Why Outsourcing is Turning Trading Inside Out

Why Outsourcing Is Turning Trading Inside Out

October 2020

By Jeremy Grant

COVID-19 has super-charged a trend that started with Europe’s MiFID II regulation and the upending of long-held broking relationships, proving the value of one-stop-shop custodial solutions.

At the height of the global pandemic in March, pension and corporate clients of Butterfield, the oldest banking group in Bermuda, were trading three times more than normal and needed to move large blocks of stock, up to $30 million per position, quickly and reliably.

Learn more about our outsourced trading solutions for the buy-side at https://certainty-bnymellon.com/

It was a “nerve-wracking” spike in market volume and volatility, recalls Zuri Darrell, vice president of investor services at the bank. The need to trade in large sizes and in short bursts meant that Darrell relied heavily on directing orders to BNY Mellon’s broker dealer in New York, BNY Mellon Capital Markets LLC, which executed trades on Butterfield’s behalf.

“Given the amount of uncertainty that was happening on the client side and the high volume of trade requests, at least we knew that when we pressed the button to their team it all happened — and seamlessly,” he explains.

Darrell’s experience is typical of what many asset managers and hedge funds did during the pandemic. The turmoil underscored the value of routing orders to third parties for execution, a trend known as outsourced trading, at a time of historic price swings, wider bid-ask spreads and the operational complexity of having traders work from home. So much so that outsourced trading has “proven to be a lifeline for some asset managers,” according to a report published in May by Aite Group, a research consultancy.

The use of third parties, including large custodian banks, to handle trading of equities, exchange-traded funds (ETFs), foreign exchange (FX) and other asset classes was already one of the most striking trends in markets before the COVID-19 market meltdown. Asset managers, and boutique firms in particular, have long grappled with rising costs as fees have declined amid an ongoing shift toward passive investment strategies. Dealing with evolving regulations also has added to operational complexity — and costs.

Such pressures started to pile on two years ago in Europe with the implementation of the Markets in Financial Instruments Directive (MiFID) II legislation enacted by the European Commission. This law not only required executors of trades — including fund managers — to obtain “best execution” for end investors, but also forced a separation of payments made to sell-side banks and brokers for execution and for research — in a so-called “unbundling” effect.

The best execution requirement produced an increased focus on transaction cost analysis (TCA), while the unbundling of research resulted in many asset managers paying for research themselves, rather than using client dealing commissions as can still be the case in the U.S.

Both have not only added to cost pressures but caused many buy-side players to reassess and reduce broker lists, focusing on how best to secure the optimal mix of tools and relationships for both execution and other operational needs. Liquidnet, an equity trading platform, found in an October 2019 survey that 53% of respondents had implemented a global policy on unbundling.

Today, asset managers are rethinking their business models and operational priorities. They are looking not only to outsource execution but to do so in a more holistic way and select a partner that can offer capabilities beyond just trading, often as part of a broader outsourcing strategy that allows them to focus on their core competencies.

Since MiFID II, small- and medium-sized players, in particular, are rethinking how they could maximize budgets, as well as outsourcing their middle office and data. While it remains true that outsourcing will not be appropriate for all asset managers, since many are comfortable with their own in-house trading capability and may have significant scale to manage costs, any doubt about the value of outsourcing appears to have been swept away by the pandemic.

It is also about more than complexity and, in some cases, about avoiding the fixed costs of having a trading desk. Indeed, Aite reports an increase in inquiries about outsourced trading, reinforcing the value proposition of outsourced providers whose sales pitches were rising in popularity even before the COVID-19 crisis.

“There are asset managers out there that had challenges managing their technology stack in a more complex operating environment. They haven’t had that robustness of infrastructure to manage working remotely and it’s a huge drain on management time, so they would rather push the easy button,” says James Slater, global head of client coverage in BNY Mellon’s asset servicing division.

BNY Mellon, for one, is working on a comprehensive menu of solutions for clients who want to outsource various activities to the bank for greater efficiency and straight-through-processing to their custody accounts.

