Investors Respond to Hopes for Immunity

Investors Respond to Hopes for Immunity

Inoculation speeds should define the pace of investment and the potential for a pause in the rotation out of U.S. bonds

March 2021

By Daniel Tenengauzer

Proprietary custodial flows show that investors are increasingly attracted to countries with robust immune response rates. Vaccinating at least 0.33% of the population daily has become critical to achieving herd immunity.

Diverging vaccine rollouts are having an outsized impact on markets, favoring countries investors were avoiding such as the U.S., U.K. and Israel, while negatively impacting economies with comparatively slow distribution.

Instead of selling U.S. dollars and piling into international equities and currencies, investors temporarily increased their U.S. bond buying, seeing that falling infection rates in the U.S. may deliver herd immunity sooner than predicted, possibly as soon as April or May.

The U.K. begins a phased reopening March 8, after daily new infection rates have fallen 90% since January. In Israel, where weekly new deaths dropped 61% in February, more than 60% of the population has received at least one dose of the Pfizer-BioNTech jab.

Investors’ recent about-face toward markets showing improved immunization amounts to a reconsideration of how far, and how fast, vaccine distribution efficacy can shape spending and production. A return to normal in some of the more efficient economies could allow some policy normalization, lifting yields to levels that are more attractive. Conversely, countries delivering one shot of the vaccine to less than 0.3% of their population each day will likely underperform.

Speed is a more critical element than vaccine type. Assuming immunity holds for six months, a country should vaccinate 60% of its population within 180 days to achieve inoculation.

For now, investors are keeping an eye on global coordination efforts. Although speedy progress may be offset by new strains arriving from South Africa, Manaus in Brazil or New York, with inoculation failing to last longer than a few months, herd immunity should be possible in the fourth quarter of this year in most economies.

