Aerial View: 2021 Macro Themes

Behind the mask: Markets in the post-vaccine world

2021 Macro Themes

Behind the mask: Markets in the post-vaccine world

December 2020

By Daniel Tenengauzer, John Velis, John Arabadjis and Geoff Yu

In our year ahead outlook, we investigate trends set to prevail after a COVID-19 vaccine is introduced. Our working assumption is that vaccinations will likely begin in April 2021.

2021: Trade War on Steroids

Productivity growth is the main challenge in the coming year

The two most important topics discussed in our 2020 Themes were the trade war and EU ESG-fueled fiscal injection. Both will likely mutate but persevere amid our six prevailing themes for 2021:

- 1: The US in a Post-Vaccine World – With the US labor force under great pressure, we expect recovery to be slow as a supply-constrained economy experiences bottlenecks. Lower productivity is priced through deeply negative real interest rates.

- 2: Eurozone Fiscal Ghosts – The eurozone’s response to the pandemic has slowly but surely taken a pro-growth and investment direction. The NGEU recovery plan, supported by EU-issued bonds, is a sign that the ghosts of austerity may have been laid to rest. European reflation may finally have a chance.

- 3: Circulating Around China’s Center – The 14th Five-Year Plan has established a 15-year strategy to achieve self-reliance. Inflows will still be welcome, but China’s growth plans are for its own ends, and reciprocation to reflate the world is not a priority.

