Smart Messaging and the Payments Revolution

Smart Messaging and the Payments Revolution

January 2022

By John Hintze

This year’s migration to a new data-rich financial messaging standard known as “ISO 20022” brings with it many challenges, but also points to a long-anticipated revolution in global payments.

In the inner sanctum of its headquarters on the outskirts of Brussels, the money-transfer network SWIFT has been working on a program that promises to drastically revamp payment messaging between banks—and with it, global commerce.

The new standard, known as ISO 20022, will allow for more structured and enriched data to be transmitted from payment providers to receiver banks. The result should be standardized messaging that can be sent through chains of correspondent banks with pinpoint accuracy, all but eliminating delay and human error, and opening the door to more automation.

Overhauling payment messaging is the biggest project banks have had to grapple with since the COVID-19 pandemic thrust remote working arrangements to the fore. Firms look set to adopt the changes just as they are grappling with an array of other technology upgrades, including the introduction of new systems to shorten the settlement cycle of securities trades, account for credit losses, and price instruments based on new interest-rate benchmarks.

“It’s redrawing the battle lines in the payments industry,” says Mike Sigal, founder of consultancy firm ISO 20022 Labs.

For Société Générale, the adoption of the new standard is the largest and most important project of the last 10 years, according to Laurent Collinot, product development manager at the bank in Paris. “We compare it to the adoption of the euro,” he notes, adding that the bank has been preparing for the transition for a few years now. “All the different parts of the bank are involved.”