Flows Flip-Flopped Since U.S. Election

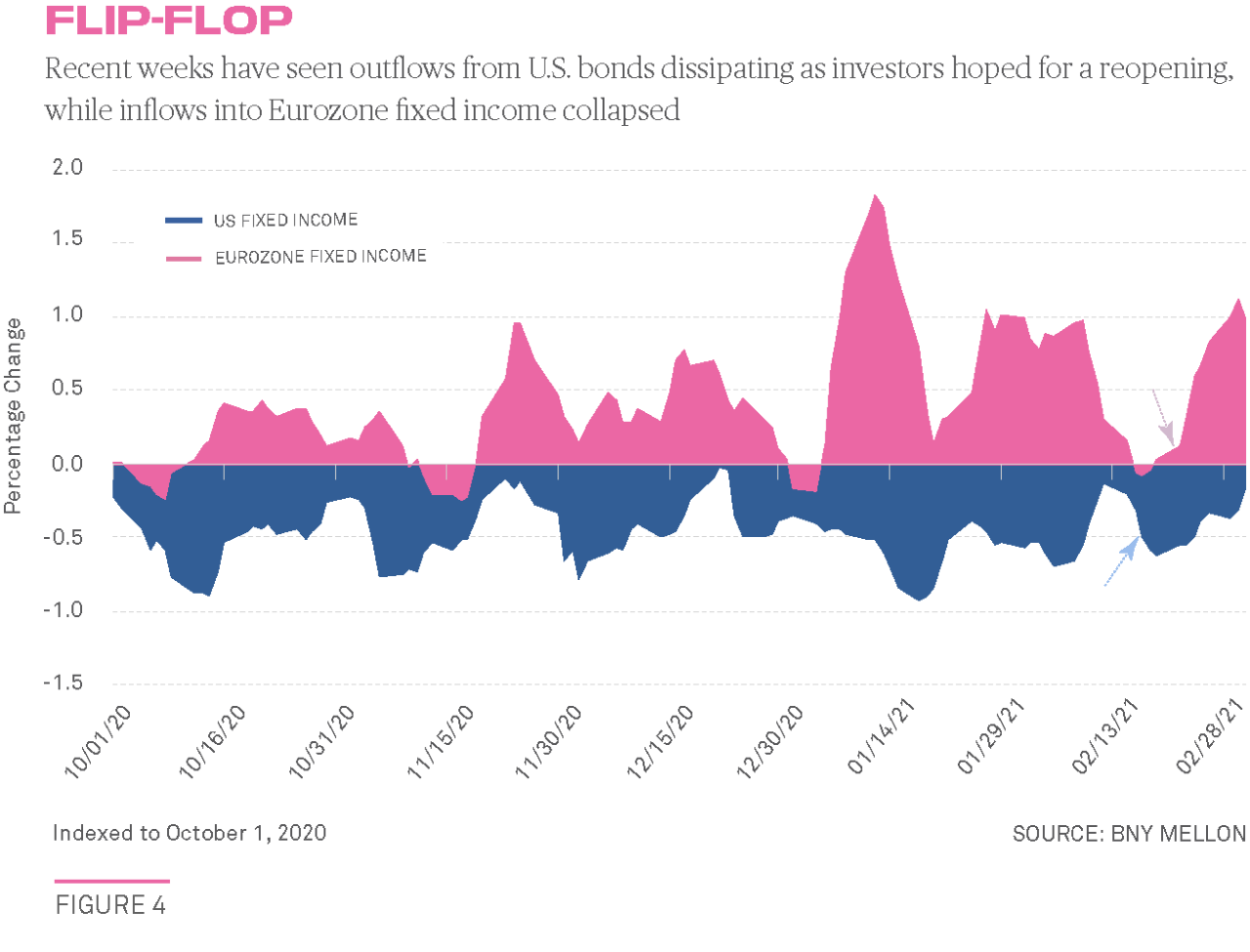

Vaccine impact is already showing up in asset flows. Following the U.S. presidential elections, a proprietary database from BNY Mellon Markets called iFlow showed that back in late 2020 investors were eschewing U.S. government bonds in favor of China and Eurozone fixed-income markets.

In the backdrop were hopes for significant fiscal easing in the U.S., which could result in higher inflation as households deploy savings accumulated throughout lockdown, and expectations of a switch in the decade-old pattern known as U.S. “exceptionalism,” where the U.S. dollar, U.S. Treasury and U.S. equities outperformed the rest of the world.

Fast forward to February 2021 and iFlow insights demonstrated a flip-flop, with marginal demand for U.S. bonds improving, particularly since the second week of January all the way up until the last week of February. A 70bp increase in 10-year Treasury bond yields to as high as 1.6% so far in 2021 briefly drew meaningful flows away from Eurozone fixed-income markets back to the U.S. bond market.

At the same time, clouds are forming in the geopolitical outlook and denting the attractiveness of international markets ranging from the Eurozone to Latin America. Lackluster efforts to achieve global herd immunity could dent those economies.

