Hong Kong-China Stock Connect 2.0

Hong Kong-China Stock Connect 2.0

April 2020

By Magdalene Tay

Since its launch just over five years ago, The Hong Kong-China Stock Connect program has allowed foreign investors faster access to the China A-shares market and facilitated the inclusion of China A-shares into key global indices. Epitomized as the gateway collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges, the Stock Connect program is flourishing.

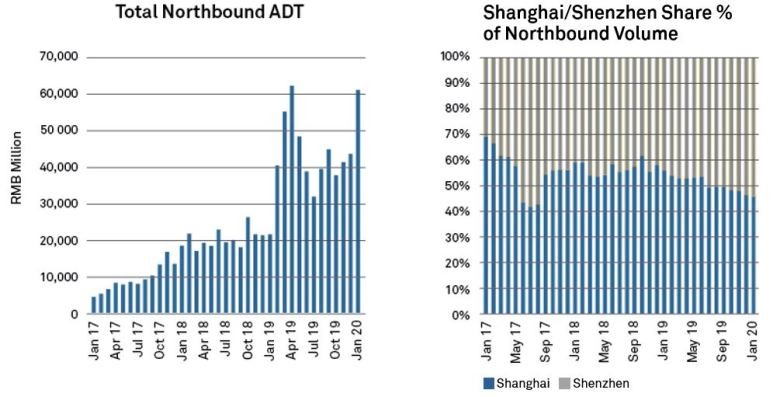

Hong Kong’s Stock Connect with mainland China’s two bourses has seen a surge in average daily turnover since last April, with the value of northbound trading almost trebling between January 2019 and January 2020. The lion’s share of this sum – RMB60 billion (US$8.66 billion) in average daily turnover (ADT) – has been channeled into the northbound Stock Connect, in which the Shenzhen Stock Exchange (SZSE) accounted for more than 50% of ADT in January 2020, peaking at 60% of ADT on 25 February1.

Figure 1: Northbound Average Daily Turnover

Source: HKEX presentation, data as of 31 January 2020.

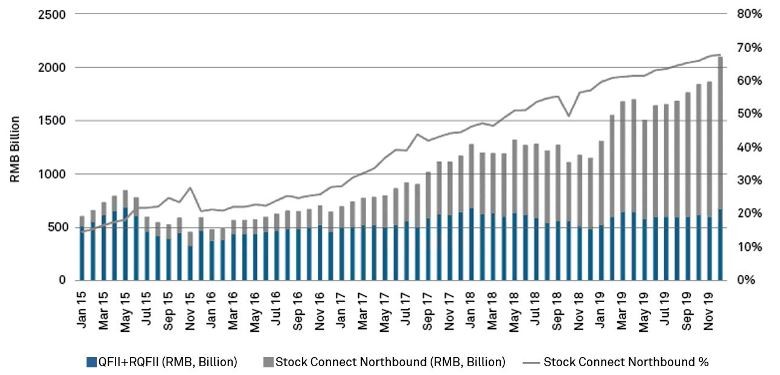

In January 2015, three months after the Shanghai-Hong Kong Stock Connect was launched, northbound Stock Connect funds accounted a mere 5% of the nearly RMB600 billion (US$86.6 billion) of foreign capital market investment in mainland China, with the majority invested under the qualified foreign institutional investor (QFII) and RMB QFII (RQFII) schemes. Yet by December 2019, that proportion had increased to around 68% of the approximately RMB2 trillion (US$289 billion) worth of Chinese A-shares held by foreign investors.

