Environmental, Social and Governance – Reality or Utopia?

Expert Insights from Asset Servicing Live Webcast Series

Environmental, Social and Governance – Reality or Utopia?

Expert Insights from Asset Servicing Live Webcast Series

October 2018

Insights on how Environmental, Social and Governance (ESG) investing relates to traditional risk and return objectives.

There is a longstanding perception that ESG-focused investment principles are only beneficial for promoting social good. However, with the emergence of machine learning and other technologies that help to extract insights from big data sets, among other factors, the influence of ESG on investment decisions has grown significantly in recent years.

BNY Mellon hosted a live audio webcast titled "ESG – Reality or Utopia?" in August, where Frances Barney, Head of Global Risk Solutions and Asset Owner (Americas), BNY Mellon and Dominic Godman, Partner and Head of Singapore, Arabesque1 shared their insights on how ESG investing relates to traditional risk and return objectives. They explored the integration of ESG factors into traditional investing approaches, investment products and strategies as well as investment stewardship.

The ESG Market is Maturing

While sustainable investment practices have been around for a long time; until recently, investment managers’ decisions made were heavily influenced by moral factors. Notably, ESG has evolved from negative exclusion to positive inclusion. The investment managers’ mindset has transformed from eliminating investments in businesses connected with sensitive issues such as gambling or tobacco to those that are geared towards responsible investing that can generate better returns for investors and greater social good.

Interestingly, academic studies have shown that there is a strong correlation between ESG scoring models and financial performance of listed companies. Listed companies who have incorporated ESG factors into their governance presented stronger financial performance over time. According to a 2015 review (Freide, Busch & Bassen2), over 60% of 2000+ academic studies has showed a positive correlation (while only 8% showing a negative correlation).

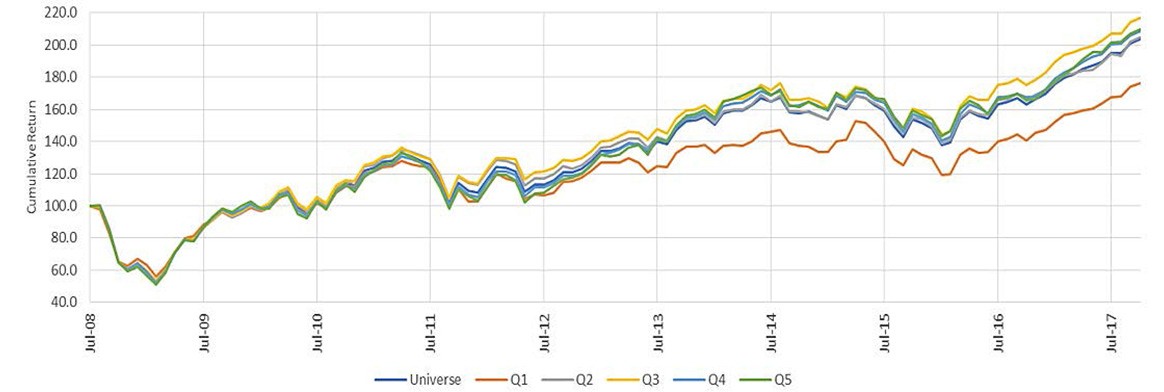

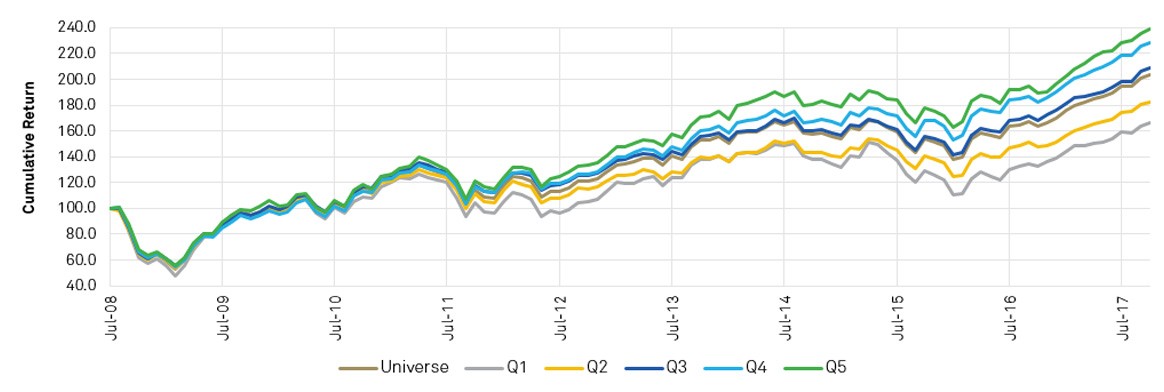

According to insights from Arabesque’s S-RayTM ESG tool, companies that score well within its model significantly outperform others in the stock market. Between 2008 and 2017, the top 20% of the companies tracked outperformed the bottom 20% in terms of cumulative return by 4.3% annually. (See figures 1 and 2). To illustrate the relationship between scores and stock price performance, Arabesque divides the companies evaluated on the S-Ray into quintiles, based on their Global Compact (GC) and ESG scores. Stocks in GC quintile 1 have the lowest GC scores; stocks in ESG quintile 1 have the lowest ESG scores and so on. The quintiles are re-balanced every quarter.

Figure 1: S-RAY™ GC Score: Companies with the Lowest Scores Underperform the Stock Market³

The Bottom 20% underperform the overall market by 1.7%

GC score provides a normative assessment of companies based on four core principles of the United Nations GC: human rights, labour rights, environment and anti-corruption. The GC score is used to approximate reputational risk facing companies with lower scores. A lower GC score correlates with a higher likelihood of a company losing its license to operate in the future (e.g., due to a major scandal or controversy).