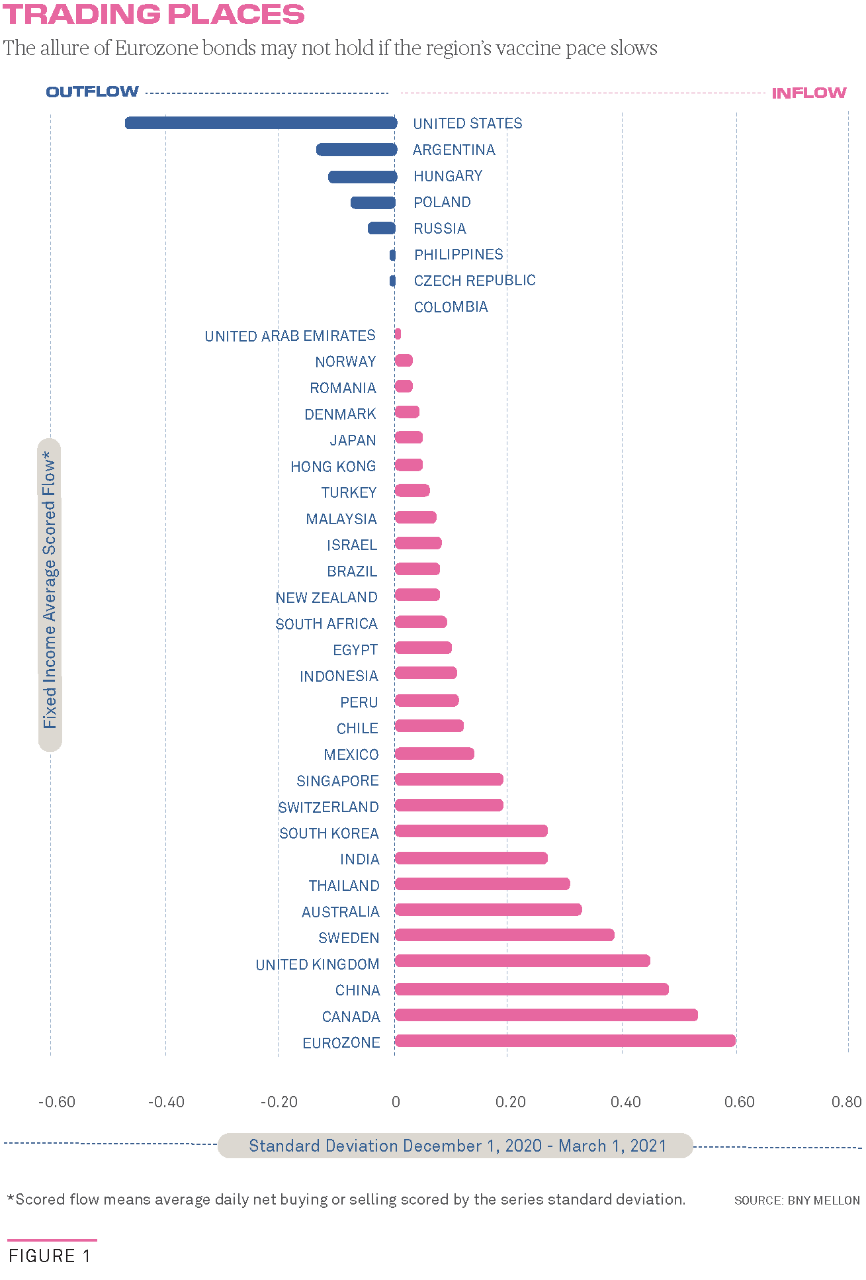

In the chart above (see figure 1), we illustrate these trends with the help of iFlow signals for global bond markets. These include flows in and out of both the sovereign and corporate debt markets we analyzed. We show flows in and out of bond markets across all countries covered by iFlow.

Between early December 2020 and early March 2021, scored flows (averaged daily net buying, scored by the economy’s standard deviation over the period studied) were most negative in the U.S. but most positive in China and the Eurozone. China, the Eurozone and G10 commodity currencies such as Canada, Australia and New Zealand hold the most appeal for bond managers, according to iFlow.

Next, in figure 4 (see below), we looked carefully at the patterns in demand for U.S. debt. While the fourth quarter of last year was still about a swing from U.S. bonds to international ones, demand for the U.S. fixed-income market has since improved. In fact, iFlow data show a few weeks of marginal inflows into U.S. bonds between January and February 2021, although there is a risk to this continuing if hopes for robust vaccine rollout in the Eurozone and China start to improve.

Scored flows turned negative for Eurozone fixed-income markets in the same period as they entered positive territory for U.S. bonds.

A key reason for the swing away from Eurozone bonds in January and February this year is, in our opinion, the lackluster vaccination progress there.

New cases in Italy have been flat at about 15,000, rising back above 18,000 more recently. The same could be said about France, where daily new cases increased from 13,000 in early January to 21,600 more recently. While the number of new cases collapsed in Spain, the number of daily new deaths spiked to the highest levels observed since the outbreak started a year ago.