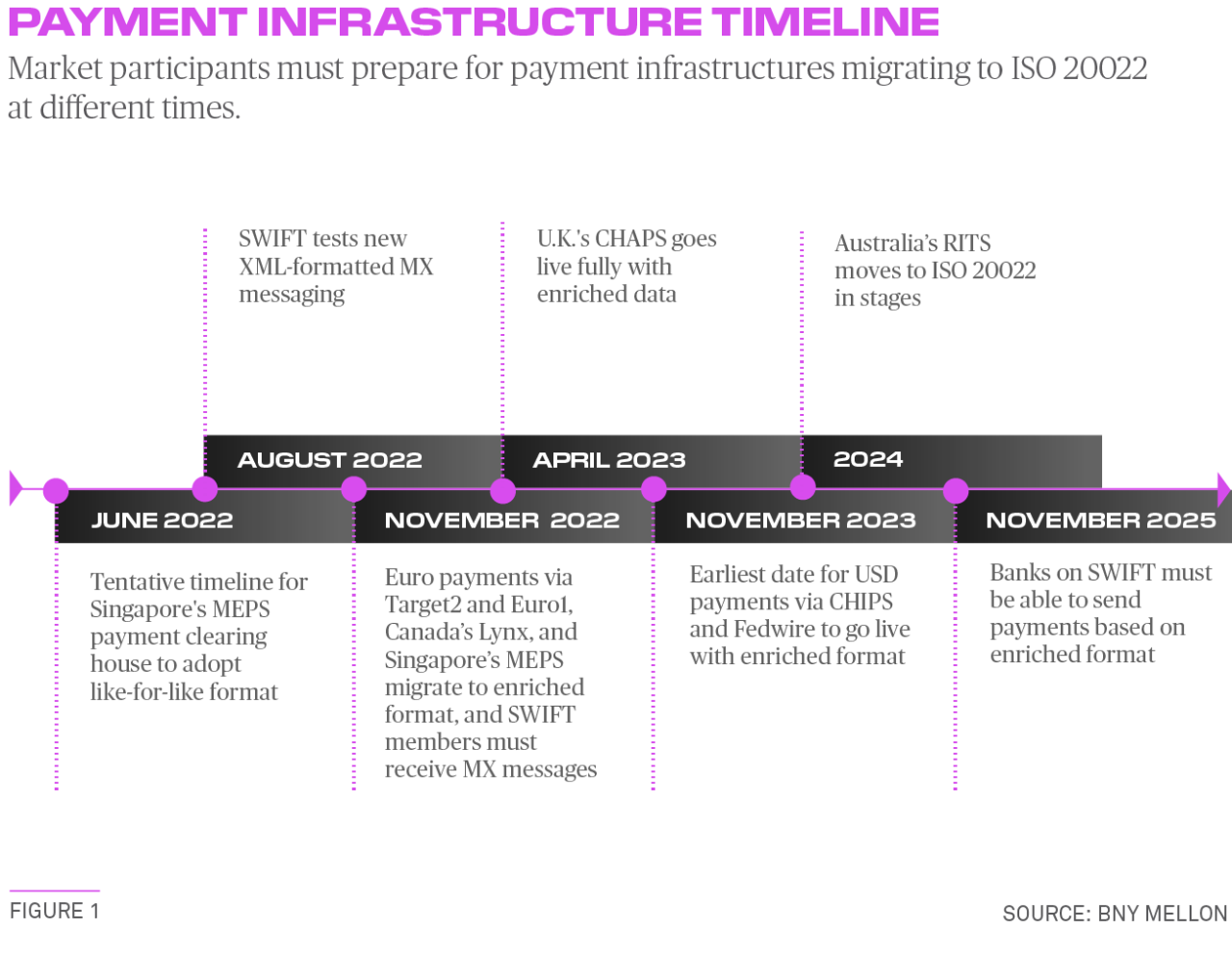

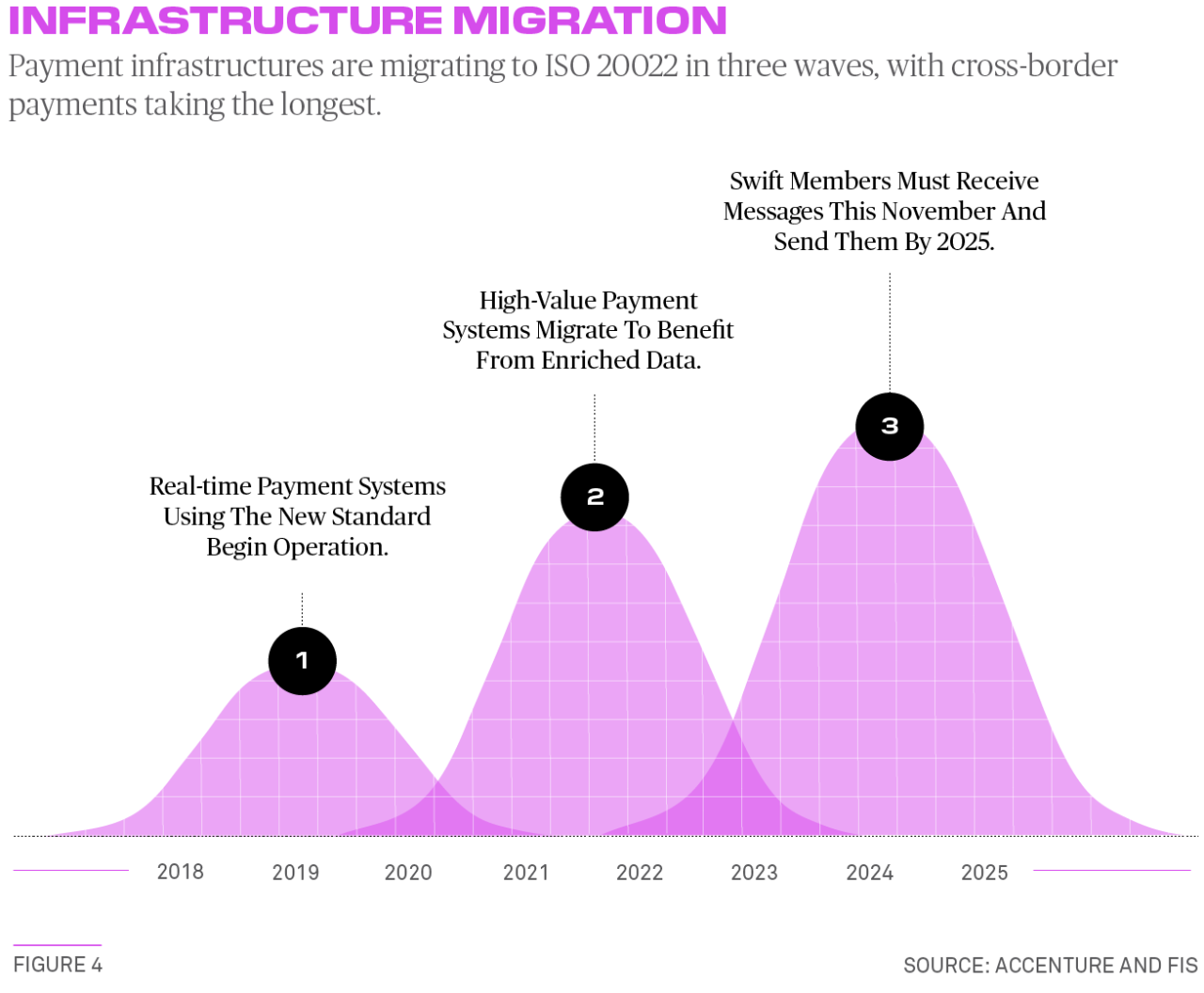

Adherence is especially urgent for European institutions. SWIFT is requiring all member firms to be able to receive payments using the new ISO 20022 standard by this November, although they will have until November 2025 to send in the new format. Meanwhile, the send-and-receive requirement is hitting Europe’s regional payment infrastructures simultaneously in November this year, impacting any firms connected to those networks, whereas U.S. payment systems won’t have to adopt the standard until at least 2023 (see Figure 1).