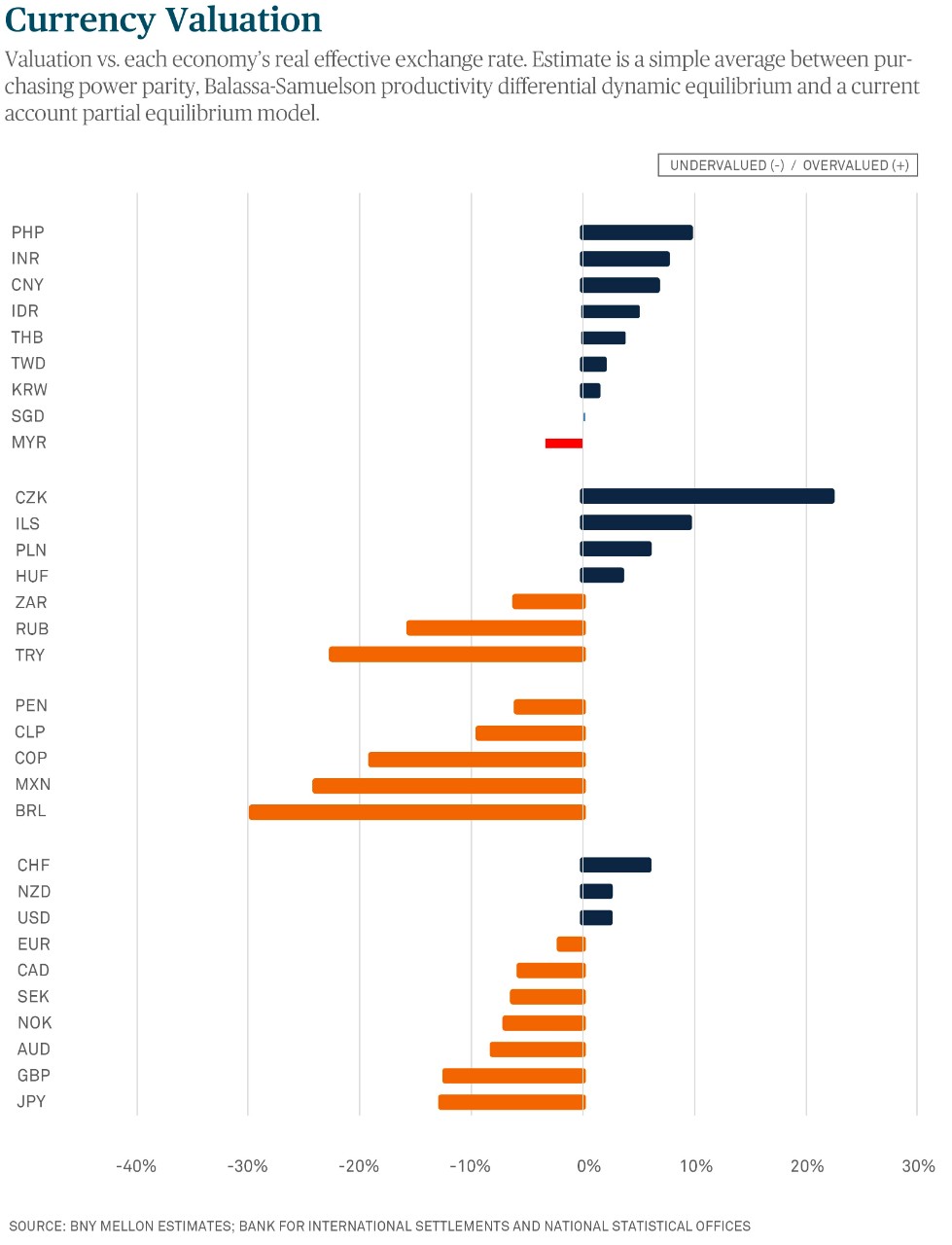

- 4: Emerging or Submerging – We find significant undervaluation in AUD, GBP, JPY, CAD, TRY, RUB, BRL and MXN. Fiscal room and vaccination should be more important, however, supporting China, Mexico, Russia and the euro area.

- 5: Duration Spoilers – Bond volatility is at rock bottom, but risks to long duration positions loom as the economy recovers with the delivery of a vaccine. The Fed might have to move to some form of yield curve control and financial repression.

- 6: The iFlow Show – Our positioning and holdings framework show broad desire to sell the USD and buy international equities. Positioning is close to neutral.

1: The US in a Post-Vaccine World

Who gets left behind?

Official and consensus forecasts for GDP growth had always assumed a vaccine at some point in 2021, with y/y growth expected to be 3.8%. We don’t agree with the trajectory of the forecasts, which is for a relatively steady ascent from here on out. We are more concerned with the coming couple of quarters, during which COVID-19 will slow the economy until the vaccine becomes effective.

Over the longer term, deeper scars in the real economy will linger, subduing the growth rate, increasing inflationary pressures and crimping the jobs recovery. The number of long-term unemployed is increasing monthly, and there are still nearly 13 million people receiving pandemic-related unemployment insurance, which expires at the end of December.

