Tokenization: Opening Illiquid Assets to Investors

Tokenization: Opening Illiquid Assets to Investors

June 2019

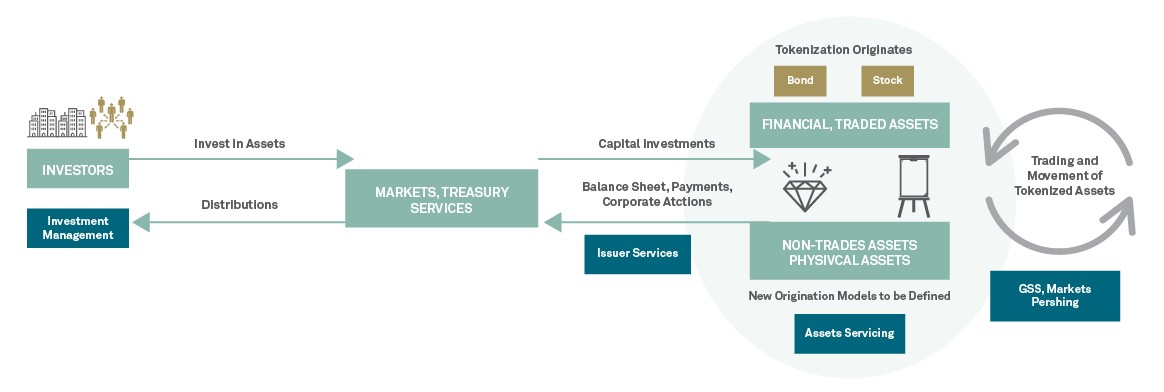

This blog is the first in a two-part series regarding the tokenization of assets. Tokenization is a capability that leverages blockchain technology to securitize assets, both traded and non-traded. Key benefits of tokenization include increased liquidity, faster settlement, lower costs and bolstered risk management.

Capital markets are still in the early phases of the adoption of blockchain and distributed ledger technologies (DLT) and the industry continues to seek viable use cases. One broad category of such use cases is the creation of digitally tokenized assets, in which the token either represents a property interest that exists only in the Blockchain (such as non-certificated securities) or represents an asset existing off the Blockchain.

The tokenization of real-world assets continues to gain momentum, and investments are being made across the industry.

Definition of Tokenization

While not new to the blockchain world, the tokenization of real-world assets is now attracting industry attention. Fundamentally, tokenization is the process of converting rights – or a unit of asset ownership – into a digital token on a blockchain. Tokenization can be applied to regulated financial instruments such as equities and bonds, tangible assets such as real estate, precious metals, and even to Tokenization of Copyright to works of authorship (e.g., music) intellectual property. The benefits of tokenization are particularly apparent for assets not currently traded electronically, such as works of art or exotic cars, as well as those needing increased transparency in payment and data flows to improve their liquidity and tradability.

The Benefits of Tokenization

The tokenization of physical assets brings a range of benefits to market participants:

- Broader investor base: There is a limit to the level of fractionalization possible with real-world assets. Selling 1/20 of an apartment or a fraction of a company share is not currently practicable. However, if that asset is tokenized, this limitation is removed, and it becomes possible to buy or sell tokens representing fractions of ownership, allowing a far broader investor base to participate. A good example of how tokenization could change the dynamic of numerous assets is in the fine art market. The prohibitive prices that some artists command at auction means that only a highly restricted number of high net worth individuals that have the means to invest in this asset, with the vast majority of retail investors unable to participate. Issuing tokens that represent a fractional ownership of an artwork may fundamentally change the situation. For example, the property rights in the most valuable painting by Jean-Michel Basquiat—sold for an eyewatering $110 million by Sotheby’s in 2017—could be tokenized, affording even small retail investors the opportunity to acquire a fractional interest in the painting. Tokenization would therefore open the market to a whole new set of investors, now able to diversify their investment portfolios into asset classes previously well out of their reach.