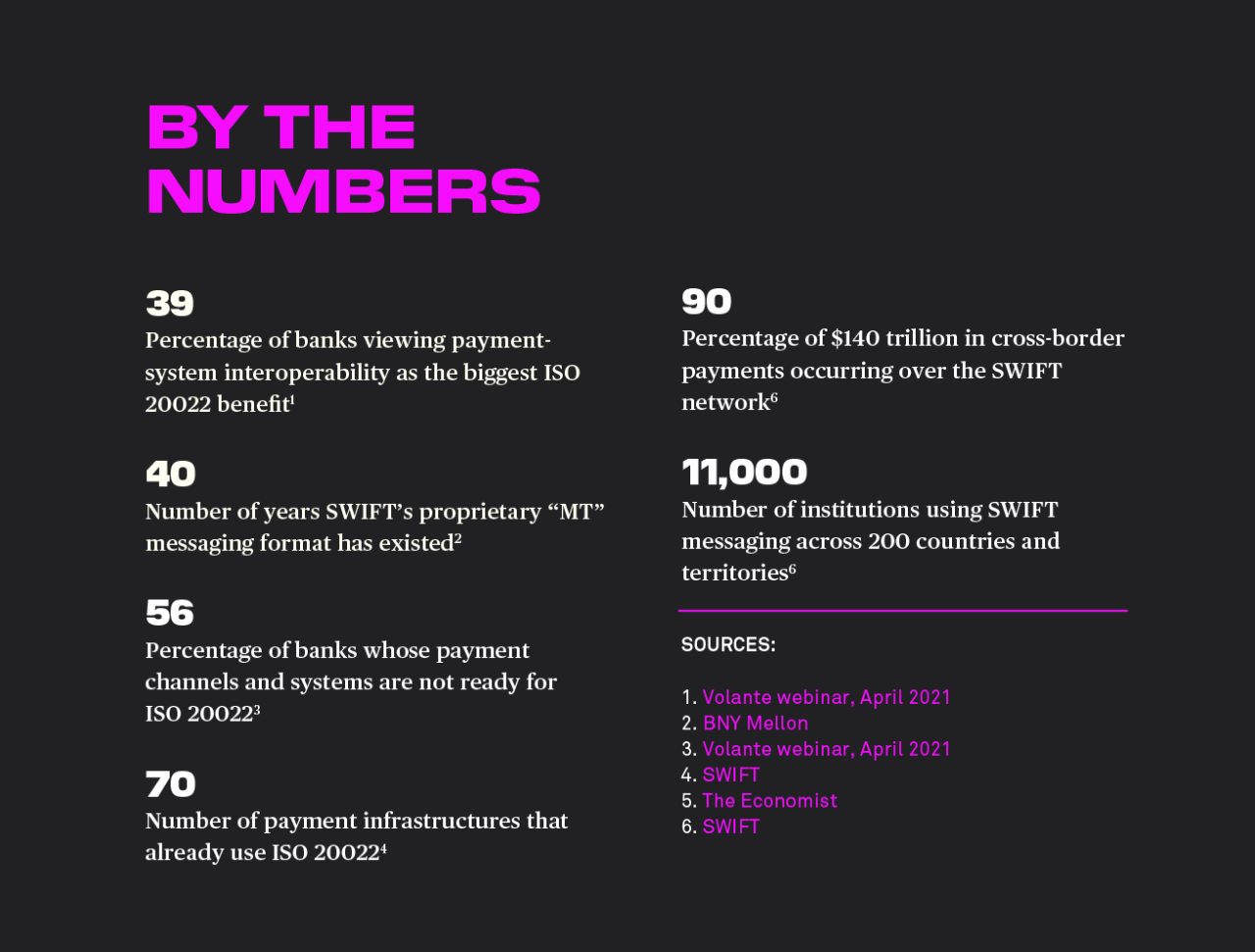

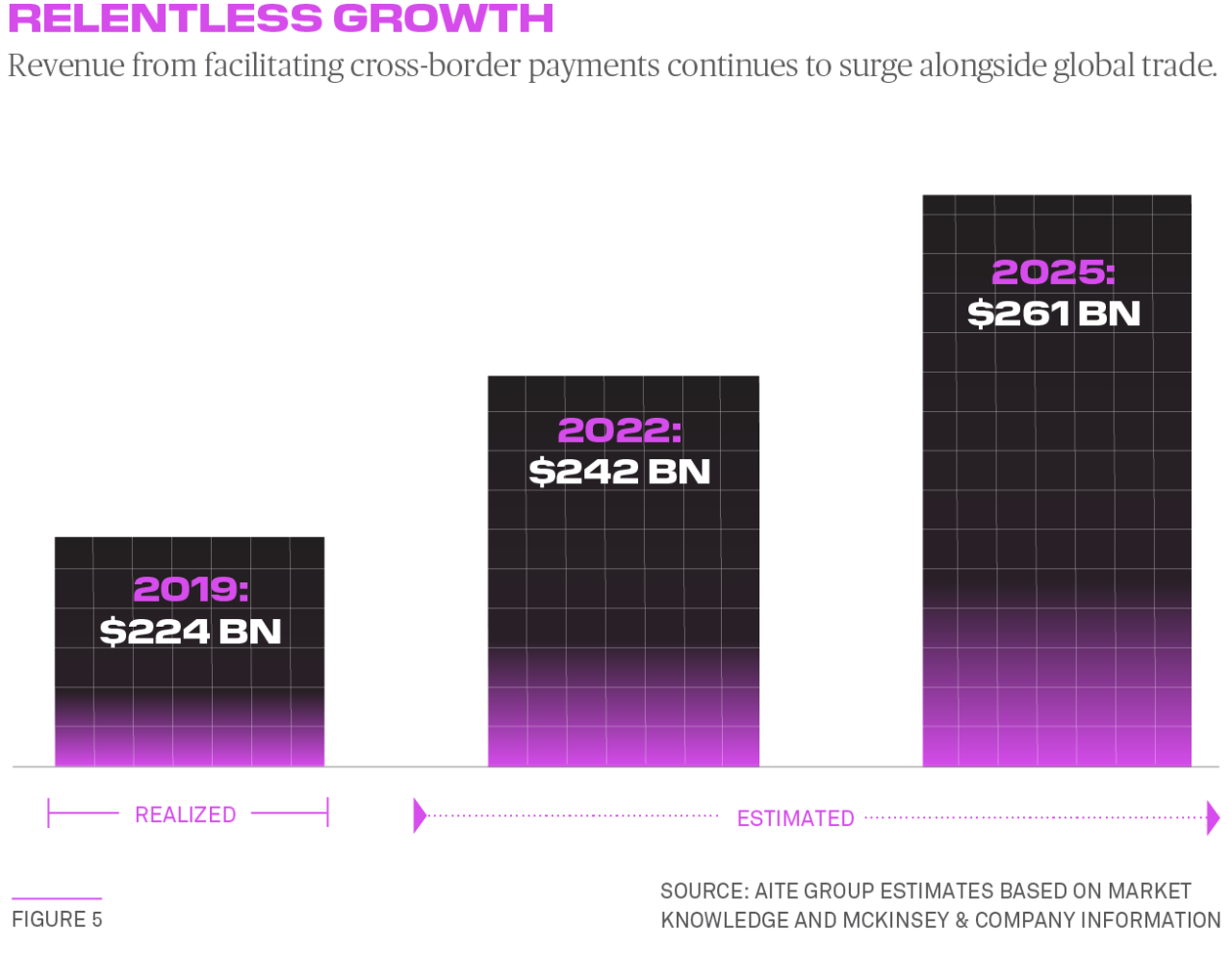

A staggering number of transactions are affected. Some 90% of the $140 trillion in cross-border payments over the past year through October occurred over the SWIFT network, via its “MT” messaging format. The subsequent fees for facilitating those payments have understandably whet the appetite of competitors, from credit-card companies to fintechs, all aiming to offer competing services that seek to improve on MT messaging.

Success or failure doesn’t hinge solely on SWIFT. Although the cooperative, formerly called the Society for Worldwide Interbank Financial Telecommunication, along with some of the major payment systems launched the program and were the instigators for much of that detail work, including the methodology, the industry has been driving it forward in a coordinated effort across banks and financial firms, technology vendors and market infrastructures.

That’s because SWIFT is not a regulator. As such, the broad-based adoption of ISO 20022 will look more like an industry convention than a regulatory mandate, much like the emergence of internet protocols at the turn of the century. Even without a regulatory stick, banks and firms either comply with the changing formats of market infrastructures or they risk losing access.