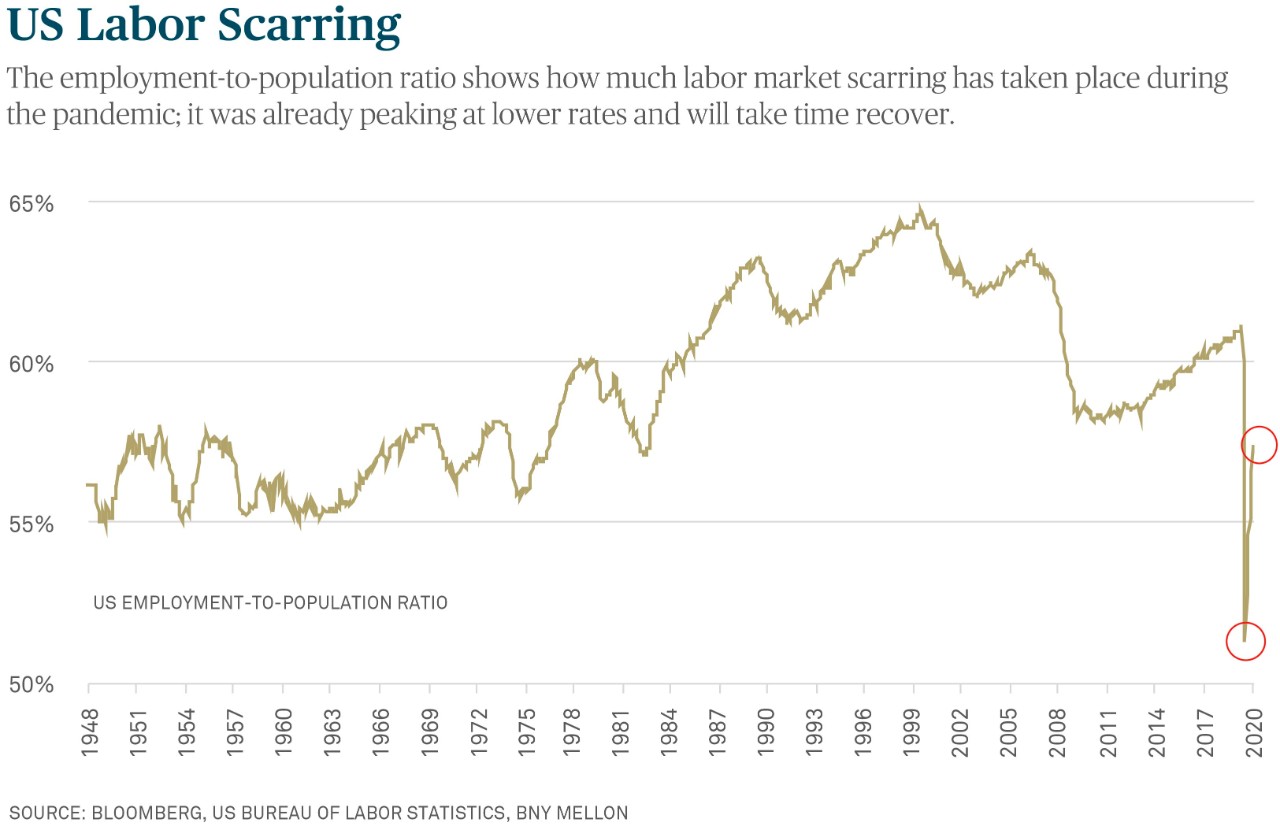

The employment-to-population ratio, shown above, rivals 1970s levels. In the midst of the pandemic it was at postwar lows. Currently, labor force participation is stubbornly low as well. A slow labor force recovery will drag on growth for several years.

Furthermore, the US policy response was more geared to income support than economy and less focused on providing loans, contingent guarantees and equity, as was the case in Europe. A zombie labor force might not find zombie companies at which to work. This fear can be seen in real interest rates, which are pricing in a long-run outlook with lower productivity.

Even though the transition to a post-vaccine economy will ultimately lead to reflation, there is still need for income support. Data from Opportunity Insights suggests that low-income household spending is up 1.6% even as low-wage employment is down -19.8%, and this is before the ending of the pandemic-related unemployment insurance programs.

The policy response is at risk of being constrained by a weak Biden presidency with the likelihood of a Republican Senate, pending the outcome of the January 5, 2021, runoff elections in Georgia.

2: Eurozone Fiscal Ghosts

NGEU seeks to avoid repeat of sovereign debt crisis response

The marathon July European Union summit led to the announcement of a groundbreaking fiscal rescue package worth up to 5% of the bloc’s 2019 GDP. Notwithstanding some last-minute objections relating to rule-of-law clauses by Poland and Hungary, we still fully expect the package’s deployment according to schedule: 70% of the total to be spent over the next two years, using funds raised directly by the EU and guaranteed by EU members. On top of the multi-year European budget, the plans are the strongest in place within the major economies. Supported by a “recalibration” of ECB stimulus in December, these combined efforts are crucial to our expectations of the EU and eurozone economy recovering strongly next year. This also implies that the euro is one of our favored vehicles to express a view on global reflation.