The new offering will integrate the bank’s front-office trading and asset-servicing capabilities with its middle-office execution, collateral and liquidity management platforms, delivering one entry point to clients for those services.

Exposing Operational Risks

While cost may have driven the outsourced trading trend hitherto, the pandemic has exposed a range of operational gaps and weaknesses that are much higher up the list of priorities as market participants cope with the uncertain landscape.

The first is scale. Size matters, and not all asset managers have sufficient scale — let alone across all asset classes and geographies — to be a meaningful counterparty to the sell-side liquidity providers, nor to provide a fully resilient trading platform.

Aite identifies two “coverage gaps” at the height of the market turmoil: bandwidth issues, where desks found themselves “strapped for trading bandwidth,” and coverage breakdowns, where reliance often on one account relationship with a broker in a smaller market meant that responsiveness depended on whether that broker was still functioning.

A further issue is that only the larger asset managers with global reach are likely to have the capacity to understand where pockets of liquidity are at the best possible price. Some firms starting from scratch want to outsource as much as possible, to see how thin they can make their operations.

“We didn’t want to start out with a large amount of overhead, staff and fixed costs. Being lean and nimble is the way to survive and prosper.”

— Jeff Meyerson, Prime Services Group

This has been a top consideration for Prime Services Group (PSG), a hedge fund that started operating early this year before the extent of the coronavirus threat became fully apparent. The firm recently started using BNY Mellon’s outsourced trading service for equities, with options coming later.

“We don’t want to be in a situation where we can’t do business because we can’t trade in a particular market,” says Jeff Meyerson, head of global trading at PSG. “We also didn’t want to start out with a large amount of overhead, staff and fixed costs. Being lean and nimble is the way to survive and prosper.”

A second area of operational gaps is related to technology and the potentially disruptive effect of working from home. The idea that traders and portfolio managers need to sit near each other — and that the case for outsourced trading was therefore not sufficiently compelling — has been challenged by the discovery that technology and new ways of working have come into their own during the pandemic.

Aite says that buy-side firms may no longer be questioning — as they did pre-pandemic — whether an off-premises trading desk provides the same, or better, service than that from on-premises traders. This means that the operational risk framework for many firms has completely changed overnight, underscoring how outsourcing is no longer just a matter of cost, and that it is more about the value of large outsourcing providers with the technology and scale to handle ever-more complex demands across asset classes.

The capabilities that clients could then take advantage of could include derivatives expertise or pre-trade research and analytics. The latter could help portfolio managers who are looking to optimize their execution, including when to execute, as well as for accessing trading insights around alternative execution strategies, instead of solely managing risk in the cash markets. These insights could help reduce the overall execution costs for their clients, preserve identified alpha, or even optimize the use of collateral.

Favoring Custodial Banks

Overall, behavioral change has become a defining feature of the COVID-19 market shock. Whole industries have had to adapt to the impact of the coronavirus, and have been adapting revenue and operating models after seeing how previous ways of working were disrupted.

In the U.S., 75% of consumers have tried a new store, brand or different way of shopping during the pandemic, according to consultants at McKinsey. Early evidence suggests that behavior during the pandemic may bring about a similar degree of change in outsourcing that could put custodial relationships with asset managers, hedge funds and others at the forefront of client dialogue.

Some firms have also noticed a change in the conversation with clients since before the pandemic, with outsourcing becoming a useful approach to the new challenges in regulatory reporting submissions and associated sign-offs.

"There was previously a lack of visibility across the fund complex. Now they have one single point of entry.”

—Ed McGann, BNY Mellon

One area receiving a lot of attention is transaction capture and trade reporting, where the benefits of outsourcing to a provider with full straight-through-processing (STP) capabilities are becoming clear. STP is critical because if a client buys a security from a trading desk operated by their custodian, it is delivered directly into their custody account, minimizing operational and settlement risks.