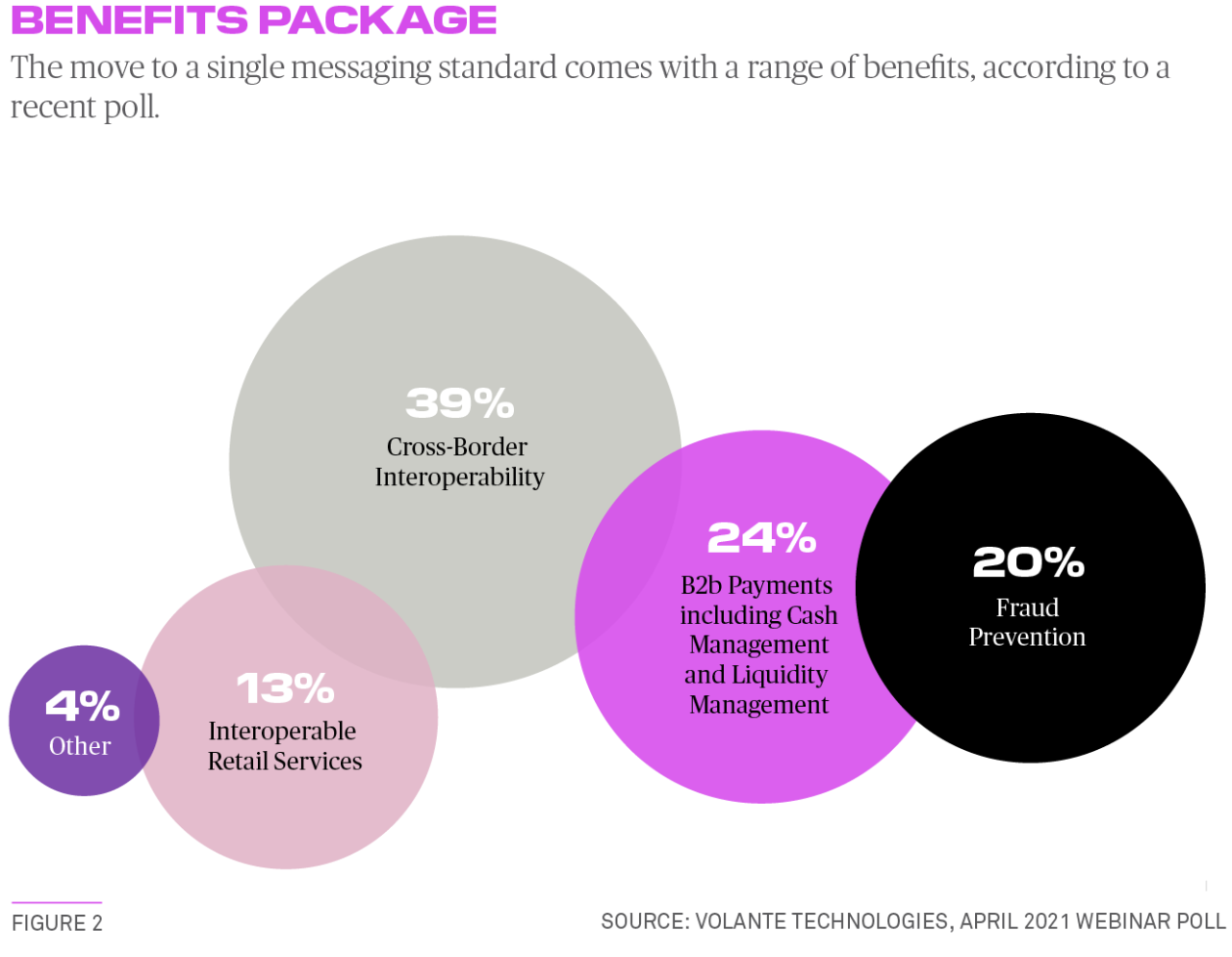

The benefits are clear: Companies whose core processing systems can read the new standard will be able to quickly ascertain who is paying for which products or services (see Figure 2), without the manual intervention often required today.

Down the line, banks would be able to, among other enhancements, analyze customer data much more effectively to understand payment trends and customer preferences. Banks could then leverage that information in new and promising ways to make for a richer client experience, using “Things like enhancing customer statements and [using] APIs to exchange information with customers, and providing data analytics to them,” explains Tim O’Donnell, managing director at Accenture in New York.

Tale of Two Speeds

SWIFT’s messaging systems and MT format have changed little in the past 40 years, and payment orders continue to pass through numerous correspondent banking institutions, which may impose unanticipated fees or whose software may confuse addresses; Cuba St. in Wellington, New Zealand, with the U.S. sanctioned country, for example.

Delays can potentially disrupt companies’ intricate supply chains that often stretch worldwide. The MT messaging format has limited data fields, allowing for a maximum of only 140 characters, creating significant challenges and potential errors for payment providers and receivers in their efforts to sort out who is paying whom.

Seeing the upside of new messaging protocols, banks have not been dragging their heels. With common, open standards for electronic communication, it could become possible to automate routine compliance checks and controls. Data can be arranged in logical hierarchies, aligned with different payment destinations and pre-validated, minimizing unexpected correspondent-banking fees.

“In the longer term, we would certainly hope this reduces the number of investigations and delays in payments when the payment gets stopped somewhere in the chain,” says Amy Sahm, manager for the international group at Lancaster, Pennsylvania’s Fulton Bank, which has $25 billion in assets.