Figure 2: S-RAY™ GC Score: Companies with superior Scores significantly outperform the Stock Market4

The “Top 20%” outperform the “Bottom 20%” by 4.3% annually

Approaches to ESG Investing

Currently, there are three key approaches to ESG investing:

- ESG integration to traditional investing. This deals with the integration of ESG factors into traditional investing and financial analysis to evaluate risks and opportunities. Typically, the decision-making process does not place considerable weight on social values but rather the understanding that ESG scoring models can give investors an edge by identifying aspects that are not typically priced by the market.

- Sustainable investing or responsible investing. This incorporates ESG objectives into investment products and strategies, such as exclusionary screens, ESG investments and impact investments

- Corporate engagement. The third approach has emerged as a form of investment stewardship as it involves engagement with companies to protect and enhance the value of clients’ assets.

One of the major barriers to ESG adoption tends to be the lack of thematic and quality of data for ESG, which can leave investors with an incomplete information to take further investment decisions. With the introduction of a stronger regulatory framework – such as the introduction of mandatory sustainability reporting by Singapore Stock Exchange and Hong Kong Stock Exchange – it is possible for investors to overcome these hurdles.

ESG Insights at BNY Mellon

BNY Mellon is at the forefront of ESG. In 2015, our Depositary Receipts business was the first in the industry to make available a wide range of ESG data and insight to help clients understand the implications of ESG factors, and provide them with a roadmap to effectively factor these into their overall capital markets strategy.

BNY Mellon’s Compliance Monitoring system has the ability to screen and monitor investments based on social and ethical factors. MSCI ESG data is currently available, which consists of over 50 business issues of concern including, alcohol, tobacco, animal welfare, terrorism and weapons. Our system also includes a full universe data-set for environmental controversy factors. Currently, BNY Mellon Compliance Monitoring service assists in monitoring portfolios of multitude of large asset owners globally, and the service has grown over 400% since 2012.

BNY Mellon Global Risk Solutions are working in collaboration with Arabesque to integrate S-RayTM ESG and GC ratings data in our Global Risk Solutions Analytics services. Further information will be made available as we near release.

With many developments expected in this space globally, ESG is quickly evolving beyond a responsible investor’s utopia into a reality for the wider investment community.

For further information, contact Abhijit Kulkarni, Vice President and APAC Product Manager for Global Risk Solutions, Asset Servicing at +65 6432 0219.

1. Arabesque is a global asset management firm, using self-learning quant models and big data to assess the performance and sustainability of companies. Company website: https://arabesque.com/

2. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2699610

3. The chart compares the cumulated share price performance of the universe, vs stocks in S-Ray GC quintiles 1-5. Stocks in S-Ray GC quintile 5 outperform stocks in S-Ray GC quintile 1 by 2.0% per annum. Source: Arabesque S-RAY™

4. The chart compares the cumulated share price performance of the universe, vs stocks in S-Ray ESG quintiles 1-5. Stocks in S-Ray ESG quintile 5 outperform stocks in S-Ray GC quintile 1 by 4.3% per annum. Source: Arabesque S-RAY™

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names in various countries by duly authorised and regulated subsidiaries, affiliates, and joint ventures of BNY Mellon, which may include any of the following. The Bank of New York Mellon, at 240 Greenwich Street, NY, NY 10286 USA, a banking corporation organised pursuant to the laws of the State of New York, and operating in England through its branch at One Canada Square, London E14 5AL, registered in England and Wales with numbers FC005522 and BR000818. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon, London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at 46 Rue Montoyerstraat, B-1000 Brussels, authorised and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, a subsidiary of The Bank of New York Mellon, and operating in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, registered in England and Wales with numbers FC029379 and BR014361. The Bank of New York Mellon SA/NV (London Branch) is authorised by the ECB and subject to limited regulation by the Financial Conduct Authority and the Prudential Regulation Authority. Details about the extent of our regulation by the Financial Conduct Authority and Prudential Regulation Authority are available from us on request. The Bank of New York Mellon SA/NV, operating in Ireland through its branch at Riverside 2, Sir John Rogerson’s Quay, Grand Canal Dock, Dublin 2, D02 KV60, Ireland, trading as The Bank of New York Mellon SA/NV, Dublin Branch, which is authorized by the ECB, regulated by the Central Bank of Ireland for conduct of business rules and registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. If this material is distributed in or from, the Dubai International Financial Centre (DIFC), it is communicated by The Bank of New York Mellon, DIFC Branch, (the “DIFC Branch”) on behalf of BNY Mellon (as defined above). This material is intended for Professional Clients and Market Counterparties only and no other person should act upon it. The DIFC Branch is regulated by the DFSA and is located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. BNY Mellon also includes The Bank of New York Mellon which has various subsidiaries, affiliates, branches and representative offices in the Asia-Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction. Details about the extent of our regulation and applicable regulators in the Asia-Pacific Region are available from us on request. Not all products and services are offered in all countries.

The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. The contents may not be comprehensive or up-todate, and BNY Mellon will not be responsible for updating any information contained within this document. If distributed in the UK or EMEA, this document is a financial promotion. This document and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. Similarly, this document may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorised, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this document in their jurisdiction. The information contained in this document is for use by wholesale clients only and is not to be relied upon by retail clients. Trademarks, service marks and logos belong to their respective owners.

BNY Mellon assumes no liability whatsoever for any action taken in reliance on the information contained in this material, or for direct or indirect damages or losses resulting from use of this material, its content, or services. Any unauthorised use of material contained herein is at the user’s own risk. Reproduction, distribution, republication and retransmission of material contained herein is prohibited without the prior consent of BNY Mellon.

© 2018 The Bank of New York Mellon Corporation. All rights reserved.