A New Day for ETFs in the United States

A New Day for ETFs in the United States

September 2019

By BNY Mellon ETF Services

We are in a new world today for ETFs.

After 4,213 days, the time it would take to send a rocket to Pluto, the Securities and Exchange Commission (“SEC”) has adopted Rule 6c-11 (the “ETF Rule”) bringing regulations in line with market demand. In March 2008, the SEC’s investment management division first published for comment a proposal to create an ETF rule, which would allow new entrants to enter the market more quickly. For a refresher on the original proposal, see our previous analysis.

While market response to the 2008 proposal was positive, the financial crisis kicked into high gear ultimately pushing any regulations for ETFs to the side.

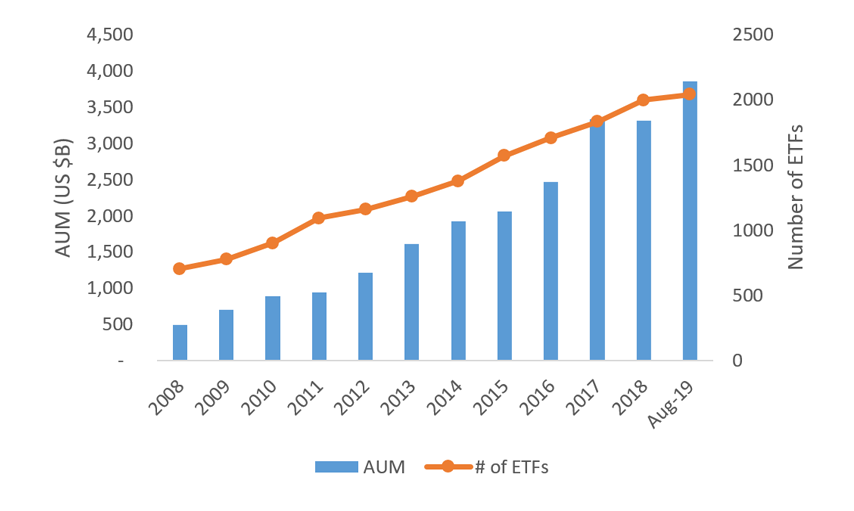

Meanwhile ETF demand experienced strong growth in the United States as reflected by assets under management (AUM) increasing at a 20% CAGR during this period with total AUM surpassing $3.5 trillion. (Exhibit 1). However, ETF AUM remains small relative to the mutual fund space in the United States, which stands at $16.8 trillion1.

Exhibit 1: US Domiciled ETF Landscape

Source: ETFGI.com “August 2019 US landscape”

Source: ETFGI.com “August 2019 US landscape”

What Made It Into the Rule?

Now let’s jump into what is included and what was left out. The key items in the final rule include:

Website Disclosures

- Fund holdings will be made available daily as used to determine the next applicable NAV. Details that must be disclosed include: ticker, CUSIP or other identifier, and description of the holding. Debt securities, for example, will require the security’s name, maturity date, coupon rate, and effective date. Additional details will also need to be provided for derivatives.

- Data elements to be posted will be: NAV per share, market price, defined as the “official closing price”, premium/discount as of the end of the prior business day.

- Table and chart showing number of days the ETF’s shares traded at a premium or discount during the most recent completed calendar year and quarters for the current year.

- Median bid-ask spread over the most recent thirty calendar days with median defined as the midpoint of the NBBO as of that time.

- Disclosure of prior business day’s NAV, market price, and premium or discount.

A big positive for the ETF market is that the theme of transparency remains in the website requirements, which will benefit both end investors and manufacturers. The new requirements are set to improve operating models by removing bespoke processes and data dissemination requirements.

Not included in the final rule is the need to publish a basket to the website daily.

Custom Baskets

Custom baskets were expected to be included in any form of a rule. This inclusion in the final rule should help level the playing field for large and small. For those looking to utilize custom baskets for the first time, we recently provided insights on key considerations as firms begin to access this new tool.

When looking to implement custom baskets, the SEC has included specific requirements that users must adhere to.

First, the definition of a custom basket is now a list that contains a non-representative selection of the ETF’s portfolio holdings.

Second, to implement custom baskets, the SEC will now require additional information, including:

- Written policies and procedures governing the following:

- Construction of baskets and the process used for acceptance of baskets proposed.

- Methodology used to construct baskets. An example given is that a basket may omit positions that are not feasible to transfer in-kind such as non in-kindable markets.

- When will the ETF use representative sampling of the portfolio to create a basket and how the ETF would sample in those scenarios.

- Description of how the ETF will test for compliance.

Regulatory Considerations

Regulatory considerations include:

- ETFs will be eligible for the redeemable securities exceptions in Rules 101(c)(4) and 102(d)(4) of Regulation M and 10b-17(c).

- The rule will require new disclosures on Form N-1A and Form N-8B-2 as proposed. Our understanding is that these disclosures will allow investors insight into the total cost in purchasing or selling ETF positions.

- Issuers must preserve and maintain copies of all written agreements (i.e., AP Agreements) between an AP and the ETF or service provider for at least five years with the first two in an easily accessible place.