- Broader geographic reach: Public blockchains are inherently global in nature because they present no external barrier to the global population and investor. However, in the Institutional Market, relevant KYC (Know Your Client) and AML (Anti-Money Laundering) laws and programs must be followed, and hence the broader adoption of public blockchains has been curbed. Nonetheless, several public blockchains are now performing KYC and AML – and this evolution and trust is expanding the footprint of these digital, Tokenized assets. Importantly, permissioned blockchains are also evolving, providing an important step for the Institutional investor.

Tokenization has potential to improve investment management.

Tokenization has potential to improve investment management.

- Reduced settlement times: Tokenization can reduce transaction times, potentially by permitting 24x7 trading, and as smart contracts triggered by predefined parameters can instantaneously complete transactions, reduce settlement times from the current durations, at best T+2, to essentially real-time transactions. This can reduce counterparty risk during the transaction and reduces the possibility of trade breaks.

- Infrastructure upgrade: For many asset classes, fundraising and trading remain slow, laborious, and require an exchange of paper-based documents. By digitizing these assets on a DLT infrastructure, efficiency in these markets can be vastly improved, with effects further amplified in areas that currently have non-existent traditional infrastructure

- Decreased cost for reconciliation in securities trading: The blockchain infrastructure provides a digital ledger for the record keeping of each shareholder position. For the issuer, this will greatly improve the efficiency of numerous administrative processes, such as profit sharing, voting rights distribution, buy-backs, and so on. Further, the existence of a secondary market will also facilitate the accounting operations of professional investors, such as net-asset-value calculations. As the market becomes more comfortable with the digital ledger as the “golden copy” of data, reconciliation may be completely obviated, as the parties will rely and accept this record.

- Regulatory evolution: There is a slow but steady movement by regulators in developed markets to lay the foundation of regulatory frameworks for the creation and exchange of digital asset tokens. Importantly, the real-time data and immutability of data held in a digital ledger will enhance the role that regulators aim to improve – clarity and protection for investors.

- Improved asset-liability management: Tokenization will improve the ability to manage asset-liability risk through accelerated transactions and improved transparency.

- Increase in available collateral: By accelerating and improving the fractionalization of new asset classes, tokenization will expand the range of available and acceptable collateral beyond traditional assets. This will significantly increase the options available to market participants when selecting non-cash assets as collateral in the securities lending or repo markets. Coupled with the holistic benefits of Tokenization described above, collateral management globally may be more efficient, transparent and relevant in new asset classes.

Asset Tokens and the Future of the Financial Industry

Leading financial institutions understand the opportunity that tokenization of financial assets represents. When it comes to turning legacy asset classes, such as corporate securities, into vibrant digital markets, we are witnessing several initiatives, notably by incumbent U.S. and European exchanges that are all developing tokenization offerings. From the origination of trading assets to Corporate Trust, the value chain is evolving.

We are still early on the journey towards the tokenization of assets, but it certainly has the potential to dramatically change the dynamic for investors and owners of numerous asset classes.

The views expressed herein are those of the authors only and may not reflect the views of BNY Mellon. This does not constitute Asset Servicing advice, or any other business or legal advice, and it should not be relied upon as such.

©2019 The Bank of New York Mellon Corporation.

Asset Servicing Global Disclosure

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. Products and services may be provided under various brand names and in various countries by subsidiaries, affiliates, and joint ventures of The Bank of New York Mellon Corporation where authorized and regulated as required within each jurisdiction. The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide or construed as legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such.

BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material. This material may not be reproduced or disseminated in any form without the prior written permission of BNY Mellon. Trademarks, logos and other intellectual property marks belong to their respective owners.

This document, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such.

The views expressed within this article are those of the author(s) only and not those of BNY Mellon or any of its subsidiaries or affiliates.

© 2019 The Bank of New York Mellon Corporation. All rights reserved.