Deep Dive into Data Relationships

The Power of Knowledge Graphs in Transforming Financial Services

Deep Dive into Data Relationships

The Power of Knowledge Graphs in Transforming Financial Services

April 2022

Want to be famous? It may take a lot more than talent. In a recent examination of the pioneers of abstract art, researchers from Columbia University and HEC Paris discovered that creativity didn’t directly correlate to fame. Instead, artists with large diverse networks of personal and professional contacts in different industries were statistically more likely to become famous.1

Are you an explainable AI company that we should know about?

Learn More [link to accelerator program page]

Interested in learning more about emerging technologies for the financial services industry?

Sign-up for The Quarterly Update

So, what does Pablo Picasso’s ability to make friends have to do with the future of the financial sector? The answer lies within knowledge graphs used to make such a correlation and the insight that results. After modeling a quantitative score for creativity, derived through both machine learning computational evaluations and the expert opinions of notable art historians,2 researchers deployed knowledge graphs to understand each artist’s network and to correlate relationships and fame. Knowledge graphs enabled researchers to uncover insight that was previously unknown. Similarly, knowledge graphs are also being leveraged in the financial sector to transform business processes and unlock new opportunities.

Understanding Knowledge Graphs

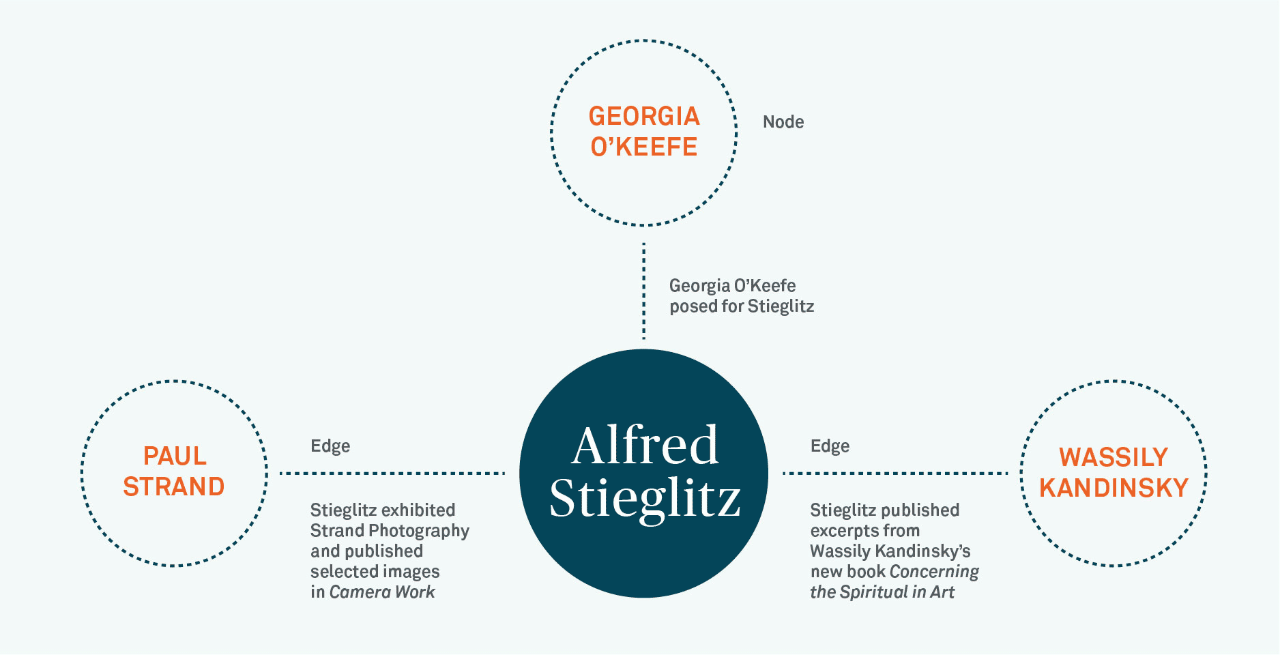

A knowledge graph, also known as a semantic network, represents a network of real-world entities — objects, events, situations or concepts — and visually illustrates the relationship between them. A knowledge graph first starts with a graph database, which is made up of three main components: nodes, edges and labels. Any object, place or person can be a node, and an edge defines the relationship between them.3

Using the example below, a simple knowledge graph of American photographer and art promoter Alfred Stieglitz illustrates the relationships within a knowledge graph. Stieglitz is the subject, the lines represent the edge, and Paul Strand, modernist photographer and filmmaker, Georgia O’Keefe, modernist painter, and Wassily Kandinsky, painter and pioneer of abstraction in Western art, represent the object (or node), with labels of the relationship.

The same structure can also be used to uncover insights from complex data sets in the financial sector. Traditionally, data has been stored in relational databases, organized as a set of tables with columns and rows with pre-defined relationships between them.4 However, this method has become increasingly limiting as relationships and entities grow more complex.5

Graph databases promote simpler and more intuitive representations of connected data in ways the traditional method could not.6 Further, natural language processing (NLP) enables unstructured data and information points to be represented in a comprehensive view of nodes and relationships between the data.

But when employing a knowledge graph, the more data accumulated, the more insightful it becomes.7 As data is ingested, this process allows knowledge graphs to identify individual objects, understand the relationships between them, and compare this to other integrated data sets. Once a knowledge graph is complete, users can retrieve information from queries.