Despite its clear advantages, however, the cost to the industry and other priorities have delayed the adoption of it for cross-border payments, where many of the initiative’s benefits could be realized. Local payment infrastructures have moved much sooner, with more than 70 of them already having adopted ISO 20022.

"We compare it to the adoption of the euro. All the different parts of the bank are involved."

— LAURENT COLLINOT, SOCIÉTÉ GÉNÉRALE

The European Payment Council, for example, used ISO 20022 to develop its Single European Payments Area (SEPA) system, which is used in 36 countries including the 27 member states of the European Union. It is also in use in Switzerland, Japan, India and China, with the Philippines having gone live in July 2021, Singapore set to go live in June 2022, and Australia aiming to do so in stages by 2024.

To remain the cross-border payment messaging network of choice, SWIFT intends to migrate its proprietary MT messaging to one called “MX”, which is based on the new ISO 20022 standard. Initially, it targeted a November 2021 deadline, but the pandemic delayed that by a year (see Figure 1). The cooperative also set an August 2022 deadline for a testing phase.

“One of the drivers for moving SWIFT’s cross-border payments to ISO 20022 is the very fact that market infrastructures around the world are moving to it as well,” says Stephen Lindsay, head of standards at SWIFT in La Hulpe, Belgium.

Several high-value payment systems—supporting large business-to-business payments—also are requiring their members to adopt the standard in 2022. While the U.K.’s Clearing House Automated Payment System (CHAPS) for high-value payments was scheduled to lead the change, the Bank of England, which had said it would adopt the new standard on a “like-for-like” basis with its existing systems, announced in January that it will move the migration date for CHAPS from June 2022 to April 2023.

Then in November 2022, Europe’s Euro1 high-value settlement system and its TARGET2 real-time gross settlement system will switch to the new standard for both receiving and sending payments, after which financial institutions will be unable to use the systems using the old messaging format (see Figure 1). Also going live with the new standard in 2022 will be Canada’s Lynx and Australia’s Reserve Bank Information and Transfer System (RITS) high-value payment system. Hong Kong’s Clearing House Automated Transfer System (CHATS) is expected to go live in 2023.

The largest banks tend to operate complex and older legacy payment architectures, and failure to prepare adequately could throw up problems. However, they tend to have the resources to tackle major changes. Laurent Steyt, business architect at Brussels-based KBC Group, said European banks’ experience with SEPA has given them a head start, but there is still plenty of work to do to ensure systems can handle the current version of ISO 20022. KBC’s graphical user interface, for example, is tailored to SWIFT’s MT format, limiting the payment-message details. That’s unsustainable in the long run and likely will require the bank to rebuild those interfaces, Steyt said. That will be a big job, and there are numerous ISO 20022-related issues that will require significant operational changes by this year’s deadline for SWIFT and the European payment systems.

“But there’s no choice,” Steyt said. “If you’re not ready by November 2022, you’re out of the [payment] systems.”

"A message is essentially a container, but if you don’t know the structure of what you put in that container, you have a problem."

— ISABEL SCHMIDT, BNY MELLON

SWIFT members in Europe and Asia, whose regional payment systems have already migrated to earlier versions of ISO 20022, face a less onerous journey to adopt SWIFT MX messaging than those moving from proprietary messages. Luke Perkins, head of global cross-border payments at Melbourne-headquartered ANZ Banking Group Ltd., said that local infrastructures’ migration to earlier versions has resulted in a lot of work for the bank in recent years. However, it has also at least partially prepared ANZ and other institutions using those infrastructures to take advantage of SWIFT’s data-rich MX messages.

“The more local market infrastructures align to ISO 20022 standards, then the more integrity we get to maintain across international payments and the more enriched their data will be,” Perkins said.

Although there are no hard adoption deadlines for regional and community banks and corporates that are not members of SWIFT, they will almost certainly face competitive pressures to handle payments sooner than later, using the full MX format. That will mean ensuring their technology, operations, and policies and procedures are up to snuff, and any third parties that they rely on for payments, such as SWIFT service bureaus, are keeping pace with the transition.

Andrew Foulds, director of clearing solutions in EMEA for financial technology services provider Fiserv, said a key area of focus for corporates will be their supply chains. Not only will payments get to suppliers faster, providing them with improved liquidity, but the detailed data can be fed back into accounts-payable, logistics and other systems to improve their speed to market.

As the new format is increasingly adopted by companies, physical supply chains will align more closely with what Foulds called financial supply chains, leading to faster payments, greater transparency and less friction. “Without the payments interoperability facilitated by ISO 20022, it becomes a lot harder to transport in an automated fashion all the information from one payment system across to another,” resulting in more manual intervention, he said.

