China’s Capital Markets Outlook: Cautiously Positive

Real-Time Payments Case Study

December 2020

The outlook for China’s capital markets in 2021 remains positive thanks to recent reforms and the expected outperformance of China’s economy. However, investors will exercise greater caution too in light of recent volatility in China’s bond markets, tighter controls of technology companies and greater oversight on initial public offerings (IPOs). Externally, global growth concerns arising from the pandemic have eased as vaccine rollout begins. On the other hand, lack of improvement in China’s bilateral relationships, ranging from executive action in the U.S. and delays in the Sino-EU bilateral investment treaty, may also limit the scale of inbound investment.

Market reforms in China have been taking place for many years, as the government looks to internationalize the Renminbi and open domestic financial markets in a bid to boost foreign investment. The Chinese government further accelerated the pace of these reforms in 2020 to open up the country’s capital markets to foreign investors, easing market access and expanding investment scope. Most notable were the harmonization and deregulation of the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) rules, the introduction of more financial instruments available to foreign investors, and greater liberalization of the foreign exchange landscape.

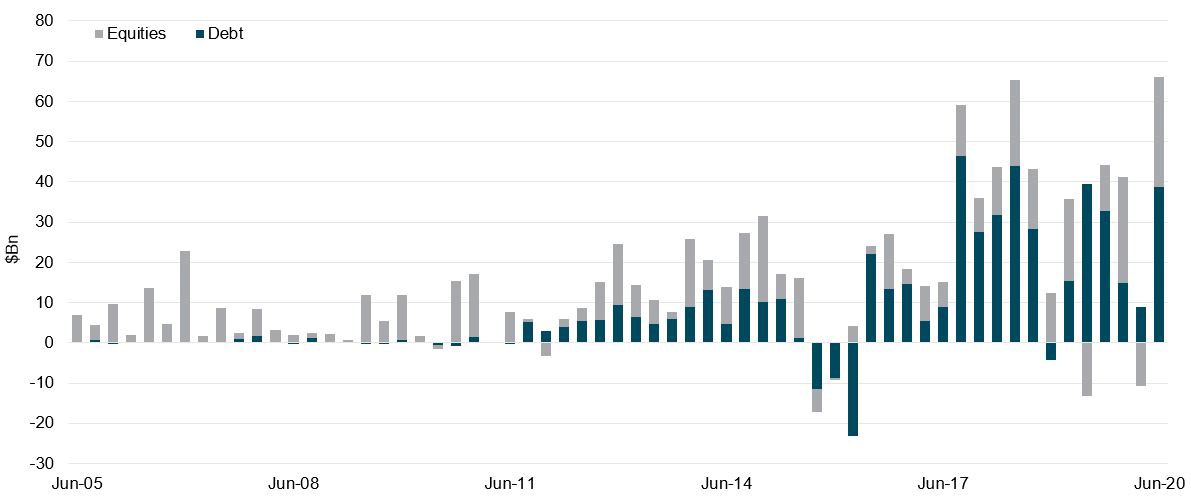

These measures are taking place amid the inclusion of Chinese equities and bonds into major global indices, creating a structural shift that may prompt global investors to think more strategically about their exposure to China. Figures on capital flows suggest that global investors are supportive of the reforms, with some US$65 billion inflows in the first half of 2020 versus US$62 billion during the same period last year, according to the State Administration of Foreign Exchange (SAFE). About three-quarters of the inflows in that period were into bonds, with a focus on Chinese government bonds, while the remaining quarter went into equities (See Figure 1). That breakdown should remain the same for the remainder of the year, according to market estimates. The run rate for capital inflows increased in the third quarter of 2020 and remained strong in the fourth quarter of 2020, pointing to cumulative year-end total inflows of US$120 billion to US$150 billion, possibly reaching even higher.

Figure 1: Capital Flows into China: Quarterly Net Incursion of Portfolio Liabilities

Source: State Administration of Foreign Exchange (SAFE), June 2020

Though it is hard to gauge the exact breakdown of where the inflows are coming from, U.S.- and Europe-based asset managers are likely to have dominated the flows, given their interest in Chinese assets. Based on BNY Mellon internal data, cumulative purchases of Chinese government bonds showed a material lift in the past few years, with a sharp increase in 2018 and an acceleration in 2020. Such increase happened independently of periods of risk aversion surrounding the pandemic, underscoring the overall demand from custody clients targeting Chinese government bonds.

Capital Markets’ Liberalization with More Simplification, Expansion and Clarification

The merging of QFII and RQFII schemes, collectively referred to as ‘Qualified Foreign Investor’ (QFI), among other regulatory changes, significantly improved access into China’s capital markets, with a focus on:

Simplification, Expansion and Clarification

Simplification of Qualified Foreign Investor (QFI) application process

- Reduced the approval time to 10 days from 20 days

- Removed investment quotas and provided more flexibility on the currencies for moving capital into China

- Eased capital and income repatriation

Expansion

- Abolished minimum investment requirements for local securities, expanding the pool of eligible investors

- Increased the available instruments and markets that investors could access, including private investment funds, asset-backed securities, assets traded at the National Equities Exchange and Quotations (NEEQ) market, among others

Clarification

- Provided clarity on issues related to client money account structures, clearly stipulating the permissible structures and also defining the beneficial owners under these structures

- Set out operational details under which situations non-trade transfers are permitted

Investors’ Voice: Focus on Flexibility of the Connect Schemes

The latest regulations already allowed foreign investors under the onshore schemes to access a wider range of instruments, but operating guidelines have not yet been issued. Many investors are now looking forward to seeing similar flexibility introduced to the Connect Schemes and increased liberalization in offshore markets.

IPOs in mainland China, for example, are not yet open through Stock Connect, so foreign investors wanting to buy into these listings need to go through the China onshore schemes. But there are limitations in terms of allocations and profit repatriation, preventing foreign investors from participating. Relaxations around such limitations would allow foreign investors to more easily access and participate in China IPOs.

Wider capital account liberalization will likely continue in an asymmetric manner. Although foreign inflows are highly welcome, domestic outbound flows will continue to face some restrictions, particularly during times of stress (such as episodes in February and March at the height of the global pandemic).

In the near term, given recent bond market gyrations in China, developments in the equity markets over IPOs, and increased oversight of technology and fintech companies, there probably needs to be a confidence-rebuilding exercise, with a more stable framework in sight to reassure market participants. On the external front, it remains to be seen whether Beijing will re-engage with Washington D.C. with the aim of lifting ownership restrictions on Chinese companies by U.S. investors.

In the short- and mid-term, China’s government plans to focus on technology innovation to help create jobs and keep the economy humming, and has made such plans a highlight in its most recent five-year plan. Much of this innovation may be funded through the capital markets, with new stock listings and bond offerings, so the outlook for China’s capital markets remains cautiously positive.

This article is based on a discussion shared by Kinson Tong, Director of Global Portfolio Services APAC at Invesco, Geoffrey Yu, Senior EMEA Market Strategist at BNY Mellon Markets and Magdalene Tay, Custody Product Manager of Asset Servicing APAC at BNY Mellon, at the webcast ‘China’s Capital Markets: Look Back and Look Ahead’ on November 18, 2020.

The views expressed herein may not reflect the views of BNY Mellon. This does not constitute legal, tax, accounting, investment, financial or other professional advice on any matter and does not constitute a recommendation by BNY Mellon of any kind.