Moreover, with the exception of Chile, the vaccination pace in Latin America has been extraordinarily slow. This could be the backdrop for a sharp turnaround in demand for bonds within the region, as shown in figure 1 above.

Vaccination Pace Defines Investment

Much of the market divergence can be explained by vaccination rollout efficiency and its impact on hospitalizations and death rates.

A daily vaccination pace reaching 0.3% to 0.45% of the global population should, in our opinion, support herd immunity at some point in the fourth quarter.

Speed is a more critical element than vaccine type. Assuming immunity holds for six months, a country should vaccinate 60% of its population within 180 days to achieve inoculation. Countries able to vaccinate 0.33% of their population with one shot every day can achieve a comfortable 60% immunization rate. This estimate is obtained by the simple ratio of 60 percentage points over 182 days, or six months (60 ÷ 182 = 0.33).

One study, which has been peer reviewed and published in the New England Journal of Medicine, took 596,618 people who were newly vaccinated in Israel and compared them with unvaccinated controls. Two doses of the mRNA Pfizer-BioNTech vaccine reduced symptomatic cases by 94%, hospitalizations by 87%, and severe COVID-19 infection by 92%.

During a mean follow-up of 15 days in Israel, 10,561 infections were documented, of which 5,996 were symptomatic COVID-19 illness, 369 required hospitalization, 229 were severe cases and 41 resulted in death. The study took place from December 20, when Israel’s national vaccination drive was launched, to February 1. It also coincided with Israel’s third and largest wave of coronavirus infection and illness.

Meanwhile, from December to mid-February, separate researchers analyzed a data set covering all of Scotland’s population. Of 5.4 million people covered in the study, 1.1 million (or 20%) were vaccinated with the first dose of either Pfizer-BioNTech or AstraZeneca. Among the 8,000 people hospitalized in Scotland in the period, less than 1% (or 58 people) came from the vaccinated group.

Even more encouragingly, for people 80 years and older, the research found an overall 81% reduction of hospital admissions by the fourth week in the Scottish study. In short, in the U.K. and Israel, vaccines should already be helping to reduce the COVID-19 burden in national healthcare systems.