This is resulting in conversations with clients around more “modular” outsourcing, whether that be outsourcing the middle office, or having the provider take over a securities lending program, handling regulatory reporting, or TCA.

At Ascensus College Savings, which has been a custody and cash management client of BNY Mellon for over a decade, the use of ETFs has grown significantly in recent years, with over a dozen ETFs traded daily and about 150 ETF positions across the college savings plans the firm is managing.

It was a natural evolution of the relationship since Ascensus has started to rely on BNY Mellon for help smoothing out settlement cycles across the portfolio, as well as providing monthly TCA reports, says Bob Geiger, vice president of investment operations. “It’s a fairly basic function of our relationship but it’s an extremely important one. When we do fund events, there are days when I have $300m-$400m of trades,” he notes.

Being able to access such services as part of the outsourced trading relationship is only likely to become more important, given increasing pressure from regulators on transparency in trade reporting. Some of this stems from watchdogs’ requirement to see how, and at what cost, trades are being routed — a regulatory motivation not unlike that which drove Europe’s MiFID II’s unbundling legislation.

Ron Hooey, head of institutional equities sales at BNY Mellon Markets, says custodian banks will increasingly have a role to play in helping mitigate such regulatory risk for asset owners as they in turn have to “take greater ownership around execution quality and show there are no biases.”

That is one way in which having good relationships on the custody side is set to become more important. Another is in FX hedging, which has come into greater focus as asset managers pay attention to the effect of FX on their investment performance.

Managing trading across multiple markets and currencies is complex, particularly given the over-the-counter nature of the FX markets. CI Investments, one of Canada’s largest investment fund companies, mandated BNY Mellon in February to provide it with FX administration as a way of consolidating FX hedging across a collection of subsidiary firms.

“There was previously a lack of visibility across the fund complex and so the gain they have now is one single point of entry,” explains Ed McGann, global head FX Program and FX platform sales at BNY Mellon.

Meanwhile, the trend of passive investments that had been exerting downward pressure on fees does not appear to have been knocked off course by the pandemic, indicating that competition and costs will remain just as intense as asset managers and others reset their businesses for the post-pandemic era. Passive funds easily overhauled actively managed funds in the first half of the year, according to Morningstar, with BlackRock and Vanguard hauling in significant new inflows as investors continue to shun actively managed products.