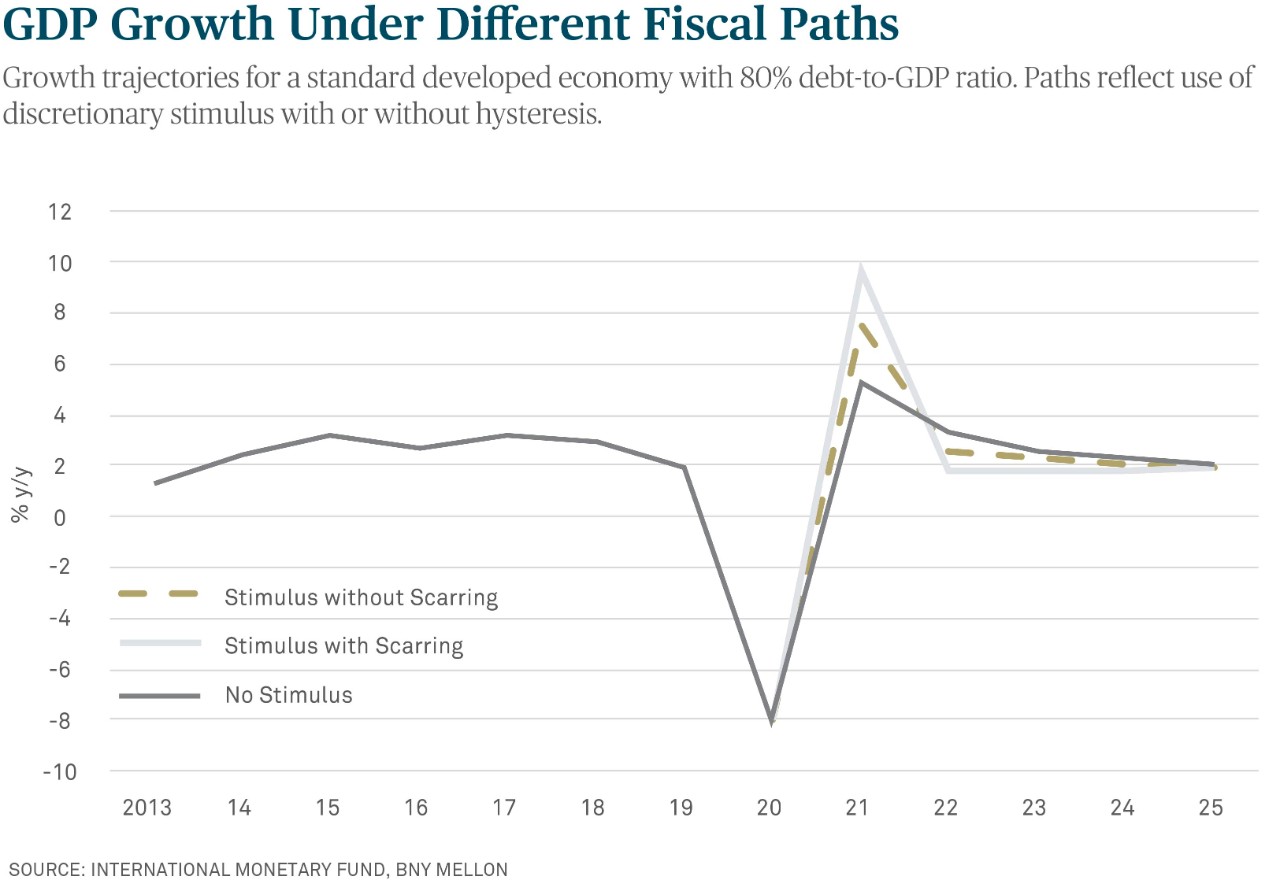

2021 may also be the year the eurozone closes its growth and inflation credibility gap and lays the fiscal ghosts of the sovereign debt crisis to rest. Firstly, while eurozone political leaders have stressed that the Next Generation EU (NGEU) rescue plan is not the first step toward fiscal union, debt mutualization is no longer taboo. Secondly, the orthodoxy of the previous decade during which austerity was required in exchange for assistance, has been cast aside. No longer will countries that receive large loan disbursements face a monitoring “troika” to ensure compliance is met. Even the International Monetary Fund (IMF) – a previous troika member – has abandoned this approach. As its own modelling shows (see chart above), discretionary fiscal stimulus can generate the strongest boost for an economy facing economic scarring, which has been the case globally. Crucially, the study shows that the primary fiscal balance by 2025 for a standard developed economy with stimulus will converge to the same level as one without, while generating higher growth over the same period.

The eurozone core has long faced calls for fiscal expansion to fill the demand gap to generate growth. Nearly a decade after the haphazard response to the sovereign debt crisis, market and political conditions may change further. Should Angela Merkel’s potential successors all position themselves in favor of stimulus, it will be a final confirmation that a new pro-growth orthodoxy has emerged in Europe.

3: Circulating Around China’s Center

Beijing to aim for a strong start to “internal circulation”

After a tumultuous 2020, maintaining stability will be the guiding principle for China across every aspect of society and economic policy. After all, the “six stabilities” remain a part of governance doctrine and have served the country well through a difficult period, especially amidst a collapse in external demand. The top priority for stability, as always, is the labor market: despite a faster return to normal domestic conditions, it is doubtful that China has not faced the economic scarring seen globally. As a result, fiscal policies will likely stay expansionary through 2021.