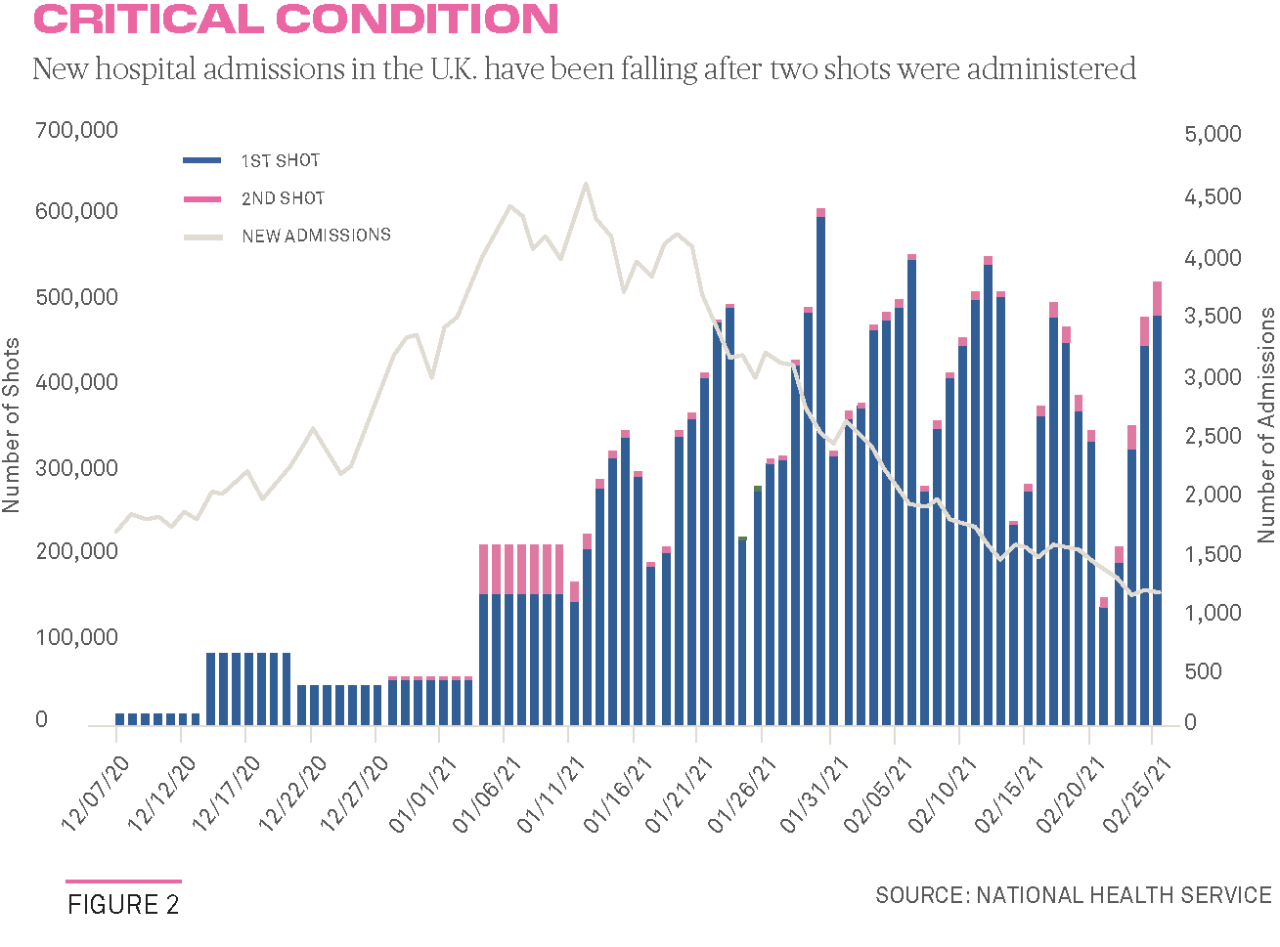

We focus on hospitalization rates (see figure 2 below) and escalation for two reasons. First, a meaningful reduction of extreme outcomes may encourage skeptics to vaccinate. Second, the most concerning worry over the past year has been overwhelming healthcare systems.

So far, the most encouraging data are emerging out of the U.S., the U.K. and Israel, countries running the fastest vaccination pace. Since early January, daily new cases in the U.S. declined from as high as 250,000 to 70,000. In the U.K., the number of new cases dropped from 58,000 to 6,300.

For Israel, the number of new cases declined from 8,400 to 3,600 and, even though hospitalizations remain high because of mutant strains of the virus and people’s tolerance of social distancing is waning, the country has more than 55% vaccinated. At the current pace, the E.U. would take 10 months, at best, to get there.

Speed Remains the Primary Risk

More recently, worries about Variants of Concern (VoCs) raised some alarm bells that vaccines may not help achieve herd immunity after all. A Harvard University study, however, shows that herd immunity might be achieved if vaccine rollout is fast enough. Even if vaccine effectiveness falls to 70% from 95%, the world still has a path to achieving herd immunity and ending the pandemic, according to the study.

These findings highlight the challenges of fast and widespread deployment of a variety of vaccines across borders. This is perhaps the backdrop of temporary reversals observed in iFlow back toward the U.S. bond market, found in our own iFlow data discussed above.

Earlier estimates based on highly effective vaccines held that within the immunity window of six months, 50-60% of the population would have to be vaccinated in order to create herd effects. At 70% vaccine effectiveness, the threshold for herd immunity will rise to roughly 75%.

According to the Harvard research, given high success ratios of the vaccines, a second-best outcome would be the development of milder symptoms — essentially turning COVID-19 into a milder illness.