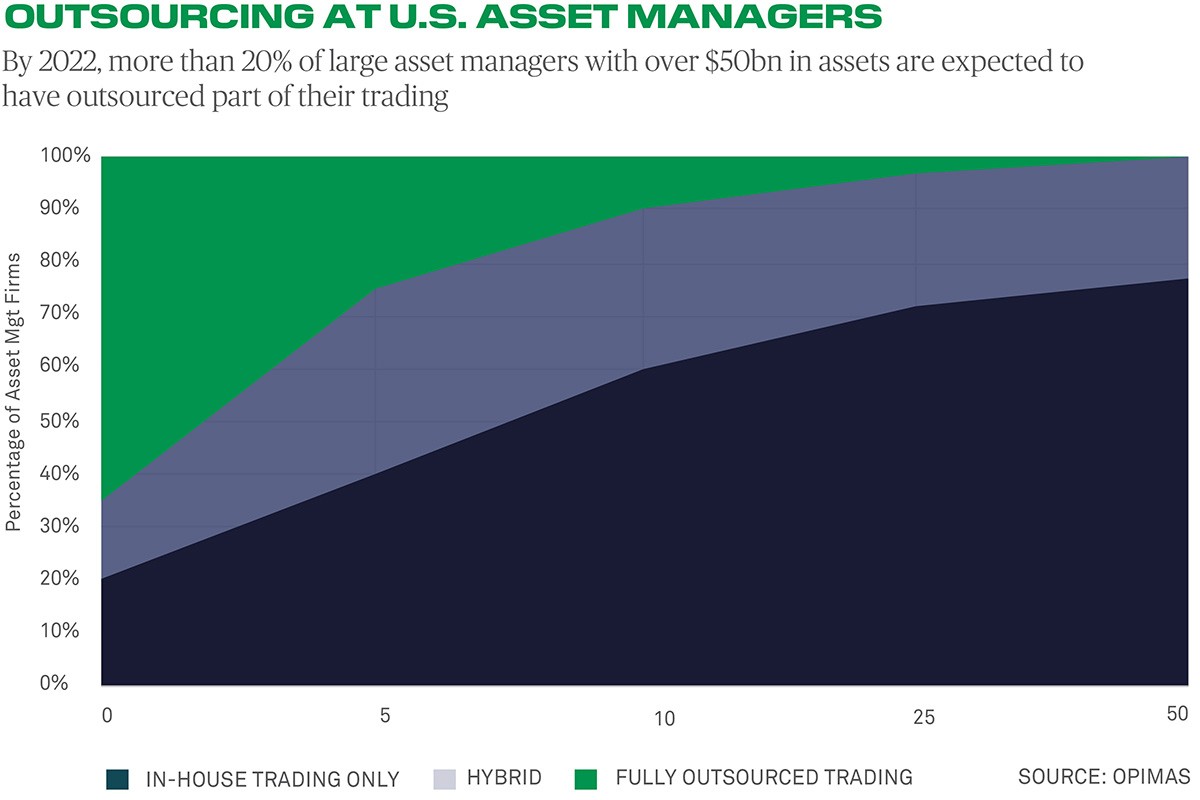

What this means for the pace of outsourced trading is hard to predict with certainty. Last year, consultancy Opimas estimated that about 20% of investment managers with assets under management of $50 billion or more would outsource some portion of their trading. But that prediction, made well before COVID-19, may need to be revised to take into account the behavioral changes brought about by the pandemic.