Found in Translation

In the interim period, the newer data-rich MX messages can be translated into older MT formats so they can be read by legacy payment systems, giving institutions time to build their capabilities. The catch is that systems must still monitor and store the data that is relevant, in order to comply with anti-money laundering (AML) and other banking regulations. This is especially challenging given that the translation from MT to MX formats may lead to a loss of some messaging data.

In addition, more regional payment systems will be adopting the standard. In the U.S., for example, the Federal Reserve in October proposed to migrate its high-value Fedwire Funds Service to ISO 20022 no earlier than November 2023, moving it to a single-day migration, rather than having three stages as it had proposed in 2018.

In a December comment letter, BNY Mellon wrote: “An asynchronous deployment of the standard across the two major payment systems for high-value USD payments will in our view add additional complexity and risk to the industry.”

The Clearing House said it supports the Fed proposal and that it would also seek to migrate its private Clearing House Interbank Payments System (CHIPS) on the same day as Fedwire (see Figure 1). That alignment is critical because payments are often redirected between the two systems, which provides for more resiliency between payment infrastructures.

The Clearing House’s growing Real Time Payment network (RTP), launched in 2017, already runs on ISO 20022, and the Fed’s FedNow service will as well, when it goes live in 2023, as anticipated.

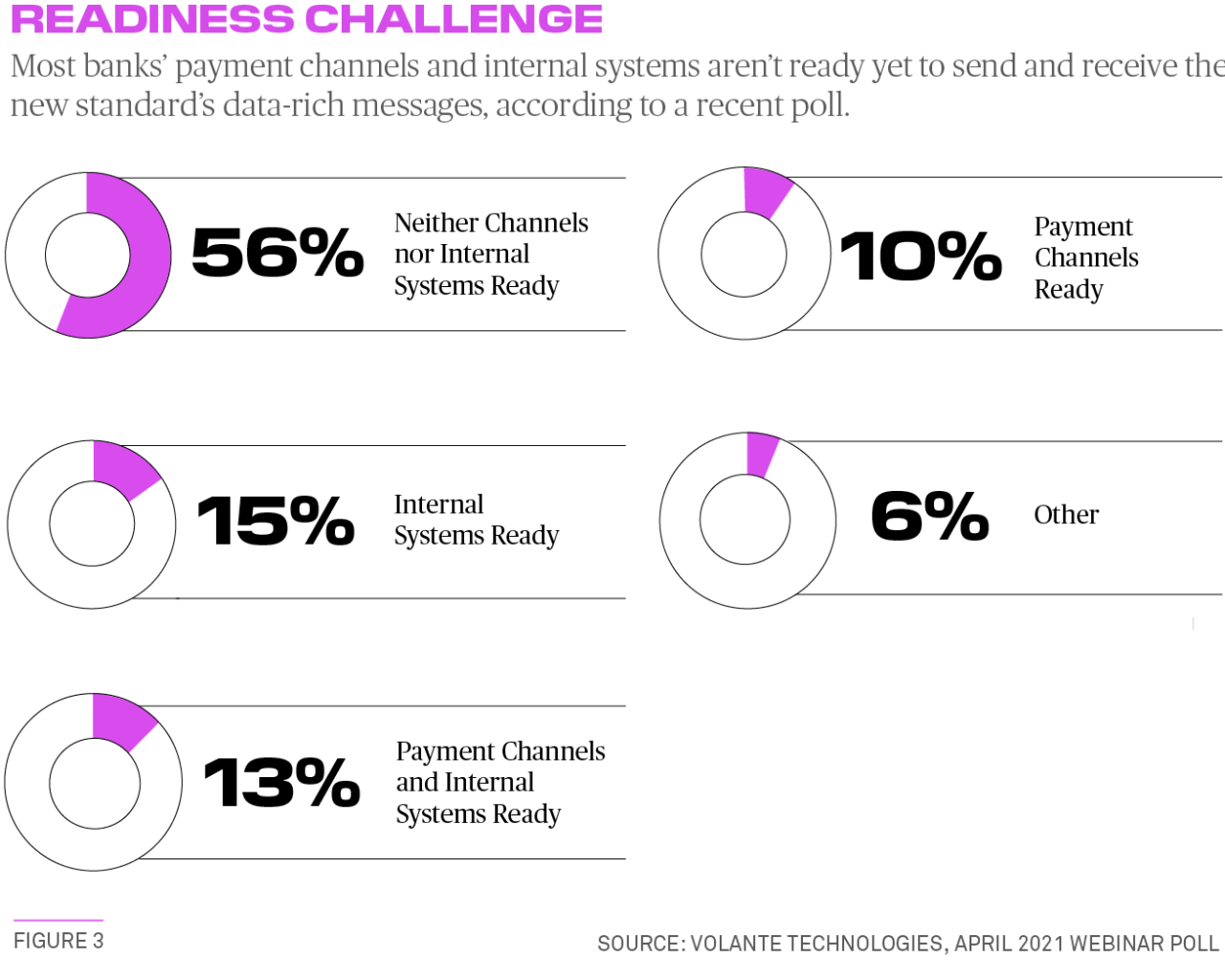

Preparing to receive MX messages on the SWIFT network, even when translated from the MT format, will require significant adjustments.

