, thus increasing cost and risk for MTs. This dynamic landscape means that the MT market will likely face significant change in the coming years, fuelled by a desire to seize commercial opportunities, reduce costs and improve member outcomes.

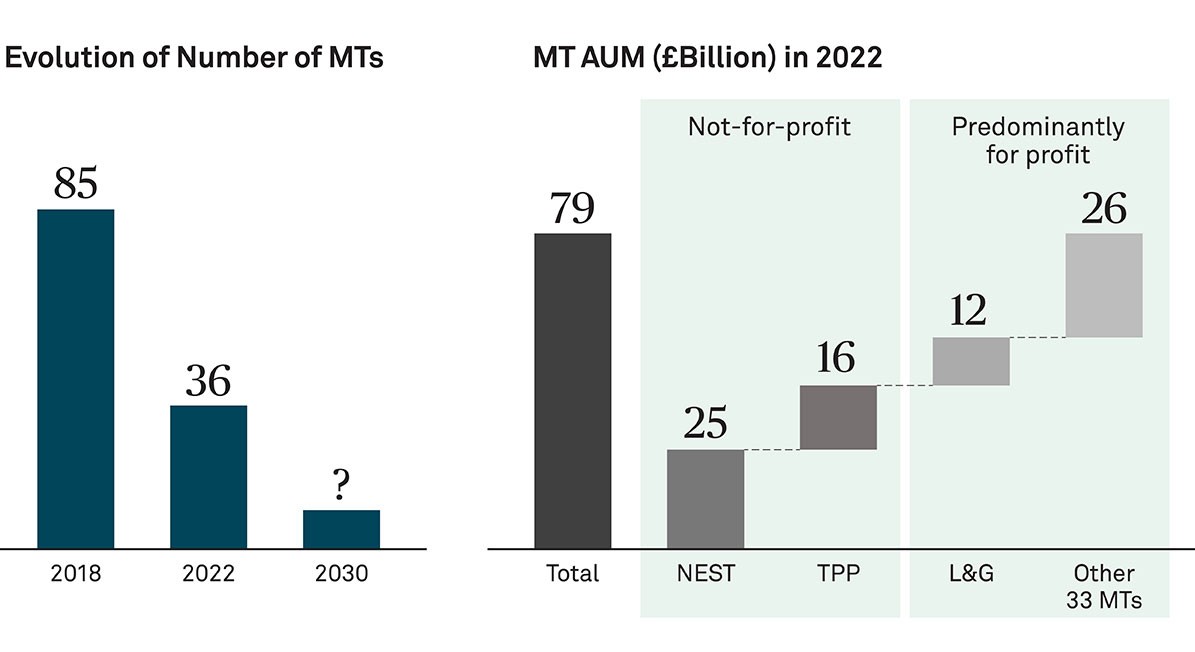

Today, there are 36 MT schemes of different shapes and sizes – two-thirds are set up by commercial providers, with the remainder being not-for-profit providers. Providers include investment managers (e.g., Aviva, Legal &General (L&G)), consultants (e.g., Mercer) and specialist MT providers (e.g., The National Employment Savings Trust (NEST), The People’s Pension (TPP), Now:Pensions). The MT market is currently dominated by two non-profit providers with the largest of those, NEST, now receiving monthly subscriptions in excess of £500 million.

Future consolidation in the MT market seems inevitable given the arguably sub-scale nature of many existing providers. Evolving member expectations, including sophisticated (responsible) investment choices and stronger (digital) member engagement, will add further pressure to reach a minimum viable scale.

In addition, the fast-growing asset pool and the commercial opportunity this presents could attract significant additional investment from commercial providers – the future MT landscape may well have a stronger for-profit focus.