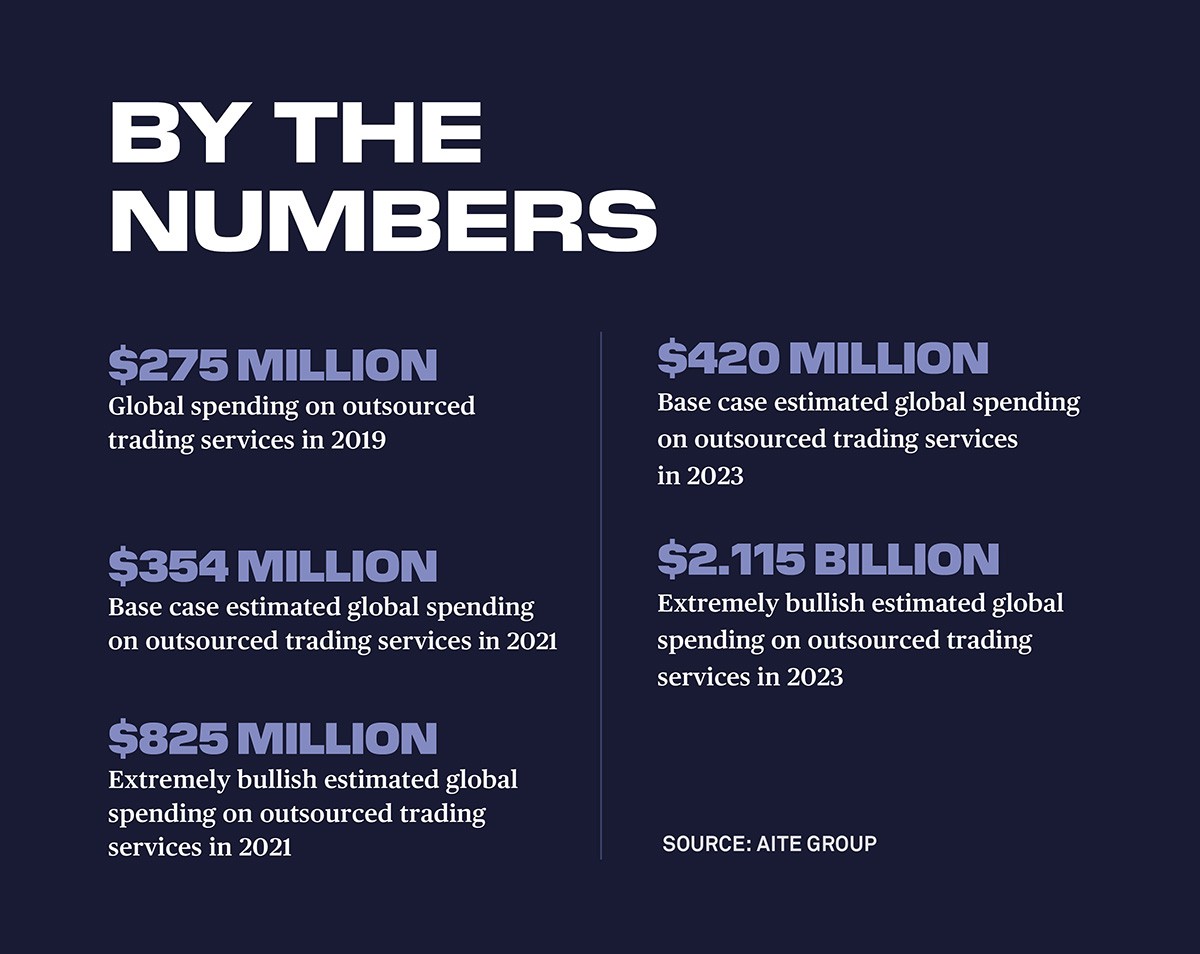

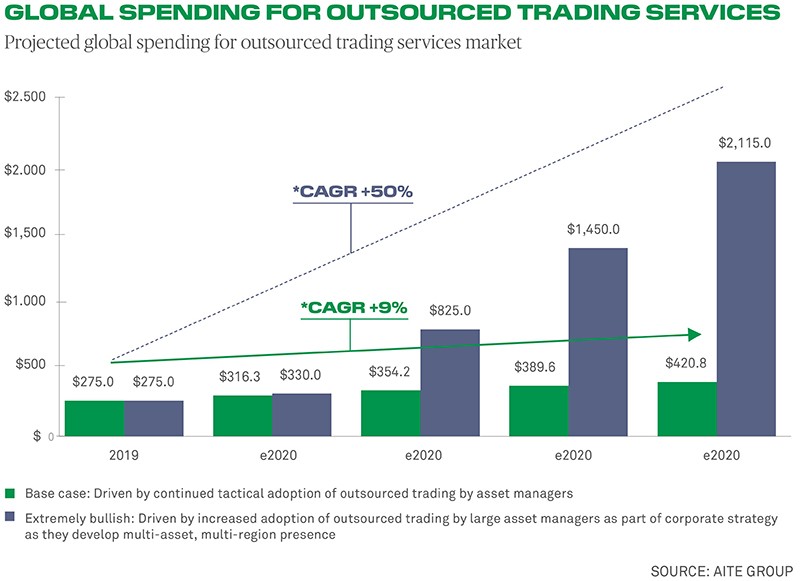

Aite suggests, in an “extremely bullish” scenario, that global spending on outsourced trading services could reach $2.1 billion by 2023, compared with an estimated $330 million for 2020, with those numbers in a “base case” scenario at $420.8 million and $316.3 million, respectively.

The outsourcing trend is here to stay and points to the larger, global outsourced trading providers being those most capable of delivering a long-term partnership that can grow and evolve over time with a client’s regulatory needs.

The pandemic has done nothing less than “put fuel on the fire” of the outsourced trading trend, notes Hooey. “Anyone who was thinking of outsourcing is now doing it.”

Jeremy Grant is a freelance writer based in London.

Questions or Comments?

Write to Ron Hooey or reach out to your usual relationship manager.