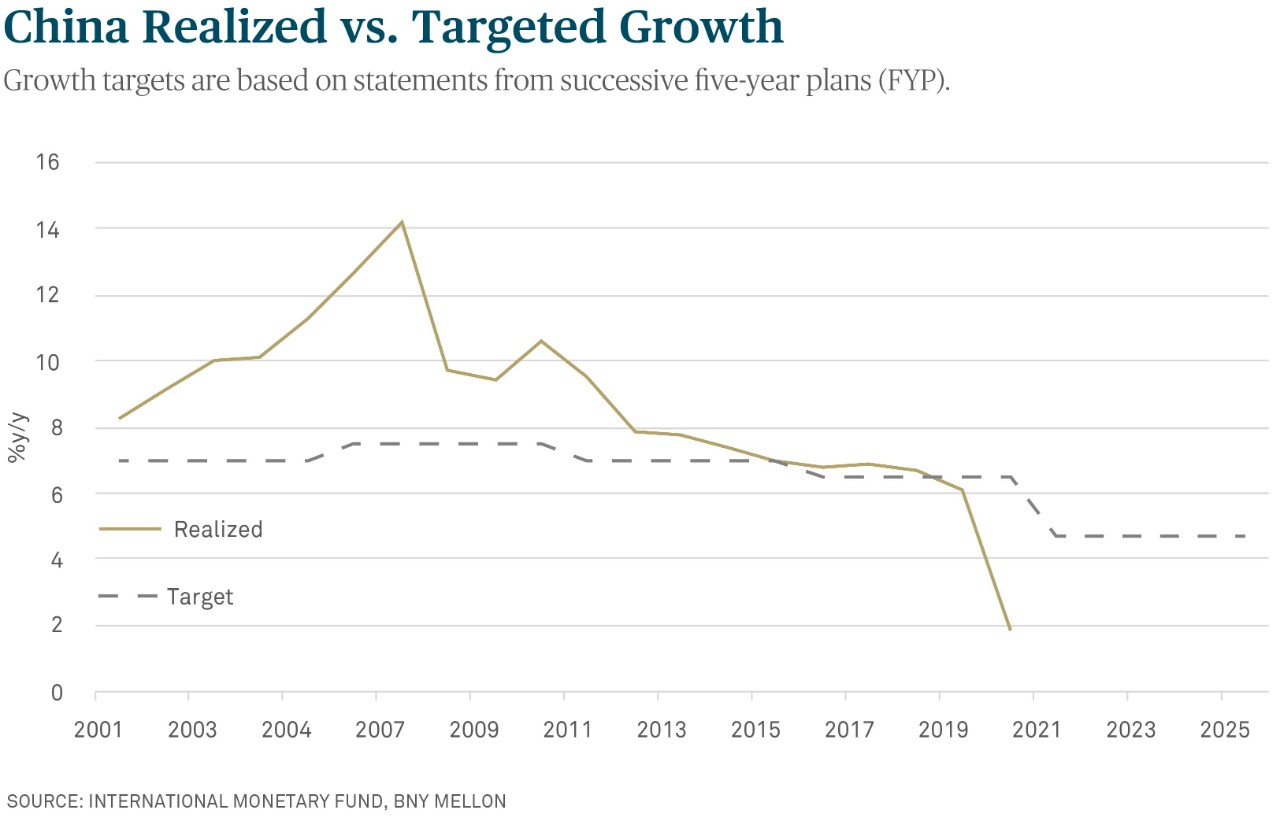

Taking the long-term view, stability itself is not enough. During the launch of the 14th Five-Year Plan (FYP), President Xi laid out an additional goal of doubling GDP over the next 15 years. Conveniently, this has given central and local planners a growth target of 4.7%, which may not be as easy to achieve as in the past given the current growth headwinds from external demand and domestic debt. This is before further demographic deterioration comes into the fray: the decennial census results will be one of the most closely watched releases from China in 2021.

China knows that the long-term economic constraints mean much of the growth needed to get to the 15-year target needs to be front-loaded. As such, the risk to growth numbers in the near future are clearly to the upside. Irrespective of political changes in the US or elsewhere, self-reliance is now the guiding principle for domestic growth, and we expect a redoubling of efforts and initiatives to balance the economy. If “internal circulation” (domestic demand-driven growth) is to work for the long haul, proof of concept can only come from a strong start to the process in 2021. Whether the self-centered growth lift helps the rest of the world matters little for Beijing, though any growth multiplier effect and associated investment inflows remain welcome: tolerance for renminbi strength will probably last a little longer, as long as the domestic economy and balance of payments are supportive.

The year ahead is not risk-free for China. Recalibrating relations with the US and the world always brings intrinsic risks, and ongoing external supply chain restrictions will hinder plans for accelerated innovation. Domestically, credit and debt problems remain, and regulators are calling for greater vigilance in the real estate and fintech sectors.

4: Emerging or Submerging

Valuation alone will not cut it for emerging markets

According to our framework (see chart below), the USD remains 3.1% overvalued. This follows a peak overvaluation observed during the Great Lockdown at 9.3%. Along with USD overvaluation, among the most liquid currencies we find the CHF to be 5.5% overvalued and the CNY to be 5.8% overvalued.