- All baskets that are exchanged with APs must be maintained but will need to include ticker symbol, CUSIP or other identifier, description of holding, quantity of holding, and percentage weight of each holding for at last five years with the first two in an easily accessible place.

- Fund of Fund (“FoF”) relief from 12(d)(1)(A) and (B) and Section 17(a)(1) and (2) of the Investment Company Act of 1940 (the “40 Act”) will be available for new issuers as long as they satisfy terms and conditions set forth in prior orders applicable to FoF orders.

- Further refinement of Form N-1A, Form N-8B-2, and Form N-CEN will be required. These updates include new narrative disclosures as a Q&A, median bid-ask spread disclosure, and historical premium and discount disclosure, and if the ETF is relying on the ETF Rule. Implementation of these will be one year after the ETF Rule’s effective date.

In a welcomed move, liquidations, reorgs, mergers or conversions will not require an ETF to sell or redeem individual shares solely with Authorized Participants. Instead the SEC has agreed in the final rule that in these instances ETFs can conduct redemptions with investors directly.

Given the differences in website data structuring, and operating models for issuers today, we are prepared to work with issuers in upgrading their operating models to comply with these new rules, while providing best practices for first time entrants.

Key Items that Were Left Out of the Final Rule Include:

IOPV

IOPVs, which were on the chopping block, will no longer be required as part of the ETF Rule. This change reflects the recognition of changes in market structure from when IOPVs were first introduced in 1993. While not required by the ETF Rule, a question remains of whether or not the exchanges will modify their listing rules to account for this change. As of today, listing rules still require an IOPV every fifteen seconds.

Certain Details in Website Disclosures

- Issuers will not be required to disclose the portfolio holdings prior to accepting orders for primary market activity.

- ETFs will no longer need to state in sales literature that ETFs do not sell or redeem individual securities, nor that investors may purchase or sell individual ETF shares through a broker via a national securities exchange

- ETF classification system will not be implemented as part of the ETF Rule.

- Custom baskets will not be required to be published to the street.

When Will the Final Rule be Implemented?

The expectation that the rule would have a one-year implementation timeline was confirmed. The ETF Rule will be effective 60 days from the effective date of September 26, 2019. As such, firms with ETFs that fall within the scope of the ETF Rule will have one year to come into compliance with the requirements of the ETF Rule.

“It is an exciting day for the ETF industry and asset management industry as a whole. As a key contributor to the global ETF industry, we are pleased to see the SEC streamline the regulatory landscape for ETFs in the U.S, allowing for more innovation and investor access to Exchange Traded Funds.”

Will Your ETFs Be Included in the ETF Rule?

Exemptive relief obtained for UIT ETFs, leveraged/inverse ETFs, share class ETFs, commodity ETPs, or non-transparent ETFs will not be affected. Those products will continue to rely on existing exemptive relief. Additionally, Fund of Fund arrangements for ETFs will not be rescinded. For those products which have received exemption from Section 12(d)(1) and Sections 17(a)(1) and (a)(2) of the 40 Act.

With the Current ETF Growth Trajectory, Will the ETF Rule Actually Make a Difference?

We certainly believe it will. Earlier this year the SEC provided updates that the average cost for exemptive relief required to launch an ETF was $100K and could run between 6 and 9 months2. Now the ability to utilize a standardized exemptive relief will provide all a faster route to market. Quicker market access is but one benefit of the ETF Rule.

Jeff McCarthy, Global Head of Exchange Traded Funds, commented on the final rule, saying: “It is an exciting day for the ETF industry and asset management industry as a whole. As a key contributor to the global ETF industry, we are pleased to see the SEC streamline the regulatory landscape for ETFs in the U.S, allowing for more innovation and investor access to Exchange Traded Funds.”

As the market begins to digest the new rule, we will continue to provide further guidance to our issuers on the best approaches to compliance by the implementation date. We stand ready to help you navigate this new and exciting world for ETFs.

Whether you are looking to enter the ETF space for the first time, expand your offering across strategies, or use new capabilities we have the depth and breadth of experience to help you navigate.

For further discussions and insights please reach out to the ETFProduct@BNYMellon.com or your current relationship manager.

1 ICI.org (August 2019). “Trends in Mutual Fund Investing July 2019”. Note: Total Net Assets represent total long-term strategies as defined by ICI.org.

2 ETF Global Markets Roundtable 2019, Panel: “Examining the Impact of Regulatory Developments on ETFs and the ETF Capital Markets”

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used as a generic term to reference the corporation as a whole and/or its various subsidiaries generally. Products and services may be provided under various brand names and in various countries by subsidiaries, affiliates, and joint ventures of The Bank of New York Mellon Corporation where authorized and regulated as required within each jurisdiction. The material contained in this document, which may be considered advertising, is for general information and reference purposes only and is not intended to provide or construed as legal, tax, accounting, investment, financial or other professional advice on any matter, and is not to be used as such.

BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material. This material may not be reproduced or disseminated in any form without the prior written permission of BNY Mellon. Trademarks, logos and other intellectual property marks belong to their respective owners.

This document, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such.

The views expressed within this article are those of the author(s) only and not those of BNY Mellon or any of its subsidiaries or affiliates.

© 2019 The Bank of New York Mellon Corporation. All rights reserved.