Assuming a six-month immunity window, a pace of delivering one shot to 0.33% of the population each day would achieve 60% immunity after six months (0.33 * 182 = 60%). The range of vaccination pace would be as follows: 0.27% of the population getting one shot daily to reach 50% immunity within six months, or 0.41% of the population vaccinated daily to reach 75% immunity also within six months.

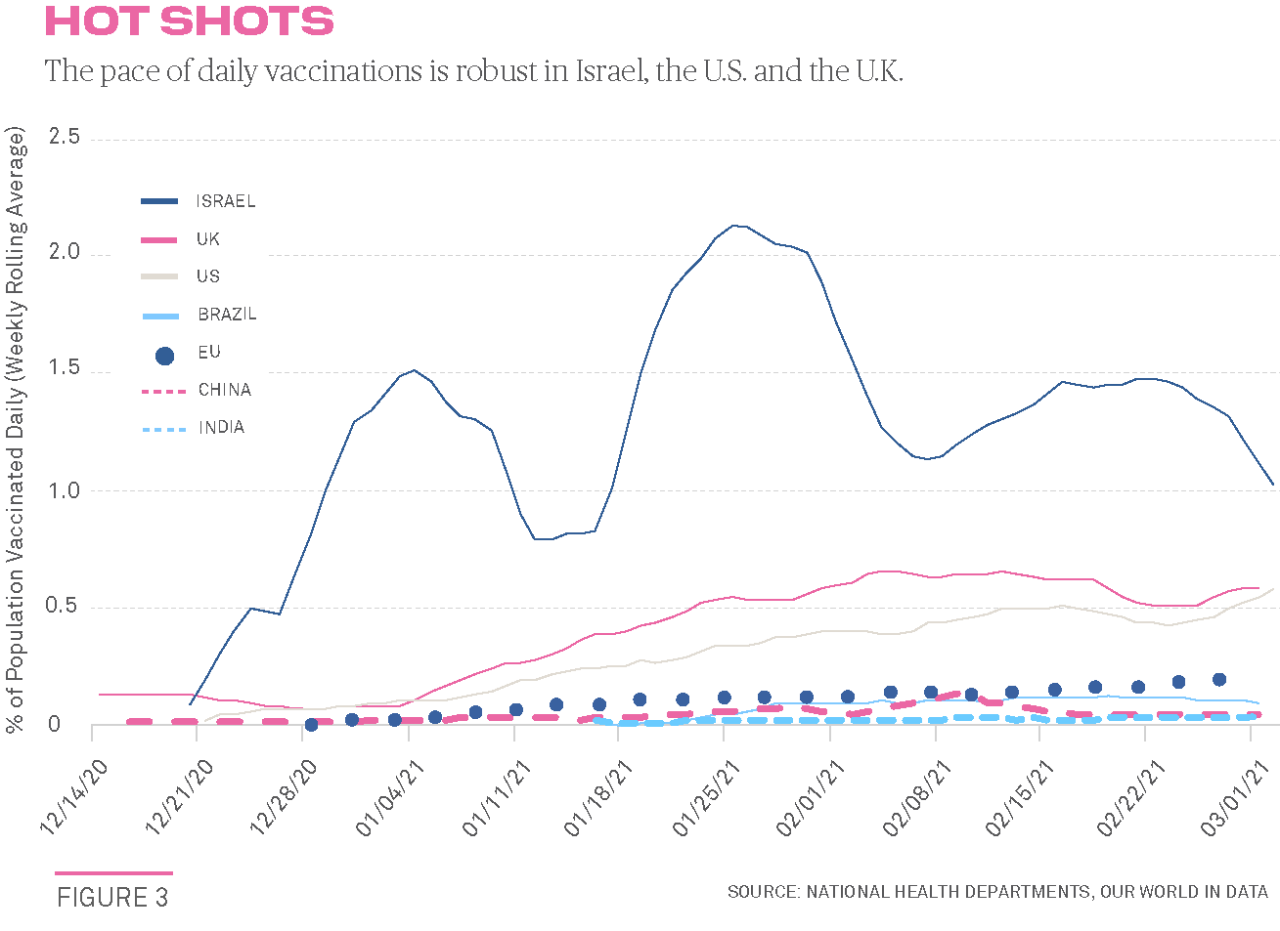

The current vaccination pace stands at 1.1% of the population receiving daily vaccines in Israel and 0.68% in the UAE. For the U.K. it is also quite robust at 0.58% (see figure 3 below) as it is in the U.S. at 0.54%. Additional countries at rates above 0.33% are Morocco, Chile and Turkey.