By region, central eastern European currencies, ILS and SAR are overvalued. Despite bond and equity inflows into Asian economies these currencies are closer to those fair-valued within the EM universe. We have observed relentless CGB buying through the year. The only undervalued currencies in Asia are MYR and HKD.

Heading into 2021, we find several noteworthy misalignments in FX markets – within LatAm and EMEA, RUB, TRY, BRL, MXN and to a lesser extent ZAR and CLP. Even more interestingly, many G10 currencies seem attractive: GBP remains undervalued on idiosyncratic news out of the EU departure process, while AUD, NOK, JPY and CAD all seem undervalued.

We believe that fiscal policy will be the most important factor defining currency behavior next year, beginning with the vaccination process, which we documented here. The distribution of national vaccination mandates varies from no mandates whatsoever in the US and Canada to, at the other end of the spectrum, most LatAm and European economies, India and Australia, where vaccination refusal would imply penalties (n=62). LatAm, India and Australia would therefore outperform.

Fiscal policy is diverging two ways. First, Anglo-Saxon economies have been more aggressive with regard to additional spending and have forgone revenue to support household income. Europe has been more aggressive in providing loans, contingent guarantees and equity. Second, the overall amount of fiscal support released as a share of GDP has been larger in G10 (15-25%) than in EM (5-10%).

Using simple z-scores, we find that within G10, UK, Sweden, the eurozone and Norway have the most room to ease. In EM, China, Taiwan, Mexico, Russia and Poland have the most easing capacity.