Application for Knowledge Graphs in Financial Services

Knowledge graphs are widely used today, by companies such as Facebook, Apple and Google to power their search engines,8 yet the tool is still gaining traction in the financial sector. Notably, the power of Google’s search engine is in their knowledge graphs, comprised of more than 500 million objects and combining disparate data sets, the technology gives users arguably, the most comprehensive information and insights.9

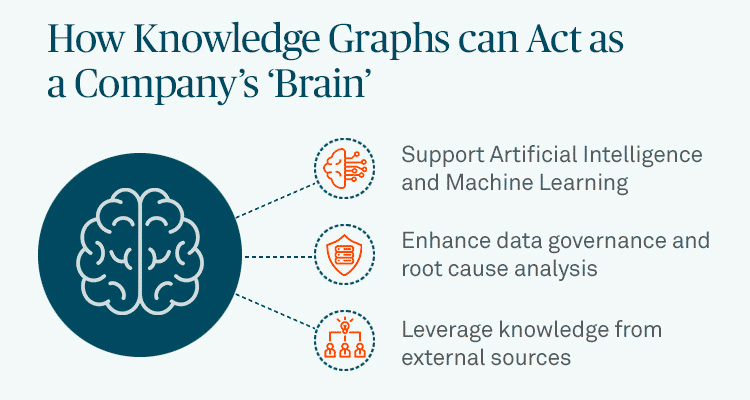

Given this potential, knowledge graphs hold significant value outside of informing search engine results. In the financial sector specifically, enterprise knowledge graphs provide the potential to operate more efficiently, connecting complex data sources, and when built and managed correctly, unlock new analytical capabilities to the extent that they can be regarded as the “brain” of an organization.10

CLICK-THROUGH SLIDESHOW

- Knowledge Graphs

- AI

- Governance

- External

As knowledge graph technology becomes more powerful, the technology has the potential to unlock opportunity across the financial ecosystem and optimize processes to help institutions foster development across all areas in the future. The following are possible use cases.

Improve tax strategy. The taxation of multi-national companies is a complex field, influenced by the legislation of many governing bodies. For multinational firms, knowledge graphs may streamline income tax calculations by condensing over tens of thousands of pages of global tax law text into a set of simple logical relationships, so that corporations can perform better tax planning.12

Create in-depth operational analyses. Large financial institutions can have tens of thousands of customers, all of which have relationships with not only the institution but also across the institutions’ customer base as well as outside it. Knowledge graph technology has the potential to leverage insights from these relationships and networks to identify potential suppliers or clients that would be affected should another client endure financial distress.13

Improve the customer experience. Knowledge graphs have the potential to improve customer relationships across multiple touchpoints, aggregating data from across lines of business to help create a 360-degree view of any one customer’s unique profile and experience. This concept, known as Customer 360, guarantees consistency in customer information across all departments, which can help break down silos and identify unique patterns and preferences to ensure continuity throughout the customer journey. In addition to strengthening current relationships, knowledge graphs’ predictive power can also be applied to identify desirable potential clients, promoting continual growth for the firm’s client base.14

Enhance Anti-Money Laundering (AML) and Know Your Customer (KYC) processes. AML regulations are mandated by both national and international authorities that place a wide variety of screening and monitoring obligations on financial institutions. These obligations include KYC, a set of standards used to verify a customer’s identity and the level of money laundering risk they may represent.15 Knowledge graph technology can help strengthen such efforts, providing a comprehensive view into a client, and the context of their network. For example, BNY Mellon leverages Quantexa’s Network Analytics Platform and knowledge graph capability to continuously monitor data to detect changes and risk triggers within the customer’s network.

The Future of Knowledge Graphs

A firm’s competitive advantage is now largely determined by its ability to store complex datasets, access sophisticated insights from the data and make intelligent decisions based on both. As knowledge graphs continue to unlock opportunity across the financial sector, the level of impact on the business as a result of data informed decision-making will only become increasingly paramount. For this reason, the application of AI, machine and deep learning technologies to knowledge graphs and solving complex problems is the next frontier for any firm to sharpen its competitive edge and help drive efficiency in the finance industry.16

- Fame Is Based More on The Company You Keep Than Your Creativity. Columbia Business School. March 12, 2019

- Study Finds Artists Become Famous through Their Friends, Not the Originality of Their Work. Artsy. February 27, 2019.

- Knowledge Graph. IBM Cloud Education. April 12, 2021.

- What is a Relational Database? Amazon Web Services.

- What Are the Limitations of Relational Databases in Business Applications? Chron. December 4, 2018.

- When (and Why) To Choose Graph Databases Over Relational Databases. LeapGraph. 2018.

- Knowledge Graph. IBM Cloud Education. April 12, 2021

- What is a Knowledge Graph? Stardog. November 17, 2020.

- How Knowledge Graphs Work. Google.

- Start Building Your Enterprise Knowledge Graph. Cambridge Semantics.

- Wisdom of Enterprise Knowledge Graphs. Deloitte. July 20, 2019.

- A Knowledge Graph for Assessing Aggressive Tax Planning Strategies. Cornell University. August, 12, 2020.

- Knowledge Graphs. Stanford University.

- What are the 360 Degree Views of an Enterprise? Pool Party.

- KYC vs AML. Comply Advantage. November 27, 2019.

- A Survey on Knowledge Graphs: Representation, Acquisition, and Applications. National Library of Medicine. April 26, 2021.

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally and may include The Bank of New York Mellon, 240 Greenwich Street, New York, NY 10286, a banking corporation organized and existing pursuant to the laws of the State of New York and operating in England through its branch at One Canada Square, London E14 5AL, England. The information contained in this material is for use by wholesale clients only and is not to be relied upon by retail clients. Not all products and services are offered at all locations.

This material, which may be considered advertising, is for general information and reference purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such. BNY Mellon does not warrant or guarantee the accuracy or completeness of, nor undertake to update or amend the information or data contained herein. We expressly disclaim any liability for any loss arising from or in reliance upon any of this information or data.

Trademarks and logos belong to their respective owners.

© 2022 The Bank of New York Mellon Corporation. All rights reserved.