Inclusion of China A in MSCI

What it Means for Investors

Inclusion of China A in MSCI

What it Means for Investors

June 2019

By Magdalene Tay

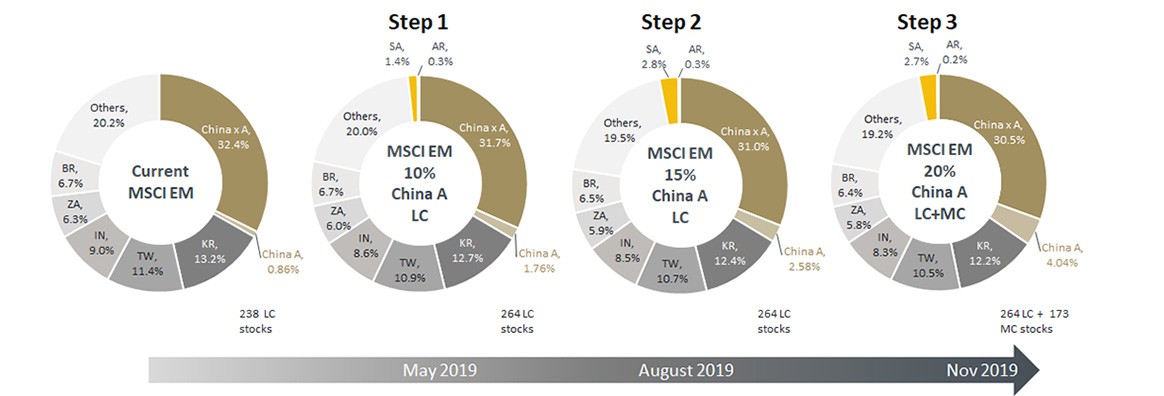

In another important milestone for China and a key development for global investors, MSCI will quadruple the weighting of China A shares in its Emerging Markets (EM) Index this year. It has already completed the first of three increases in May 2019, taking the inclusion factor of China A Large Cap equities from 5% to 10%, with further rises to 15% and 20% planned for later in the year.

Equity Allocations

These changes mean that investors will have to reassess their China equity allocations. By the end of 2019, China A shares will have a weighting of approximately 4% in the pro forma MSCI Emerging Markets Index, up from 1% at the beginning of 2019, and become too large to ignore (Figure 1).

Figure 1: Pro-Forma Weight in MSCI EM Index

Source: MSCI

Note: LC = Large Cap shares; MC = Mid Cap shares; KR = South Korea; TW = Taiwan; IN = India; BR = Brazil; SA = Saudi Arabia; AR = Argentina; ZA = South Africa; China x A = Chinese equities excluding A Shares (including B shares, H shares, Red Chip, P Chip, and other overseas Chinese equities).

Data as of April 17, 2019. May 2019 SAIR Update: 26 China A shares (18 ChiNext) will be added to the pro forma MSCI China Index and the inclusion factor will be increased for 238 securities from 0.05 to 0.10. This will lead to a weight of 5.25% and 1.76% in the pro forma MSCI China and MSCI EM Indexes, respectively.

MSCI is also adding Mid Cap shares to its indexes in November 2019. By that time, the MSCI EM Index, based on proforma, will include 253 Large Cap China A shares and 168 Mid Cap shares, including 27 ChiNext stocks, with a 20% inclusion factor. MSCI estimates that full inclusion will result in China A shares representing 43% of the MSCI EM Index, with half of the stocks on the Index being onshore or offshore Chinese listings.

Zhen Wei, Executive Director and Head of China Research, MSCI, explained that the benchmark index change has important implications because most investors are currently under-weighted in China equities – even against the current Emerging Markets benchmark index.

“China shares already account for 30% of the MSCI EM Index, but many mutual funds’ allocation to China were below 25% at the end of 2018”, he revealed at the BNY Mellon Asset Servicing webcast on 29 May.

According to Mr. Zhen, China is under-represented in the global and emerging equity market opportunity set. For example, China accounts for around 4% of global equity market capitalization weight, whereas the US is 55%. Breaking down the same opportunity set via the MSCI ACWI Index, around 16% of global cash flow or revenue is generated by Chinese companies and only 29% by US companies. Furthermore, China is expected to contribute more than 20% of global GDP within five years, rivalling the historical dominance of the U.S.

This disparity shows us that investors are still underprepared to bridge the gap between China’s market representation and the fundamental reality of its contribution from a cash flow and GDP perspective.

Investor Strategies

“A minority of investors want to delay incorporating China A shares into their allocations because they are ill-prepared and unfamiliar with the market. Others are responding passively by following the index evolution. However, the majority are seeking to correct their positioning by bringing their China weight on par with the equity benchmark” said Mr. Zhen.

Benchmark-sensitive investors are embracing the integrated benchmark universe by regarding China as part of the broader opportunity set. Some have adopted the EM Index with full China inclusion, while others are applying a revenue weight or GDP weight to reflect the market’s economic significance.