5: Duration Spoilers

Bond volatility moribund ahead of long-end tantrum

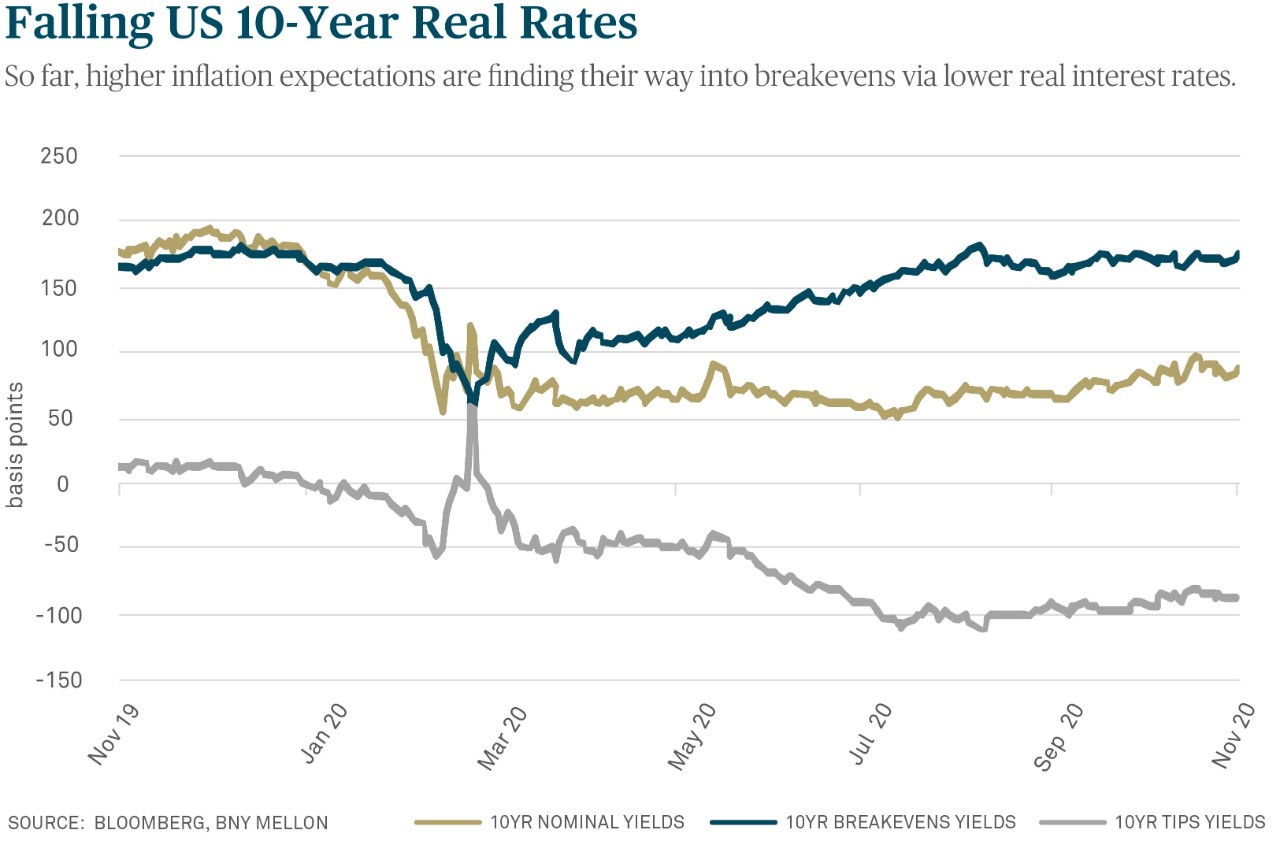

The reflation trade is gaining steam, looking through short-term weakness and pricing in a post-vaccine return to “normal”. The exception is in the US Treasury market, where 10-year bond yields remain below 1%. Bond volatility is at its all-time low, even lower (in a relative sense) than equity and FX vols.

Yet, as we wrote in section one of this document, we expect the US to be operating with significant bottlenecks going forward, the result of the reallocation shock across the economy. The labor force will take time to regain employment, yet reflation will take hold in a supply-constrained economy.

Looking ahead, consensus forecasts for US PCE inflation is for it to finish 2020 at 1.4%, rising to nearly 2% next year, with an intra-year high of 2.6%. WTI is now trading above levels (c. $45 p.b.) last seen in March. The copper-gold ratio is now at levels that imply much higher long bond yields.

So far the expected inflation pressures have pushed real rates lower, more so than pushing nominal yields higher. However, the term premium is increasing, and the reflation priced into other markets should begin to price itself into inflation breakevens (BEs) – 5y5y BEs are at just 1.8%, well below their highs of around 2.3% in 2018. Would the Fed be content to see an additional 50bps of inflation risk priced into nominal rates? We think so, as long as it didn’t lead to materially tighter financial conditions.

At what level of yields would equities and other risky assets begin to succumb to valuation pressures? Currently, the S&P’s earnings yield is 2.8x that of US IG credit, about as high a spread as seen on the eve of the 2013 Taper Tantrum.

In our base case of Republican control of the Senate, we would see a modest fiscal package less than 5% of US GDP. But, if the Democrats were to win both seats in Georgia, we could see as much as $2 trillion in spending. Such issuance, an additional 10% of GDP (approximately), could certainly upend the curve further.

In the 1940s, the Fed targeted rates pegging an upward sloping curve. This forced the Fed to purchase excess Treasury issuance not taken up by the market. Such financial repression allowed the US to increase its wartime debt, and a form of it might be on the agenda now, as otherwise, duration spoilers loom next year.