Banks must decide whether to invest in making their payment systems ready to adopt full MX messages by November 2022 (see Figure 3), or instead accept the translations until their systems are ready. Both approaches will require several steps, Lindsay said, including a requirement that the bank or its vendors have enabled the correct FINPlus Service software that is capable of receiving the ISO 20022 MX messages.

Banks also will need to consider their compliance obligations. Even if a bank accepts the translation and chooses not to process all the data in an MX message, it may still be required to archive it and potentially screen it to satisfy compliance requirements.

Another issue that tends to be forgotten is the use of the data itself, said Isabel Schmidt, head of direct clearing and asset account services at BNY Mellon. Banks and their customers will have to discover clients’ and counterparties’ relevant static data, such as the specific payment destinations or instructions, to create payment messages according to the required format.

“A message is essentially a container, but if you don’t know the structure of what you put in that container, you have a problem,” Schmidt said. “If you’re a company paying a supplier in a specific location and for certain items, can you structure that location data properly? Banks like us are ensuring that our client and counterparty records are capable of containing all of that information.”

Schmidt also pointed to local payment infrastructures around the globe migrating to ISO 20022 at different times, potentially resulting in interoperability issues. For example, one or more correspondent banks along the path of a payment via SWIFT may not yet be able to pass on the data-rich MX message.

Choosing FINplus In-Flow Translation or the equivalent vendor software provides a solution. However, it is a two-edged sword. Translating data-rich MX messages to the traditional MT format provides institutions with more time to prepare but it also delays the benefits of applying richer data.

Fulton Bank says it will rely on its SWIFT service bureau to translate ISO 20022 messages into the MT format for now. The bank is heavily reliant on its vendors, which will largely determine when its migration to ISO 20022 is complete, and it is talking to upstream bank correspondents about the data they will expect Fulton Bank to send and what it will receive. “It will probably be 2023 when we will actively work on converting our own outgoing payments to MX,” Sahm said.

Ultimately, however, the translation services are a short- to medium-term solution, according to Michelle Gauchat, a principal at Deloitte. Banks that want to use the extended remittance information to improve their products and services aimed at corporate clients, such as cash flow forecasting and reconciliation, will have to make more fundamental changes. “You’re likely to see more of those benefits come from a core payments architecture revamp,” Gauchat said.

It Takes a Village

One regional U.S. bank seeking to take advantage of MX benefits is Kansas City-headquartered UMB Financial. The $38 billion bank, which connects to SWIFT through a third party, has upgraded its wire-payment technology and can already receive SWIFT payments in the ISO 20022 format.

Like even the largest banks, however, it relies on vendors for much of that technology and upgrading it to the new standard. “We have several third parties where it’s going to be critical that they help us upgrade our systems so we’re ready for this,” said Jason Goodvin, payments and product manager at UMB.

Some banks may choose to upgrade their payment systems as soon as possible to take advantage of ISO 20022 enriched data, and that will depend on their ability to make the necessary technical and operational changes to their systems (see Figure 4).

Education and training will also play a major role, not just for the IT and operational staff pursuing technical aspects of the migration but also for upper management to consider in their strategic plans and the sales staff to convey the benefits to clients and what they need to do.

Business clients, for example, will have to make sure their enterprise resource planning (ERP) and other systems are ISO 20022 compatible, opening the door for banks to provide a helping hand. “That’s where the financial institution hopefully will be able to step in with services to help them make that transition as easy as possible,” notes Goodvin.

Banks should also develop myriad new products, services and other customer benefits from the new anonymized data they will collect, said Kenneth Wong, head of product strategy and innovation at Canada’s TD Securities. The more data there is, the more analytics they can pursue, perhaps analyzing why customers choose one type of payment over another, and for what purpose.

Looking further ahead, widespread adoption of the new standard— particularly for more complex cross-border transactions—appears likely to level the playing field in terms of the economic value of getting payments completed (see Figure 5).

This may take a while, notes Sigal at ISO 20022 Labs, but eventually profits are likely to go to the institutions that most effectively and creatively take advantage of the enriched and structured data to develop products and services.

“With the new data, there will be tremendous things we can do in terms of new products and enhancing existing products to do even more, with a better level of accuracy,” Wong said.

John Hintze is a freelance writer based in New Jersey.

Questions or Comments?

Write to Isabel.Schmidt@bnymellon.com in BNY Mellon's Treasury Services or reach out to your usual relationship manager