“Investors that are less benchmark sensitive may want to treat China as a separate equity segment like the US”, Mr. Zhen explained. When the choice is between an integrated EM strategy with China or a dedicated China strategy, some investors choose a dedicated strategy because their EM managers may be less ready in managing China A shares. However, reconfiguring the EM sleeve into two allocations – one China and one EM excluding China – remains problematic and restrictive, as most managers may find it difficult to manage an EM universe without any Chinese equities.

Market Challenges

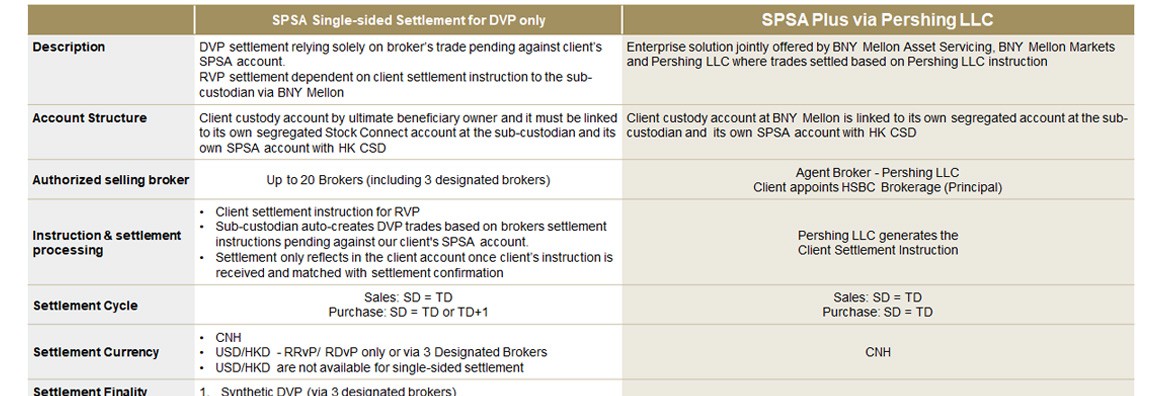

In general, foreign investors appreciate China’s efforts to make its capital market more accessible, but some accessibility issues remain (Figure 2).

Figure 2: China Access Schemes – Key Market Nuances

Chief among them is the short settlement cycle for China A shares, which requires trades to be cleared and settled according to onshore market rules, where security settlement takes place on Trade Date (TD) and money settlement on TD+1. With other MSCI EM Index constituent markets operating on a TD+2 or TD+3 settlement cycle, this disconnect causes operational friction and creates problems from an index tracking perspective.

“The short settlement cycle creates operational challenge as the post trade settlement processing timeframe is short and may lead to risk of settlement failure. This is a particular concern for foreign investors without presence in Asia, as they cannot easily meet the market cut-off time,” said Magdalene Tay, Custody Product Manager, Asia Pacific, Asset Servicing, BNY Mellon.

To support such foreign investors without presence in Asia, BNY Mellon has two Stock Connect service models (Figure 3). The first allows single-sided settlement for delivery versus payment (DvP), with auto-created instructions based on broker details received from the central depository. In the case of purchase transactions, settlement is based upon instruction from the client who generally made prior arrangement with their broker to settle on TD+1 basis. This gives client sufficient time to instruct and fund their transactions.

The other service model is SPSA Plus Pershing, which builds on the Hong Kong Stock Exchange’s Special Segregated Accounts model, with Pershing LLC acting as an agency broker for foreign investors. It provides a seamless, end-to-end process from trade execution to custody, with settlement finality on Trade-Date without requiring client instruction.

“Importantly, SPSA Plus Pershing allows foreign investors to tap into China A-shares via Stock Connect during their time zone,” Ms. Tay noted.

Figure 3. BNY Mellon SPSA Stock Connect Service Models

Notes – SPSA= Special Segregated Account; TD = Trade Date; SD = Settlement Date; 3 Designated Brokers – HSBC Broker, CLSA = Credit Lyonnais SA, CS = Credit Suisse.

*On SD if broker and its cash correspondent bank participate in end of day ‘extra-cash’ clearing window and has its cash account funded.

Brokerage service(s) are not provided or endorsed by BNY Mellon Asset Servicing and BNY Mellon Asset Servicing does not take responsibility for brokerage or other services provided by Pershing LLC or any other broker (including HSBC Brokerage). Please note that Pershing LLC is part of BNY Mellon..

Future Landscape

China’s ongoing efforts to enhance market accessibility for foreign investors are key to its agenda on financial markets reforms.

“Among key upgrades investors have asked for, many would like to be given access to a listed futures market and other derivatives products to enhance risk management as they scale their portfolios with higher inclusion ratios”, said Mr. Zhen.

The misalignment between offshore and onshore trading holidays also needs to be addressed, and the introduction of an omnibus trading account, that is an account which allows local brokerages to combine individual investors’ trading accounts, would be welcomed by large fund managers and broker dealers for greater efficiency and lower cost.