6: The iFlow Show

Buying hesitation

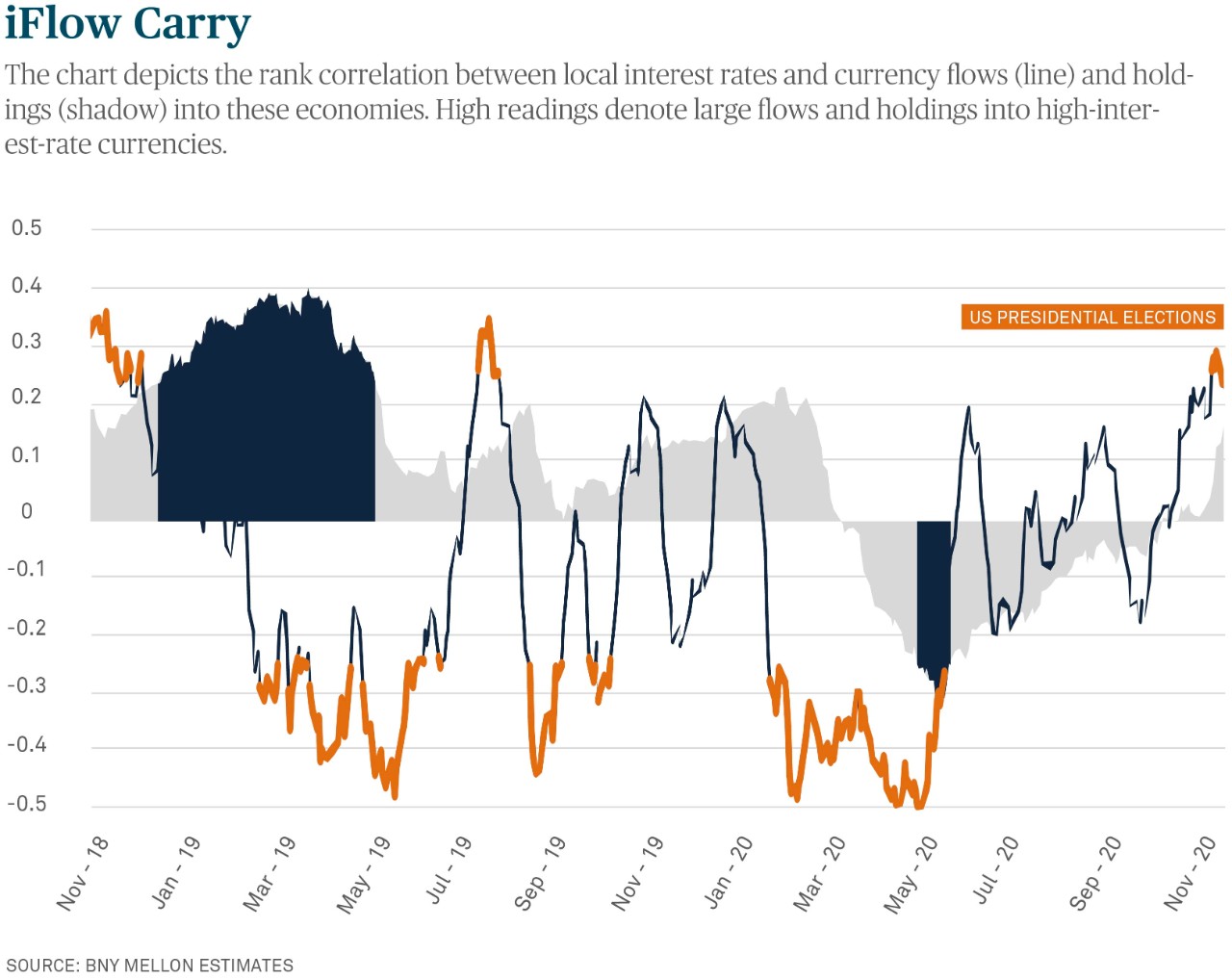

Heading into the US elections, we closely watched our iFlow Carry indicator. In the chart below, we present the rank correlation between local interest rates and currency flows (line) and holdings (shadow) into these economies. High readings denote large flows and holdings into high-interest-rate currencies. We update this daily in our iFlow Monitor.

In early May, iFlow Carry was significantly negative in both flows and holdings. Investors were selling high yield, and holdings were extremely underweight. Since then the trend has been overall benign. Following the US presidential election flows picked up and holdings turned marginally positive for the first time since the Great Lockdown. Nevertheless, overall, investors remain extraordinarily cautious.

The reason holdings in carry currencies have not been rising as quickly is because investors remain exposed in a variety of currencies irrespective of their yields. As shown in a previous theme, the EUR and CNY have been the best performers in the past year, despite EUR negative interest rates.

In iFlow Chart we present a weekly update of each economy’s FX, equity and bond flow and holdings. We find large long holdings in CHF, GBP, JPY, BRL, MXN, CZK, HUF, ILS, PLN, IDR, INR and SGD. On the short side of FX holdings are COP, PEN, RUB, TRY, PHP and THB.

The combination of (under) holdings and (in) flow in iFlow Cloud support long exposures in CNY, THB, NZD, COP, CLP, ZAR and TRY. Short positions in currencies (over) held with (out) flows would be CHF, JPY and TWD.

The large number of long exposures emanating from our flow and holdings framework overwhelms the shorts. This is in line with a clear signal out of iFlow Hedge showing investors are hedging FX exposure in their equity portfolios in the US. Even though the bias has been toward buying US equities for over a month, investors are also selling USD along these positions. .

The other main additional exposure prevailing across iFlow is a relentless trend to sell US Treasuries and buy US corporate debt. Fed policies since the Great Lockdown are likely the key catalyst for this behavior.

Otherwise, in equities we are seeing unequivocal demand for international stocks in the UK, Europe and its periphery. These are on top of Brazil, China and India equity longs.

Questions or Comments?

Write to Daniel Tenengauzer or reach out to your usual relationship manager. (link name, do not post email link)