In the Eurozone the pace remains sluggish, at 0.2% in Spain, 0.17% in Germany and 0.18% in France. Italy is even lower at 0.17%. Canada is at 0.15%. Even more disturbing, the largest and most populous countries are registering very low vaccination strides: Brazil is vaccinating only 0.11% daily, with India and Indonesia at 0.03% and 0.04%, respectively.

This global divergence is concerning because inoculation may never reach the desired levels of 60-75% within the critical six-month immunity window. A vicious circle may therefore evolve as more potent variants emerge.

The good news is that countries are improving their pacing and do become more efficient as a larger variety of jabs are approved and start mass production. The U.K., for instance, began at 0.12% of its population vaccinated daily as of December 14, reaching 0.58% now. Israel started at 0.09% on December 20, and now stands at 1%. The E.U. started at 0.01% on December 1 and is now at 0.2%. Most of the lagging economies will likely double these daily vaccination paces over the next several weeks.

In the U.K., extending the gap between the first and second shot was crucial to helping a wider share of the population get at least partially inoculated. Now Portugal is adopting a similar approach. Some academic papers now agree that as long as the health system obliges by a second shot administered within the immunity window, tail-risk outcomes of the disease are unlikely.

A study released in February by Cambridge University Hospitals NHS Foundation Trust (CUH) and the University of Cambridge analyzed results from thousands of COVID-19 tests carried out on a single dose of Pfizer-BioNTech vaccine. It found a four-fold decrease in the risk of asymptomatic infection amongst healthcare workers who had been vaccinated for 12 days or more (75% protection). The level of asymptomatic infection halved in those vaccinated for less than 12 days.

We believe that such a convergence in inoculation speed will be the harbinger supporting similar patterns to those observed toward the last few months of 2020. In other words, flows may seep back out of U.S. bonds into international markets as those economies speed up.

Nevertheless, bumps along the road will continue to reflect diverging approaches from different countries’ vaccination policies. Many countries are opting to vaccinate different target groups with essential workers being classified differently between China, the E.U. and the U.S., for instance. India and China rollouts have been slow so far, but their vaccine may prove to be more robust against VoCs than those in the West.

The Serum Institute of India (SII) has obtained authorization to manufacture the AstraZeneca Oxford vaccine. It will supply the vaccine to the Indian government but also to a large number of low and middle-income countries. SII also has contracts in place to manufacture Novovax, which is the world’s largest vaccine manufacturer by number of doses produced and sold globally, deploying doses in approximately 170 countries around the globe.

China has belatedly acknowledged the inadequate speed of its vaccination program and is now targeting 40% of its population by June. However, despite its manufacturing prowess, there is a risk of supply shortages given the country’s commitment to overseas orders. On the other hand, Beijing may want to avoid the impression of prioritizing overseas commitments over domestic needs. Doing so would boost global recovery hopes but delay China’s border reopenings.

Such global efforts will be the main indication of a global recovery, assuming a daily vaccination pace reaching 0.3% to 0.45% of the global population in short order. This pace should, in our opinion, support herd immunity at some point in the fourth quarter.

iFlow will continue to track these developments quite closely. Ebbs and flows in global bond and equity markets are increasingly more likely to mirror these very same vaccination milestones.

Daniel Tenengauzer is Head of Markets Strategy at BNY Mellon Markets.

Questions or Comments?

Write to daniel.tenengauzer@bnymellon.com or reach out to your usual relationship manager.