Figure 2: Foreign ownership of China A-shares

Source: HKEX presentation - HKEX, WIND, PBOC

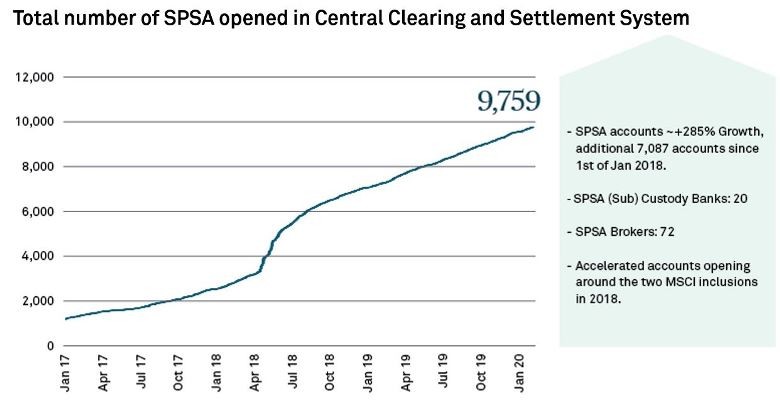

Tae Yoo, Managing Director of Global Client Development in the Markets Division at Hong Kong Exchanges and Clearing Ltd, said: “We now have 9,759 institutional accounts open.” That’s almost three times the number opened two years ago in January 2018, a development he attributed to the many market improvements that have been made, such as the introduction of real-time delivery versus payment, and a multi-currency settlement arrangement spanning HKD, USD and RMB.

Figure 3: Growth in Special Segregated Accounts (SPSA)

Source: HKEX presentation; data as of 31 January 2020

These figures represent tremendous growth of equity ownership held through the Stock Connect program, demonstrating the fact that it has become an important avenue for international investors looking to invest in Chinese capital markets.

Yoo further added that “despite the Sino-US trade war, there has been consistent foreign investment growth in China’s capital markets. Global investors have continued to invest in A-shares, and that trend is not slowing down.”

“Growth and participation in Stock Connect has resulted in a large increase in the balances and books of global investors, and clients have found ways to utilize these assets within their global collateral,” said Greig Ramsay, Product Manager of Clearance and Collateral Management for Asia Pacific at BNY Mellon. “Collateralizing these assets can help manage capital funding and balance sheet considerations.”

Future Enhancements

Efforts to make improvements to Stock Connect are ongoing. As of early this year, a number of significant projects are under review by the relevant regulatory authorities:

- MCSI China A Index Futures – improves access to hedging tools and derivatives instruments (announced in March 2019 but launch date is pending regulatory approval)

- Master Special Segregated Accounts (SPSA) – enhanced optional mechanism under the existing Stock Connect framework to allow pre-trade checking of sell orders for fund managers at an aggregate level for operational efficiencies of average pricing execution to achieve best execution at the fund manager level while maintaining the same post-trade settlement processes at the individual SPSA level for consistency (to be launched in 1H 2020 subject to regulatory approval)

- Distributed Ledger Technology solution – Hong Kong Exchanges and Clearing (HKEX) are planning to introduce a new integrated settlement platform using Distributed Ledger Technology (DLT) for Northbound Stock Connect to better manage the T+0 settlement market, which challenges the current established operation and settlement flow designed for a T+2 settlement market. (To be further communicated to the market in the near future subject to regulatory approval)

There are other Stock Connect enhancement initiatives which are being reviewed as follow:

- Trading holidays of Stock Connect

- Increase in foreign ownership restrictions

- Increase in the breadth of Stock Connect coverage

- Securities lending/ short-selling enhancements

- Block trading

Collateralizing Stock Connect assets

BNY Mellon was the first Triparty agent to provide collateral services for securities settled through Hong Kong Stock Connect, supporting growing cross-border trade volumes in and out of China. This bespoke solution allows clients to post Stock Connect assets in non-title transfer pledge arrangements, providing numerous benefits:

The ability to use Stock Connect assets within a financing transaction reduces clients’ collateral costs. It also enables enhanced optimization of assets within their global collateral portfolios, helping institutions maximize their balance sheet. Clients utilizing Triparty collateral services reduce operational risks through the centralization of post-trade collateral management functions.

Ultimately, BNY Mellon’s Triparty Stock Connect solution helps clients use collateral more efficiently while also helping clients ensure that other obligations are met, addressing a broad range of collateral management needs for clients.

As China market continues to reform, more future enhancements are expected to further improve operating model and market accessibility.

bnymellon.com

The views expressed herein include external speaker and may not reflect the views of BNY Mellon. This does not constitute legal, tax, accounting, investment, financial or other professional advice on any matter and does not constitute a recommendation by BNY Mellon of any kind.

Asset Servicing Global Disclosure

© 2020 The Bank of New York Mellon Corporation. All rights reserved.