Further reforms would pave the way for more positive investor feedback and an accelerated path towards full inclusion of onshore securities in global indices. This is particularly important at the current juncture, when China faces domestic pressures from its economic rebalancing and escalating trade tensions with the US.

The views expressed herein include external speaker and may not reflect the views of BNY Mellon. This does not constitute legal, tax, accounting, investment, financial or other professional advice on any matter and does not constitute a recommendation by BNY Mellon of any kind.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names in various countries by duly authorised and regulated subsidiaries, affiliates, and joint ventures of BNY Mellon, which may include any of the following. The Bank of New York Mellon, at 240 Greenwich Street, NY, NY 10286 USA, a banking corporation organised pursuant to the laws of the State of New York, and operating in England through its branch at One Canada Square, London E14 5AL, registered in England and Wales with numbers FC005522 and BR000818. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon, London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at 46 Rue Montoyerstraat, B-1000 Brussels, authorised and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, a subsidiary of The Bank of New York Mellon, and operating in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, registered in England and Wales with numbers FC029379 and BR014361. The Bank of New York Mellon SA/NV (London Branch) is authorised by the ECB and subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority. Details about the extent of our regulation by the Financial Conduct Authority and Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, operating in Ireland through its branch at Riverside 2, Sir John Rogerson’s Quay, Grand Canal Dock, Dublin 2, D02 KV60, Ireland, trading as The Bank of New York Mellon SA/NV, Dublin Branch, which is authorized by the ECB, regulated by the Central Bank of Ireland for conduct of business rules and registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. The Bank of New York Mellon SA/NV is trading in Germany as The Bank of New York Mellon SA/NV, Asset Servicing, Niederlassung Frankfurt am Main, and has its registered office at MesseTurm, Friedrich-Ebert-Anlage 49, 60327 Frankfurt am Main, Germany. It is subject to limited additional regulation by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, Marie-Curie-Str. 24-28, 60439 Frankfurt, Germany) under registration number 122721. The Bank of New York Mellon (International) Limited is registered in England & Wales with Company No. 03236121 with its Registered Office at One Canada Square, London E14 5AL. The Bank of New York Mellon (International) Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. If this material is distributed in or from, the Dubai International Financial Centre (DIFC), it is communicated by The Bank of New York Mellon, DIFC Branch, (the “DIFC Branch”) on behalf of BNY Mellon (as defined above). This material is intended for Professional Clients and Market Counterparties only and no other person should act upon it. The DIFC Branch is regulated by the DFSA and is located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE.

BNY Mellon also includes The Bank of New York Mellon which has various subsidiaries, affiliates, branches and representative offices in the Asia-Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction. Details about the extent of our regulation and applicable regulators in the Asia-Pacific Region are available from us on request. Not all products and services are offered in all countries. In Asia-Pacific, The Bank of New York Mellon, Singapore Branch is subject to regulation by the Monetary Authority of Singapore. The Bank of New York Mellon, Hong Kong Branch is subject to regulation by the Hong Kong Monetary Authority and the Securities & Futures Commission of Hong Kong. BNY Mellon in Australia is subject to regulation by the Australian Prudential Regulation Authority and is exempt from holding an Australian Financial Services License and is regulated by the New York State Department of Financial Services under the New York Banking Law which is different from Australian law. This document is issued or distributed in Australia by The Bank of New York Mellon, on behalf of BNY Mellon Australia Pty Ltd (ACN 113 947 309) located at Level 2, 1 Bligh Street, Sydney NSW 2000, and relates to products and services of BNY Mellon Australia Pty Ltd or one of its subsidiaries. BNY Mellon Australia Pty Ltd is ultimately wholly owned by The Bank of New York Mellon Corporation. The Bank of New York Mellon does not provide this product or service. None of BNY Mellon Australia Pty Ltd or its subsidiaries is an authorized deposit-taking institution and the obligations of BNY Mellon Australia Pty Ltd or its subsidiaries do not represent investments, deposits or other liabilities of The Bank of New York Mellon. Neither The Bank of New York Mellon nor any of its related entities stands behind or guarantees obligations of BNY Mellon Australia Pty Ltd.

The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. The contents may not be comprehensive or up-to-date, and BNY Mellon will not be responsible for updating any information contained within this document. If distributed in the UK or EMEA, this document is a financial promotion. This document and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. Similarly, this document may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorised, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this document in their jurisdiction. The information contained in this document is for use by wholesale clients only and is not to be relied upon by retail clients. Trademarks, service marks and logos belong to their respective owners. BNY Mellon assumes no liability whatsoever for any action taken in reliance on the information contained in this material, or for direct or indirect damages or losses resulting from use of this material, its content, or services. Any unauthorised use of material contained herein is at the user’s own risk. Reproduction, distribution, republication and retransmission of material contained herein is prohibited without the prior consent of BNY Mellon.

© 2019 The Bank of New York Mellon Corporation. All rights reserved.